Key Insights

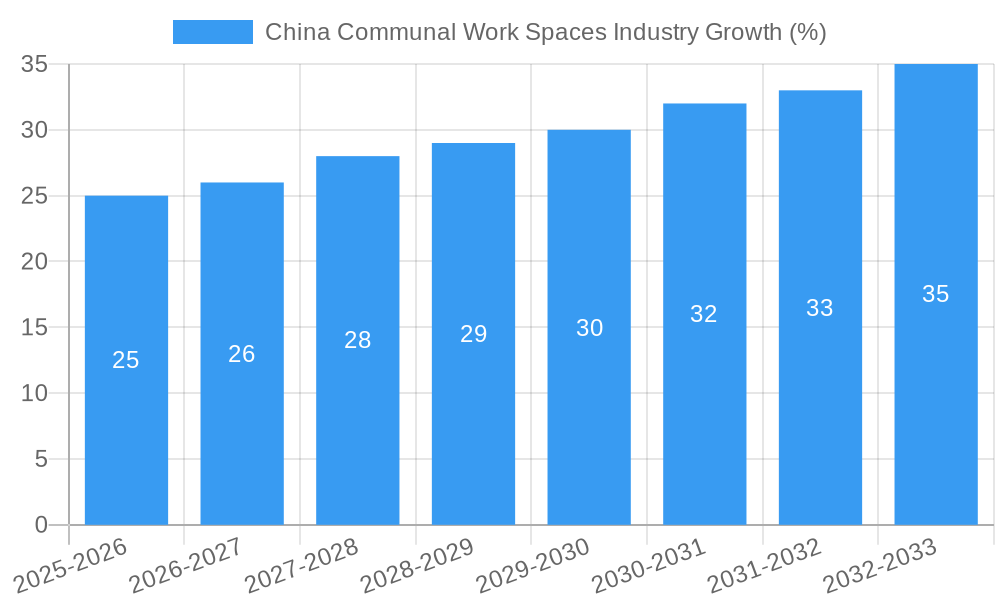

The China communal workspace industry is experiencing robust growth, driven by the increasing adoption of flexible work arrangements, a burgeoning entrepreneurial landscape, and the rising preference for cost-effective and collaborative work environments. The market, currently valued in the hundreds of millions (exact figures require further data), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is fueled by several key factors: the rapid growth of the IT and ITES sectors, coupled with the increasing demand for flexible office solutions from legal services, consulting firms, and the BFSI sector. The rise of small- and medium-sized enterprises (SMEs) significantly contributes to this demand as they seek cost-effective alternatives to traditional office spaces. Large-scale companies also utilize communal workspaces for satellite offices, project-based teams, or to attract and retain talent who value work-life balance and flexible work options. While the market faces potential restraints such as economic fluctuations and competition from traditional office spaces, the overall trajectory points towards sustained growth. The diverse segmentations—flexible managed offices, serviced offices—cater to a broad range of needs, ensuring market resilience.

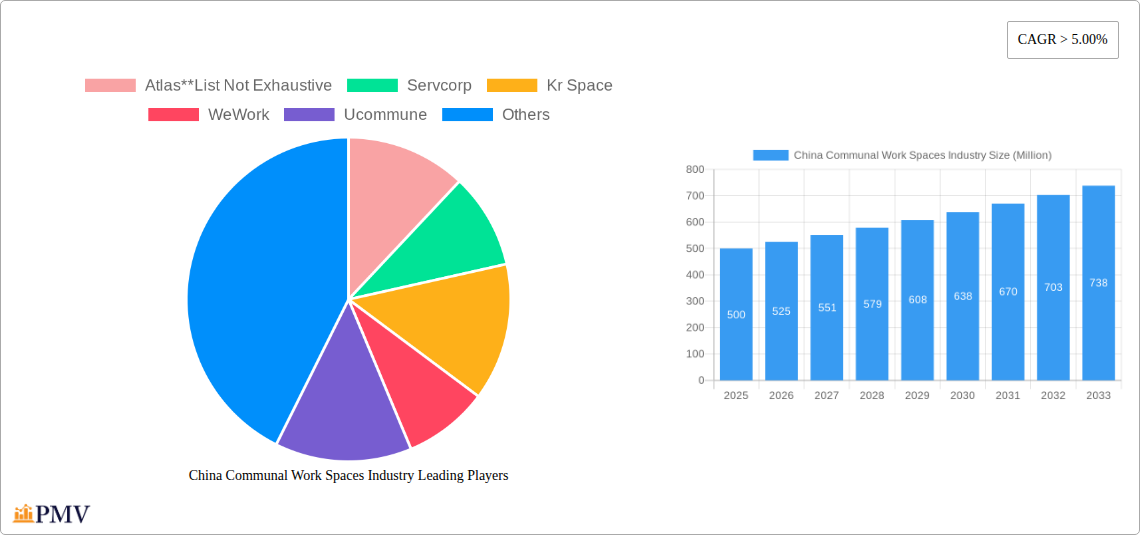

The dominance of key players like WeWork, Regus, and others indicates a competitive yet dynamic market. However, the emergence of local players and specialized coworking spaces targeting specific industries highlights the diverse opportunities within the sector. China's large population, expanding middle class, and ongoing urbanization create a fertile ground for the continued expansion of the communal workspace industry. Further growth will likely be fueled by technological advancements that enhance workspace management, community building, and overall user experience. The industry’s future is promising, suggesting significant potential for investors and businesses alike within this evolving sector of China's commercial real estate landscape.

China Communal Work Spaces Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China communal work spaces industry, offering valuable insights for investors, businesses, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The study period is 2019-2033, the base year is 2025, the estimated year is 2025, and the forecast period is 2025-2033, with the historical period spanning 2019-2024. Expect detailed analysis across various segments, including flexible managed offices, serviced offices, and end-user applications like IT, legal services, consulting, and BFSI. Key players like Atlas, Servcorp, Kr Space, WeWork, Ucommune, Cowork Booking, PeopleSquared, Regus, MydreamPlus, and Coworker are analyzed, alongside market size projections in Millions.

China Communal Work Spaces Industry Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the China communal work spaces industry. Market concentration is assessed through market share analysis of key players, revealing the dominance of established players and the emergence of new entrants. The report evaluates the innovation ecosystems within the sector, considering factors like technological advancements, R&D investments, and collaborative partnerships. The regulatory framework governing the industry, including licensing requirements and zoning regulations, is examined. Product substitutes, such as traditional office spaces and remote work arrangements, are also evaluated in terms of their impact on market growth. End-user trends, focusing on shifting preferences and evolving workspace needs, are analyzed. Finally, the report examines M&A activities within the industry, including deal values and their impact on market consolidation. While precise market share figures and M&A deal values are unavailable for public disclosure without specific data sources, this section will illustrate industry concentration trends and provide qualitative insights based on available information. We predict a xx Million market size in 2025 with a xx% market concentration among the top 5 players. We also expect an average M&A deal value in the xx Million range during the forecast period.

- Market Concentration: Analysis of market share distribution among major players.

- Innovation Ecosystems: Assessment of R&D activity and collaborative efforts.

- Regulatory Frameworks: Overview of laws and regulations impacting the industry.

- Product Substitutes: Examination of alternative workspace solutions.

- End-User Trends: Analysis of evolving workplace demands and preferences.

- M&A Activity: Evaluation of mergers and acquisitions and their influence on the market.

China Communal Work Spaces Industry Industry Trends & Insights

This section delves into the dynamic trends shaping the China communal work spaces industry. Market growth drivers, such as the increasing popularity of flexible work arrangements and the rise of the gig economy, are explored. Technological disruptions, including the adoption of smart office technologies and the integration of digital platforms, are analyzed for their impact on industry transformation. Evolving consumer preferences, such as the demand for collaborative workspaces and personalized office solutions, are examined. Competitive dynamics, including pricing strategies, service differentiation, and brand positioning, are also analyzed. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033) and estimates market penetration to reach xx% by 2033. The impact of economic fluctuations and government policies on market growth is also considered.

Dominant Markets & Segments in China Communal Work Spaces Industry

This section identifies the leading regions, countries, and segments within the China communal work spaces industry. Dominant segments are analyzed across various categories:

By Type:

- Flexible Managed Office: This segment is predicted to be dominant due to its flexibility and cost-effectiveness, attracting a broad range of users. Key drivers include increasing demand for short-term leases and adaptable spaces.

- Serviced Office: This segment appeals to businesses requiring fully equipped, ready-to-use spaces. Demand is driven by businesses prioritizing operational efficiency and minimal setup costs.

By Application:

- Information Technology (IT and ITES): This segment is expected to be a significant contributor to market growth due to the high demand for collaborative workspaces within the tech industry. Key drivers include the growth of startups and tech companies.

- BFSI (Banking, Financial Services, and Insurance): This segment displays a steady growth trajectory driven by the need for secure and efficient work environments.

By End User:

- Small-scale Company: This segment exhibits high growth potential due to the affordability and scalability of communal workspaces. Key drivers include lower operational costs and flexible contract terms.

- Large-scale Company: This segment is driven by the need for expansion capabilities and strategic locations. Key drivers include the attraction of talent and enhanced business operations.

The dominant region is expected to be [Specific Region in China - requires further research to provide a precise answer] due to factors such as [Specific reasons based on research - requires further research]. This section provides a detailed analysis of the key economic policies and infrastructure development that fuel this dominance.

China Communal Work Spaces Industry Product Innovations

The China communal work spaces industry is witnessing significant product innovations, driven by technological advancements and evolving user preferences. This involves the integration of smart building technologies, advanced communication systems, and eco-friendly designs. These innovations aim to enhance productivity, collaboration, and overall workspace experience, ultimately improving market fit and offering strong competitive advantages. New service packages focused on hybrid work models and tailored solutions for specific industries are also emerging.

Report Segmentation & Scope

This report segments the China communal work spaces market based on type (Flexible Managed Office, Serviced Office), application (Information Technology, Legal Services, Consulting, BFSI), and end-user (Personal User, Small-scale Company, Large-scale Company). Each segment is analyzed based on growth projections, market size (in Millions), and competitive dynamics. The report provides forecasts and historical data for each segment, highlighting potential opportunities and challenges.

Key Drivers of China Communal Work Spaces Industry Growth

Growth in the China communal work spaces industry is driven by several factors: the rising popularity of flexible work arrangements, technological advancements fostering remote and hybrid work, government initiatives promoting entrepreneurship and innovation, and the increasing demand for collaborative workspaces. Economic growth and expanding urban populations further fuel this expansion.

Challenges in the China Communal Work Spaces Industry Sector

The China communal work spaces industry faces challenges such as intense competition, fluctuating real estate prices, and potential regulatory changes. Supply chain disruptions and attracting and retaining talent also pose significant hurdles. These challenges impact profitability and market stability. The quantifiable impact is estimated at xx Million in lost revenue potential annually due to [specific challenge].

Leading Players in the China Communal Work Spaces Industry Market

Key Developments in China Communal Work Spaces Industry Sector

- March 2022: WeWork partnered with Currys, implementing a new hybrid working policy for corporate and commercial sectors. Currys equipped its 1,000+ workforce with WeWork spaces. This highlights the growing adoption of hybrid work models.

- January 2023: The GSA and Cisco launched a hybrid workspace option for federal employees, creating the Workplace Innovation Lab. This showcases the government's support for modern workspaces and their potential impact on the industry. While not directly related to China, this serves as an indicator of global trends impacting similar industries worldwide.

Strategic China Communal Work Spaces Industry Market Outlook

The China communal work spaces industry exhibits significant future potential, driven by continuous technological advancements, evolving workstyles, and a growing entrepreneurial ecosystem. Strategic opportunities lie in tapping into underserved markets, developing innovative workspace solutions, and leveraging technology to enhance user experience. Focus on sustainability and personalized offerings will further drive market growth. We predict a xx Million market size in 2033, demonstrating significant growth and continued market expansion.

China Communal Work Spaces Industry Segmentation

-

1. Type

- 1.1. Flexible Managed Office

- 1.2. Serviced Office

-

2. Applications

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. Consulting

- 2.4. BFSI (Banking, Financial Services, and Insurance)

-

3. End User

- 3.1. Personal User

- 3.2. Small-scale Company

- 3.3. Large-scale Company

-

4. Geography

- 4.1. Shanghai

- 4.2. Beijing

- 4.3. Wuhan

China Communal Work Spaces Industry Segmentation By Geography

- 1. Shanghai

- 2. Beijing

- 3. Wuhan

China Communal Work Spaces Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of startups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Co-Working Spaces to Support Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Communal Work Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Managed Office

- 5.1.2. Serviced Office

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. Consulting

- 5.2.4. BFSI (Banking, Financial Services, and Insurance)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Personal User

- 5.3.2. Small-scale Company

- 5.3.3. Large-scale Company

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Shanghai

- 5.4.2. Beijing

- 5.4.3. Wuhan

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Shanghai

- 5.5.2. Beijing

- 5.5.3. Wuhan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Shanghai China Communal Work Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Managed Office

- 6.1.2. Serviced Office

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Legal Services

- 6.2.3. Consulting

- 6.2.4. BFSI (Banking, Financial Services, and Insurance)

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Personal User

- 6.3.2. Small-scale Company

- 6.3.3. Large-scale Company

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Shanghai

- 6.4.2. Beijing

- 6.4.3. Wuhan

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Beijing China Communal Work Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Managed Office

- 7.1.2. Serviced Office

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Legal Services

- 7.2.3. Consulting

- 7.2.4. BFSI (Banking, Financial Services, and Insurance)

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Personal User

- 7.3.2. Small-scale Company

- 7.3.3. Large-scale Company

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Shanghai

- 7.4.2. Beijing

- 7.4.3. Wuhan

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Wuhan China Communal Work Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Managed Office

- 8.1.2. Serviced Office

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Legal Services

- 8.2.3. Consulting

- 8.2.4. BFSI (Banking, Financial Services, and Insurance)

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Personal User

- 8.3.2. Small-scale Company

- 8.3.3. Large-scale Company

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Shanghai

- 8.4.2. Beijing

- 8.4.3. Wuhan

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Atlas**List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Servcorp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kr Space

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 WeWork

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Ucommune

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cowork Booking

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 PeopleSquared

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Regus

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 MydreamPlus

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Coworker

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Atlas**List Not Exhaustive

List of Figures

- Figure 1: China Communal Work Spaces Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Communal Work Spaces Industry Share (%) by Company 2024

List of Tables

- Table 1: China Communal Work Spaces Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Communal Work Spaces Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Communal Work Spaces Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: China Communal Work Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: China Communal Work Spaces Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: China Communal Work Spaces Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Communal Work Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Communal Work Spaces Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 9: China Communal Work Spaces Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 10: China Communal Work Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 11: China Communal Work Spaces Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: China Communal Work Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Communal Work Spaces Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: China Communal Work Spaces Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 15: China Communal Work Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 16: China Communal Work Spaces Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: China Communal Work Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Communal Work Spaces Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: China Communal Work Spaces Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 20: China Communal Work Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: China Communal Work Spaces Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: China Communal Work Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Communal Work Spaces Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the China Communal Work Spaces Industry?

Key companies in the market include Atlas**List Not Exhaustive, Servcorp, Kr Space, WeWork, Ucommune, Cowork Booking, PeopleSquared, Regus, MydreamPlus, Coworker.

3. What are the main segments of the China Communal Work Spaces Industry?

The market segments include Type, Applications, End User, Geography .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of startups.

6. What are the notable trends driving market growth?

Increasing Demand for Co-Working Spaces to Support Growth.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

January 2023: The General Services Administration (GSA) and cloud cyber giant Cisco launched a new hybrid workspace option for federal employees. The couple just launched the GSA's new Workplace Innovation Lab, a coworking facility for federal government employees. The 25,000-square-foot building includes conference rooms, common collaboration space, and six suites of offices. Along with Cisco, the GSA launched the Workplace Innovation Lab in collaboration with Allsteel, Haworth/Price Modern, Miller-Knoll, Kimball International, and Swiftspace/VOE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Communal Work Spaces Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Communal Work Spaces Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Communal Work Spaces Industry?

To stay informed about further developments, trends, and reports in the China Communal Work Spaces Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence