Key Insights

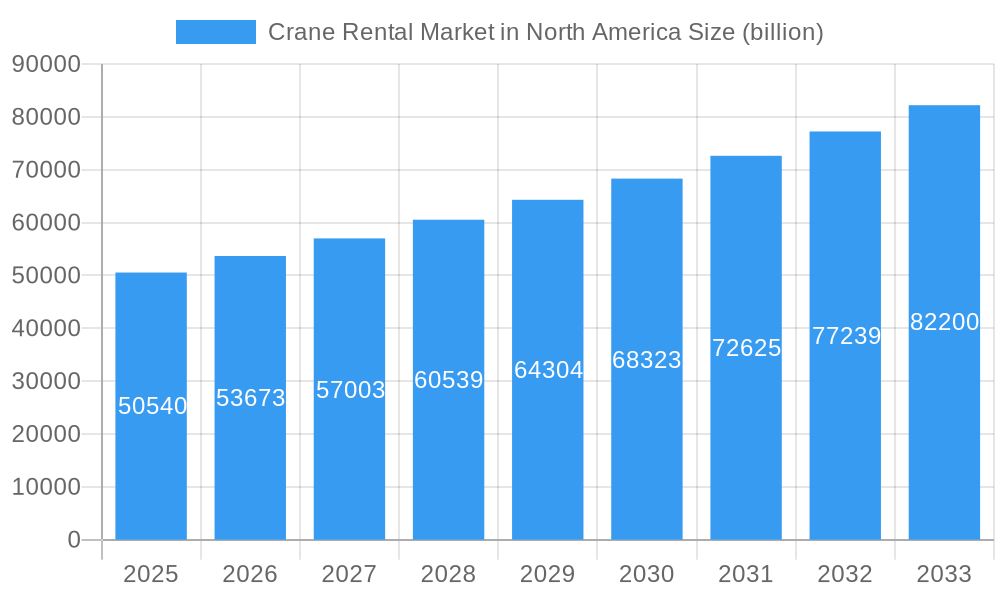

The North American crane rental market is poised for significant expansion, projected to reach an estimated $50.54 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.1%, indicating a sustained upward trajectory through 2033. Key drivers fueling this expansion include the burgeoning construction sector, particularly in infrastructure development and residential projects across the United States, Canada, and Mexico. Increased investments in mining and excavation activities, coupled with the ongoing demand from the marine & offshore industry for port expansions and offshore energy exploration, also contribute significantly to market buoyancy. Furthermore, industrial applications, encompassing manufacturing and heavy industry, continue to rely on flexible and cost-effective crane rental solutions for their operational needs. The market's dynamism is further evident in the diverse range of crane types available, from versatile wheel-mounted mobile cranes to specialized straddle and railroad cranes, catering to a wide array of project requirements.

Crane Rental Market in North America Market Size (In Billion)

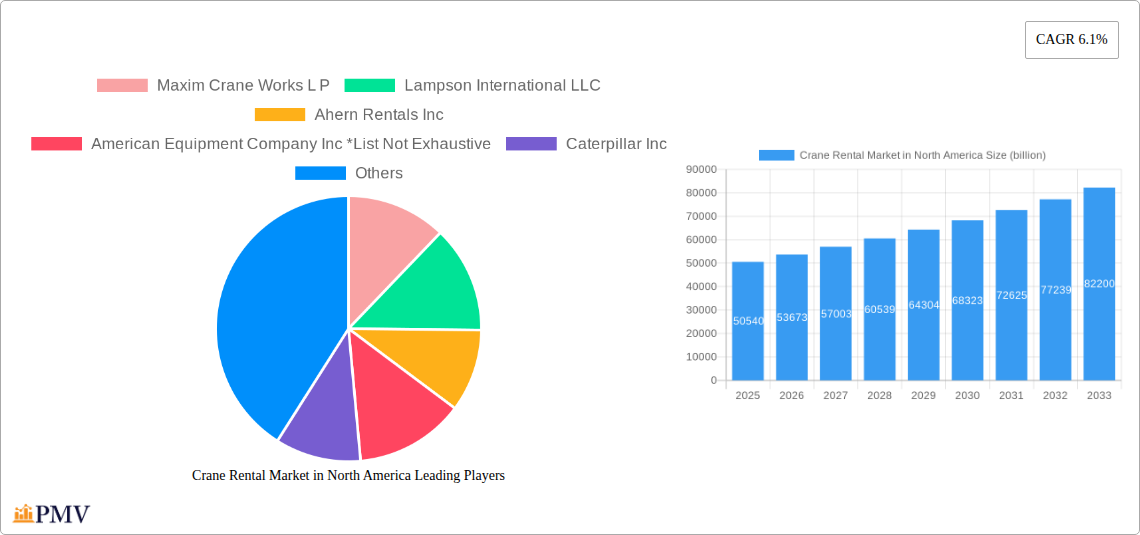

The market is characterized by a competitive landscape featuring prominent players such as Maxim Crane Works L.P., Lampson International LLC, and United Rentals Inc., among others. These companies are actively involved in expanding their fleets, investing in advanced crane technology, and enhancing their service offerings to meet evolving customer demands. Emerging trends include a growing emphasis on rental of sophisticated, technologically advanced cranes, including those with enhanced safety features and telematics for remote monitoring and operational efficiency. The adoption of sustainable and eco-friendly crane rental practices is also gaining traction, aligning with broader industry environmental goals. However, the market faces potential restraints such as fluctuating raw material prices impacting equipment manufacturing costs, stringent regulatory compliance requirements, and a shortage of skilled crane operators. Despite these challenges, the overall outlook for the North American crane rental market remains overwhelmingly positive, driven by consistent economic development and a strong demand for heavy lifting solutions across various critical industries.

Crane Rental Market in North America Company Market Share

North America Crane Rental Market Report: In-Depth Analysis and Future Outlook (2019-2033)

This comprehensive report provides an authoritative analysis of the North America Crane Rental Market, offering critical insights into market structure, competitive dynamics, industry trends, and future growth opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving crane rental landscape. We delve deep into market segmentation by crane type and application, highlight dominant markets, and explore groundbreaking product innovations. With meticulous examination of key growth drivers and challenges, alongside a detailed overview of leading players and recent developments, this report equips you with the strategic intelligence needed to navigate this dynamic sector.

Crane Rental Market in North America Market Structure & Competitive Dynamics

The North America Crane Rental Market exhibits a moderately concentrated market structure, characterized by the presence of several large, established players alongside a significant number of regional and specialized providers. The innovation ecosystem is driven by advancements in crane technology, safety features, and fleet management software, fostering a competitive advantage for companies investing in R&D. Regulatory frameworks, including OSHA standards and environmental regulations, play a crucial role in shaping operational procedures and equipment requirements, influencing market entry and competitive strategies. Product substitutes are limited, with the core need for heavy lifting and material handling primarily met by various crane types. However, alternative material handling solutions in specific niche applications might present indirect competition. End-user trends are increasingly demanding flexible rental terms, specialized equipment for complex projects, and enhanced digital integration for booking and management. Mergers and acquisitions (M&A) are a significant force in consolidating market share and expanding geographic reach. For instance, the acquisition of Capital City Group, Inc. by The Bay Crane Companies, Inc. in February 2022 bolstered Bay Crane's footprint, positioning them as a top 10 crane service provider. Maxim Crane's strategic purchase of 51 Grove mobile cranes in July 2021 underscores the drive to enhance fleet capabilities and serve new markets. While specific market share figures are dynamic, the top 5 players collectively hold an estimated market share of approximately 40-45% in 2025, with M&A deal values often reaching tens to hundreds of millions of US dollars annually, further shaping the competitive landscape and market concentration.

Crane Rental Market in North America Industry Trends & Insights

The North America Crane Rental Market is experiencing robust growth, propelled by several interconnected industry trends and insights. A significant market growth driver is the sustained investment in infrastructure development across the United States and Canada. Government initiatives aimed at modernizing transportation networks, energy facilities, and urban centers are creating a perpetual demand for heavy lifting services. The construction sector, particularly in residential, commercial, and industrial building, remains the largest application segment, contributing substantially to market expansion. Moreover, the mining & excavation sector is seeing renewed activity due to rising commodity prices and strategic resource exploration, requiring specialized, high-capacity cranes for complex projects. Technological disruptions are playing an increasingly pivotal role. The adoption of telematics and IoT devices on cranes allows for real-time monitoring of performance, predictive maintenance, and enhanced safety protocols, leading to increased operational efficiency and reduced downtime. Furthermore, advancements in crane design, such as the development of more fuel-efficient engines, enhanced boom technologies, and improved safety features like anti-collision systems, are attracting rental demand from safety-conscious end-users. Consumer preferences are shifting towards integrated service providers offering not just crane rental but also specialized rigging, operator training, and project planning. This holistic approach simplifies project execution for clients and fosters stronger customer loyalty. The competitive dynamics are characterized by a race to acquire new, technologically advanced equipment and to expand service networks. Companies are also focusing on optimizing fleet utilization through sophisticated rental management software. The market penetration of rental services is high, as many construction and industrial firms opt for rental over outright ownership to manage capital expenditure and maintain fleet flexibility. The compound annual growth rate (CAGR) of the North America Crane Rental Market is projected to be in the range of 4.5% to 5.5% during the forecast period (2025–2033), driven by these factors. The market size in 2025 is estimated to be in the vicinity of XX billion US dollars, with continued expansion anticipated. The increasing complexity of construction projects, the need for specialized equipment, and the ongoing technological evolution are key insights shaping the future trajectory of this industry.

Dominant Markets & Segments in Crane Rental Market in North America

The North America Crane Rental Market is segmented by Crane Type into Wheel-mounted Mobile Crane, Commercial Truck-mounted Crane, Side Boom, Straddle Crane, Railroad Crane, and Others. By Application Type, it is categorized into Construction, Mining & Excavation, Marine & Offshore, and Industrial Applications.

Dominant Region and Country

- United States: As the largest economy in North America, the United States consistently dominates the crane rental market due to its extensive infrastructure projects, robust industrial base, and significant construction activity.

- Key Drivers: Federal and state investments in infrastructure renewal (roads, bridges, airports), ongoing urbanization and commercial development, and the shale gas industry's demand for specialized lifting services.

Dominant Crane Type

- Wheel-mounted Mobile Crane: This category, encompassing All-Terrain Cranes and Rough-Terrain Cranes, is a significant contributor to market revenue due to its versatility, mobility, and suitability for a wide range of construction and industrial applications.

- Key Drivers: Their ability to navigate diverse terrains and job sites, coupled with increasing demand for higher lifting capacities and enhanced maneuverability in confined spaces.

Dominant Application Type

- Construction: The construction sector is the undisputed leader in crane rental demand, driven by new builds, renovations, and maintenance across residential, commercial, industrial, and infrastructure segments.

- Key Drivers: Population growth leading to increased housing demand, corporate expansion fueling commercial and industrial construction, and large-scale public infrastructure projects.

Detailed Dominance Analysis

The United States' dominance is underpinned by massive annual spending on infrastructure, including the Bipartisan Infrastructure Law, which is injecting billions into rebuilding roads, bridges, and public transit. This translates directly into a perpetual need for cranes in various capacities. Major metropolitan areas continue to experience high levels of commercial and residential development, requiring a constant influx of rental cranes.

Within crane types, Wheel-mounted Mobile Cranes, particularly All-Terrain Cranes, are highly sought after. Their ability to travel on public roads and then transition to challenging off-road conditions makes them exceptionally versatile. The trend towards taller buildings and more complex industrial facilities necessitates cranes with higher lifting capacities and greater reach, areas where all-terrain and large rough-terrain cranes excel. The strategic acquisitions of new Grove mobile cranes by companies like Maxim Crane highlight this segment's importance and the companies' commitment to bolstering their fleets in this area.

The Construction application type's supremacy is driven by its broad reach across multiple sub-sectors. From erecting steel frames for skyscrapers to placing wind turbines in remote locations, cranes are integral to nearly every phase of construction. The ongoing expansion of manufacturing facilities and the development of energy infrastructure (including renewable energy projects) further solidify construction as the primary end-user.

While Mining & Excavation and Marine & Offshore applications represent smaller but significant segments, their demand is often project-specific and can be highly cyclical. However, periods of intense activity in these sectors can lead to substantial crane rental volumes. Industrial applications, encompassing manufacturing, petrochemical, and power generation, also contribute steadily to the market through routine maintenance, upgrades, and new plant construction. The overall market leadership is thus a confluence of a large and active end-user base, a demand for versatile and high-capacity equipment, and consistent governmental and private sector investment in development.

Crane Rental Market in North America Product Innovations

Product innovations in the North America Crane Rental Market are primarily focused on enhancing safety, efficiency, and operational capabilities. Recent developments include the integration of advanced telematics systems for remote monitoring and diagnostics, enabling predictive maintenance and reducing downtime. Furthermore, the introduction of cranes with greater lifting capacities, extended reach, and improved fuel efficiency addresses the evolving demands of complex construction and industrial projects. The development of hybrid and electric crane technologies is also gaining traction, driven by environmental regulations and a growing preference for sustainable solutions. These innovations provide competitive advantages by offering clients more reliable, cost-effective, and environmentally conscious lifting solutions.

Report Segmentation & Scope

This report meticulously segments the North America Crane Rental Market across two primary dimensions.

Crane Type: The market is analyzed by Wheel-mounted Mobile Crane, characterized by its broad applicability across various terrains and project sizes; Commercial Truck-mounted Crane, known for its ease of transport and suitability for urban environments; Side Boom Cranes, crucial for pipeline construction and heavy lifting in the oil and gas industry; Straddle Cranes, essential for port operations and intermodal freight handling; Railroad Cranes, specialized for railway maintenance and construction; and Others, encompassing various niche lifting equipment. Each segment's growth is influenced by specific industry demands and technological advancements.

Application Type: The market is further segmented by Construction, representing the largest segment driven by infrastructure development and building activities; Mining & Excavation, demanding robust and high-capacity cranes for resource extraction; Marine & Offshore, requiring specialized cranes for port activities, shipbuilding, and offshore energy exploration and production; and Industrial Applications, covering manufacturing, petrochemical plants, and power generation facilities. Projections indicate continued strong growth in the Construction segment, with significant contributions from Industrial Applications.

Key Drivers of Crane Rental Market in North America Growth

The growth of the North America Crane Rental Market is propelled by several key drivers. Sustained infrastructure investment across the continent, fueled by government initiatives and private sector development, is a primary catalyst. The increasing complexity and scale of construction projects, demanding specialized and high-capacity lifting equipment, further fuels demand. Technological advancements in crane design, including automation, telematics, and the development of more efficient and safer machinery, are enhancing operational capabilities and attracting rental contracts. Furthermore, the economic benefit of rental versus ownership, particularly for small and medium-sized enterprises, by offering flexibility and avoiding significant capital outlay, remains a crucial driver. The burgeoning renewable energy sector, with its need for heavy lifting in wind turbine installation, also contributes to market expansion.

Challenges in the Crane Rental Market in North America Sector

Despite its growth trajectory, the North America Crane Rental Market faces several challenges. Stringent regulatory compliance and evolving safety standards necessitate continuous investment in updated equipment and training, impacting operational costs. Skilled labor shortages for certified crane operators and maintenance technicians present a significant bottleneck, potentially limiting service delivery and project timelines. Fluctuations in raw material prices and global supply chain disruptions can affect equipment manufacturing costs and availability. Intense price competition among rental providers, especially for standard equipment, can compress profit margins. Additionally, seasonal demand variations and the economic cyclicality of key end-user industries can lead to periods of underutilization for rental fleets, posing financial challenges.

Leading Players in the Crane Rental Market in North America Market

- Maxim Crane Works L P

- Lampson International LLC

- Ahern Rentals Inc

- American Equipment Company Inc

- Caterpillar Inc

- All Erection & Crane Rental Corp

- Buckner HeavyLift Cranes

- United Rentals Inc

Key Developments in Crane Rental Market in North America Sector

- February 2022: Capital City Group, Inc. acquired by The Bay Crane Companies, Inc., enhancing Bay Crane's position as a top 10 crane service provider in North America with 15 full-service facilities.

- July 2021: Maxim Crane purchased 51 Grove mobile cranes, comprising high-capacity rough-terrain cranes and five-axle and six-axle all-terrain cranes, to strengthen its fleet across new locations.

Strategic Crane Rental Market in North America Market Outlook

The strategic outlook for the North America Crane Rental Market remains highly positive, driven by ongoing urbanization, significant infrastructure renewal projects, and the sustained demand from the industrial and energy sectors. Key growth accelerators include the continued adoption of advanced technologies that enhance operational efficiency and safety, such as AI-powered diagnostics and autonomous features. Strategic opportunities lie in expanding service offerings to include comprehensive project management and specialized rigging solutions, catering to an increasing client preference for integrated service providers. Furthermore, the growing focus on sustainability will likely spur demand for hybrid and electric crane rentals, presenting a niche but rapidly expanding market segment. Companies that strategically invest in modernizing their fleets, enhancing their digital presence for seamless booking and management, and cultivating a skilled workforce will be well-positioned to capitalize on the market's robust growth potential.

Crane Rental Market in North America Segmentation

-

1. Crane Type

- 1.1. Wheel-mounted Mobile Crane

- 1.2. Commercial Truck-mounted Crane

- 1.3. Side Boom

- 1.4. Straddle Crane

- 1.5. Railroad Crane

- 1.6. Others

-

2. Application Type

- 2.1. Construction

- 2.2. Mining & Excavation

- 2.3. Marine & Offshore

- 2.4. Industrial Applications

Crane Rental Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

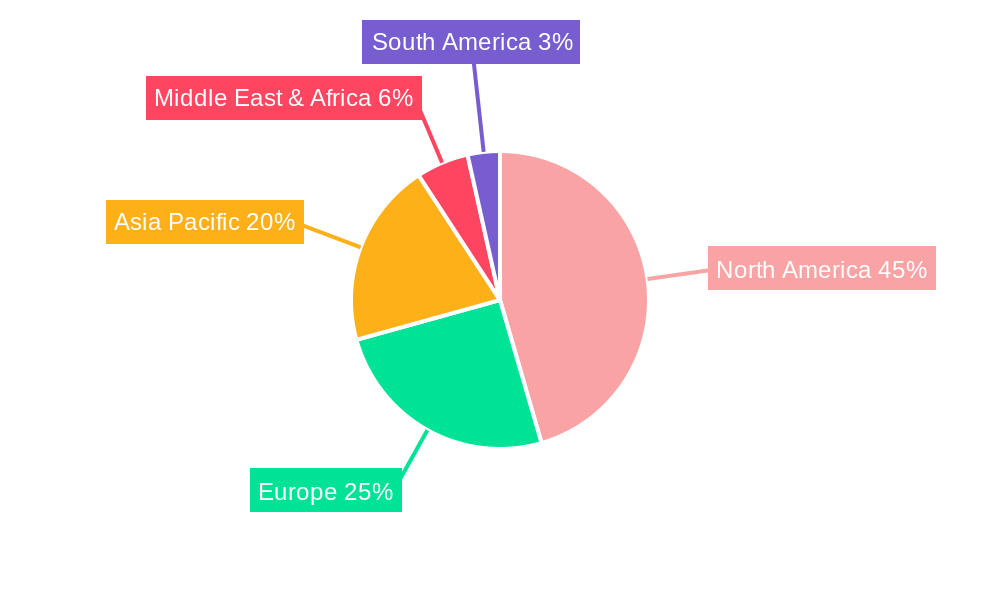

Crane Rental Market in North America Regional Market Share

Geographic Coverage of Crane Rental Market in North America

Crane Rental Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. Construction Activities to Elevate Crane Rental Services in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crane Type

- 5.1.1. Wheel-mounted Mobile Crane

- 5.1.2. Commercial Truck-mounted Crane

- 5.1.3. Side Boom

- 5.1.4. Straddle Crane

- 5.1.5. Railroad Crane

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Construction

- 5.2.2. Mining & Excavation

- 5.2.3. Marine & Offshore

- 5.2.4. Industrial Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Crane Type

- 6. North America Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crane Type

- 6.1.1. Wheel-mounted Mobile Crane

- 6.1.2. Commercial Truck-mounted Crane

- 6.1.3. Side Boom

- 6.1.4. Straddle Crane

- 6.1.5. Railroad Crane

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Construction

- 6.2.2. Mining & Excavation

- 6.2.3. Marine & Offshore

- 6.2.4. Industrial Applications

- 6.1. Market Analysis, Insights and Forecast - by Crane Type

- 7. South America Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crane Type

- 7.1.1. Wheel-mounted Mobile Crane

- 7.1.2. Commercial Truck-mounted Crane

- 7.1.3. Side Boom

- 7.1.4. Straddle Crane

- 7.1.5. Railroad Crane

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Construction

- 7.2.2. Mining & Excavation

- 7.2.3. Marine & Offshore

- 7.2.4. Industrial Applications

- 7.1. Market Analysis, Insights and Forecast - by Crane Type

- 8. Europe Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crane Type

- 8.1.1. Wheel-mounted Mobile Crane

- 8.1.2. Commercial Truck-mounted Crane

- 8.1.3. Side Boom

- 8.1.4. Straddle Crane

- 8.1.5. Railroad Crane

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Construction

- 8.2.2. Mining & Excavation

- 8.2.3. Marine & Offshore

- 8.2.4. Industrial Applications

- 8.1. Market Analysis, Insights and Forecast - by Crane Type

- 9. Middle East & Africa Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crane Type

- 9.1.1. Wheel-mounted Mobile Crane

- 9.1.2. Commercial Truck-mounted Crane

- 9.1.3. Side Boom

- 9.1.4. Straddle Crane

- 9.1.5. Railroad Crane

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Construction

- 9.2.2. Mining & Excavation

- 9.2.3. Marine & Offshore

- 9.2.4. Industrial Applications

- 9.1. Market Analysis, Insights and Forecast - by Crane Type

- 10. Asia Pacific Crane Rental Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Crane Type

- 10.1.1. Wheel-mounted Mobile Crane

- 10.1.2. Commercial Truck-mounted Crane

- 10.1.3. Side Boom

- 10.1.4. Straddle Crane

- 10.1.5. Railroad Crane

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Construction

- 10.2.2. Mining & Excavation

- 10.2.3. Marine & Offshore

- 10.2.4. Industrial Applications

- 10.1. Market Analysis, Insights and Forecast - by Crane Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Maxim Crane Works L P

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lampson International LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ahern Rentals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Equipment Company Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Caterpillar Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 All Erection & Crane Rental Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Buckner HeavyLift Cranes

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 United Rentals Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Maxim Crane Works L P

List of Figures

- Figure 1: Global Crane Rental Market in North America Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 3: North America Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 4: North America Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 9: South America Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 10: South America Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 11: South America Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 15: Europe Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 16: Europe Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 17: Europe Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 21: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 22: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Crane Rental Market in North America Revenue (billion), by Crane Type 2025 & 2033

- Figure 27: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Crane Type 2025 & 2033

- Figure 28: Asia Pacific Crane Rental Market in North America Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Crane Rental Market in North America Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Crane Rental Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 2: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global Crane Rental Market in North America Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 5: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 11: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 17: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 29: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 30: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Crane Rental Market in North America Revenue billion Forecast, by Crane Type 2020 & 2033

- Table 38: Global Crane Rental Market in North America Revenue billion Forecast, by Application Type 2020 & 2033

- Table 39: Global Crane Rental Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Crane Rental Market in North America Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crane Rental Market in North America?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Crane Rental Market in North America?

Key companies in the market include Maxim Crane Works L P, Lampson International LLC, Ahern Rentals Inc, American Equipment Company Inc *List Not Exhaustive, Caterpillar Inc, All Erection & Crane Rental Corp, Buckner HeavyLift Cranes, United Rentals Inc.

3. What are the main segments of the Crane Rental Market in North America?

The market segments include Crane Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Construction Activities to Elevate Crane Rental Services in North America.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

In February 2022, Capital City Group, Inc. has been acquired by The Bay Crane Companies, Inc., the leading specialist crane and rigging equipment service and rental provider in the northeastern United States. As a result of the deal, Bay Crane now has 15 full-service facilities and is among the top 10 crane service providers in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crane Rental Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crane Rental Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crane Rental Market in North America?

To stay informed about further developments, trends, and reports in the Crane Rental Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence