Key Insights

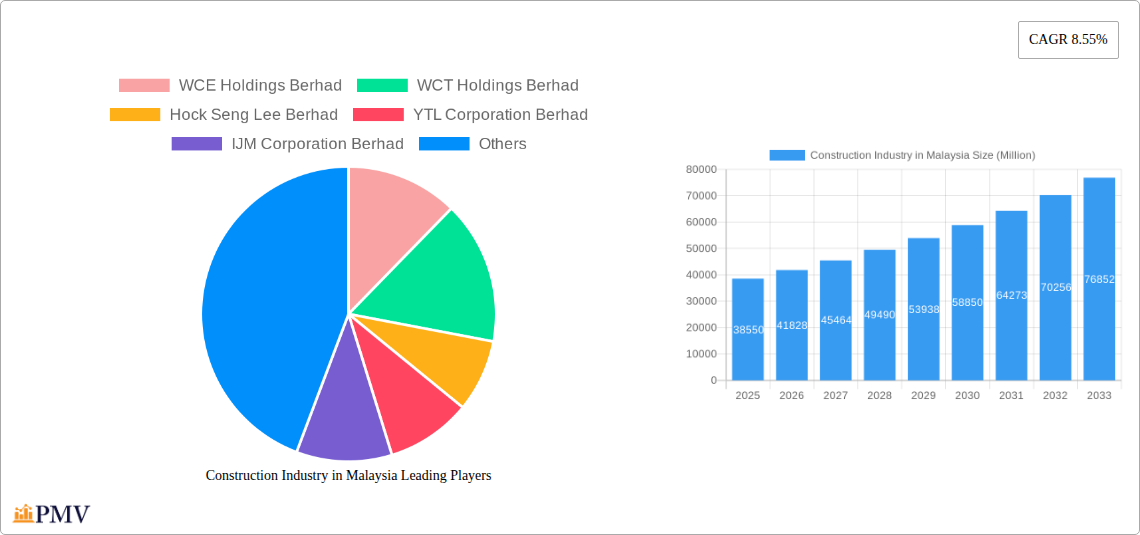

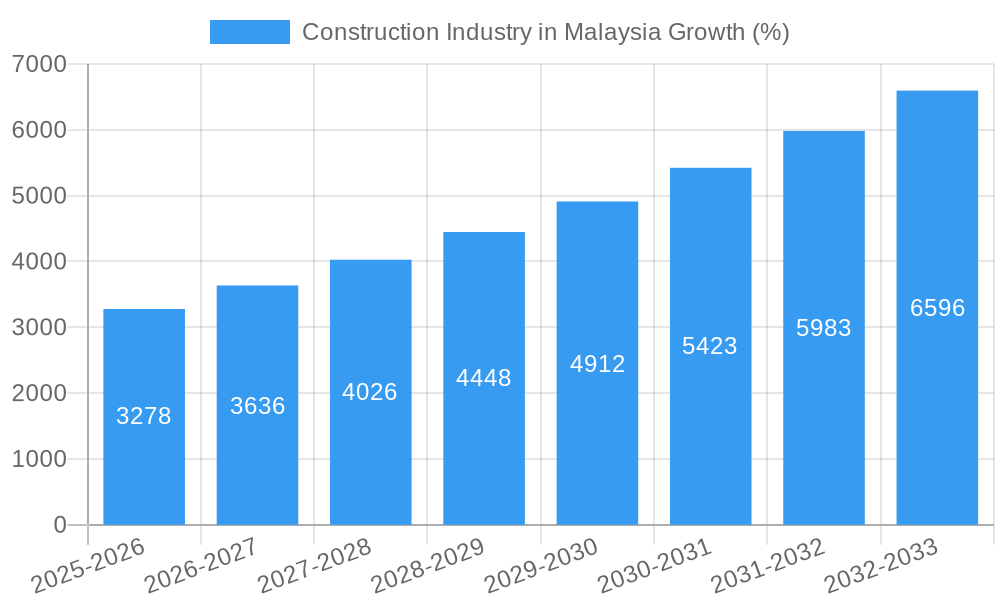

The Malaysian construction industry, valued at RM 38.55 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.55% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives focused on infrastructure development, particularly in transportation (roads, railways, and airports), and energy and utilities projects, are significantly contributing to the market's upward trajectory. Increased urbanization and a rising population are driving demand for residential construction, while industrial growth necessitates further expansion in factory and warehouse spaces. The construction sector is segmented into various sub-sectors: commercial, residential, industrial, infrastructure (transportation), and energy & utilities construction. Within these, new construction projects constitute a major portion of the market, although additions and renovations also play a significant role. Major players like WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, and others, are actively shaping the industry's landscape through their projects and technological advancements.

However, the industry also faces challenges. Fluctuations in material prices, skilled labor shortages, and stringent regulatory compliance requirements pose potential restraints on growth. Managing these challenges effectively through strategic planning and investment in technological advancements, particularly in sustainable building practices, will be crucial for sustained market expansion. The forecast period anticipates a continued growth trajectory, with the market value exceeding RM 80 billion by 2033, driven by consistent governmental investment and the nation’s ongoing economic progress. This positive outlook underscores the importance of continuous innovation and strategic adaptation for businesses within the Malaysian construction sector.

Construction Industry in Malaysia: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysian construction industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market trends, competitive dynamics, key players, and future growth prospects. The report leverages a robust data set to quantify market size in Millions across various segments, providing actionable intelligence for navigating this dynamic sector.

Construction Industry in Malaysia Market Structure & Competitive Dynamics

The Malaysian construction market, valued at approximately RM xx Million in 2024, exhibits a moderately concentrated structure. Key players like IJM Corporation Berhad, Gamuda Berhad, and YTL Corporation Berhad hold significant market share, although the presence of numerous smaller firms contributes to a competitive landscape. The industry is influenced by a regulatory framework emphasizing sustainable practices and safety standards.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2024.

- Innovation Ecosystems: Collaboration between construction firms and technology providers is driving the adoption of Building Information Modeling (BIM) and other digital technologies.

- Regulatory Frameworks: Stringent building codes and environmental regulations are shaping industry practices.

- Product Substitutes: The use of prefabricated materials and alternative construction methods is slowly increasing, posing a challenge to traditional construction techniques.

- End-User Trends: Demand for sustainable and resilient infrastructure projects is driving innovation and investment.

- M&A Activities: The past five years have witnessed several mergers and acquisitions, with deal values totaling approximately RM xx Million. Notable examples include (specific deals need to be researched and inserted here).

Construction Industry in Malaysia Industry Trends & Insights

The Malaysian construction industry is characterized by fluctuating growth, influenced by government spending on infrastructure projects, economic cycles, and global events. The historical period (2019-2024) showed a CAGR of xx%, while the forecast period (2025-2033) is projected to witness a CAGR of xx%, driven by factors such as increasing urbanization, rising population, and government initiatives. Market penetration of new technologies like BIM remains relatively low but is expected to increase significantly over the next decade. The industry is facing challenges related to labor shortages and rising material costs, impacting profitability. Competitive dynamics are marked by intense bidding for large-scale projects and a constant push for cost efficiency.

Dominant Markets & Segments in Construction Industry in Malaysia

By Sector:

- Infrastructure (Transportation) Construction: This segment is expected to remain the dominant sector, driven by continuous government investment in road networks, railways, and airports. Key drivers include ongoing urbanization, improving connectivity, and the need to support economic growth.

- Residential Construction: This sector shows consistent demand, fuelled by a growing population and increasing affordability schemes. However, growth might be constrained by land scarcity and regulatory approvals.

- Commercial Construction: This segment experiences cyclical growth, tied to economic conditions and business confidence. High-rise buildings and shopping malls are key components.

- Industrial Construction: This segment is experiencing growth due to foreign direct investment and government incentives for industrial zones. However, it’s highly susceptible to global economic shifts.

- Energy and Utilities Construction: This sector is poised for expansion driven by the country’s energy transition goals and renewable energy initiatives.

By Construction Type:

- New Construction: This remains the largest segment, accounting for the majority of projects.

- Additions & Renovations: This segment experiences steady growth driven by older building stock requiring upgrades and modifications.

- Demolition: This segment's growth is tied to urban renewal projects and the need to make way for newer developments.

Construction Industry in Malaysia Product Innovations

Technological advancements are significantly impacting the construction industry in Malaysia. The adoption of Building Information Modeling (BIM) for improved project management and cost optimization is slowly accelerating. Prefabrication and modular construction techniques are gaining traction, promising faster project completion and reduced waste. The increasing use of drones for site surveying and progress monitoring represents another key technological shift. These innovations offer improved efficiency, reduced costs, and enhanced safety measures, thus gaining wider market acceptance.

Report Segmentation & Scope

This report segments the Malaysian construction market comprehensively. The "By Sector" segmentation includes Commercial, Residential, Industrial, Infrastructure (Transportation), and Energy & Utilities Construction. Each sector's growth trajectory, market size, and key players are analyzed. The "By Construction Type" segmentation involves Additions, Demolition, and New Construction, providing a granular understanding of project types and market dynamics. The report offers growth projections, size estimations (in Millions of RM), and competitive landscape analysis for each segment across the study period.

Key Drivers of Construction Industry in Malaysia Growth

Several factors propel growth in the Malaysian construction sector. Government initiatives aimed at infrastructure development, particularly in transportation and energy, play a significant role. The expanding urbanization and population growth fuels the demand for housing and commercial spaces. Foreign direct investment (FDI) inflow supports the construction of industrial facilities and logistics hubs. Lastly, the push for sustainable construction practices creates new opportunities in green building materials and technologies.

Challenges in the Construction Industry in Malaysia Sector

The Malaysian construction industry faces various challenges. Labor shortages due to a skills gap and the high cost of skilled labor are major concerns. Supply chain disruptions caused by global events can lead to material price volatility and project delays. Intense competition among firms can put downward pressure on profit margins. Stringent regulatory requirements and lengthy approval processes can also slow down project execution and add to costs.

Leading Players in the Construction Industry in Malaysia Market

- WCE Holdings Berhad

- WCT Holdings Berhad

- Hock Seng Lee Berhad

- YTL Corporation Berhad

- IJM Corporation Berhad

- Muhibbah Engineering (M) Bhd

- Malaysian Resources Corporation Berhad

- Gamuda Berhad

- Mudajaya Group Berhad

- UEM Group Berhad

Key Developments in Construction Industry in Malaysia Sector

- October 2023: Gamuda Bhd's joint venture for a MYR 4 billion hydroelectric power plant signifies significant investment in the energy sector, potentially driving growth in related construction activities.

- July 2023: IJM Corporation's foray into industrial property development in the Klang Valley marks diversification and expansion into a high-growth segment, influencing future market dynamics.

Strategic Construction Industry in Malaysia Market Outlook

The Malaysian construction industry is poised for continued growth, driven by ongoing infrastructure development, urbanization, and rising demand for housing and commercial spaces. Strategic opportunities exist in sustainable construction, prefabrication, and the adoption of advanced technologies. Companies that embrace innovation, adapt to evolving regulations, and effectively manage labor and supply chain challenges will be best positioned for success. The market offers significant potential for both domestic and international players.

Construction Industry in Malaysia Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Construction

Construction Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition and New Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition and New Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition and New Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition and New Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition and New Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WCE Holdings Berhad

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WCT Holdings Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hock Seng Lee Berhad

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 YTL Corporation Berhad

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IJM Corporation Berhad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Muhibbah Engineering (M) Bhd**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malaysian Resources Corporation Berhad

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gamuda Berhad

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mudajaya Group Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UEM Group Berhad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WCE Holdings Berhad

List of Figures

- Figure 1: Global Construction Industry in Malaysia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Malaysia Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 3: Malaysia Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 7: North America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 8: North America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 11: South America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 12: South America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 13: South America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 14: South America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 17: Europe Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Europe Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 19: Europe Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 20: Europe Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 23: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 24: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 25: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 26: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 29: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 30: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 31: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 32: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 7: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 8: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 14: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 20: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 31: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 32: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 40: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 41: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Malaysia?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Construction Industry in Malaysia?

Key companies in the market include WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, YTL Corporation Berhad, IJM Corporation Berhad, Muhibbah Engineering (M) Bhd**List Not Exhaustive, Malaysian Resources Corporation Berhad, Gamuda Berhad, Mudajaya Group Berhad, UEM Group Berhad.

3. What are the main segments of the Construction Industry in Malaysia?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects.

6. What are the notable trends driving market growth?

Residential Construction Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023: Gamuda Bhd entered into a joint-venture agreement with Sabah Energy Corp Sdn Bhd (SEC) and Kerjaya Kagum Hitech JV Sdn Bhd (KKHJV) to undertake a private finance initiative for the development of the MYR 4 billion (USD 0.86 billion) 187.5 MW hydroelectric power plant in Tenom, Sabah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Construction Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence