Key Insights

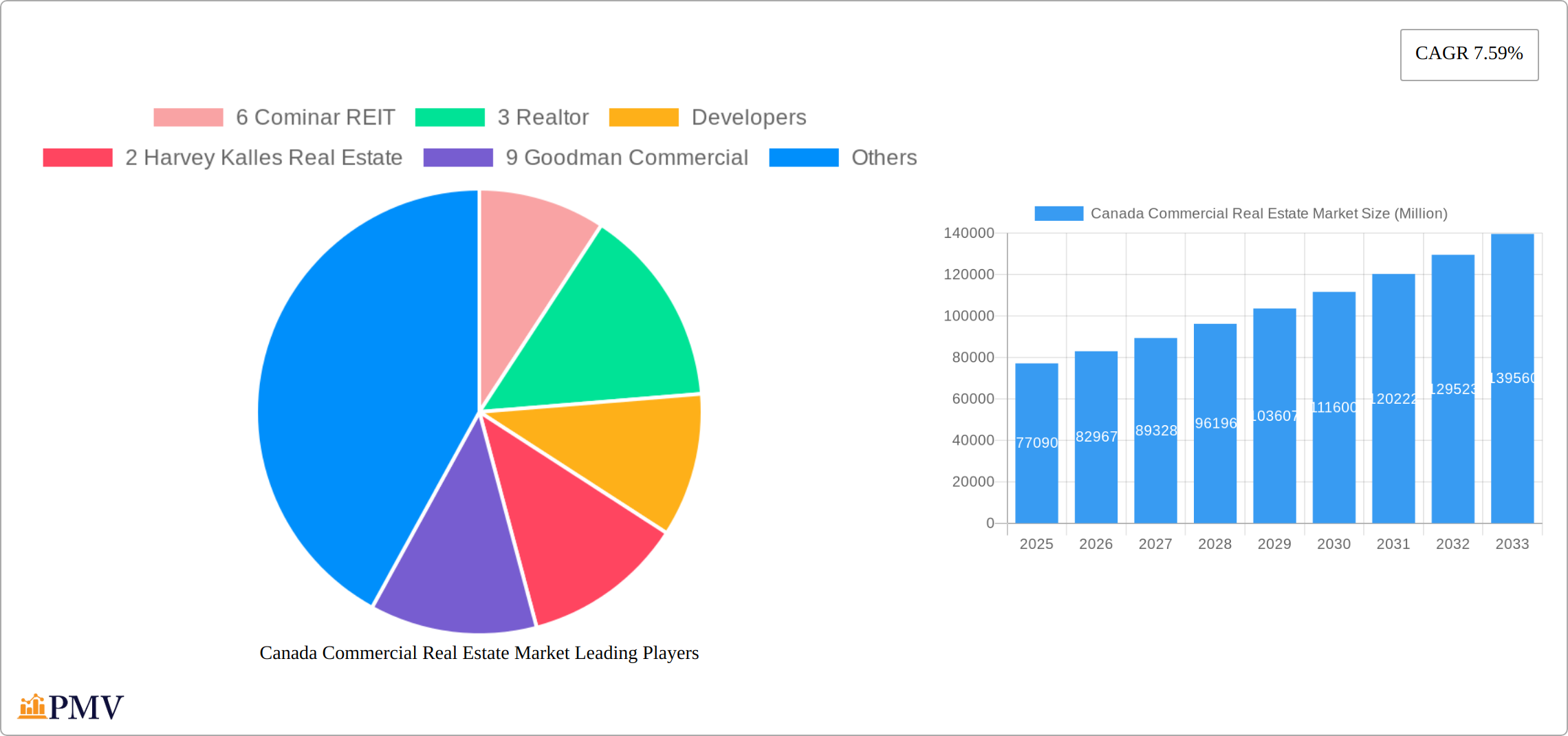

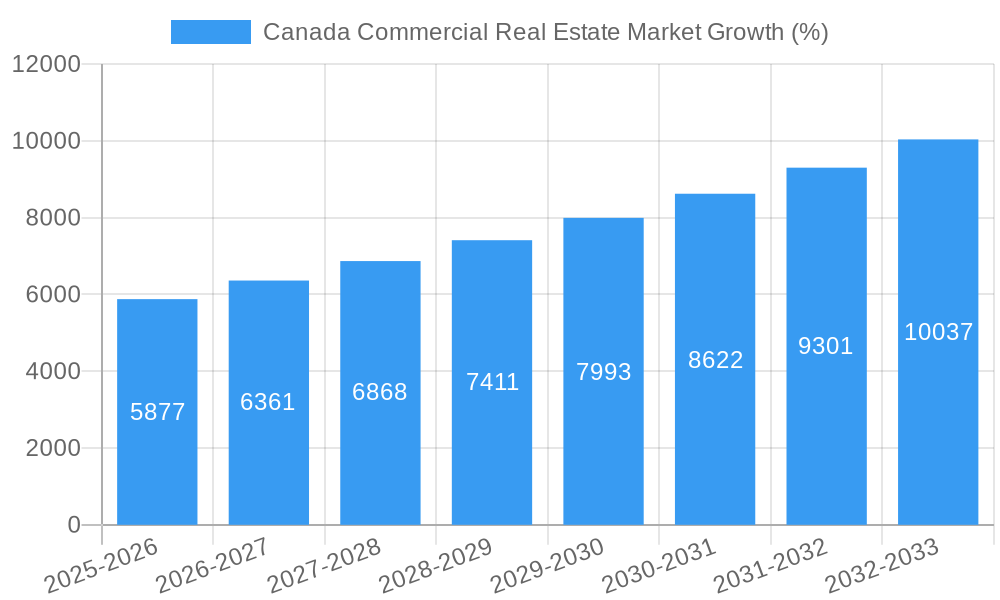

The Canadian commercial real estate market, valued at $77.09 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 7.59% from 2025 to 2033. This expansion is fueled by several key drivers. Strong population growth in major cities like Toronto, Vancouver, and Calgary, coupled with increasing urbanization and a thriving economy, consistently boosts demand for office, retail, and industrial spaces. The hospitality sector also benefits from rising tourism and business travel. Furthermore, the ongoing development of sustainable and technologically advanced buildings is attracting significant investment. However, the market isn't without its challenges. Rising interest rates and construction costs pose significant restraints, potentially impacting development timelines and profitability. Supply chain disruptions and fluctuations in global economic conditions also present ongoing risks. The market is segmented by property type (office, retail, industrial, multi-family, hospitality) and key cities (Toronto, Vancouver, Calgary, Ottawa, Montreal, Edmonton, and the Rest of Canada), reflecting regional variations in market dynamics and growth potential. Competition among established players like Cominar REIT, Allied REIT, Dream Office REIT, and Goodman Commercial, along with emerging developers and real estate brokerage firms, is intense, leading to innovation and strategic partnerships.

The forecast period (2025-2033) anticipates a continued upward trajectory, though the rate of growth may fluctuate due to macroeconomic factors. The diverse range of property types and geographical locations offers both opportunities and challenges. Strategic investments in specific sectors, such as logistics and data centers within the industrial segment, are anticipated to yield high returns. Meanwhile, the multi-family sector will likely benefit from sustained population growth and changing demographic trends. Careful monitoring of interest rates and economic indicators will be crucial for investors and developers navigating this dynamic market. Further research focusing on specific segments and regions will reveal finer details within this broad market trend.

Canada Commercial Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canadian commercial real estate market, covering the period from 2019 to 2033, with a focus on 2025. It offers invaluable insights into market structure, competitive dynamics, industry trends, dominant segments, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes a robust methodology, incorporating historical data (2019-2024), base year data (2025), and forecast data (2025-2033) to deliver accurate and reliable projections. The total market size is estimated at XX Million for 2025 and projected to reach XX Million by 2033.

Canada Commercial Real Estate Market Structure & Competitive Dynamics

The Canadian commercial real estate market exhibits a moderately concentrated structure, with a mix of large multinational corporations, established REITs, and smaller regional players. Market share is distributed across various segments, with significant concentration in major metropolitan areas like Toronto and Vancouver. Innovation in the sector is driven by technological advancements in property management, construction techniques, and data analytics.

The regulatory framework, encompassing federal and provincial laws, significantly impacts market activity, particularly regarding zoning, building codes, and environmental regulations. Product substitutes, such as co-working spaces and flexible office solutions, are increasingly challenging traditional office spaces. End-user trends, such as the shift towards remote work and e-commerce, are reshaping demand across different property types.

Mergers and acquisitions (M&A) activity is a key driver of market consolidation. Recent deals have involved significant investment values, with some transactions exceeding XX Million. Key M&A activities include:

- Consolidation among REITs (e.g., Allied REIT's acquisitions).

- Strategic land acquisitions by major developers (e.g., WestBank Corp, Onni Group).

- Increased activity in the industrial sector due to e-commerce growth.

Market share data for key players is as follows (estimated): Goodman Commercial (9%), Cominar REIT (6%), Dream Office REIT (5%), Redev Properties (10%), Allied REIT (7%). These numbers represent a snapshot and may fluctuate based on market conditions and acquisitions.

Canada Commercial Real Estate Market Industry Trends & Insights

The Canadian commercial real estate market is experiencing dynamic shifts driven by several factors. Technological disruptions, such as PropTech solutions and building automation systems, are enhancing efficiency and sustainability. Consumer preferences are influencing demand for flexible workspaces, sustainable buildings, and amenities-rich properties. The CAGR for the overall market during the forecast period (2025-2033) is estimated at XX%, with market penetration of new technologies reaching approximately XX% by 2033. Population growth, particularly in major urban centers, is a key market driver, alongside government infrastructure investments and the ongoing expansion of e-commerce. However, macroeconomic factors like interest rates and economic uncertainty present challenges. Increased focus on ESG (Environmental, Social, and Governance) factors is also shaping investor behavior and development strategies, driving demand for sustainable and environmentally responsible properties. The competition amongst developers and investors remains fierce, with a clear focus on innovation and adaptation to changing market demands.

Dominant Markets & Segments in Canada Commercial Real Estate Market

The Toronto and Vancouver markets dominate the Canadian commercial real estate landscape, fueled by strong economic activity, population growth, and robust infrastructure. Montreal and Calgary also represent significant markets, albeit with different sector strengths.

Dominant Segments:

- Office: Toronto and Vancouver dominate due to strong corporate presence and financial sectors. Challenges include shifting workplace dynamics and increased competition from flexible office spaces.

- Retail: Experiencing transformation with the rise of e-commerce and changing consumer behaviour. High-street retail remains prevalent in major cities, with a trend towards experiential retail concepts.

- Industrial: Booming due to e-commerce growth, requiring substantial warehouse and logistics space, particularly in major distribution hubs. This segment is witnessing significant investment and development activity.

- Multi-family: Robust demand in major cities, driven by population growth and limited housing supply. Development activity is high, focusing on high-density residential projects.

- Hospitality: Recovering from the pandemic, but facing ongoing challenges related to international tourism and fluctuating demand.

Key Drivers by City:

- Toronto: Strong financial sector, technological innovation, and population growth.

- Vancouver: Tech industry growth, international investment, and limited land supply.

- Calgary: Energy sector fluctuations impact demand, with strengths in industrial and hospitality.

- Montreal: Growing tech sector and robust healthcare industry.

- Ottawa: Government presence and strong public sector employment.

- Edmonton: Energy sector, but diversifying into tech and healthcare.

Canada Commercial Real Estate Market Product Innovations

The Canadian commercial real estate sector is witnessing significant innovation. Smart building technologies, including energy-efficient systems, building automation, and data analytics platforms, are becoming more prevalent. The integration of these technologies enhances operational efficiency, reduces costs, and improves tenant experience. Prefabricated construction methods are gaining traction, enabling faster construction times and cost savings. The focus on sustainable building materials and green certifications is increasing, driven by both environmental concerns and investor preferences. These innovations are leading to a more efficient, sustainable, and responsive commercial real estate landscape.

Report Segmentation & Scope

This report segments the Canadian commercial real estate market by property type (Office, Retail, Industrial, Multi-family, Hospitality) and key cities (Toronto, Vancouver, Calgary, Ottawa, Montreal, Edmonton, Rest of Canada). Each segment provides a detailed analysis of market size, growth projections, competitive dynamics, and key trends. The growth projections for each segment vary based on underlying economic conditions and individual market dynamics; for instance, the Industrial sector is expected to exhibit significant growth driven by e-commerce, while the Hospitality sector's recovery will depend on tourism trends. The competitive landscape differs across segments and cities, with larger players dominating in some areas and smaller, specialized firms thriving in others.

Key Drivers of Canada Commercial Real Estate Market Growth

Several factors drive growth in the Canadian commercial real estate market. Firstly, robust population growth in major urban centers fuels demand for housing and commercial space. Secondly, increasing foreign investment, particularly in key cities, contributes to development activity. Thirdly, government infrastructure investments and supportive economic policies stimulate growth. Finally, technological advancements, such as smart building technologies and proptech solutions, increase efficiency and attract investment.

Challenges in the Canada Commercial Real Estate Market Sector

The Canadian commercial real estate sector faces several challenges. Regulatory hurdles, particularly zoning restrictions and environmental regulations, can hinder development projects. Supply chain disruptions can delay construction projects and increase costs. Economic uncertainty and fluctuating interest rates impact investment decisions and property values. Finally, intense competition among developers and investors puts pressure on margins and profitability. These challenges require strategic adaptation and effective risk management.

Leading Players in the Canada Commercial Real Estate Market Market

- 6 Cominar REIT

- 3 Realtor, Developers

- 2 Harvey Kalles Real Estate

- 9 Goodman Commercial

- 3 Amacon

- 4 Pinnacle International

- 1 Brookfield Global Integrated Solutions

- Real Estate Brokerage Firms

- 1 Manulife Real Estate

- 10 Redev Properties*

- 7 Allied REIT**List Not Exhaustive

- 2 WestBank Corp

- 1 Onni Group

- 6 Knights Bridge Development Corp

- 5 Dream Office REIT

- Other Companies (startups associations etc)

- 2 Relogix

- 8 TAG Developments

- 7 Chard Development

- 4 Hausway

- 3 Maxwell Realty*

- 5 Anthem Properties Group Limited

Key Developments in Canada Commercial Real Estate Market Sector

June 2023: Prologis, Inc. and Blackstone's USD 3.1 billion deal for 14 Million square feet of industrial properties signals significant investment in the industrial sector and reflects the strong demand in this segment. The acquisition's cap rates indicate current market conditions.

May 2023: VICI Properties Inc.'s USD 164.7 Million acquisition of Century Casinos' assets demonstrates increasing interest in the Canadian gaming and hospitality sectors, suggesting a positive outlook for this segment's recovery and expansion.

Strategic Canada Commercial Real Estate Market Outlook

The Canadian commercial real estate market presents significant growth opportunities. Continued population growth, technological innovation, and foreign investment will drive demand. Strategic opportunities lie in developing sustainable and technologically advanced properties, catering to changing end-user needs and embracing flexible work models. Focusing on key growth areas, such as industrial real estate and multi-family housing, will yield strong returns. Investors should remain adaptable to market fluctuations and proactive in mitigating risks.

Canada Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial

- 1.4. Multi-family

- 1.5. Hospitality

-

2. Key Cities

- 2.1. Toronto

- 2.2. Vancouver

- 2.3. Calgary

- 2.4. Ottawa

- 2.5. Montreal

- 2.6. Edmonton

- 2.7. Rest of Canada

Canada Commercial Real Estate Market Segmentation By Geography

- 1. Canada

Canada Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing

- 3.3. Market Restrains

- 3.3.1. High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Evolution of retail sector driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Multi-family

- 5.1.5. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Toronto

- 5.2.2. Vancouver

- 5.2.3. Calgary

- 5.2.4. Ottawa

- 5.2.5. Montreal

- 5.2.6. Edmonton

- 5.2.7. Rest of Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

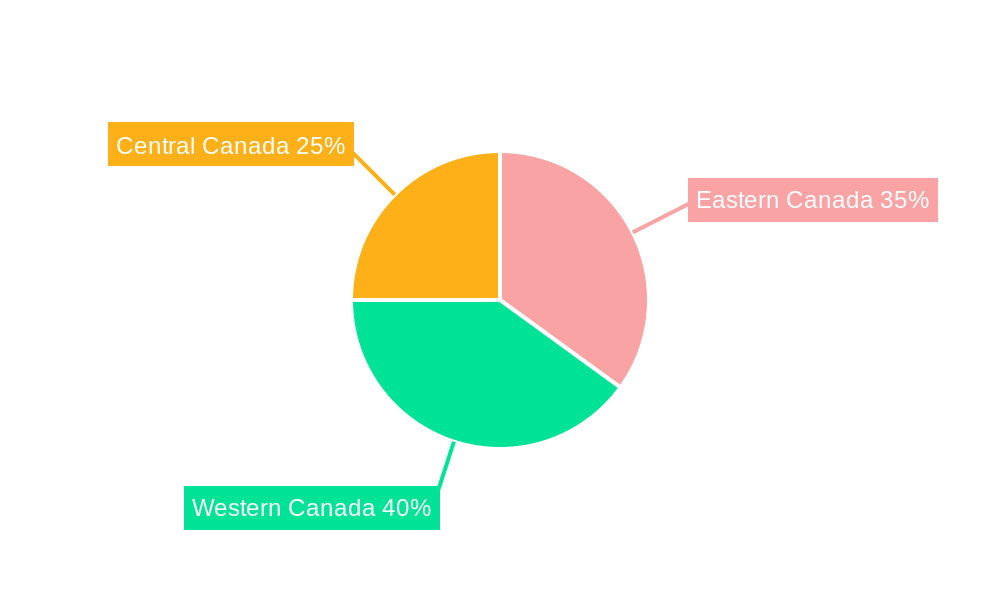

- 6. Eastern Canada Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 6 Cominar REIT

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 3 Realtor

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Developers

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 2 Harvey Kalles Real Estate

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 9 Goodman Commercial

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 3 Amacon

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 4 Pinnacle International

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 1 Brookfield Global Integrated Solutions

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Real Estate Brokerage Firms

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 1 Manulife Real Estate

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 10 Redev Properties*

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 7 Allied REIT**List Not Exhaustive

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 2 WestBank Corp

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 1 Onni Group

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 6 Knights Bridge Development Corp

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 5 Dream Office REIT

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Other Companies (startups associations etc )

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 2 Relogix

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 8 TAG Developments

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 7 Chard Development

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.21 4 Hausway

- 9.2.21.1. Overview

- 9.2.21.2. Products

- 9.2.21.3. SWOT Analysis

- 9.2.21.4. Recent Developments

- 9.2.21.5. Financials (Based on Availability)

- 9.2.22 3 Maxwell Realty*

- 9.2.22.1. Overview

- 9.2.22.2. Products

- 9.2.22.3. SWOT Analysis

- 9.2.22.4. Recent Developments

- 9.2.22.5. Financials (Based on Availability)

- 9.2.23 5 Anthem Properties Group Limited

- 9.2.23.1. Overview

- 9.2.23.2. Products

- 9.2.23.3. SWOT Analysis

- 9.2.23.4. Recent Developments

- 9.2.23.5. Financials (Based on Availability)

- 9.2.1 6 Cominar REIT

List of Figures

- Figure 1: Canada Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Canada Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 11: Canada Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Real Estate Market?

The projected CAGR is approximately 7.59%.

2. Which companies are prominent players in the Canada Commercial Real Estate Market?

Key companies in the market include 6 Cominar REIT, 3 Realtor, Developers, 2 Harvey Kalles Real Estate, 9 Goodman Commercial, 3 Amacon, 4 Pinnacle International, 1 Brookfield Global Integrated Solutions, Real Estate Brokerage Firms, 1 Manulife Real Estate, 10 Redev Properties*, 7 Allied REIT**List Not Exhaustive, 2 WestBank Corp, 1 Onni Group, 6 Knights Bridge Development Corp, 5 Dream Office REIT, Other Companies (startups associations etc ), 2 Relogix, 8 TAG Developments, 7 Chard Development, 4 Hausway, 3 Maxwell Realty*, 5 Anthem Properties Group Limited.

3. What are the main segments of the Canada Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing.

6. What are the notable trends driving market growth?

Evolution of retail sector driving the market.

7. Are there any restraints impacting market growth?

High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

June 2023: Prologis, Inc. and Blackstone announced a definitive agreement for Prologis to acquire nearly 14 million square feet of industrial properties from opportunistic real estate funds affiliated with Blackstone for USD 3.1 billion, funded by cash. The acquisition price represents an approximately 4% cap rate in the first year and a 5.75% cap rate when adjusting to today's market rents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence