Key Insights

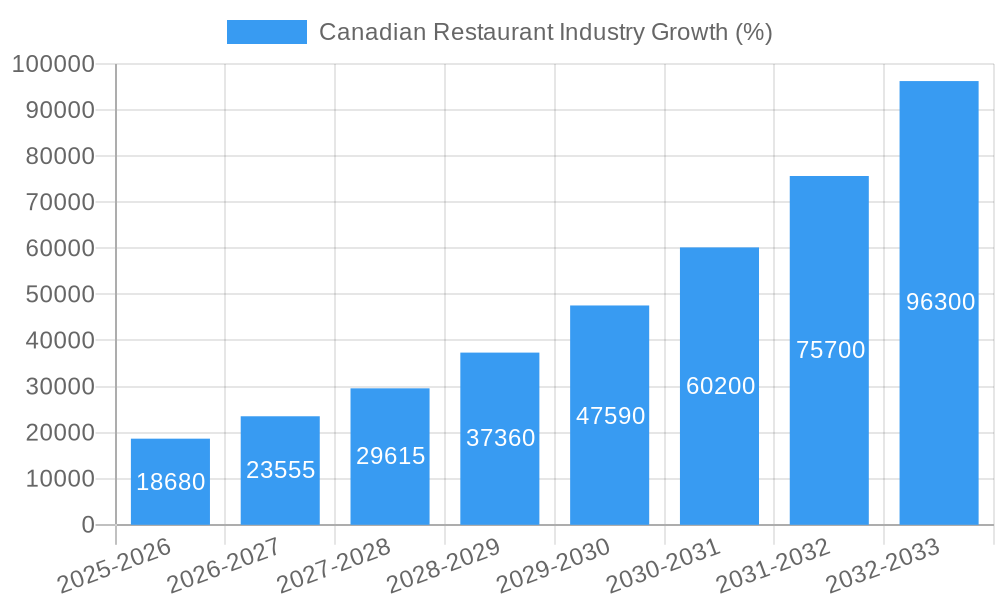

The Canadian restaurant industry, a vibrant sector characterized by diverse culinary offerings and a strong reliance on tourism and consumer spending, is projected for significant growth. With a current market size exceeding $XX million (the exact figure requires further specification, but based on a 26.40% CAGR from 2019-2025 and assuming a starting point, this figure can be estimated), the industry demonstrates resilience and adaptability. Key drivers include rising disposable incomes, increasing urbanization leading to higher demand for convenient dining options, and a growing preference for diverse culinary experiences. The expanding tourism sector also fuels this growth, particularly in major cities and popular tourist destinations. However, challenges exist, including rising food and labor costs, intense competition, and the ever-present need to adapt to evolving consumer preferences and technological advancements. The industry is segmented by outlet type (chained vs. independent), location (leisure, lodging, retail, standalone, travel), and food service type (cafes, bars, etc.), each presenting unique opportunities and challenges. Independent restaurants often face difficulties competing with larger chains, while those in less accessible locations might struggle with lower foot traffic. The success of individual establishments hinges on factors like menu innovation, effective marketing, superior customer service, and cost management.

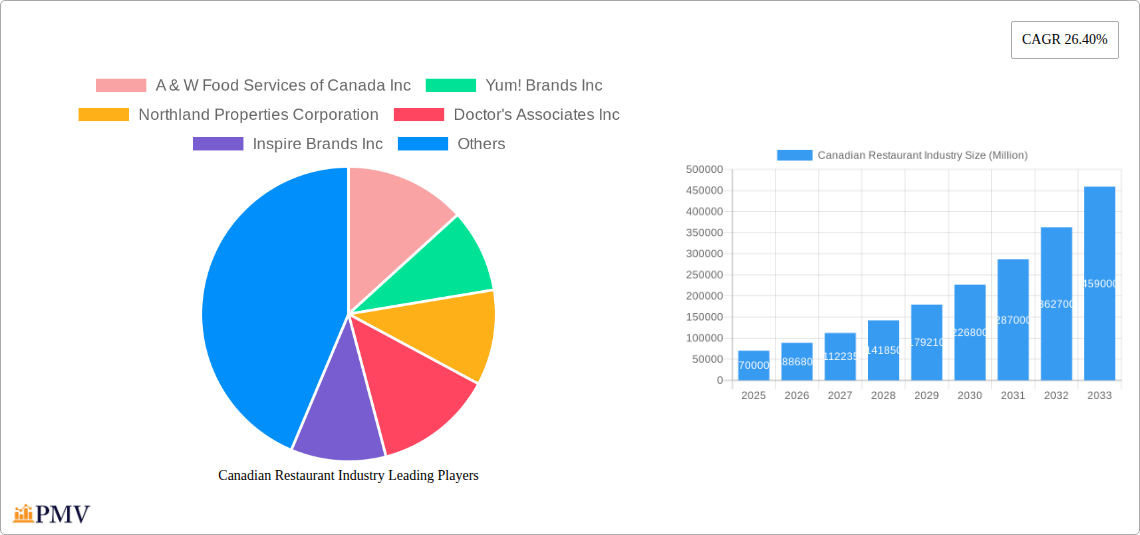

The forecast period (2025-2033) indicates sustained growth, fueled by a projected CAGR of 26.40%. While this growth rate may not be perfectly linear across all segments and locations, the overall trend suggests a positive outlook for the industry. However, external factors such as economic downturns, changes in consumer behavior, and government regulations could influence this growth. To sustain this trajectory, restaurants need to invest in technology, enhance operational efficiency, and consistently adapt to consumer demands for healthy, sustainable, and ethically sourced food options. The leading companies, including A & W Food Services of Canada Inc, Yum! Brands Inc, and others, are likely to play a pivotal role in shaping the future of the Canadian restaurant industry, influencing trends and setting standards across the board. Competition will remain fierce, necessitating innovation and adaptability to ensure long-term success.

Canadian Restaurant Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian restaurant industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis and expert insights to offer actionable intelligence for industry stakeholders, investors, and strategic planners. The Base Year is 2025, with the forecast period spanning 2025-2033 and the historical period encompassing 2019-2024. The Canadian restaurant market is estimated to be worth XX Million in 2025.

Canadian Restaurant Industry Market Structure & Competitive Dynamics

The Canadian restaurant industry exhibits a diverse competitive landscape, characterized by a mix of large multinational chains and independent smaller operators. Market concentration is moderate, with a few dominant players controlling significant market share, while numerous smaller entities contribute to the overall dynamism. Key players such as A & W Food Services of Canada Inc, Yum! Brands Inc, Northland Properties Corporation, Doctor's Associates Inc, Inspire Brands Inc, Seven & I Holdings Co Ltd, RECIPE Unlimited Corporation, The Wendy's Company, and Domino's Pizza Inc contribute significantly to the market's overall value.

The industry is subject to a robust regulatory framework governing food safety, hygiene, and labor practices. Innovation ecosystems are emerging, driven by technological advancements in online ordering, delivery platforms, and kitchen automation. Product substitutes, such as meal kits and prepared foods from grocery stores, present competitive pressure. End-user trends, like the increasing demand for healthy and sustainable options, are reshaping the industry's offerings.

M&A activity has been substantial, with several significant deals impacting the competitive landscape. Recent deals, though specific values are unavailable (XX Million), include MTY Food Group's acquisition of Wetzel's Pretzels, demonstrating the consolidation trend within the sector. These acquisitions often result in expanded market reach and diversification of offerings. Market share analysis indicates that the top 5 players hold approximately XX% of the total market share.

Canadian Restaurant Industry Industry Trends & Insights

The Canadian restaurant industry is experiencing a period of dynamic transformation driven by several factors. Market growth is primarily influenced by evolving consumer preferences, technological advancements, and economic conditions. The compound annual growth rate (CAGR) for the period 2025-2033 is projected at XX%, driven by factors such as increased urbanization, rising disposable incomes, and the growing popularity of quick-service and casual dining concepts.

Technological disruptions, such as online ordering and delivery platforms, are significantly impacting restaurant operations and customer behavior. Market penetration of online ordering systems has reached XX% in 2025 and is expected to grow further. Consumer preferences are shifting towards healthier, more convenient, and personalized dining experiences, influencing menu innovation and service models. Competitive dynamics remain intense, leading to increased price competition and promotions.

Dominant Markets & Segments in Canadian Restaurant Industry

The Canadian restaurant industry is geographically diverse, with significant variations in market size and segment performance across different regions. While precise data for dominance is unavailable at this time, urban centers like Toronto and Vancouver generally exhibit higher concentration of restaurants and higher per capita spending.

- Outlet Type: Chained outlets dominate market share due to brand recognition, economies of scale, and marketing capabilities. Independent outlets provide niche offerings and local flavor, yet face challenges in competing with larger chains.

- Location: The retail segment, particularly within urban areas, represents a significant portion of the market. The leisure and lodging segments are heavily influenced by tourism and seasonal trends. Standalone locations are prevalent across the country, while travel-related dining is concentrated near major transportation hubs and tourist destinations.

- Foodservice Type: Cafes and bars represent diverse segments within the market, with varying growth potential based on geographic location and consumer preference trends.

Key drivers contributing to market dominance include favorable economic policies, infrastructure development that supports retail spaces, and proximity to tourism destinations.

Canadian Restaurant Industry Product Innovations

Recent product innovations reflect ongoing trends towards health-conscious and personalized dining experiences. Technology plays a significant role, with restaurant chains implementing digital ordering and payment systems, loyalty programs, and personalized menu recommendations. The adoption of ghost kitchens and cloud kitchens is gaining traction, optimizing delivery services and reducing overhead costs. These innovations improve customer experience and provide cost-effective solutions for restaurant operators.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Canadian restaurant industry along various dimensions:

- Outlet Type: Chained Outlets and Independent Outlets. Chained outlets are projected to show a XX Million market value in 2033, while Independent Outlets are projected at XX Million.

- Location: Leisure, Lodging, Retail, Standalone, and Travel. Growth projections vary depending on factors like tourism trends and economic activity.

- Foodservice Type: Cafes and Bars. Each segment displays different competitive dynamics and market growth potential.

Each segment's analysis includes market size, growth projections, competitive landscape, and key drivers of growth.

Key Drivers of Canadian Restaurant Industry Growth

The Canadian restaurant industry's growth is propelled by several factors: rising disposable incomes supporting increased spending on dining out; evolving consumer preferences favouring convenience and diverse culinary experiences; technological innovations streamlining operations and enhancing customer experience; and favorable government policies supporting business development.

Challenges in the Canadian Restaurant Industry Sector

Challenges faced include rising food costs and labor shortages impacting profitability; intense competition among numerous players; and stringent regulatory compliance requirements increasing operating costs. These challenges necessitate efficient management strategies and innovative approaches to maintain profitability and growth. Supply chain disruptions caused a XX Million loss to the industry in 2022.

Leading Players in the Canadian Restaurant Industry Market

- A & W Food Services of Canada Inc

- Yum! Brands Inc

- Northland Properties Corporation

- Doctor's Associates Inc

- Inspire Brands Inc

- Seven & I Holdings Co Ltd

- RECIPE Unlimited Corporation

- The Wendy's Company

- Domino's Pizza Inc

Key Developments in Canadian Restaurant Industry Sector

- November 2022: 7-Eleven launched three new licensed outlets in Edmonton, expanding its food offerings. This highlights the expansion of convenience store dining.

- December 2022: 7-Eleven expanded its Canadian presence by converting restaurants into authorized outlets with fine dining seating, suggesting a shift towards upscale convenience.

- December 2022: MTY Food Group acquired Wetzel’s Pretzels, signaling consolidation within the fast-casual segment and a diversification strategy.

Strategic Canadian Restaurant Industry Market Outlook

The Canadian restaurant industry presents significant growth potential driven by increasing urbanization, diverse culinary preferences, technological innovations, and evolving consumer expectations. Strategic opportunities lie in embracing technology, catering to evolving consumer tastes, optimizing operations, and adapting to the dynamic competitive landscape. The market is poised for continued growth, with expansion into new segments and formats creating substantial opportunities for established and emerging players.

Canadian Restaurant Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

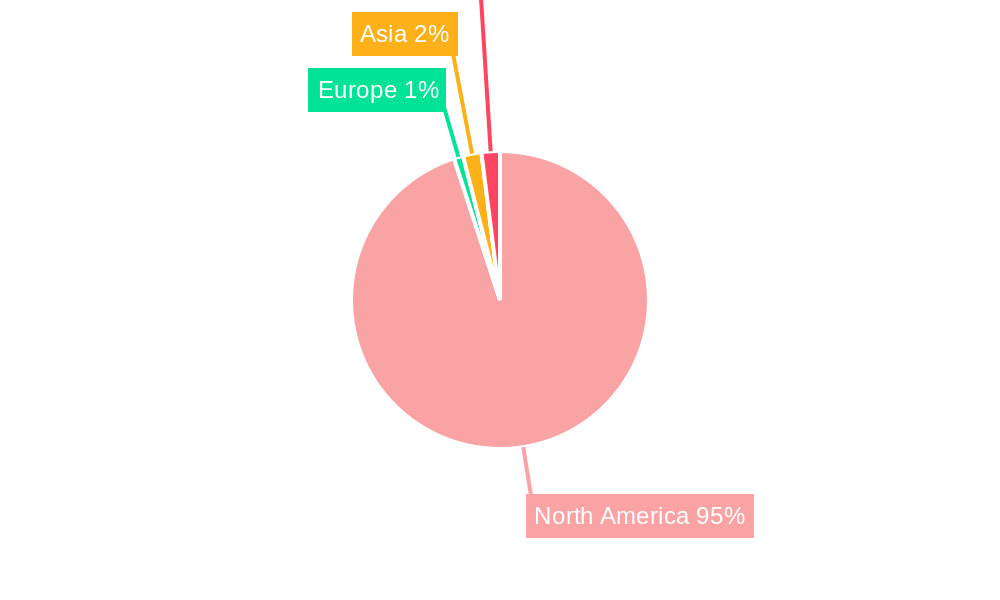

Canadian Restaurant Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Canadian Restaurant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Increase in number of QSRs and street food vendors owing to the rise in popularity of on-the-go meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. United States Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 12. Canada Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 A & W Food Services of Canada Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Yum! Brands Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Northland Properties Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Doctor's Associates Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Inspire Brands Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Seven & I Holdings Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 RECIPE Unlimited Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 The Wendy's Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Domino's Pizza Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 A & W Food Services of Canada Inc

List of Figures

- Figure 1: Global Canadian Restaurant Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Canadian Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Canadian Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 11: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 12: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 13: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 18: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 19: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 20: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 25: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 26: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 27: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 38: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 39: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 40: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 48: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 49: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 50: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Restaurant Industry?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Canadian Restaurant Industry?

Key companies in the market include A & W Food Services of Canada Inc, Yum! Brands Inc, Northland Properties Corporation, Doctor's Associates Inc, Inspire Brands Inc, Seven & I Holdings Co Ltd, RECIPE Unlimited Corporation, The Wendy's Company, Domino's Pizza Inc.

3. What are the main segments of the Canadian Restaurant Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Increase in number of QSRs and street food vendors owing to the rise in popularity of on-the-go meals.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

December 2022: 7-Eleven announced that it started increasing its footprint in Canada by converting a number of its restaurants into authorized outlets with fine dining seating.December 2022: MTY Food Group Inc., one of its wholly owned subsidiaries, acquired all of the issued and outstanding shares of COP WP Parent Inc. (Wetzel’s Pretzels) from CenterOak Partners. Wetzel’s Pretzels is an American chain of fast-food restaurants specializing in pretzels and hot dogs, operating in the United States, Canada, and Central America.November 2022: 7-Eleven declared the launch of its three new licensed 7-Eleven outlets in Edmonton with a few newly added food items on its menu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Restaurant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Restaurant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Restaurant Industry?

To stay informed about further developments, trends, and reports in the Canadian Restaurant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence