Key Insights

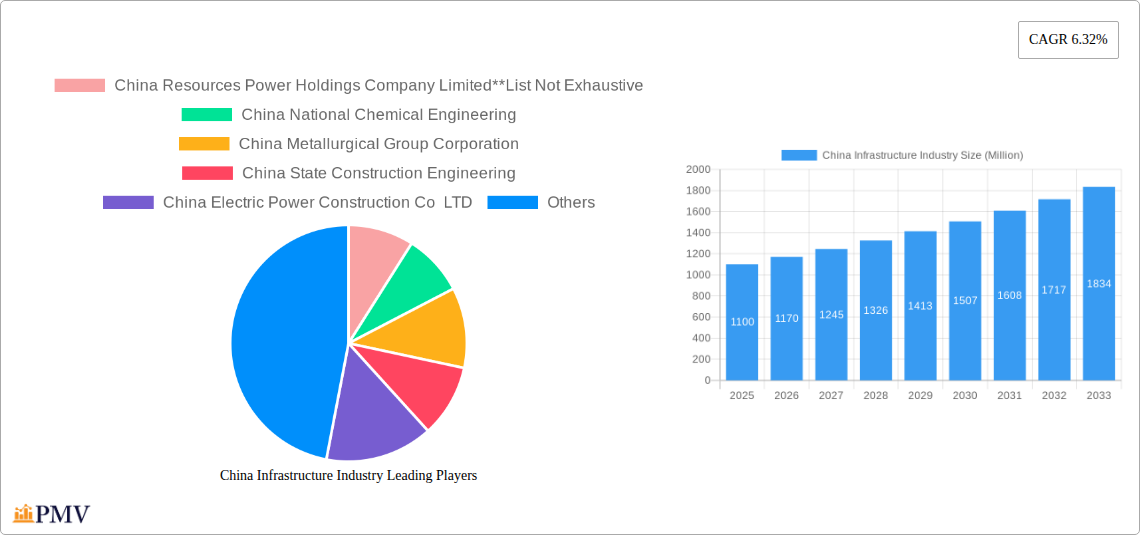

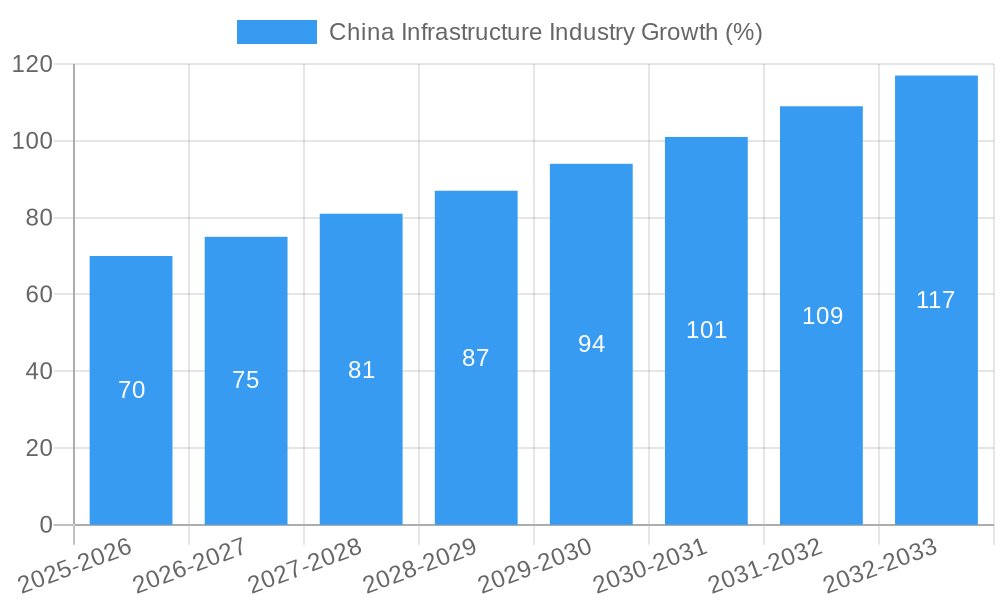

The China infrastructure market, valued at $1.10 billion in 2025, is projected to experience robust growth, driven by sustained government investment in social and economic infrastructure development. A compound annual growth rate (CAGR) of 6.32% from 2025 to 2033 indicates a significant expansion of this sector. Key drivers include urbanization, industrialization, and the ongoing need to modernize transportation networks, water management systems, and telecommunications infrastructure. The government's focus on sustainable development and smart city initiatives further fuels this growth. The market is segmented by infrastructure type (social infrastructure, transportation, waterways, telecoms, manufacturing) and key cities (Shanghai, Beijing, Shenzhen), reflecting the uneven distribution of investment and development across the country. While challenges exist, including potential resource constraints and environmental concerns, the overall outlook remains positive, with large state-owned enterprises like China State Construction Engineering, China Communications Construction Company, and China Railway Group Limited playing a crucial role in shaping the market’s future. The continued expansion of high-speed rail networks, improved port facilities, and the ongoing development of 5G technology are all likely to contribute significantly to the market's expansion in the coming years. Competition among these major players is expected to intensify, leading to further innovation and efficiency gains within the sector.

The forecast period of 2025-2033 presents substantial opportunities for both domestic and international companies operating within the Chinese infrastructure landscape. The market's segmentation offers specialized opportunities for companies focused on specific infrastructure types or geographical regions. Strategic partnerships and collaborations will be essential for success, as will adapting to evolving regulatory frameworks and environmental considerations. Further research into specific sub-sectors, such as renewable energy infrastructure or smart city technologies, could reveal even more granular insights into emerging trends and investment opportunities within the larger China infrastructure market. The continued focus on technological advancement, including the application of big data and AI, will also play a significant role in optimizing project delivery and enhancing overall efficiency across various infrastructure projects.

China Infrastructure Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China infrastructure industry, offering invaluable insights for investors, businesses, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, key segments, and future growth potential. The report leverages extensive data analysis to project a market valued at XXX Million by 2033, showcasing a robust CAGR of xx% during the forecast period.

China Infrastructure Industry Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of China's infrastructure industry, focusing on market concentration, innovation, regulatory frameworks, and M&A activity. The industry displays a moderately concentrated structure, with a few dominant players holding significant market share. For instance, China State Construction Engineering and China Railway Group Limited likely command a combined market share exceeding xx%. Innovation is primarily driven by government initiatives focused on technological advancements in areas such as high-speed rail and smart city development. The regulatory environment is complex, with various central and local government agencies influencing infrastructure development. This involves navigating permits, land acquisition, and environmental impact assessments. Product substitution is limited within specific infrastructure segments, but the industry experiences competition from alternative materials and construction techniques. End-user trends show a growing demand for sustainable and technologically advanced infrastructure solutions. M&A activity has been significant, with deal values exceeding xx Million in recent years, reflecting consolidation within the sector. Examples include mergers aiming for synergies in project management and resource optimization.

China Infrastructure Industry Industry Trends & Insights

The China infrastructure industry demonstrates substantial growth driven by government investments in infrastructure projects, urbanization, and technological advancements. Government policies play a critical role, with initiatives like the Belt and Road Initiative stimulating significant infrastructure development both domestically and internationally. Technological disruptions are transforming the industry, with increased adoption of Building Information Modeling (BIM), advanced materials (e.g., high-strength concrete, composite materials), and automation in construction processes. Consumer preferences are shifting toward sustainable and resilient infrastructure, driving demand for environmentally friendly materials and design strategies. Competitive dynamics are marked by intense competition amongst large state-owned enterprises and the emergence of specialized private sector firms. The market has experienced a CAGR of xx% from 2019 to 2024, demonstrating substantial growth, and market penetration of innovative technologies varies depending on the infrastructure segment. For example, BIM adoption is more prevalent in large-scale projects.

Dominant Markets & Segments in China Infrastructure Industry

This section analyzes the dominant markets and segments within China's infrastructure sector.

By Type:

- Transportation Infrastructure: This segment dominates the market, driven by rapid urbanization and the ongoing expansion of China's high-speed rail network and road infrastructure. Key growth drivers include government investments in transportation networks, connecting various regions and promoting economic activity. The market size for transportation infrastructure is significantly large compared to other segments.

- Social Infrastructure: This segment, encompassing healthcare, education, and other social infrastructure, is experiencing significant growth. Driven by increasing government spending on improving the quality of life, it is expected to show a strong increase over the next decade.

- Waterways: This sector is vital for trade and transportation. Expansion of existing waterways and construction of new ones continues to drive growth, supported by government investments and trade development strategies.

- Extraction Infrastructure: Growth is linked to resource extraction activities and energy infrastructure developments, contributing to national energy security and industrial production.

By Key Cities:

- Shanghai: Remains a dominant market, attracting significant investment due to its strategic location and economic importance. Its extensive transportation networks and the development of smart city initiatives are key drivers.

- Beijing: As the capital city, Beijing benefits from significant government investments in infrastructure. Growth is fueled by continued development and modernization projects.

- Shenzhen: As a technological and economic hub, Shenzhen sees substantial growth in infrastructure development due to the expansion of technology parks and urban areas.

China Infrastructure Industry Product Innovations

The industry is witnessing rapid innovation, driven by government policies promoting technological advancements. This includes the development of smart infrastructure incorporating IoT sensors, advanced materials for increased durability and sustainability (such as self-healing concrete), and the adoption of 3D printing for construction. These advancements are improving efficiency, reducing costs, and enhancing infrastructure resilience. Market acceptance of these innovations varies across different segments, with transportation infrastructure generally adopting advanced technologies at a faster rate.

Report Segmentation & Scope

This report segments the China infrastructure industry by type (Social Infrastructure, Transportation Infrastructure, Waterways, Extraction Infrastructure, Telecoms, Manufacturing Infrastructure) and by key cities (Shanghai, Beijing, Shenzhen). Each segment's analysis includes market size, growth projections, and competitive dynamics. For example, the transportation infrastructure segment exhibits the highest growth potential, with a projected market size of XXX Million by 2033, driven by ongoing investments in high-speed rail and road networks. The market in Shanghai is expected to show strong growth due to ongoing urban development and smart city initiatives.

Key Drivers of China Infrastructure Industry Growth

Growth in China's infrastructure sector is propelled by several key factors. Firstly, significant government investment in infrastructure projects, particularly in transportation and social infrastructure, remains a primary driver. Secondly, rapid urbanization and the continuous expansion of cities necessitates substantial infrastructure development. Finally, technological advancements, such as BIM and automation, are enhancing construction efficiency and creating opportunities for innovation.

Challenges in the China Infrastructure Industry Sector

The industry faces several challenges including navigating complex regulatory processes, managing potential supply chain disruptions and ensuring efficient resource allocation. Environmental concerns and public opposition to specific projects can cause delays and increase costs. Competition among various players for limited resources and projects poses a considerable challenge.

Leading Players in the China Infrastructure Industry Market

- China Resources Power Holdings Company Limited

- China National Chemical Engineering

- China Metallurgical Group Corporation

- China State Construction Engineering

- China Electric Power Construction Co LTD

- China Communications Construction Company

- China Energy Engineering Corporation

- Shanghai Construction Group

- China Railway Group Limited

- China Power International Development Limited

- China Railway Construction Corporation

Key Developments in China Infrastructure Industry Sector

- 2022 Q4: Launch of a major smart city initiative in Shenzhen, integrating IoT technology into urban infrastructure.

- 2023 Q1: Completion of a significant high-speed rail project connecting two major cities, improving transportation efficiency.

- 2023 Q2: Announcement of a large-scale investment in renewable energy infrastructure, promoting sustainable development.

Strategic China Infrastructure Industry Market Outlook

The China infrastructure industry presents substantial growth opportunities driven by continued government investment, urbanization, and technological advancements. Focus areas for strategic investment include sustainable infrastructure, smart city development, and digitalization of the construction sector. The market exhibits strong potential for innovative technologies and sustainable solutions, offering opportunities for both established players and new entrants. This sector is poised to play a significant role in China's economic growth and development in the coming decade.

China Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other Social Infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Distribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other Manufacturing Infrastructures

-

1.1. Social Infrastructure

-

2. Key Cities

- 2.1. Shanghai

- 2.2. Beijing

- 2.3. Shenzhen

China Infrastructure Industry Segmentation By Geography

- 1. China

China Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Transportation Infrastructure is Witnessing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Infrastructure Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other Social Infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Distribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other Manufacturing Infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shanghai

- 5.2.2. Beijing

- 5.2.3. Shenzhen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Resources Power Holdings Company Limited**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China National Chemical Engineering

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Metallurgical Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Electric Power Construction Co LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Energy Engineering Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Construction Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Railway Group Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Power International Development Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 China Railway Construction Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 China Resources Power Holdings Company Limited**List Not Exhaustive

List of Figures

- Figure 1: China Infrastructure Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Infrastructure Industry Share (%) by Company 2024

List of Tables

- Table 1: China Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: China Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: China Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Infrastructure Industry?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the China Infrastructure Industry?

Key companies in the market include China Resources Power Holdings Company Limited**List Not Exhaustive, China National Chemical Engineering, China Metallurgical Group Corporation, China State Construction Engineering, China Electric Power Construction Co LTD, China Communications Construction Company, China Energy Engineering Corporation, Shanghai Construction Group, China Railway Group Limited, China Power International Development Limited, China Railway Construction Corporation.

3. What are the main segments of the China Infrastructure Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Transportation Infrastructure is Witnessing Significant Growth.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Infrastructure Industry?

To stay informed about further developments, trends, and reports in the China Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence