Key Insights

The Canadian Condominiums and Apartments market is poised for substantial expansion, driven by persistent urbanization and demographic shifts. Projected to achieve a Compound Annual Growth Rate (CAGR) of 4.9%, the market is estimated to reach $1279.93 billion by 2025. Key growth factors include escalating urban migration, strong immigration, and supportive government initiatives encouraging housing development. Geographically, Toronto, Montreal, and Vancouver are leading markets due to concentrated economic activity and population density, with emerging potential in Calgary and Ottawa. Prominent developers like Tridel, Aquilini Development, and The Daniels Corporation are instrumental in shaping market trends. Emerging challenges such as rising construction expenses, limited prime land, and regulatory considerations are being actively managed by industry stakeholders.

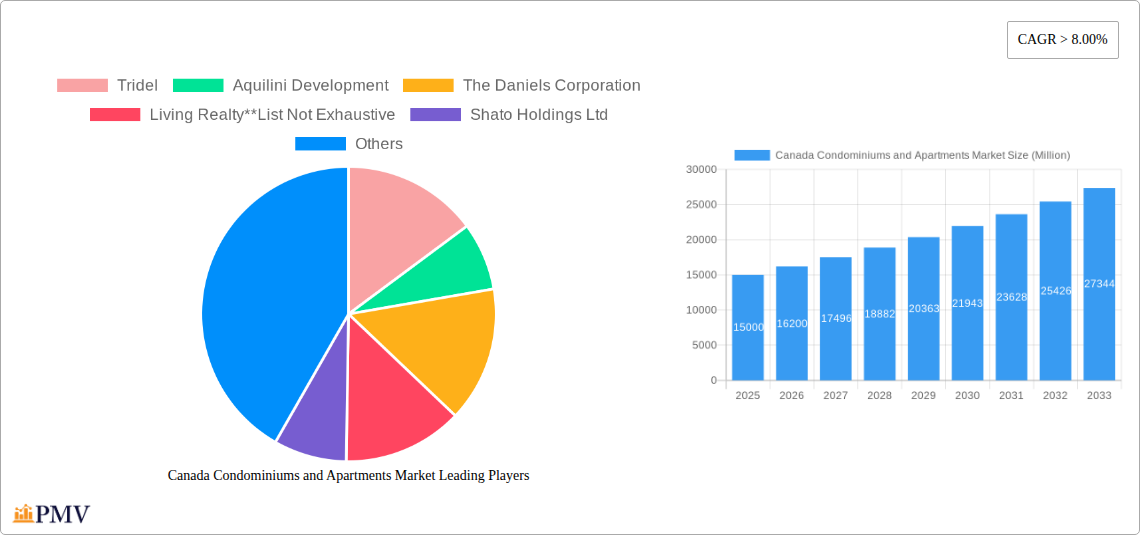

Canada Condominiums and Apartments Market Market Size (In Million)

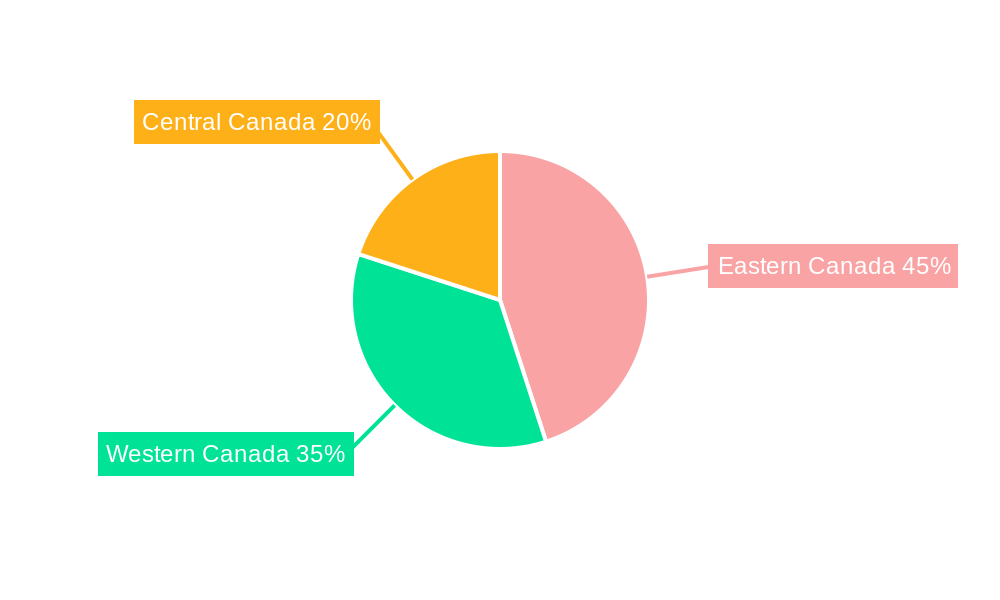

The forecast period (2025-2033) indicates sustained market momentum. Western Canada, specifically British Columbia and Alberta, is anticipated to experience robust growth fueled by economic diversification and energy sector investments. Eastern Canada will continue its strong performance, underpinned by Toronto's thriving economy and ongoing population increases. Heightened developer competition is expected to spur innovation in design, technology, and sustainable building practices. The market will likely see a rise in luxury condominiums and rental apartments, aligning with evolving consumer demands. Long-term market trajectory will be influenced by interest rates, economic stability, and governmental policies, though the core drivers of urbanization and population growth assure a positive outlook.

Canada Condominiums and Apartments Market Company Market Share

Canada Condominiums and Apartments Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Canadian condominiums and apartments market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, key players, and future growth potential, empowering stakeholders with data-driven strategies for success in this dynamic sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period spanning 2025-2033.

Canada Condominiums and Apartments Market Market Structure & Competitive Dynamics

This section analyzes the market's competitive landscape, encompassing market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and merger & acquisition (M&A) activities. The Canadian condominium and apartment market demonstrates a moderately concentrated structure, with a few large players holding significant market share. However, a vibrant ecosystem of smaller developers and builders contributes to overall dynamism.

- Market Share: The top five players (Tridel, Aquilini Development, The Daniels Corporation, Bosa Properties, and Brookfield Asset Management) collectively hold an estimated 35% market share in 2025, with Tridel leading the pack at approximately 8%. This market share is expected to slightly decrease by 2033 due to increased competition.

- Innovation: The market witnesses ongoing innovation in building materials, design, and technology, including the integration of smart home features and sustainable building practices.

- Regulatory Framework: Provincial and municipal regulations significantly influence development and construction. Zoning laws, building codes, and environmental regulations shape the market's trajectory.

- M&A Activity: The market has seen significant M&A activity in recent years, with deal values exceeding xx Million annually, driven by consolidation and expansion strategies. For example, the acquisition of a Toronto property in December 2022 by The Apartment Fund for USD 50 Million signifies the ongoing investor interest in the sector.

- Product Substitutes: The primary substitutes are rental townhouses and single-family homes, competing based on price, location, and amenities.

Canada Condominiums and Apartments Market Industry Trends & Insights

This section explores key industry trends shaping the Canadian condominiums and apartments market. Driven by factors like urbanization, population growth, and changing lifestyles, the market exhibits a robust growth trajectory. Technological disruptions, such as PropTech advancements and the rise of online platforms for property listings and rental management, transform operations and market access. Consumer preferences evolve towards sustainable, technologically advanced units with enhanced amenities.

The compound annual growth rate (CAGR) for the market is projected to be xx% during the forecast period (2025-2033), exceeding the historical CAGR of xx% between 2019 and 2024. Market penetration by major players is expected to remain high, although this will likely be slightly diluted by new entrants and increased competition in the coming years.

Dominant Markets & Segments in Canada Condominiums and Apartments Market

Toronto, Vancouver, and Montreal emerge as the dominant markets for condominiums and apartments in Canada, driven by strong population growth, economic opportunities, and robust infrastructure development.

- Toronto: High demand, limited supply, and strong economic activity fuel consistent growth.

- Vancouver: Desirable lifestyle and geographical location maintain high property values and rental rates.

- Montreal: A comparatively more affordable market with a strong rental sector and steady population growth.

Key Drivers:

- Strong job markets: These cities attract significant skilled labor, boosting demand for housing.

- Robust infrastructure: Investments in public transportation, supporting amenities and utilities underpin market growth.

- Government policies: While varying across provinces, government policies either positively or negatively affect housing supply.

Other major markets include Ottawa, Calgary, and Hamilton. These markets show promising growth trajectories, though at a slower pace compared to the top three. "Other Cities" constitutes a significant segment, with localized growth drivers specific to each region.

Canada Condominiums and Apartments Market Product Innovations

The market showcases a dynamic landscape of product innovations. Building designs prioritize energy efficiency and sustainability, incorporating smart home technology and advanced building materials. Technological advancements like the Rentsync and Urbanation partnership that created a market data platform are improving market transparency and efficiency. These innovations enhance market competitiveness and appeal to environmentally conscious and tech-savvy consumers.

Report Segmentation & Scope

This report segments the Canadian condominium and apartment market by city: Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and Other Cities. Each segment is analyzed based on its size, growth potential, and competitive dynamics. Growth projections vary across segments, reflecting the unique characteristics of each market. The report offers detailed insights into the supply and demand dynamics of each city, including factors driving growth or stagnation. Competitive landscapes also vary; for example, the Toronto market has more established players, while some smaller cities offer more opportunities for new entrants.

Key Drivers of Canada Condominiums and Apartments Market Growth

Several factors fuel the growth of the Canadian condominiums and apartments market. Sustained population growth, particularly in major urban centers, significantly drives demand. Robust economic conditions and strong job markets enhance affordability, increasing purchasing and rental power. Government initiatives to support affordable housing and infrastructure development also contribute to this growth. Finally, technological advancements lead to increased efficiency in construction and property management, further propelling market growth.

Challenges in the Canada Condominiums and Apartments Market Sector

Challenges in the Canadian condominium and apartment market include escalating construction costs, labor shortages, and increasing regulatory complexity. These factors lead to cost overruns and project delays. Competition for land and resources is also intense in major cities, impacting profitability. Furthermore, the market sensitivity to interest rate fluctuations and macroeconomic conditions presents an ongoing challenge to maintaining stable growth.

Leading Players in the Canada Condominiums and Apartments Market Market

- Tridel

- Aquilini Development

- The Daniels Corporation

- Living Realty

- Shato Holdings Ltd

- B C Investment Management Corp

- Bosa Properties

- Brookfield Asset Management

- Concert Properties Ltd

- Amacon

- The Minto Group

- Polygon Realty Limited

- Slavens & Associates

- Onni Group

Key Developments in Canada Condominiums and Apartments Market Sector

- December 2022: The Equiton Residential Income Fund Trust acquired a multi-family residential property in Toronto for USD 50 Million. This demonstrates significant investor confidence in the Toronto market. The Ravine Park Apartments project, with its proximity to public transportation and amenities, highlights the trend towards location-based advantages.

- October 2022: The collaboration between Rentsync and Urbanation created a comprehensive data platform. This initiative enhances market transparency and data-driven decision-making for all stakeholders.

Strategic Canada Condominiums and Apartments Market Market Outlook

The Canadian condominiums and apartments market presents a promising outlook, driven by continued population growth, urbanization, and a strong economy. Strategic opportunities exist in sustainable building practices, technological integration, and targeted development in secondary markets. The market will continue to evolve, driven by both market demands and technological advancements. Players focusing on innovative design, efficient operations, and strong community engagement will likely capture the greatest market share.

Canada Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Toronto

- 1.2. Montreal

- 1.3. Vancouver

- 1.4. Ottawa

- 1.5. Cagalry

- 1.6. Hamilton

- 1.7. Other Cities

Canada Condominiums and Apartments Market Segmentation By Geography

- 1. Canada

Canada Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Canada Condominiums and Apartments Market

Canada Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects

- 3.3. Market Restrains

- 3.3.1. 4.; Funding is a major challenge for infrastructure construction and maintenance

- 3.4. Market Trends

- 3.4.1. Increased demand for affordable housing driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Toronto

- 5.1.2. Montreal

- 5.1.3. Vancouver

- 5.1.4. Ottawa

- 5.1.5. Cagalry

- 5.1.6. Hamilton

- 5.1.7. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tridel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aquilini Development

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Daniels Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Living Realty**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shato Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B C Investment Management Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosa Properties

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Brookfield Asset Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Concert Properties Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amacon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Minto Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Polygon Realty Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Slavens & Associates

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Onni Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Tridel

List of Figures

- Figure 1: Canada Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 2: Canada Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 4: Canada Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Canada Condominiums and Apartments Market?

Key companies in the market include Tridel, Aquilini Development, The Daniels Corporation, Living Realty**List Not Exhaustive, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Amacon, The Minto Group, Polygon Realty Limited, Slavens & Associates, Onni Group.

3. What are the main segments of the Canada Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects.

6. What are the notable trends driving market growth?

Increased demand for affordable housing driving the market.

7. Are there any restraints impacting market growth?

4.; Funding is a major challenge for infrastructure construction and maintenance.

8. Can you provide examples of recent developments in the market?

December 2022: The Equiton Residential Income Fund Trust (The Apartment Fund) acquired a multi-family residential property in Toronto, Ontario. The property was purchased for USD 50 million. The Ravine Park Apartments will include seven stories, 169 units, and 183 combined indoor and outdoor parking spaces. It's close to public transportation, directly across the street from the upcoming Eglinton LRT Ionview Station, within walking distance of the Kennedy Subway and GO stations, and various amenities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Canada Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence