Key Insights

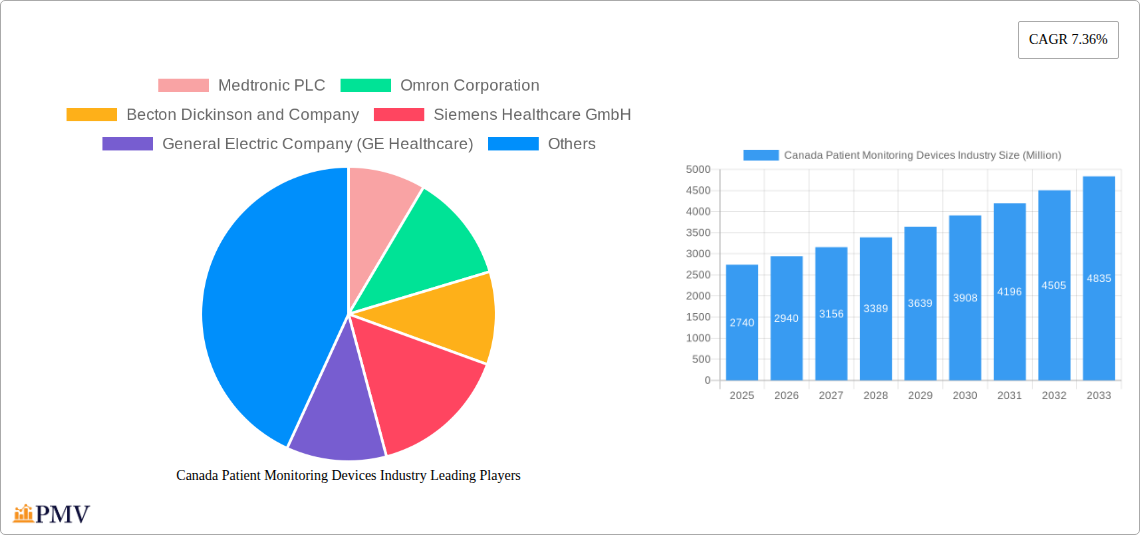

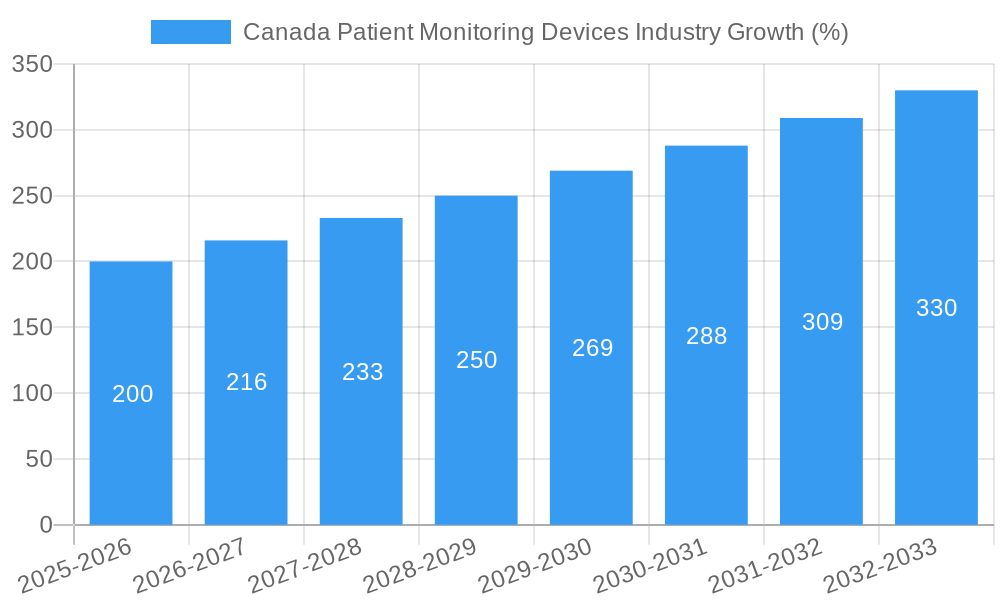

The Canadian patient monitoring devices market, valued at $2.74 billion in 2025, is projected to experience robust growth, driven by a rising elderly population, increasing prevalence of chronic diseases (such as heart disease and diabetes requiring continuous monitoring), and technological advancements leading to more sophisticated and portable devices. The market's Compound Annual Growth Rate (CAGR) of 7.36% from 2025 to 2033 signifies a substantial expansion, indicating a strong demand for advanced patient monitoring solutions across various healthcare settings. Key growth drivers include the increasing adoption of remote patient monitoring (RPM) programs aimed at reducing hospital readmissions and improving patient outcomes, coupled with government initiatives promoting telehealth and home healthcare. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) in patient monitoring devices enhances diagnostic accuracy and enables proactive intervention, fueling market expansion. Segmentation reveals a significant contribution from hospitals and clinics, followed by home healthcare, reflecting the growing preference for cost-effective and convenient care. The diverse range of devices, including hemodynamic, neuromonitoring, cardiac, and respiratory monitoring systems, caters to the multifaceted needs of various patient populations. However, high initial investment costs for advanced technologies and the stringent regulatory requirements for medical device approval could pose some challenges to market growth.

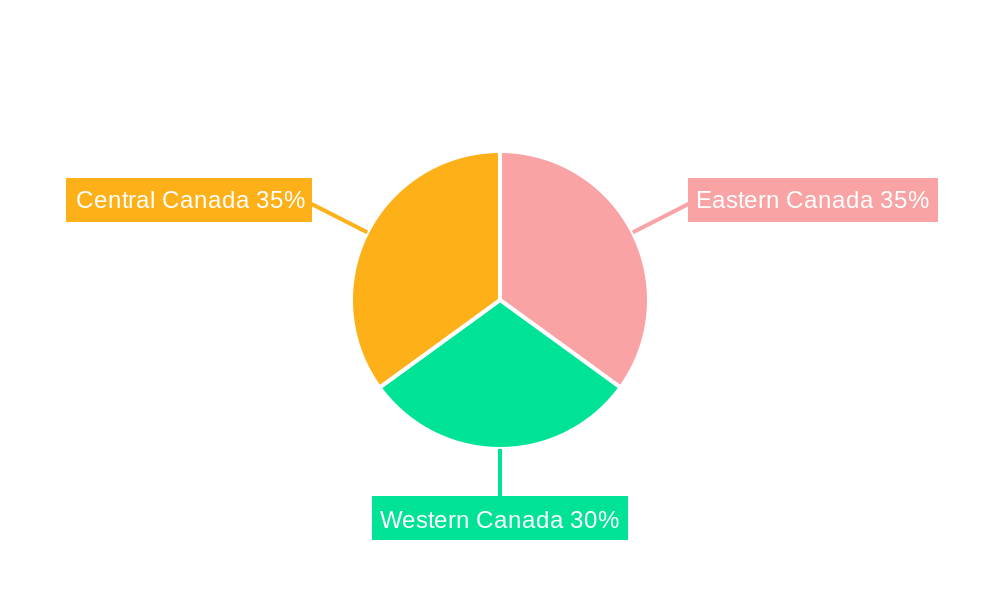

The competitive landscape is marked by the presence of established global players such as Medtronic, Omron, Becton Dickinson, and Philips, alongside other significant contributors. These companies are actively engaged in research and development, focusing on innovative product launches, strategic partnerships, and mergers and acquisitions to maintain their market positions. The regional segmentation within Canada (Eastern, Western, and Central Canada) suggests variations in market penetration depending on factors such as healthcare infrastructure development and the distribution of healthcare providers. The forecast period (2025-2033) promises further market expansion, propelled by the convergence of technological advancements and an increasing demand for efficient and effective patient monitoring solutions. This growth will likely be influenced by factors like reimbursement policies, technological innovation, and the evolving needs of the healthcare system.

Canada Patient Monitoring Devices Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada patient monitoring devices industry, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is invaluable for industry stakeholders, investors, and researchers seeking a detailed understanding of this dynamic market.

Canada Patient Monitoring Devices Industry Market Structure & Competitive Dynamics

The Canadian patient monitoring devices market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players include Medtronic PLC, Omron Corporation, Becton Dickinson and Company, Siemens Healthcare GmbH, General Electric Company (GE Healthcare), Koninklijke Philips NV, Masimo Corporation, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc, and Abbott Laboratories. These companies compete primarily on the basis of technological innovation, product features, pricing, and distribution networks. The market is characterized by a robust innovation ecosystem, with ongoing development of advanced monitoring technologies such as remote patient monitoring (RPM) and AI-powered diagnostics.

Regulatory frameworks, particularly those related to medical device approvals and data privacy, significantly influence market dynamics. Health Canada's regulatory oversight ensures product safety and efficacy. Substitutes for certain patient monitoring devices exist, such as traditional methods of physical examination, but the increasing demand for accurate, timely, and convenient monitoring solutions strengthens the market for patient monitoring devices. End-user trends favor minimally invasive, wireless, and user-friendly devices. The market has witnessed several mergers and acquisitions (M&A) in recent years, although the exact deal values remain unavailable (xx Million). These M&A activities reflect the ongoing consolidation and expansion within the industry.

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: Robust, with focus on RPM and AI

- Regulatory Framework: Stringent, driven by Health Canada

- M&A Activity: Several deals completed, total value xx Million

Canada Patient Monitoring Devices Industry Industry Trends & Insights

The Canadian patient monitoring devices market is experiencing substantial growth, driven by factors such as an aging population, rising prevalence of chronic diseases, increasing demand for home healthcare, technological advancements, and supportive government initiatives. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of artificial intelligence (AI) and the Internet of Things (IoT) in patient monitoring systems, are transforming healthcare delivery and enhancing patient outcomes. Consumer preferences increasingly lean towards remote monitoring solutions that offer convenience, personalized care, and improved accessibility. The competitive dynamics are shaped by factors such as product innovation, pricing strategies, and partnerships. Market penetration of advanced monitoring technologies is steadily increasing, driven by the growing awareness among healthcare providers and patients alike. This trend is complemented by increasing government support for the adoption of such technologies. The overall market size is estimated to reach xx Million by 2025.

Dominant Markets & Segments in Canada Patient Monitoring Devices Industry

The Hospitals and Clinics segment dominates the end-user landscape, accounting for the largest market share due to the high volume of patients requiring continuous monitoring. However, the Home Healthcare segment is exhibiting the fastest growth rate, fueled by increasing demand for convenient and cost-effective care options. Within the device types, Cardiac Monitoring Devices and Multi-parameter Monitors hold significant market shares, reflecting the prevalence of cardiovascular and other related conditions.

- Dominant End-User Segment: Hospitals and Clinics

- Fastest-Growing End-User Segment: Home Healthcare

- Dominant Device Type: Cardiac Monitoring Devices and Multi-parameter Monitors

- Key Drivers:

- Aging Population

- Rising Prevalence of Chronic Diseases

- Growing Adoption of Home Healthcare

- Technological Advancements

- Government Initiatives (e.g., funding for assistive devices)

Canada Patient Monitoring Devices Industry Product Innovations

Recent product developments focus on miniaturization, wireless connectivity, improved data analytics capabilities, and integration with electronic health records (EHRs). These innovations are designed to enhance ease of use, improve data accuracy, and enable remote patient monitoring. The competitive advantage lies in offering advanced features, superior data analytics, seamless integration with existing healthcare infrastructure, and robust security measures. Technological trends indicate a continued focus on AI-powered diagnostics, predictive analytics, and personalized medicine.

Report Segmentation & Scope

This report segments the Canadian patient monitoring devices market by end-users (Home Healthcare, Hospitals and Clinics, Other End Users), type of device (Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Multi-parameter Monitors, Respiratory Monitoring Devices, Other Types of Devices), and application (Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, Other Applications). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. Market size projections for each segment are included, varying widely depending on the specific segment and are estimated to contribute to the overall market value of xx Million by 2025. The competitive landscape within each segment is assessed, identifying major players and their strategies.

Key Drivers of Canada Patient Monitoring Devices Industry Growth

The growth of the Canadian patient monitoring devices market is driven by several factors, including:

- Technological advancements: Miniaturization, wireless technology, AI integration, and cloud-based data storage are increasing the efficiency and accessibility of patient monitoring solutions.

- Economic factors: Increased healthcare spending and government initiatives promoting the use of advanced medical technologies.

- Regulatory support: Favorable regulatory environment and reimbursement policies promoting adoption of patient monitoring devices.

Challenges in the Canada Patient Monitoring Devices Industry Sector

Challenges facing the industry include:

- Regulatory hurdles: Navigating stringent regulatory approval processes for new devices.

- Supply chain issues: Ensuring reliable supply of components and devices.

- Competitive pressures: Intense competition among established players and new entrants. This is further complicated by price pressures and the need for continuous innovation. The overall impact of these challenges is estimated to suppress market growth by approximately xx%.

Leading Players in the Canada Patient Monitoring Devices Industry Market

- Medtronic PLC

- Omron Corporation

- Becton Dickinson and Company

- Siemens Healthcare GmbH

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Masimo Corporation

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

- Abbott Laboratories

Key Developments in Canada Patient Monitoring Devices Industry Sector

- March 2022: The Ontario government provides coverage for the Dexcom G6 CGM System through Ontario's Assistive Devices Program (ADP) for people living with type 1 diabetes who are over 2 years of age in Canada. This significantly expanded market access for continuous glucose monitoring (CGM) systems.

- August 2022: Teladoc Health and Cloud DX entered a strategic partnership to better serve the remote monitoring needs of patients across Canada. This collaboration accelerated the adoption of telehealth and remote patient monitoring solutions.

Strategic Canada Patient Monitoring Devices Industry Market Outlook

The Canadian patient monitoring devices market is poised for continued growth, driven by technological innovation, increasing demand for remote patient monitoring, and supportive government policies. Strategic opportunities exist for companies focused on developing innovative, user-friendly, and cost-effective solutions. Companies that can effectively leverage telehealth platforms, integrate AI and machine learning into their devices, and establish strong partnerships with healthcare providers are expected to experience significant market success. Future market potential lies in personalized medicine and preventative care applications, driving growth and improving healthcare outcomes across Canada.

Canada Patient Monitoring Devices Industry Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Multi-parameter Monitors

- 1.5. Respiratory Monitoring Devices

- 1.6. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End Users

- 3.1. Home Healthcare

- 3.2. Hospitals and Clinics

- 3.3. Other End Users

Canada Patient Monitoring Devices Industry Segmentation By Geography

- 1. Canada

Canada Patient Monitoring Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. Resistance Toward the Adoption of Patient Monitoring Systems; High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Respiratory Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Patient Monitoring Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Respiratory Monitoring Devices

- 5.1.6. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals and Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Eastern Canada Canada Patient Monitoring Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Patient Monitoring Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Patient Monitoring Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Medtronic PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Omron Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Becton Dickinson and Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Siemens Healthcare GmbH

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 General Electric Company (GE Healthcare)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Koninklijke Philips NV

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Masimo Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Johnson & Johnson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Boston Scientific Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Baxter International Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Abbott Laboratories

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Medtronic PLC

List of Figures

- Figure 1: Canada Patient Monitoring Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Patient Monitoring Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Type of Device 2019 & 2032

- Table 5: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 7: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by End Users 2019 & 2032

- Table 9: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: Eastern Canada Canada Patient Monitoring Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Eastern Canada Canada Patient Monitoring Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Western Canada Canada Patient Monitoring Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Western Canada Canada Patient Monitoring Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Central Canada Canada Patient Monitoring Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Central Canada Canada Patient Monitoring Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 20: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Type of Device 2019 & 2032

- Table 21: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 23: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 24: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by End Users 2019 & 2032

- Table 25: Canada Patient Monitoring Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Canada Patient Monitoring Devices Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Patient Monitoring Devices Industry?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Canada Patient Monitoring Devices Industry?

Key companies in the market include Medtronic PLC, Omron Corporation, Becton Dickinson and Company, Siemens Healthcare GmbH, General Electric Company (GE Healthcare), Koninklijke Philips NV, Masimo Corporation, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc, Abbott Laboratories.

3. What are the main segments of the Canada Patient Monitoring Devices Industry?

The market segments include Type of Device, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Respiratory Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Resistance Toward the Adoption of Patient Monitoring Systems; High Cost of Technology.

8. Can you provide examples of recent developments in the market?

August 2022: Teladoc Health and Cloud DX entered a strategic partnership to better serve the remote monitoring needs of patients across Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Patient Monitoring Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Patient Monitoring Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Patient Monitoring Devices Industry?

To stay informed about further developments, trends, and reports in the Canada Patient Monitoring Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence