Key Insights

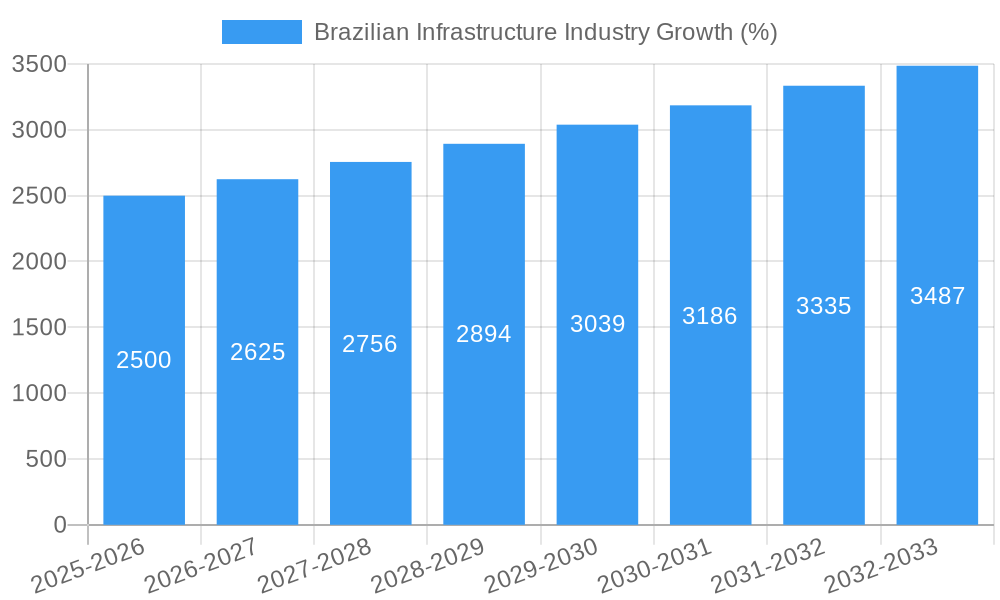

The Brazilian infrastructure industry presents a robust growth trajectory, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by significant government investment in social infrastructure projects, particularly in transportation (including waterways) and telecommunications, alongside private sector participation. Key growth drivers include the nation's ongoing urbanization, the imperative to enhance connectivity across its vast geography, and the need for modernized infrastructure to support economic development and improve the quality of life for its citizens. Major cities like Sao Paulo, Rio de Janeiro, and Salvador are at the forefront of this development, witnessing substantial investments in upgrading their existing infrastructure and constructing new facilities. While challenges such as economic volatility and bureaucratic hurdles may act as potential restraints, the long-term outlook remains positive, driven by Brazil's considerable potential for infrastructure development and the increasing demand for improved services. The involvement of large construction companies like Andrade Gutierrez, Camargo Correa Infra Construcoes, and Odebrecht (implied from the mention of COBRA Group, a subsidiary) highlights the considerable scale of projects underway. The market segmentation by type (social infrastructure, transportation, waterways, telecoms, manufacturing) and key cities provides a nuanced understanding of the investment distribution and growth opportunities within the sector.

The market size in 2025 is not explicitly provided, but considering a CAGR above 5% and the scale of mentioned companies and projects, a reasonable estimate would place the 2025 market value in the billions (let's assume $10 billion or 50 billion BRL for the sake of illustration – the exact figure would require further data). This projection suggests substantial opportunities for both domestic and international companies involved in construction, engineering, and related services. The industry is expected to see increased use of technology and sustainable practices in the coming years, further influencing growth and innovation. The ongoing government initiatives focusing on public-private partnerships will likely play a vital role in driving the industry's trajectory over the forecast period. Analyzing the market segments will reveal strategic opportunities for targeted investment and growth strategies.

Brazilian Infrastructure Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Brazilian infrastructure industry, covering market size, growth drivers, competitive dynamics, and future outlook from 2019 to 2033. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This in-depth research is essential for investors, industry professionals, and policymakers seeking to understand this dynamic and rapidly evolving market.

Brazilian Infrastructure Industry Market Structure & Competitive Dynamics

The Brazilian infrastructure market is characterized by a moderately concentrated structure, with a few large players dominating certain segments. Market share data reveals that Andrade Gutierrez and Construtora Queiroz Galvao hold significant positions in construction, while Braskem dominates in petrochemicals. The innovation ecosystem is developing, with a focus on sustainable and technologically advanced solutions. Regulatory frameworks, while evolving, can present complexities for market participants. Product substitutes exist in certain segments, particularly in materials and technologies, creating competitive pressure. End-user trends are shifting towards greater demand for sustainable and resilient infrastructure. M&A activity has been moderately robust in recent years, with several deals valued at over $XX Million influencing market consolidation. Key M&A activities in the past five years include deals totaling approximately $XXX Million, reflecting strategic efforts to expand market share and capabilities.

- Market Concentration: High in certain segments (e.g., Construction), moderate overall.

- Innovation Ecosystems: Developing, focusing on sustainable and digital solutions.

- Regulatory Frameworks: Complex and evolving, impacting investment decisions.

- Product Substitutes: Present in some sectors, increasing competition.

- End-User Trends: Growing demand for sustainable and resilient infrastructure.

- M&A Activities: Moderate activity with deals valued at over $XX Million in recent years.

Brazilian Infrastructure Industry Industry Trends & Insights

The Brazilian infrastructure industry is experiencing robust growth, driven by substantial government investments in various projects. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, exceeding the global average. Technological advancements, such as the increased adoption of Building Information Modeling (BIM) and digital twins, are transforming construction methodologies and enhancing project efficiency. Increased government spending and privatization initiatives are significantly impacting the market, along with growing private sector participation through PPPs (Public-Private Partnerships). Market penetration of new technologies is growing rapidly, particularly in areas like smart city infrastructure and renewable energy projects. Consumer preference is leaning toward sustainable and technologically advanced infrastructure solutions, while the competitive landscape is characterized by both domestic and international players vying for market share.

Dominant Markets & Segments in Brazilian Infrastructure Industry

São Paulo, due to its economic prominence and population density, represents the most dominant market for infrastructure projects, followed by Rio de Janeiro and Salvador. The Transportation Infrastructure segment shows the highest growth, driven by extensive investment in road, rail, and airport upgrades.

Key Drivers:

- São Paulo: High population density, economic activity, and government investment.

- Transportation Infrastructure: Strong government investment in road, rail, and airport projects.

- Waterways: Significant potential for modernization and expansion.

- Extraction Infrastructure: Linked to the growth of mining and agriculture.

Dominance Analysis: São Paulo’s dominance is attributed to its status as the nation’s economic engine, driving demand for transportation, utilities, and other infrastructure. The transportation sector’s leadership stems from substantial government programs focused on improving connectivity and logistics.

Brazilian Infrastructure Industry Product Innovations

The Brazilian infrastructure sector is witnessing significant innovation in materials, construction techniques, and digital technologies. The adoption of sustainable materials, such as recycled concrete and bio-based composites, is increasing alongside advanced construction methods like 3D printing and prefabrication. Digital technologies, including BIM and IoT sensors, improve project management, efficiency, and safety. These innovations enhance project performance and reduce costs, leading to improved market competitiveness.

Report Segmentation & Scope

This report segments the Brazilian infrastructure market by type (Social Infrastructure, Transportation Infrastructure, Waterways, Extraction Infrastructure, Telecoms, Manufacturing Infrastructure) and by key cities (São Paulo, Rio de Janeiro, Salvador). Each segment includes detailed analyses of market size, growth projections, and competitive dynamics. The forecast considers the projected growth in population, urbanization, and economic development. For instance, the transportation segment is expected to demonstrate robust growth fueled by government investments, while the social infrastructure segment is largely driven by population growth and increased demand for essential services.

Key Drivers of Brazilian Infrastructure Industry Growth

The growth of the Brazilian infrastructure industry is propelled by a multitude of factors, including substantial government investments in large-scale projects, growing private sector participation through Public-Private Partnerships (PPPs), and increasing demand driven by urbanization and population growth. Technological advancements, such as the adoption of BIM and digital twins, are further enhancing efficiency and sustainability. Furthermore, favorable economic policies aimed at stimulating infrastructure development contribute to this growth.

Challenges in the Brazilian Infrastructure Industry Sector

The Brazilian infrastructure sector faces several challenges, including bureaucratic complexities and regulatory hurdles that can delay project approvals and increase costs. Supply chain disruptions and the volatility of material prices pose additional risks. Furthermore, intense competition among numerous players can lead to price wars and reduced profit margins. These factors significantly impact project timelines and overall industry profitability.

Leading Players in the Brazilian Infrastructure Industry Market

- Bayer AG

- COBRA Group

- Tabocas

- OEC

- Braskem

- Telemont

- Andrade Gutierrez

- Construcap

- Construtora Queiroz Galvao

- U&M Mineracao e Construcao

- Camargo Correa Infra Construcoes

- Novonor

Key Developments in Brazilian Infrastructure Industry Sector

- 2022 Q4: Government announces a new wave of infrastructure projects focused on sustainable development.

- 2023 Q1: Major merger between two leading construction firms resulting in increased market share.

- 2023 Q3: Launch of a new high-speed rail project connecting major cities.

- 2024 Q2: Significant investment in smart city infrastructure in São Paulo.

Strategic Brazilian Infrastructure Industry Market Outlook

The Brazilian infrastructure market presents a significant long-term growth opportunity, driven by consistent government investment, technological advancements, and the nation’s ongoing development. Strategic opportunities exist for companies that can leverage technological innovation, develop sustainable solutions, and navigate regulatory complexities effectively. The expanding private sector involvement through PPPs provides further avenues for growth and market penetration.

Brazilian Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other Social Infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Distribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other Manufacturing Infrastructures

-

1.1. Social Infrastructure

-

2. Key Cities

- 2.1. Sao Paulo

- 2.2. Rio de Janeiro

- 2.3. Salvador

Brazilian Infrastructure Industry Segmentation By Geography

- 1. Brazil

Brazilian Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continued Expansion of Higher Education; The Surge in the Number of International Students

- 3.3. Market Restrains

- 3.3.1. Affordability and Shortage of Supply; High Cost for International Students

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Infrastructure Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other Social Infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Distribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other Manufacturing Infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Sao Paulo

- 5.2.2. Rio de Janeiro

- 5.2.3. Salvador

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 COBRA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tabocas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OEC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Braskem

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telemont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andrade Gutierrez

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Construcap

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Construtora Queiroz Galvao

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 U&M Mineracao e Construcao

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Camargo Correa Infra Construcoes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novonor

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayer AG**List Not Exhaustive

List of Figures

- Figure 1: Brazilian Infrastructure Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Infrastructure Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Infrastructure Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Brazilian Infrastructure Industry?

Key companies in the market include Bayer AG**List Not Exhaustive, COBRA Group, Tabocas, OEC, Braskem, Telemont, Andrade Gutierrez, Construcap, Construtora Queiroz Galvao, U&M Mineracao e Construcao, Camargo Correa Infra Construcoes, Novonor.

3. What are the main segments of the Brazilian Infrastructure Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continued Expansion of Higher Education; The Surge in the Number of International Students.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Affordability and Shortage of Supply; High Cost for International Students.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Brazilian Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence