Key Insights

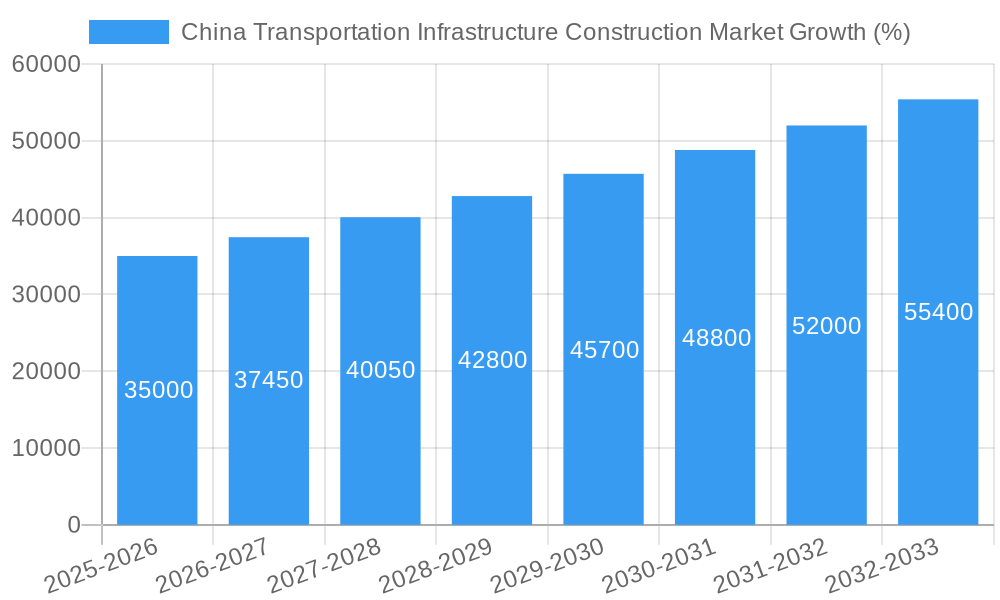

The China Transportation Infrastructure Construction Market is experiencing robust growth, projected to maintain a 7.00% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is fueled by significant government investment in upgrading and expanding existing networks, coupled with a burgeoning need to support rapid economic development and urbanization across the country. Key drivers include the ongoing development of high-speed rail lines, the expansion of airport capacity to accommodate increasing air travel demand, and investments in improving road networks, especially in less developed regions. The market is segmented by transportation mode, encompassing roadways, railways, airports, ports, and inland waterways, each presenting unique growth opportunities. Roadways currently dominate the market share, driven by extensive highway construction projects and rural road development. However, significant investment in high-speed rail and port modernization is expected to increase their market share over the forecast period. Challenges remain, including land acquisition complexities, environmental concerns, and the need for advanced technologies to improve efficiency and sustainability in construction. Major players such as China State Construction Engineering, China Communications Construction Company, and China Railway Group are leveraging their expertise and scale to capture significant market share, driving competition and innovation.

The forecast period (2025-2033) indicates a continued expansion of the market, with the value likely surpassing several hundred billion USD by 2033 (the exact figure depends on the base year market size, which is not provided). This growth will be sustained by ongoing government initiatives aimed at connecting remote areas, enhancing logistics capabilities, and promoting economic integration. The market will likely witness increased adoption of innovative construction techniques and materials, including prefabrication and advanced building information modeling (BIM), to improve project speed, efficiency, and environmental sustainability. Competition among major players will intensify as they strive to secure large-scale projects, leading to strategic partnerships, acquisitions, and the adoption of advanced technologies. The market's success will depend on ongoing government support, effective regulatory frameworks, and a focus on sustainable and environmentally friendly practices.

China Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Transportation Infrastructure Construction Market, offering crucial insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report unveils the market's structure, competitive landscape, and future growth trajectories. The study meticulously analyzes market segments by mode – Roadways, Railways, Airports, Ports, and Inland Waterways – revealing dominant players and key trends shaping this dynamic sector. The report's value is further enhanced by detailed financial projections and analysis of leading companies including China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, Yunnan Construction and Investment Holding Group, Shanghai Construction Group (SCG), China Wu Yi co Ltd, Power Construction Corporation of China, Beijing Construction Engineering Group, Sichuan Road and Bridge Group (list not exhaustive). Expect precise data and actionable intelligence to guide your strategic planning.

China Transportation Infrastructure Construction Market Market Structure & Competitive Dynamics

The China transportation infrastructure construction market exhibits a concentrated structure, dominated by several large state-owned enterprises (SOEs). These companies, including China State Construction Engineering, China Communications Construction Company, and China Railway Group, hold significant market share, often exceeding xx% individually in specific segments. This high concentration reflects the government's substantial role in project awarding and financing. However, smaller regional players, such as Sichuan Road and Bridge Group, hold niche positions in localized markets. The regulatory framework, characterized by stringent safety standards and environmental regulations, plays a vital role in shaping market dynamics. The innovation ecosystem is largely driven by government initiatives fostering technological advancements in areas like high-speed rail and smart infrastructure. While direct product substitutes are limited, competition is fierce amongst the major players, primarily revolving around securing lucrative government contracts. M&A activity has been relatively subdued in recent years, with deal values totaling approximately xx Million in the historical period (2019-2024), reflecting the already consolidated nature of the market. Future consolidation, however, may be driven by the need for greater efficiency and broader geographical reach.

- Market Concentration: High, with major SOEs holding substantial market share.

- Innovation Ecosystem: Primarily driven by government initiatives and technological advancements.

- Regulatory Framework: Stringent, impacting project approval and execution.

- M&A Activity (2019-2024): xx Million in total deal value.

China Transportation Infrastructure Construction Market Industry Trends & Insights

The China transportation infrastructure construction market is witnessing robust growth, fueled by sustained government investment in national infrastructure development plans, such as the Belt and Road Initiative. This investment drives demand across all segments, particularly in high-speed rail and roadway expansion. Technological advancements, including the adoption of BIM (Building Information Modeling), prefabrication, and automation, are enhancing efficiency and reducing project timelines. These innovations are lowering costs and improving overall project quality, contributing to a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Consumer preferences are increasingly focused on enhanced connectivity and seamless travel experiences, further underpinning demand for advanced infrastructure solutions. Intense competition amongst leading players encourages continuous improvement and innovation, driving market growth and shaping future trends. Market penetration of advanced technologies like AI in project management is also expected to increase significantly in the coming years.

Dominant Markets & Segments in China Transportation Infrastructure Construction Market

The Roadways segment currently dominates the China transportation infrastructure construction market, driven by extensive network expansion and upgrades throughout the country. This dominance is underpinned by substantial government investment focused on improving national and regional connectivity. The high-speed rail segment is experiencing rapid growth, reflecting strategic national priorities for efficient long-distance transportation.

- Roadways:

- Key Drivers: Extensive network expansion, government investment, increasing urbanization.

- Railways (High-Speed Rail):

- Key Drivers: Government emphasis on high-speed rail connectivity, national development strategies.

- Airports:

- Key Drivers: Growth in air travel demand, expansion of air travel infrastructure in secondary cities.

- Ports:

- Key Drivers: Growth of international trade, expansion of port facilities to handle larger volumes.

- Inland Waterways:

- Key Drivers: Government focus on inland waterway transportation efficiency.

China Transportation Infrastructure Construction Market Product Innovations

Recent product innovations focus on sustainable and smart technologies, enhancing project efficiency and environmental performance. Advanced materials, prefabricated components, and digital construction tools are significantly improving project delivery timelines and lowering operational costs. Furthermore, innovations targeting smart infrastructure – such as integrated traffic management systems – are enhancing overall transportation efficiency. The market is increasingly driven towards sustainable practices, incorporating eco-friendly materials and construction methods. This shift caters to both government regulations and rising environmental awareness.

Report Segmentation & Scope

This report segments the China transportation infrastructure construction market by mode: Roadways, Railways, Airports, Ports, and Inland Waterways. Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The roadways segment is further broken down by road type (e.g., highways, expressways), while the railways segment considers both high-speed and conventional rail lines. Airport analysis covers commercial and cargo airports. Port analysis differentiates between container and bulk handling facilities. Inland waterway analysis considers rivers, canals, and lakes.

Key Drivers of China Transportation Infrastructure Construction Market Growth

Several factors drive the growth of the China transportation infrastructure construction market: substantial government investment in infrastructure development; rapid urbanization and increasing population density; expansion of the national and regional transportation networks; increasing demand for efficient and sustainable transportation solutions; and technological advancements leading to improved construction methods and project management.

Challenges in the China Transportation Infrastructure Construction Market Sector

Challenges include securing project financing for large-scale projects, ensuring timely acquisition of land and permits, managing complex regulatory requirements, addressing environmental concerns associated with infrastructure development, and mitigating risks associated with large-scale construction projects. Supply chain disruptions and labor shortages also pose significant challenges. These challenges result in potential project delays and cost overruns, impacting overall market growth.

Leading Players in the China Transportation Infrastructure Construction Market Market

- China State Construction Engineering

- China Communications Construction Company

- China Railway Group

- China Railway Construction

- Yunnan Construction and Investment Holding Group

- Shanghai Construction Group (SCG)

- China Wu Yi co Ltd

- Power Construction Corporation of China

- Beijing Construction Engineering Group

- Sichuan Road and Bridge Group

Key Developments in China Transportation Infrastructure Construction Market Sector

- 2023 Q3: Launch of a new high-speed rail line connecting two major cities.

- 2022 Q4: Significant investment announced for port expansion in a key coastal city.

- 2021 Q2: Merger of two mid-sized construction companies specializing in roadway projects.

- 2020 Q1: Government approval of a new five-year plan for infrastructure development.

Strategic China Transportation Infrastructure Construction Market Market Outlook

The China transportation infrastructure construction market is poised for continued growth, driven by ongoing government investment, technological advancements, and evolving consumer preferences. Strategic opportunities exist in developing sustainable and smart infrastructure solutions, leveraging technological advancements to enhance efficiency and reduce costs, and expanding into new and emerging transportation modes. The market presents significant potential for companies offering innovative products and services, and those able to navigate the complex regulatory landscape successfully.

China Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

China Transportation Infrastructure Construction Market Segmentation By Geography

- 1. China

China Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Government Initiatives Driving Transport Infrastructure Construction Market in China

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China State Construction Engineering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Communications Construction Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Railway Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Railway Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yunnan Construction and Investment Holding Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shanghai Construction Group (SCG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Wu Yi co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Construction Corporation of China

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Construction Engineering Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sichuan Road and Bridge Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China State Construction Engineering

List of Figures

- Figure 1: China Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: China Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Transportation Infrastructure Construction Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the China Transportation Infrastructure Construction Market?

Key companies in the market include China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, Yunnan Construction and Investment Holding Group, Shanghai Construction Group (SCG), China Wu Yi co Ltd, Power Construction Corporation of China, Beijing Construction Engineering Group**List Not Exhaustive, Sichuan Road and Bridge Group.

3. What are the main segments of the China Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Government Initiatives Driving Transport Infrastructure Construction Market in China.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the China Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence