Key Insights

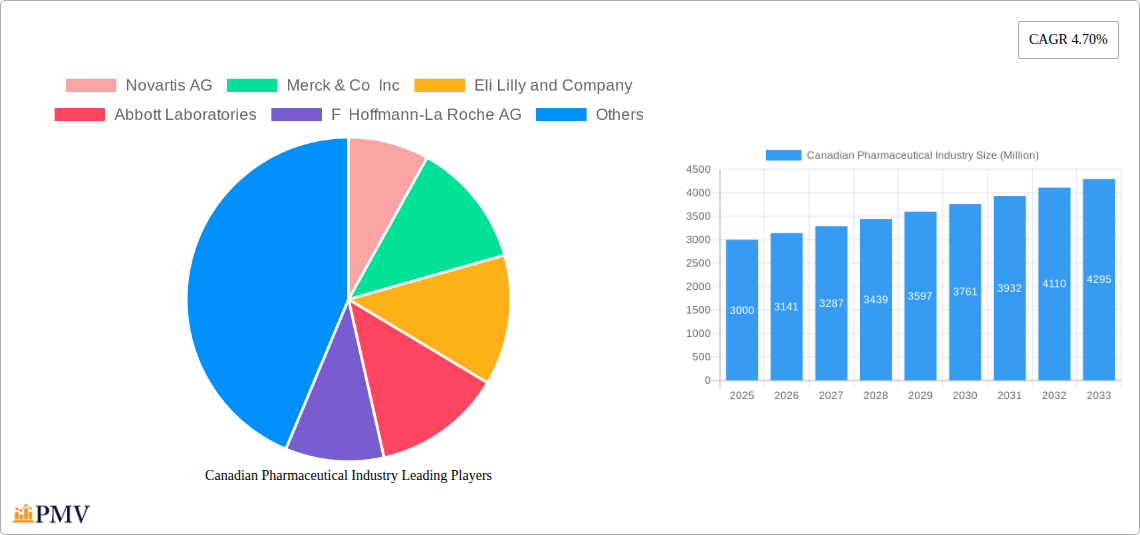

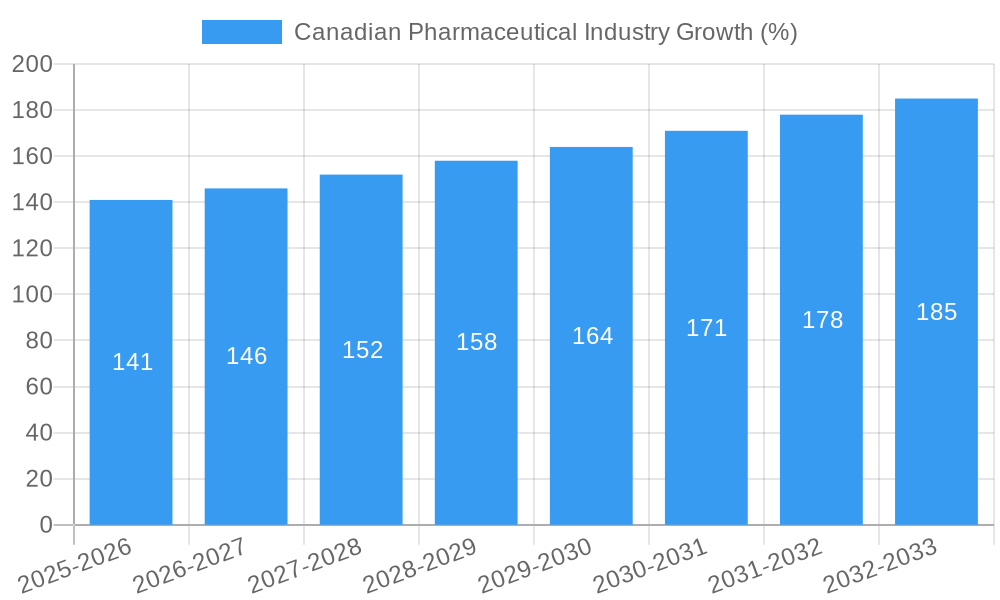

The Canadian pharmaceutical market, a significant segment of the broader North American industry, exhibits robust growth potential. With a global market size of $33.34 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 4.70%, the Canadian market's value can be projected using this global CAGR and considering Canada's economic strength and healthcare spending patterns. While precise Canadian market figures aren't provided, a reasonable estimate for the 2025 market size, considering Canada's share of the North American market and its advanced healthcare system, would likely fall within the range of $2 to $4 billion. Key growth drivers include an aging population requiring increased medication, the rising prevalence of chronic diseases like diabetes and cardiovascular conditions, and ongoing pharmaceutical innovation leading to the development of new and more effective drugs. Trends like the increasing adoption of biosimilars and generic drugs, alongside a focus on value-based healthcare, will continue to shape market dynamics. However, regulatory hurdles, patent expirations impacting branded drug sales, and pricing pressures from government payers represent potential restraints to growth. The market is segmented by therapeutic area (e.g., cardiovascular, oncology, central nervous system) and drug type (prescription, over-the-counter), offering diverse investment opportunities. Major players like Novartis, Merck, Eli Lilly, and Pfizer are likely to maintain dominant positions, although competition from generic drug manufacturers and innovative biotech companies is intensifying.

The Canadian pharmaceutical landscape is characterized by strong government regulation and a publicly funded healthcare system, which influences pricing and market access strategies. The Canadian market's performance is closely intertwined with broader North American trends and global pharmaceutical industry innovations. Future growth will hinge on factors including the success of new drug launches, government healthcare policies related to drug pricing and reimbursement, and the overall health and economic outlook for the country. The continued expansion of specialized healthcare services and advancements in personalized medicine will likely create further market opportunities, particularly in areas such as oncology and immunology. Understanding these drivers and restraints is critical for companies seeking to navigate this dynamic and competitive market effectively.

This comprehensive report provides a detailed analysis of the Canadian pharmaceutical industry, offering invaluable insights for stakeholders across the value chain. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to provide actionable intelligence for strategic decision-making. It segments the market by ATC/Therapeutic Class and drug type, analyzing key trends, competitive dynamics, and growth opportunities.

Canadian Pharmaceutical Industry Market Structure & Competitive Dynamics

The Canadian pharmaceutical market is characterized by a blend of multinational giants and domestic players, resulting in a moderately concentrated market structure. Major players such as Novartis AG, Merck & Co Inc, Eli Lilly and Company, Abbott Laboratories, F Hoffmann-La Roche AG, Apotex Inc, AbbVie Inc, Bristol Myers Squibb Company, Johnson & Johnson, and Pfizer Inc. hold significant market share, though the exact proportions fluctuate annually. The industry exhibits a robust innovation ecosystem, driven by substantial R&D investments from multinational firms and a growing focus on biosimilars and generic drug development by domestic companies. Health Canada's stringent regulatory framework plays a crucial role in shaping market access and product approvals, influencing both pricing and competition. The market witnesses a constant influx of new products and therapeutic innovations, driving competition, while simultaneously experiencing pressure from the rise of generic alternatives and price controls. M&A activity within the industry has been significant, with total deal values exceeding XX Million in the past five years, fueled by strategic acquisitions to expand market share and portfolio diversification. Significant end-user trends include an increasing demand for specialized medications, personalized medicine, and digital health solutions. This creates opportunities for companies to innovate and serve specific patient needs.

Canadian Pharmaceutical Industry Industry Trends & Insights

The Canadian pharmaceutical market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is primarily fueled by several key factors: an aging population leading to increased demand for chronic disease management medications, rising healthcare expenditures, increasing prevalence of chronic diseases like diabetes and cardiovascular illnesses, growing awareness of health and wellness, and increased access to healthcare services. Technological advancements such as personalized medicine, targeted therapies, and drug delivery systems are significantly transforming the industry landscape. However, competitive pressures from generic drugs and pricing regulations continue to exert downward pressure on profitability for some segments. Market penetration of biosimilars is also increasing, influencing pricing strategies and competitive dynamics. Consumer preferences are shifting towards convenient and cost-effective treatment options, including the adoption of telemedicine and home healthcare solutions, which are also driving change.

Dominant Markets & Segments in Canadian Pharmaceutical Industry

By ATC/Therapeutic Class: The segments exhibiting the highest market value are likely Antineoplastic and Immunomodulating Agents (driven by the aging population and rising cancer incidence), followed by Cardiovascular System and Nervous System medications. These segments' dominance stems from a combination of high prevalence of related diseases and the availability of high-priced innovative drugs. Growth is driven by factors such as advancements in treatment options, technological innovations leading to improved treatment outcomes, and continued investment in R&D. However, the market faces pricing pressures and the ongoing introduction of generics. The Alimentary Tract and Metabolism segment also demonstrates robust growth, largely attributed to the increasing incidence of gastrointestinal disorders.

By Drug Type: Prescription drugs constitute the largest segment due to high demand for specialized medications, while the OTC drug market shows steady growth fueled by increased consumer awareness and self-medication practices. Growth in this sector is driven by factors such as increased consumer awareness of health and wellness, growing demand for convenient and easy-to-access medications, and the introduction of innovative OTC products. However, competition among brands is high and pricing pressures exist.

Canadian Pharmaceutical Industry Product Innovations

Recent advancements showcase a strong focus on innovative drug delivery systems, personalized medicine approaches, and biosimilars to improve efficacy and reduce side effects. For instance, the launch of new targeted therapies for cancer is transforming treatment paradigms, while the increasing availability of biosimilars is driving cost-effectiveness in several therapeutic areas. These innovations cater to unmet clinical needs, aligning with ongoing market trends towards precision medicine and patient-centric care. Market fit is demonstrably strong in areas where the innovations offer improved outcomes or reduced costs.

Report Segmentation & Scope

This report segments the Canadian pharmaceutical market comprehensively by ATC/Therapeutic Class (Alimentary Tract and Metabolism; Blood and Blood-forming Organs; Cardiovascular System; Dermatologicals; Genito Urinary System and Sex Hormones; Systemic Hormonal Preparations; Antiinfectives for Systemic Use; Antineoplastic and Immunomodulating Agents; Musculoskeletal System; Nervous System; Antiparasitic Products, Insecticides, and Repellents; Respiratory System; Sensory Organs; Various Other ATC/Therapeutic Classes) and by Drug Type (Prescription, Generic, OTC Drugs). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing a granular understanding of the market landscape. The market size for each segment is estimated to be in the range of XX Million to XX Million based on the year, with varying growth projections for each. Competitive dynamics are analyzed based on leading players, market share, product portfolios, and innovation strategies.

Key Drivers of Canadian Pharmaceutical Industry Growth

Several key factors contribute to the growth of the Canadian pharmaceutical industry. Firstly, an aging population fuels a greater demand for medication to manage age-related illnesses. Secondly, the rising prevalence of chronic diseases necessitates the continuous development and usage of pharmaceutical interventions. Thirdly, increased government investment in healthcare infrastructure and research supports pharmaceutical innovation. Fourthly, growing technological advancements are constantly improving treatment modalities, leading to better outcomes. Finally, the Canadian government's emphasis on healthcare accessibility enhances market growth.

Challenges in the Canadian Pharmaceutical Industry Sector

The Canadian pharmaceutical sector faces several challenges. Stringent regulatory approvals, coupled with lengthy review processes, cause significant delays in new product launches. Supply chain disruptions can impact medication accessibility and pricing. Furthermore, intense competition, driven by both multinational and domestic players, results in price pressures and smaller profit margins. These issues cumulatively impact the industry’s overall profitability and efficiency, negatively affecting investment and innovation.

Leading Players in the Canadian Pharmaceutical Industry Market

- Novartis AG

- Merck & Co Inc

- Eli Lilly and Company

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Apotex Inc

- AbbVie Inc

- Bristol Myers Squibb Company

- Johnson & Johnson

- Pfizer Inc

Key Developments in Canadian Pharmaceutical Industry Sector

October 2023: Panacea Biotec launched Paclitaxel protein-bound particles for injectable suspension (albumin-bound) through Apotex Inc., indicated for treating metastatic breast cancer, non-small cell lung cancer, and pancreatic adenocarcinoma. This launch expands treatment options for these cancers in Canada.

March 2023: Natco Pharma introduced a generic version of Pomalidomide Capsules, the first generic alternative to Pomalyst, approved by Health Canada for treating multiple myeloma. This increases access to affordable cancer treatment.

Strategic Canadian Pharmaceutical Industry Market Outlook

The Canadian pharmaceutical market presents significant growth opportunities. The continued aging of the population, the increasing prevalence of chronic diseases, and the rising adoption of innovative treatment approaches will fuel expansion. Companies with a focus on personalized medicine, digital health solutions, and cost-effective therapies will be particularly well-positioned to capitalize on this growth. Strategic partnerships and collaborations are vital for navigating regulatory complexities and accelerating innovation within this dynamic and competitive market. The continued evolution of the healthcare landscape promises further growth prospects, but the ability to adapt quickly to shifting dynamics and regulatory changes will be key.

Canadian Pharmaceutical Industry Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolism

- 1.2. Blood and Blood-forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatologicals

- 1.5. Genito Urinary System and Sex Hormones

- 1.6. Systemic Hormonal Preparations

- 1.7. Antiinfectives for Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculoskeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Various Other ATC/Therapeutic Classes

- 1.15. Others

-

2. Drug Type

-

2.1. By Prescription Type

- 2.1.1. Branded

- 2.1.2. Generic

- 2.2. OTC Drugs

-

2.1. By Prescription Type

Canadian Pharmaceutical Industry Segmentation By Geography

- 1. Canada

Canadian Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Highly Expensive Drugs

- 3.4. Market Trends

- 3.4.1. The Alimentary Tract and Metabolism Segment is Expected to Register Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolism

- 5.1.2. Blood and Blood-forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatologicals

- 5.1.5. Genito Urinary System and Sex Hormones

- 5.1.6. Systemic Hormonal Preparations

- 5.1.7. Antiinfectives for Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculoskeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Various Other ATC/Therapeutic Classes

- 5.1.15. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. By Prescription Type

- 5.2.1.1. Branded

- 5.2.1.2. Generic

- 5.2.2. OTC Drugs

- 5.2.1. By Prescription Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. North America Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Middle East and Africa Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 GCC

- 9.1.2 South Africa

- 9.1.3 Rest of Middle East and Africa

- 10. South America Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Brazil

- 10.1.2 Argentina

- 10.1.3 Rest of South America

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Novartis AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck & Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eli Lilly and Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann-La Roche AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Apotex Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbbVie Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bristol Myers Squibb Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Novartis AG

List of Figures

- Figure 1: Global Canadian Pharmaceutical Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Canada Canadian Pharmaceutical Industry Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 13: Canada Canadian Pharmaceutical Industry Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 14: Canada Canadian Pharmaceutical Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 15: Canada Canadian Pharmaceutical Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 16: Canada Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Canada Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 32: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 33: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Pharmaceutical Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Canadian Pharmaceutical Industry?

Key companies in the market include Novartis AG, Merck & Co Inc, Eli Lilly and Company, Abbott Laboratories, F Hoffmann-La Roche AG, Apotex Inc , AbbVie Inc, Bristol Myers Squibb Company, Johnson & Johnson, Pfizer Inc.

3. What are the main segments of the Canadian Pharmaceutical Industry?

The market segments include ATC/Therapeutic Class, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

The Alimentary Tract and Metabolism Segment is Expected to Register Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Highly Expensive Drugs.

8. Can you provide examples of recent developments in the market?

October 2023: Panacea Biotec launched Paclitaxel protein-bound particles for injectable suspension (albumin-bound), which is indicated for the treatment of metastatic breast cancer, non-small cell lung cancer, and adenocarcinoma of the pancreas in the Canadian market through its strategic partner, Apotex Inc. of Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Canadian Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence