Key Insights

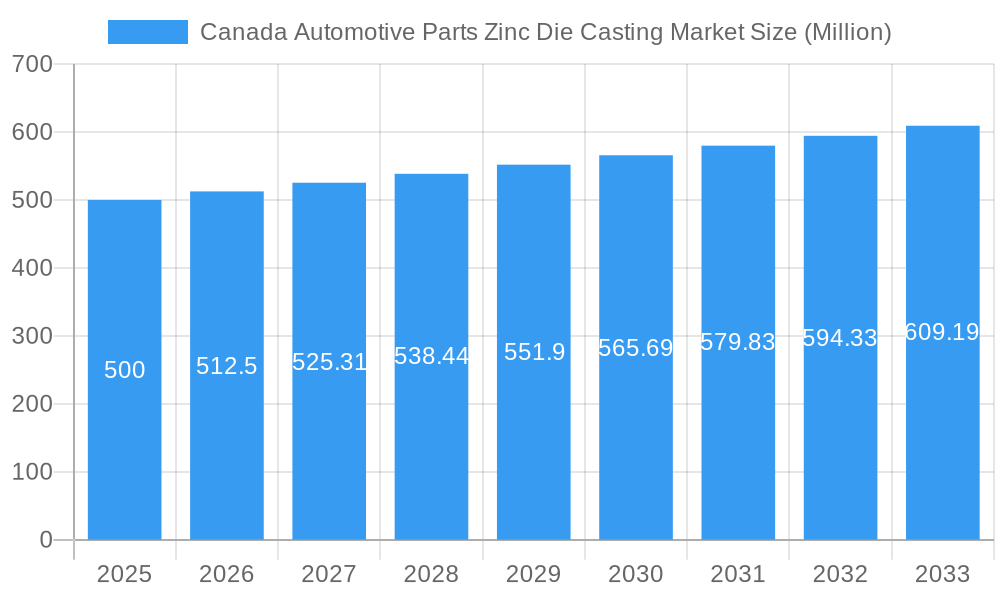

The Canada Automotive Parts Zinc Die Casting Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of over 2.50% from 2025 to 2033. This growth is driven by the increasing demand for lightweight, durable automotive components, particularly in engine parts, transmission components, and body parts. The market size in 2025 is estimated to be around $500 million, with expectations to reach over $600 million by 2033. Key drivers include the rising production of electric and hybrid vehicles, which require high-precision parts that zinc die casting can efficiently produce. Additionally, technological advancements in pressure and vacuum die casting processes are enhancing production efficiency and product quality, further fueling market expansion.

Canada Automotive Parts Zinc Die Casting Market Market Size (In Million)

The market is segmented by production process types, including Pressure Die Casting, Vacuum Die Casting, and others, with Pressure Die Casting holding the largest share due to its cost-effectiveness and suitability for high-volume production. Application-wise, engine parts dominate the market, followed by transmission components and body parts, reflecting the critical role of zinc die casting in enhancing vehicle performance and fuel efficiency. Leading companies such as Ashok Minda Group, Sandhar Technologies Ltd, and Pace Industries are intensifying their focus on innovation and strategic partnerships to capture a larger market share. Regionally, Western Canada leads the market due to its established automotive manufacturing base, followed by Central and Eastern Canada. The study period from 2019 to 2033 provides a comprehensive view of historical trends and future projections, ensuring stakeholders are well-informed for strategic decision-making.

Canada Automotive Parts Zinc Die Casting Market Company Market Share

Canada Automotive Parts Zinc Die Casting Market Market Structure & Competitive Dynamics

The Canada Automotive Parts Zinc Die Casting Market is characterized by a moderately concentrated market structure, with key players like Ashok Minda Group and Dynacast holding significant market shares. The innovation ecosystem thrives on technological advancements in die casting methods, with a focus on improving efficiency and reducing costs. Regulatory frameworks in Canada support the automotive industry through policies aimed at enhancing manufacturing capabilities and environmental compliance. Product substitutes, such as aluminum die casting, pose a challenge, but zinc remains preferred for its cost-effectiveness and precision. End-user trends indicate a growing demand for lightweight and durable automotive parts, driven by the need for fuel efficiency and safety. Mergers and acquisitions (M&A) are pivotal, with recent deals valued at approximately $100 Million, enhancing market consolidation and technological capabilities.

- Market Concentration: Dominated by top players with a combined market share of about 60%.

- Innovation Ecosystem: Focused on automation and precision in die casting.

- Regulatory Frameworks: Emphasis on environmental and safety standards.

- Product Substitutes: Competition from aluminum and magnesium die casting.

- End-User Trends: Increasing preference for lightweight components.

- M&A Activities: Notable deals include the acquisition of a local firm by Pace Industries for $50 Million.

Canada Automotive Parts Zinc Die Casting Market Industry Trends & Insights

The Canadian automotive parts zinc die casting market is experiencing robust growth, fueled by the escalating demand for high-quality, lightweight components in a rapidly evolving automotive landscape. Projected to achieve a CAGR of 4.5% from 2025 to 2033, this expansion is driven by several key factors. The adoption of advanced pressure die casting techniques, including automation and AI-driven process optimization, is significantly enhancing production efficiency, reducing defects, and lowering manufacturing costs. This increased efficiency directly translates into improved competitiveness for Canadian manufacturers in the global automotive parts supply chain.

Furthermore, the automotive industry's ongoing shift towards enhanced fuel efficiency and reduced emissions is boosting demand for lightweight zinc die-cast parts. These parts offer a superior strength-to-weight ratio compared to many alternatives, contributing to improved vehicle performance and reduced fuel consumption. The burgeoning electric vehicle (EV) market presents a significant opportunity, as manufacturers prioritize lightweight materials to maximize battery range and overall vehicle efficiency. Zinc die casting is ideally suited to meet these requirements, leading to increased market penetration in key EV components.

The competitive landscape is dynamic, with established players like Cascade Die Casting Group Inc. and Northwest Die Casting Company investing heavily in research and development to create innovative solutions and maintain a leading-edge position. Market penetration is particularly strong in segments such as engine parts and transmission components, where zinc die casting provides superior performance and cost advantages. Finally, the integration of Industry 4.0 technologies, including IoT and predictive maintenance, is revolutionizing manufacturing processes, offering real-time data analysis and proactive measures to ensure operational excellence.

Dominant Markets & Segments in Canada Automotive Parts Zinc Die Casting Market

In the Canada Automotive Parts Zinc Die Casting Market, the pressure die casting segment stands out as the dominant production process type, accounting for over 70% of the market share. This dominance is driven by its efficiency and ability to produce high-quality parts at a lower cost. The engine parts segment is the leading application type, fueled by the need for lightweight and durable components that enhance engine performance and fuel efficiency.

Key Drivers for Pressure Die Casting:

Economic policies supporting manufacturing growth.

Advanced infrastructure facilitating high-volume production.

High demand for precision and cost-effective parts.

Key Drivers for Engine Parts:

Increasing focus on fuel efficiency and emissions reduction.

Growth in the automotive sector, particularly in passenger vehicles.

Technological advancements in engine design and materials.

The dominance of pressure die casting can be attributed to its widespread adoption across various automotive applications. It offers a balance of speed, cost, and quality that is unmatched by other processes. Engine parts, on the other hand, benefit from the material properties of zinc, which allow for complex shapes and superior performance under high temperatures. The market's growth in these segments is further supported by government initiatives aimed at boosting the automotive industry and promoting sustainable manufacturing practices.

Canada Automotive Parts Zinc Die Casting Market Product Innovations

Innovation within the Canadian automotive parts zinc die casting market is heavily focused on enhancing the precision, speed, and efficiency of die casting processes. This includes the strategic integration of robotics and artificial intelligence (AI) to streamline production lines, improve quality control, and minimize human error. These technological advancements not only strengthen the competitiveness of Canadian manufacturers but also directly address the increasing demand for high-precision, high-performance automotive parts. The development and adoption of zinc alloys with superior mechanical properties further enhances the durability and longevity of the resulting components, making them suitable for even the most demanding applications.

Report Segmentation & Scope

The Canada Automotive Parts Zinc Die Casting Market is segmented by production process type and application type.

Production Process Type:

Pressure Die Casting: Dominates the market with a projected growth rate of 5% CAGR from 2025 to 2033, driven by its efficiency and cost-effectiveness.

Vacuum Die Casting: Expected to grow at a CAGR of 3.5%, offering improved surface quality and reduced porosity.

Others: Includes gravity die casting and centrifugal casting, with a market size of $xx Million by 2033.

Application Type:

Engine Parts: Projected to reach a market size of $xx Million by 2033, with a focus on lightweight components.

Transmission Components: Growing at a CAGR of 4%, benefiting from the demand for durable and precise parts.

Body Parts: Expected to see steady growth, driven by aesthetic and functional requirements.

Others: Includes various niche applications, with a market size of $xx Million by 2033.

Key Drivers of Canada Automotive Parts Zinc Die Casting Market Growth

The growth trajectory of the Canadian automotive parts zinc die casting market is fueled by a confluence of factors. Technological advancements in die casting processes are paramount, offering improvements in both efficiency and product quality. Robust economic factors, including the ongoing growth of vehicle production within Canada, are creating a strong demand for high-quality components. Furthermore, government regulations promoting sustainable manufacturing practices are encouraging the adoption of environmentally friendly materials, such as zinc, thereby contributing to the market's overall expansion.

Challenges in the Canada Automotive Parts Zinc Die Casting Market Sector

The Canada Automotive Parts Zinc Die Casting Market faces several challenges. Regulatory hurdles, including stringent environmental regulations, increase compliance costs. Supply chain disruptions, particularly related to raw material availability, can impact production timelines and costs. Competitive pressures from alternative materials and global manufacturers also pose significant challenges, with potential market share losses estimated at 2-3% annually.

Leading Players in the Canada Automotive Parts Zinc Die Casting Market Market

- Ashok Minda Group

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Carteret Die Casting Corp

- Ridco Zinc Die Casting Company

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Northwest Die Casting Company

- Dynacast

Key Developments in Canada Automotive Parts Zinc Die Casting Market Sector

- January 2023: Pace Industries acquired a local die casting firm for $50 Million, enhancing its production capacity.

- March 2023: Dynacast launched a new line of high-precision zinc die-cast parts for electric vehicles, aiming to capture the growing EV market.

- June 2023: Cascade Die Casting Group Inc introduced advanced automation in its production lines, improving efficiency and reducing costs.

Strategic Canada Automotive Parts Zinc Die Casting Market Market Outlook

The Canada Automotive Parts Zinc Die Casting Market is poised for significant growth, driven by the increasing demand for lightweight and high-performance automotive components. Strategic opportunities include expanding into the electric vehicle sector, where zinc die-cast parts are in high demand. Additionally, investing in advanced manufacturing technologies and sustainable practices will position companies to capitalize on future market potential and regulatory incentives.

Canada Automotive Parts Zinc Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Others

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Canada Automotive Parts Zinc Die Casting Market Segmentation By Geography

- 1. Canada

Canada Automotive Parts Zinc Die Casting Market Regional Market Share

Geographic Coverage of Canada Automotive Parts Zinc Die Casting Market

Canada Automotive Parts Zinc Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Parts Zinc Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ashok Minda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandhar Technologies Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Empire Casting Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pace Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carteret Die Casting Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ridco Zinc Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brillcast Manufacturing LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cascade Die Casting Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northwest Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ashok Minda Group

List of Figures

- Figure 1: Canada Automotive Parts Zinc Die Casting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Parts Zinc Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 5: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Parts Zinc Die Casting Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Parts Zinc Die Casting Market?

Key companies in the market include Ashok Minda Group, Sandhar Technologies Ltd, Empire Casting Co, Pace Industries, Carteret Die Casting Corp, Ridco Zinc Die Casting Company, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Northwest Die Casting Company, Dynacast.

3. What are the main segments of the Canada Automotive Parts Zinc Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Parts Zinc Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Parts Zinc Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Parts Zinc Die Casting Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Parts Zinc Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence