Key Insights

The global camcorder market, valued at $4.10 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of video content creation across various platforms, from professional filmmaking to social media sharing and live streaming, fuels demand for high-quality video capture devices. Technological advancements, such as improved image stabilization, 4K and even 8K resolution capabilities, and enhanced low-light performance are attracting both amateur and professional users. The integration of smart features, including Wi-Fi connectivity and mobile app control, further enhances user experience and convenience. However, the market faces challenges from the rise of high-quality smartphone cameras, which offer convenient and readily accessible video recording capabilities. This competition necessitates camcorder manufacturers to continuously innovate and offer features and performance levels beyond those found in smartphones. The market segmentation, while not provided, likely includes professional, consumer, and action camcorder categories, each with its own specific growth trajectory. Canon, Sony, GoPro, and others are leading players, constantly competing through product innovation and marketing strategies. The projected CAGR of 3.29% suggests a consistent, albeit moderate, expansion over the forecast period (2025-2033), indicating a mature market with sustained demand.

The market's future growth will be shaped by the ongoing evolution of video technology. Advancements in areas like AI-powered video editing features built directly into camcorders, improved battery life, and the integration of advanced audio recording capabilities are likely to drive future growth. Moreover, the expansion of niche markets, such as those focused on live streaming and virtual reality applications, provides further avenues for growth. Geographical variations in market penetration and adoption rates also exist, with developed economies likely showing more mature markets and developing economies potentially showing higher growth rates. Understanding these diverse market segments and regional dynamics will be crucial for manufacturers to effectively target their products and optimize market share. Competitive pricing strategies and robust marketing campaigns emphasizing superior image quality and advanced features are key to success in this evolving market.

Comprehensive Camcorder Market Report: 2019-2033

This in-depth report provides a comprehensive analysis of the global camcorder market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, industry trends, technological advancements, and future growth prospects. The report leverages extensive data analysis and expert insights to offer actionable intelligence for businesses operating within, or seeking entry into, this dynamic market. The report projects a market value exceeding xx Million by 2033. Download now to gain a competitive edge!

Camcorder Market Market Structure & Competitive Dynamics

The global camcorder market exhibits a moderately concentrated structure, with a few major players holding significant market share. Canon Inc, Sony Group Corporation, and Panasonic Holding Corporation are established leaders, while companies like GoPro Inc and Blackmagic Design Pty Ltd are aggressively challenging the status quo with innovative products. The market's competitive landscape is characterized by intense innovation, driven by the need to enhance image quality, functionality, and user experience. Regulatory frameworks, particularly concerning data privacy and intellectual property, play a crucial role. Product substitution is a key concern, with smartphones increasingly encroaching on the lower-end camcorder market. However, high-end professional camcorders continue to hold their ground due to superior image quality and specialized features. The M&A activity in the sector is moderate, with deal values averaging xx Million annually over the historical period (2019-2024).

- Market Concentration: High, with top 5 players holding approximately xx% of the market share (2024).

- Innovation Ecosystems: Active, with ongoing R&D in sensor technology, image processing, and lens design.

- Regulatory Frameworks: Vary across regions, impacting data privacy and import/export regulations.

- Product Substitutes: Smartphones are a major substitute, but professional camcorders maintain niche market share.

- End-User Trends: Growing demand for high-quality video content fuels market growth in professional and consumer segments.

- M&A Activities: Moderate activity, with deal values averaging xx Million annually (2019-2024).

Camcorder Market Industry Trends & Insights

The camcorder market is experiencing a period of significant transformation, driven by several factors. Technological advancements, such as improved sensor technology, advanced image stabilization, and 4K/8K video capabilities, are fueling growth. Changing consumer preferences, including a greater emphasis on video content creation and live streaming, are driving adoption. The market is witnessing a shift towards smaller, more portable models. The CAGR for the forecast period (2025-2033) is estimated at xx%, with market penetration expected to reach xx% by 2033. Competitive dynamics are intensely focused on innovation and strategic partnerships to secure market share. The rise of affordable high-quality camcorders is a key trend, extending the market to a broader consumer base.

Dominant Markets & Segments in Camcorder Market

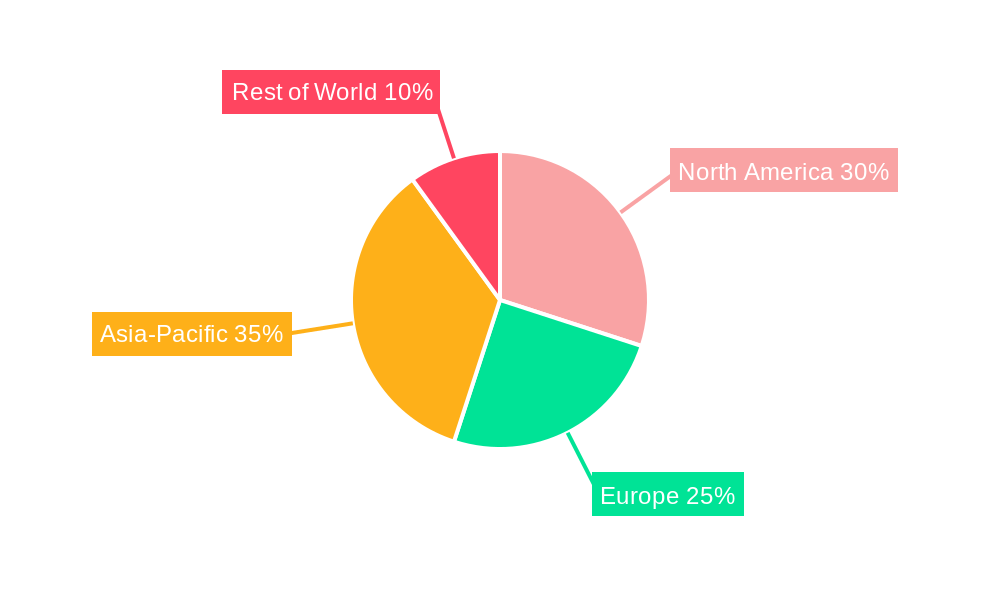

The North American region holds a significant share of the global camcorder market, followed by Europe and Asia Pacific. This dominance is attributable to factors such as high disposable income, robust infrastructure, and a flourishing entertainment industry.

Key Drivers in North America:

- Strong consumer demand for high-quality video content.

- Advanced infrastructure supporting content creation and distribution.

- Favorable economic conditions and high disposable incomes.

Key Drivers in Europe:

- Significant investment in film and television production.

- A growing number of professional content creators.

- Relatively high disposable incomes in many Western European countries.

Dominance Analysis: The strong presence of major camcorder manufacturers in North America, coupled with the region's advanced media infrastructure and high consumer spending on electronics, contributes to its leading position in the market. The region's technological advancements and supportive regulatory environment further bolster its dominance.

Camcorder Market Product Innovations

Recent innovations include significant advancements in sensor technology, resulting in improved image quality, low-light performance, and wider dynamic range. The integration of advanced image stabilization features enhances video smoothness, even in challenging shooting conditions. The market is also witnessing the rise of compact, highly versatile camcorders suitable for various applications. These innovations cater to evolving market needs for high-quality video capture across professional and consumer segments. The introduction of sophisticated video editing software integrated with camcorders adds significant value.

Report Segmentation & Scope

This report segments the camcorder market by product type (professional, consumer, and others), resolution (HD, 4K, 8K, etc.), application (filmmaking, broadcasting, personal use, surveillance), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). Each segment offers distinct growth trajectories, market sizes, and competitive dynamics. Growth projections vary significantly based on the segment, with professional-grade camcorders showing a slightly higher growth rate than the consumer segment in the forecast period.

Key Drivers of Camcorder Market Growth

Technological advancements, such as improved image sensors, higher resolution capabilities, and enhanced stabilization technologies, are paramount drivers. The increasing demand for high-quality video content across various platforms like YouTube, streaming services, and social media is another significant catalyst. Government initiatives promoting media production and investment in technological infrastructure further propel market expansion.

Challenges in the Camcorder Market Sector

The rising popularity of smartphones with integrated cameras poses a significant challenge, particularly in the lower-end consumer segment. Fluctuations in raw material prices and supply chain disruptions can impact production costs and market stability. Intense competition among established and emerging players necessitates continuous innovation and effective marketing strategies to maintain market share.

Leading Players in the Camcorder Market Market

- Canon Inc

- Sony Group Corporation

- Pixellot Ltd

- Panasonic Holding Corporation

- GoPro Inc

- Blackmagic Design Pty Ltd

- Olympus

- Leica

- JVCKENWOOD Corporation

- Ricoh Company Ltd

Key Developments in Camcorder Market Sector

May 2024: Blackmagic Design slashed the price of its high-end Blackmagic Cinema Camera 6K to USD 1,575, offering a significant 40% discount. This move significantly impacts the competitive landscape, making high-end features more accessible. The camera's superior image quality and versatile features are expected to boost sales.

March 2024: Sony unveiled the BURANO camera, a new addition to its CineAlta lineup. The BURANO's combination of high image quality and enhanced mobility targets single-camera operators and smaller teams. Its innovative in-body image stabilization in a PL-Mount camera is a significant technological advancement.

Strategic Camcorder Market Market Outlook

The camcorder market is poised for continued growth, driven by advancements in technology, rising demand for high-quality video content, and increased adoption across various professional and consumer applications. Strategic opportunities exist in developing innovative features, expanding into new market segments, and establishing strategic partnerships. Focus on user experience, affordability, and niche applications will play a vital role in shaping the future of the camcorder market.

Camcorder Market Segmentation

-

1. Type

- 1.1. Mini-DV Camcorders

- 1.2. DVD Camcorders

- 1.3. Hard Disk Drive (HDD) Camcorders

- 1.4. Flash Memory Camcorders

-

2. Application

- 2.1. Personal Use

- 2.2. Professional Use

Camcorder Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Camcorder Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Content Creation; Advancements in Technology

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Content Creation; Advancements in Technology

- 3.4. Market Trends

- 3.4.1. Professional Application Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mini-DV Camcorders

- 5.1.2. DVD Camcorders

- 5.1.3. Hard Disk Drive (HDD) Camcorders

- 5.1.4. Flash Memory Camcorders

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Use

- 5.2.2. Professional Use

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mini-DV Camcorders

- 6.1.2. DVD Camcorders

- 6.1.3. Hard Disk Drive (HDD) Camcorders

- 6.1.4. Flash Memory Camcorders

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Use

- 6.2.2. Professional Use

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mini-DV Camcorders

- 7.1.2. DVD Camcorders

- 7.1.3. Hard Disk Drive (HDD) Camcorders

- 7.1.4. Flash Memory Camcorders

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Use

- 7.2.2. Professional Use

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mini-DV Camcorders

- 8.1.2. DVD Camcorders

- 8.1.3. Hard Disk Drive (HDD) Camcorders

- 8.1.4. Flash Memory Camcorders

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Use

- 8.2.2. Professional Use

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mini-DV Camcorders

- 9.1.2. DVD Camcorders

- 9.1.3. Hard Disk Drive (HDD) Camcorders

- 9.1.4. Flash Memory Camcorders

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Use

- 9.2.2. Professional Use

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mini-DV Camcorders

- 10.1.2. DVD Camcorders

- 10.1.3. Hard Disk Drive (HDD) Camcorders

- 10.1.4. Flash Memory Camcorders

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Use

- 10.2.2. Professional Use

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mini-DV Camcorders

- 11.1.2. DVD Camcorders

- 11.1.3. Hard Disk Drive (HDD) Camcorders

- 11.1.4. Flash Memory Camcorders

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Personal Use

- 11.2.2. Professional Use

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Canon Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sony Group Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Pixellot Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Panasonic Holding Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 GoPro Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Blackmagic Design Pty Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Olympus

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leica

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 JVCKENWOOD Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ricoh Company Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Canon Inc

List of Figures

- Figure 1: Global Camcorder Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Camcorder Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 8: North America Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 9: North America Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 16: Europe Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 17: Europe Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 19: Europe Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 20: Europe Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 21: Europe Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 23: Europe Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Asia Pacific Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Asia Pacific Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Asia Pacific Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 32: Asia Pacific Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 33: Asia Pacific Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 35: Asia Pacific Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Pacific Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Australia and New Zealand Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 41: Australia and New Zealand Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Australia and New Zealand Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Australia and New Zealand Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 44: Australia and New Zealand Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 45: Australia and New Zealand Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Australia and New Zealand Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Australia and New Zealand Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Latin America Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Latin America Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Latin America Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Latin America Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 56: Latin America Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 57: Latin America Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Latin America Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 59: Latin America Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Latin America Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 64: Middle East and Africa Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 65: Middle East and Africa Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 66: Middle East and Africa Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 67: Middle East and Africa Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 68: Middle East and Africa Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 69: Middle East and Africa Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 70: Middle East and Africa Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 71: Middle East and Africa Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Middle East and Africa Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Camcorder Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Camcorder Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Camcorder Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Global Camcorder Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Camcorder Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 13: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 17: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 19: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 23: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 25: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 31: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 35: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 37: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 41: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 43: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Camcorder Market?

The projected CAGR is approximately 3.29%.

2. Which companies are prominent players in the Camcorder Market?

Key companies in the market include Canon Inc, Sony Group Corporation, Pixellot Ltd, Panasonic Holding Corporation, GoPro Inc, Blackmagic Design Pty Ltd, Olympus, Leica, JVCKENWOOD Corporation, Ricoh Company Ltd*List Not Exhaustive.

3. What are the main segments of the Camcorder Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Content Creation; Advancements in Technology.

6. What are the notable trends driving market growth?

Professional Application Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Growing Demand for Content Creation; Advancements in Technology.

8. Can you provide examples of recent developments in the market?

May 2024: Blackmagic Design slashed the price of its high-end Blackmagic Cinema Camera 6K to USD 1,575, offering a significant 40% discount. The Blackmagic Cinema Camera 6K stands out for its ability to capture precise skin tones and vibrant organic colors. Key features include a large 24 x 36 mm full-frame 6K sensor boasting a wide dynamic range, a versatile L-Mount for lenses, and a custom-designed optical low pass filter tailored to the sensor.March 2024: Sony unveiled its latest addition to the CineAlta lineup: the BURANO camera. The BURANO is equipped with a sensor that aligns with the color science of the VENICE 2. This camera seamlessly blends top-tier image quality with enhanced mobility, tailored for single-camera operators and smaller teams. Notably, it stands out as the world's inaugural digital cinema camera boasting a PL-Mount, now equipped with in-body image stabilization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Camcorder Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Camcorder Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Camcorder Market?

To stay informed about further developments, trends, and reports in the Camcorder Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence