Key Insights

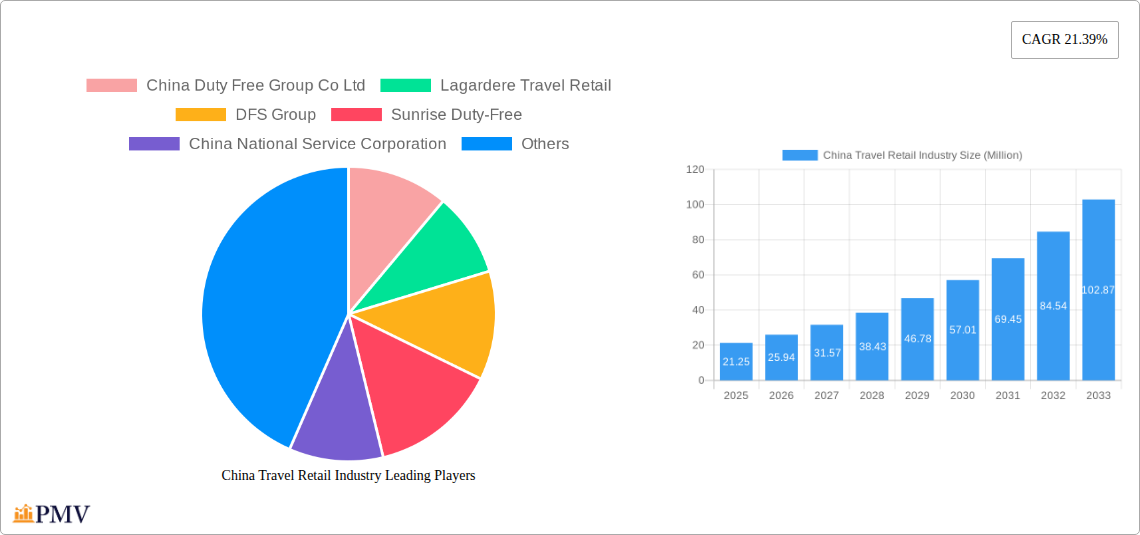

The China Travel Retail Industry is poised for remarkable expansion, with a current market size of 21.25 Million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 21.39% through 2033. This robust growth is fueled by a confluence of compelling drivers, including the burgeoning outbound Chinese tourism market, increasing disposable incomes, and a growing preference for premium and localized products. As travel restrictions ease and consumers become more confident, the demand for travel retail offerings is set to surge. Key growth engines include the fashion and accessories sector, as well as a significant appetite for jewelry and watches, and the ever-popular wine & spirits and food & confectionery segments. The increasing sophistication of Chinese travelers, seeking unique and high-quality items, further propels this trend. Airports continue to be the dominant distribution channel, reflecting the high volume of air travelers, though efforts are underway to enhance retail experiences in other channels like railway stations.

Despite the overwhelmingly positive outlook, certain restraints could temper the pace of growth. These include evolving regulatory landscapes, intense competition among established and emerging players, and the need for continuous innovation in product offerings and consumer engagement to cater to diverse preferences. However, the underlying demand and the strategic positioning of key companies such as China Duty Free Group, Lagardere Travel Retail, and DFS Group suggest a strong capacity to overcome these challenges. The industry's ability to adapt to digital advancements, integrate omnichannel strategies, and provide seamless shopping experiences will be crucial in maximizing its potential. With a strong historical performance from 2019-2024, the market is well-positioned for sustained and significant growth in the coming years.

Unlock the Future of Global Commerce: The Definitive China Travel Retail Industry Report

This comprehensive report provides unparalleled insights into the dynamic China Travel Retail Industry, a multi-billion dollar market poised for unprecedented growth. Delving deep into China duty-free market trends, travel retail China opportunities, and the evolving China travel shopping landscape, this study is an indispensable resource for stakeholders seeking to capitalize on this burgeoning sector. We analyze market structures, competitive dynamics, product innovations, and strategic outlooks, offering actionable intelligence for luxury travel retail China, airport retail China, and digital travel retail China. Our detailed segmentation covers Fashion and Accessories, Jewelry and Watches, Wine & Spirits, Food & Confectionery, Fragrances and Cosmetics, Tobacco, and Others, across Airports, Railway Stations, and Others distribution channels.

This report meticulously examines the China Travel Retail Industry Market Structure & Competitive Dynamics from 2019–2033, with a base year of 2025. We explore market concentration, innovation ecosystems, and regulatory frameworks influencing the sector. Insights into product substitutes and end-user trends, including the impact of companies like L'Oreal, Starbucks, Samsung Electronics, Huawei Technologies, and Haagen-Dazs China, are provided. We also analyze M&A activities, with estimated M&A deal values projected to reach $500 Million by 2030, and key players such as China Duty Free Group Co Ltd commanding a significant market share exceeding 60% in the domestic duty-free segment.

- Market Concentration: Dominated by key players like China Duty Free Group, with a consolidated market share.

- Innovation Ecosystems: Focus on digitalization, personalized shopping experiences, and sustainable retail practices.

- Regulatory Frameworks: Evolving policies supporting Hainan's offshore duty-free expansion and a general push for market liberalization.

- Product Substitutes: Growing influence of e-commerce and cross-border platforms, necessitating a strong omnichannel strategy.

- End-User Trends: Increasing demand for premium and exclusive products, personalized services, and experiential retail.

- M&A Activities: Strategic consolidations and acquisitions aimed at expanding market reach and portfolio diversification, with estimated deal values in the hundreds of millions.

The China Travel Retail Industry Industry Trends & Insights section explores the critical factors driving market expansion throughout the forecast period (2025–2033). This segment, meticulously researched, forecasts a robust Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033. We delve into the resurgence of international travel post-pandemic, significantly boosting China travel retail growth. The report highlights how technological disruptions, such as the widespread adoption of AI-powered personalization and augmented reality shopping experiences, are reshaping consumer engagement. China's consumer preferences are increasingly leaning towards sustainable and ethically sourced products, alongside a sustained demand for luxury and exclusive items. Competitive dynamics are intensifying, with traditional players like Lagardere Travel Retail and DFS Group actively investing in digital transformation to counter the rise of new entrants and direct-to-consumer models. Market penetration for premium beauty and fashion segments is expected to continue its upward trajectory, driven by an affluent and discerning consumer base. The strategic importance of the Hainan Free Trade Port continues to be a major catalyst, attracting substantial investment and further solidifying China's position as a global travel retail powerhouse.

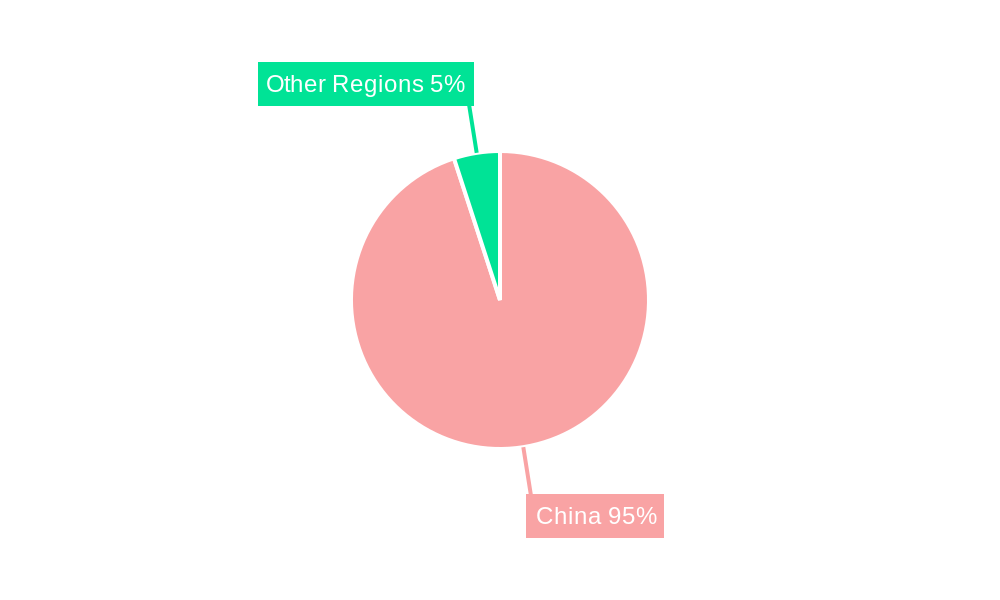

The Dominant Markets & Segments in China Travel Retail Industry section provides a detailed analysis of leading regions, countries, and product categories. Airports remain the dominant distribution channel, accounting for an estimated 70% of total sales within the travel retail sector. Within product types, Fragrances and Cosmetics continue to lead, projected to capture over 30% of the market share by 2033, followed closely by Jewelry and Watches and Wine & Spirits.

- Leading Region/Country: China, with a particular focus on key international gateway airports and the Hainan Free Trade Port.

- Dominant Product Segments:

- Fragrances and Cosmetics: Driven by Chinese consumers' strong preference for international beauty brands and a growing interest in skincare. Projected market value of $25 Billion by 2030.

- Jewelry and Watches: Sustained demand for luxury timepieces and high-end jewelry, with significant contributions from brands like Rolex and Cartier.

- Wine & Spirits: Continued popularity of premium wines, champagne, and popular liquor brands, with strong performance in Bordeaux wines and Scotch whisky.

- Dominant Distribution Channels:

- Airports: The primary hub for travel retail, benefiting from high passenger traffic and captive audiences. Forecasted to contribute 75% of total airport retail revenue.

- Others (Hainan Duty-Free): The Hainan Free Trade Port is a rapidly growing segment, showcasing significant growth potential and attracting both domestic and international tourists.

China Travel Retail Industry Product Innovations are revolutionizing the shopping experience. Companies are increasingly leveraging AI-powered personalization for product recommendations and virtual try-on technologies. The integration of augmented reality (AR) allows consumers to visualize products in real-time, enhancing engagement. Sustainable packaging and ethically sourced products are gaining traction, aligning with growing consumer consciousness. These innovations cater to evolving consumer preferences and provide a competitive edge in a dynamic market.

The Report Segmentation & Scope meticulously details the market breakdown. The Product Type segmentation includes: Fashion and Accessories (projected to grow at 8% CAGR), Jewelry and Watches (forecasted at 9.5% CAGR), Wine & Spirits (estimated 7% CAGR), Food & Confectionery (expected 6% CAGR), Fragrances and Cosmetics (leading segment at 12% CAGR), Tobacco (stable growth, 3% CAGR), and Others. The Distribution Channel segmentation covers: Airports (dominant, 70% market share), Railway Stations (growing segment, 15% market share), and Others (including downtown duty-free stores and Hainan, 15% market share).

Key Drivers of China Travel Retail Industry Growth are multi-faceted, fueled by a rapidly expanding middle class with increasing disposable income, government initiatives supporting travel retail expansion, particularly the Hainan Free Trade Port, and a growing appetite for international luxury brands. Technological advancements in e-commerce and digital marketing are also playing a crucial role.

Challenges in the China Travel Retail Industry Sector include stringent import/export regulations, intense competition from both domestic and international players, evolving consumer preferences requiring constant adaptation, and potential supply chain disruptions. The ongoing geopolitical landscape also presents a degree of uncertainty.

Leading Players in the China Travel Retail Industry Market include: China Duty Free Group Co Ltd Lagardere Travel Retail DFS Group Sunrise Duty-Free China National Service Corporation L'Oreal Starbucks Samsung Electronics Huawei Technologies Haagen-Dazs China

Key Developments in China Travel Retail Industry Sector significantly impact market dynamics.

- February 2024: DFS Group partnered with Douyin Life Service, a short video platform in China. The partnership aims to improve international travel retail shopping experiences.

- June 2023: DFS entered a strategic partnership with Ctrip Global Shopping and Unipay International. These partnerships aim to strengthen digitalization in the travel retail market.

The Strategic China Travel Retail Industry Market Outlook is exceptionally promising. Future growth will be propelled by further digitalization, personalized customer journeys, and the continued expansion of the Hainan Free Trade Port. Strategic opportunities lie in developing omnichannel experiences, catering to niche luxury segments, and embracing sustainable retail practices to meet the evolving demands of the discerning Chinese traveler.

China Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Jewelry and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionery

- 1.5. Fragrances and Cosmetics

- 1.6. Tobacco

- 1.7. Others

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Railway Stations

- 2.3. Others

China Travel Retail Industry Segmentation By Geography

- 1. China

China Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Duty-Free Shopping; Government Policies Supporting Tourism

- 3.3. Market Restrains

- 3.3.1. Rise of Duty-Free Shopping; Government Policies Supporting Tourism

- 3.4. Market Trends

- 3.4.1. Expansion of Duty-Free Shopping Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewelry and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionery

- 5.1.5. Fragrances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Railway Stations

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Duty Free Group Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lagardere Travel Retail

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DFS Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunrise Duty-Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China National Service Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Starbucks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samsung Electronics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Haagen-Dazs China**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Duty Free Group Co Ltd

List of Figures

- Figure 1: China Travel Retail Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Travel Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: China Travel Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: China Travel Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 3: China Travel Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: China Travel Retail Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: China Travel Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Travel Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: China Travel Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Travel Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: China Travel Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: China Travel Retail Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: China Travel Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: China Travel Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: China Travel Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: China Travel Retail Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Travel Retail Industry?

The projected CAGR is approximately 21.39%.

2. Which companies are prominent players in the China Travel Retail Industry?

Key companies in the market include China Duty Free Group Co Ltd, Lagardere Travel Retail, DFS Group, Sunrise Duty-Free, China National Service Corporation, L'Oreal, Starbucks, Samsung Electronics, Huawei Technologies, Haagen-Dazs China**List Not Exhaustive.

3. What are the main segments of the China Travel Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Duty-Free Shopping; Government Policies Supporting Tourism.

6. What are the notable trends driving market growth?

Expansion of Duty-Free Shopping Driving the Market.

7. Are there any restraints impacting market growth?

Rise of Duty-Free Shopping; Government Policies Supporting Tourism.

8. Can you provide examples of recent developments in the market?

February 2024: DFS Group partnered with Douyin Life Service, a short video platform in China. The partnership aims to improve international travel retail shopping experiences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Travel Retail Industry?

To stay informed about further developments, trends, and reports in the China Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence