Key Insights

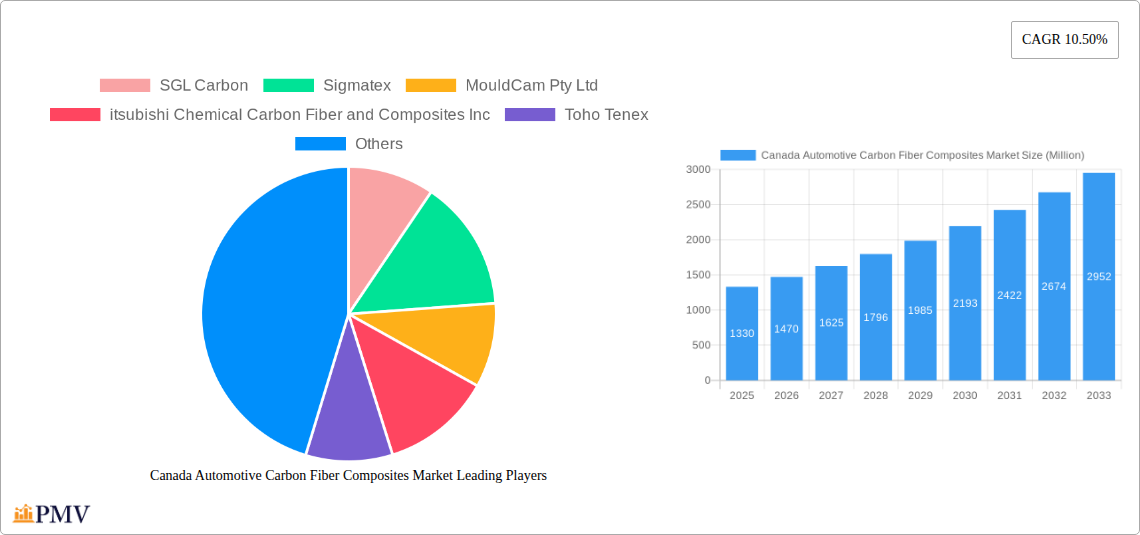

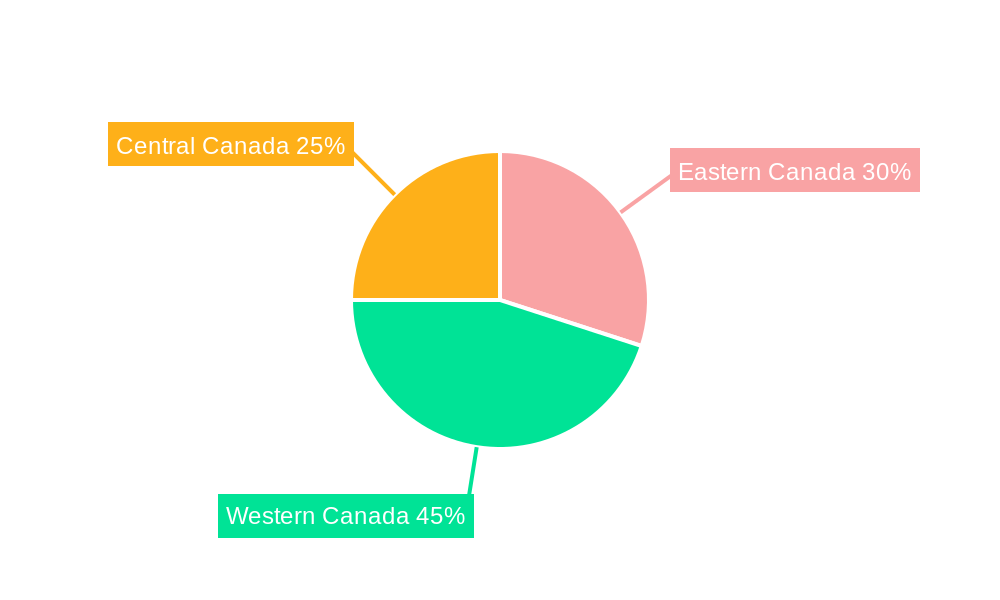

The Canada automotive carbon fiber composites market is poised for substantial growth, projected to reach a market size of $1.33 billion in 2025 and experience a compound annual growth rate (CAGR) of 10.50% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a primary driver. Furthermore, the automotive industry's ongoing pursuit of enhanced vehicle performance, particularly in terms of strength and durability, fuels the adoption of carbon fiber composites. Technological advancements in manufacturing processes, leading to reduced production costs and improved component quality, also contribute significantly to market growth. The market is segmented by application type, encompassing structural assembly, powertrain components, interior and exterior applications, and other uses. The rising popularity of electric vehicles (EVs) further bolsters market demand, as carbon fiber composites are well-suited for EV battery packs and other crucial components. Regional growth is expected to be strongest in the Western and Central Canada regions, driven by significant automotive manufacturing activity and government initiatives promoting sustainable transportation.

Canada Automotive Carbon Fiber Composites Market Market Size (In Billion)

The key restraints to market growth include the relatively high cost of carbon fiber composites compared to traditional materials, and concerns regarding the manufacturing complexity and specialized skills required for their effective integration into vehicle designs. However, ongoing research and development efforts focused on lowering production costs and simplifying manufacturing processes are gradually mitigating these challenges. Leading companies such as SGL Carbon, Sigmatex, Toray Industries, and Hexcel Corporation are actively investing in innovation and expansion, aiming to capitalize on the growing market opportunity. The competition is intense, with both domestic and international players vying for market share. This competitive landscape encourages innovation and fosters a dynamic market environment. The forecast period (2025-2033) presents a lucrative window of opportunity for businesses involved in the production, processing, and integration of carbon fiber composites within the Canadian automotive sector.

Canada Automotive Carbon Fiber Composites Market Company Market Share

Canada Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Automotive Carbon Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, growth drivers, challenges, and future outlook. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Canada Automotive Carbon Fiber Composites Market Market Structure & Competitive Dynamics

The Canadian automotive carbon fiber composites market exhibits a moderately concentrated structure, with a few dominant players and a growing number of smaller, specialized companies. Market share is primarily held by global giants like SGL Carbon, Sigmatex, Toray Industries, and Hexcel Corporation, alongside regional players. Innovation ecosystems are developing rapidly, spurred by government incentives for EV adoption and lightweighting initiatives. The regulatory framework, while supportive of sustainable technologies, presents challenges related to material sourcing and manufacturing processes. Product substitutes, such as advanced aluminum alloys and high-strength steels, exert competitive pressure, particularly in cost-sensitive segments. End-user trends favour lightweighting and improved fuel efficiency, driving demand for carbon fiber composites in automotive applications. M&A activities have been relatively limited in recent years, with deal values averaging xx Million per transaction. However, increased consolidation is anticipated as the market matures.

- Market Concentration: Moderately concentrated with a few major players dominating.

- Innovation Ecosystems: Rapidly developing, driven by government incentives and technological advancements.

- Regulatory Framework: Supportive of sustainable technologies but presents challenges in sourcing and manufacturing.

- Product Substitutes: Advanced aluminum alloys and high-strength steels pose competitive pressure.

- End-User Trends: Strong preference for lightweighting and improved fuel efficiency.

- M&A Activity: Relatively low in recent years, but expected to increase in the coming years.

Canada Automotive Carbon Fiber Composites Market Industry Trends & Insights

The Canadian automotive carbon fiber composites market is experiencing robust growth, fueled by the increasing demand for lightweight vehicles, particularly electric vehicles (EVs). The rising adoption of EVs is a significant driver, as carbon fiber composites offer crucial advantages in terms of weight reduction, enhanced performance, and extended battery life. Technological advancements in carbon fiber manufacturing processes, such as the innovative bitumen-to-carbon fiber process developed at UBC, are further accelerating market expansion. Consumer preference for sustainable and high-performance vehicles is also driving demand. The market is witnessing increased competition, particularly among Tier 1 suppliers, leading to strategic partnerships and technological innovations. The market penetration of carbon fiber composites in the Canadian automotive sector is still relatively low but is projected to increase significantly in the next decade. The estimated CAGR for the forecast period is xx%.

Dominant Markets & Segments in Canada Automotive Carbon Fiber Composites Market

The structural assembly segment currently dominates the Canadian automotive carbon fiber composites market, driven by the growing need for lightweight and high-strength components in EVs and other vehicles. This is followed by the powertrain component segment, benefiting from the need for efficient and durable components in high-performance vehicles.

- Key Drivers for Structural Assembly Dominance:

- Increasing demand for lightweight vehicles, especially EVs.

- Improved structural integrity and crashworthiness.

- Government regulations promoting fuel efficiency.

- Key Drivers for Powertrain Component Growth:

- Demand for high-performance and efficient vehicles.

- Improved fuel economy and reduced emissions.

- Advancements in carbon fiber composite material properties.

Ontario and Quebec are the leading regions due to the concentration of automotive manufacturing facilities. The favorable economic policies and well-developed infrastructure in these regions contribute to market dominance.

Canada Automotive Carbon Fiber Composites Market Product Innovations

Recent innovations focus on enhancing the performance and reducing the cost of carbon fiber composites. New manufacturing techniques, such as the UBC process using bitumen, are revolutionizing material sourcing and production. These advancements are improving the market fit of carbon fiber composites by offering better mechanical properties, durability, and cost-effectiveness, thereby driving wider adoption across various automotive applications. The focus is on developing lighter, stronger, and more sustainable materials for electric vehicles and hybrid electric vehicles.

Report Segmentation & Scope

This report segments the Canada Automotive Carbon Fiber Composites Market by Application Type:

- Structural Assembly: This segment includes body panels, chassis components, and other structural elements. It is expected to exhibit strong growth due to the increasing demand for lightweight vehicles. The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

- Powertrain Component: This segment encompasses components such as drive shafts, engine parts, and transmission housings. Growth is driven by the need for lightweight and high-performance powertrain components in electric vehicles. The 2025 market size is estimated at xx Million.

- Interior: This segment includes dashboards, door panels, and other interior trim components. While currently smaller, it's anticipated to see moderate growth due to increasing demand for luxurious and lightweight interiors.

- Exterior: This segment comprises exterior body panels, bumpers, and other visible components. Growth is driven by aesthetics and the need for durable, lightweight, and scratch-resistant materials.

- Other Applications: This segment includes various other components like seats and specialized parts.

Key Drivers of Canada Automotive Carbon Fiber Composites Market Growth

The Canadian automotive carbon fiber composites market's growth is primarily driven by the increasing demand for lightweight and fuel-efficient vehicles, particularly EVs. Government regulations promoting sustainable transportation and investments in advanced manufacturing technologies are also significant contributors. Technological advancements in carbon fiber production, reducing material costs and improving performance, further bolster market growth. The rising consumer preference for high-performance and eco-friendly vehicles adds to the growth trajectory.

Challenges in the Canada Automotive Carbon Fiber Composites Market Sector

High material costs and complex manufacturing processes remain significant challenges. Supply chain disruptions related to raw material sourcing and skilled labor shortages also impact growth. Competition from alternative lightweight materials, such as aluminum and high-strength steel, poses a significant challenge. The overall impact of these challenges on market growth is estimated at a reduction in CAGR by approximately xx%.

Leading Players in the Canada Automotive Carbon Fiber Composites Market Market

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Key Developments in Canada Automotive Carbon Fiber Composites Market Sector

- February 2023: Tesla's launch of its new carbon-wrapped motor significantly impacted the market, highlighting the potential of carbon fiber composites in high-performance electric vehicle applications. This development spurred increased R&D investment in similar technologies.

- June 2023: The successful transformation of bitumen into carbon fiber at UBC opened up a new avenue for sustainable and cost-effective carbon fiber production in Canada, potentially disrupting the existing supply chain dynamics.

Strategic Canada Automotive Carbon Fiber Composites Market Market Outlook

The Canadian automotive carbon fiber composites market presents a significant growth opportunity for companies that can effectively address the existing challenges and capitalize on emerging trends. Strategic investments in R&D, sustainable sourcing practices, and efficient manufacturing processes are crucial for success. The focus should be on developing innovative products that meet the specific needs of the automotive industry, while also aligning with sustainability goals. The long-term outlook remains positive, driven by the increasing demand for lightweight and high-performance vehicles, alongside supportive government policies and technological advancements.

Canada Automotive Carbon Fiber Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Applications

Canada Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Canada

Canada Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Canada Automotive Carbon Fiber Composites Market

Canada Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Interior is Projected to Grow at an Exponential Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Canada Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Canada Automotive Carbon Fiber Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Canada Automotive Carbon Fiber Composites Market?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Interior is Projected to Grow at an Exponential Rate.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

February 2023: Tesla's new carbon-wrapped motor made waves in the automotive industry, with many touting it as the world's most advanced motor. This innovative technology is expected to offer increased efficiency, improved performance, longer battery life, and environmental benefits for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence