Key Insights

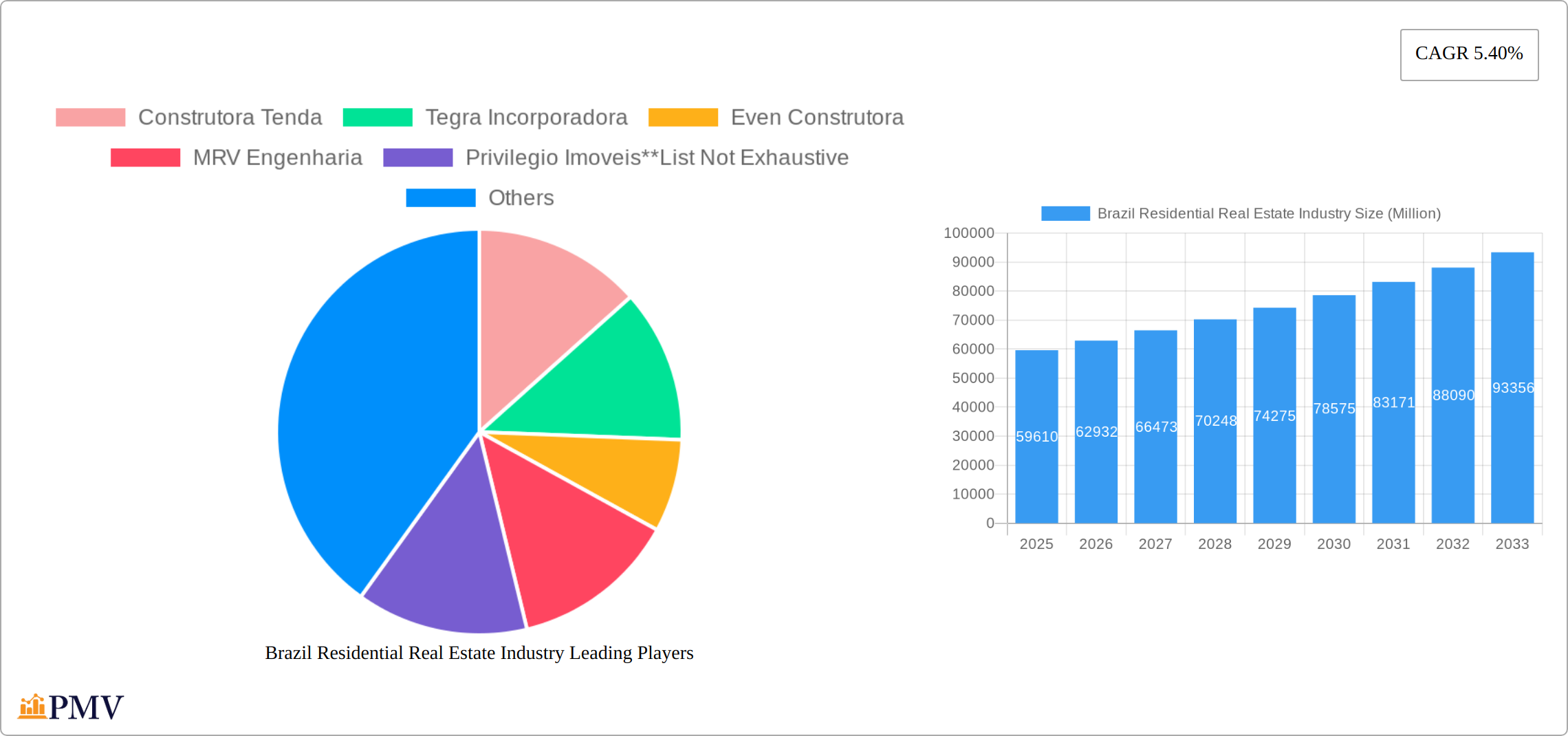

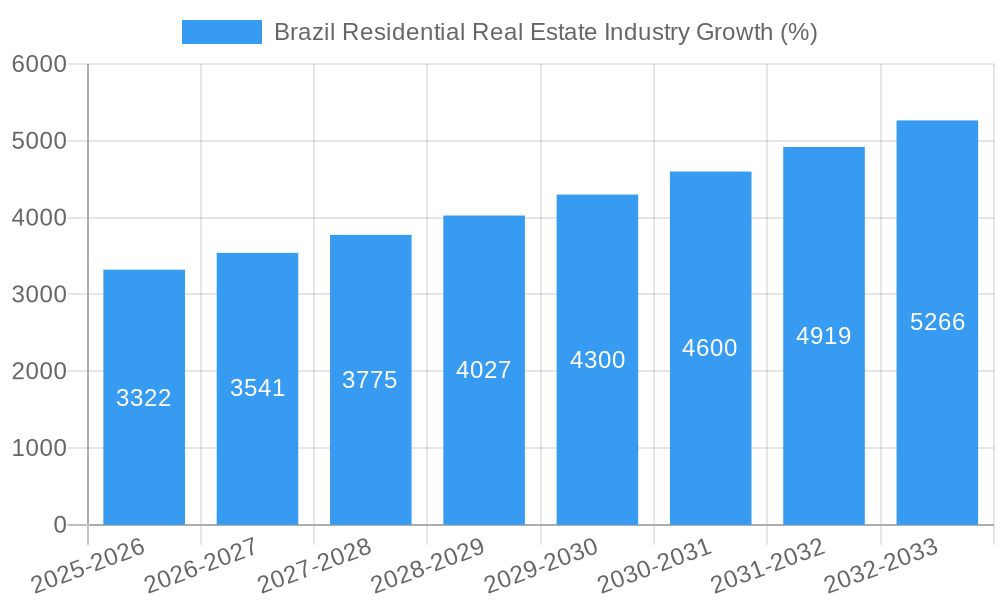

The Brazilian residential real estate market, valued at $59.61 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.40% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable income is a primary factor, coupled with favorable government policies aimed at stimulating homeownership. Urbanization trends continue to propel demand for housing in major metropolitan areas like São Paulo and Rio de Janeiro. Furthermore, low-interest mortgage rates and innovative financing options are making homeownership more accessible to a wider segment of the population. However, challenges remain. Inflationary pressures and fluctuating interest rates pose potential risks to market stability. Furthermore, the availability of land suitable for development, especially in prime urban locations, presents a constraint to future growth. Competition among major players, including Construtora Tenda, Tegra Incorporadora, Even Construtora, MRV Engenharia, Privilégio Imóveis, Gafisa, Cyrela Brazil Realty, Lopes Consultoria de Imóveis, Multiplan Real Estate Company, and Direcional Engenharia, is intense, driving innovation and efficiency in the sector. The market is segmented primarily by property type (e.g., apartments, houses, townhouses), with specific sub-segments likely to experience varying growth rates based on consumer preferences and evolving lifestyle choices.

The forecast for the Brazilian residential real estate market reflects a positive outlook, albeit with inherent market risks. Maintaining sustainable growth will require addressing challenges related to affordability, infrastructure development, and regulatory frameworks. The market's success hinges on the ability of developers to adapt to evolving consumer demands, leveraging technology and sustainable building practices while navigating economic uncertainties. The ongoing diversification of the housing portfolio to cater to diverse income brackets and lifestyle preferences will likely be a crucial strategy for long-term success. The intense competition among established players and the emergence of new entrants will continue to shape market dynamics and pricing strategies.

Brazil Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Brazil residential real estate industry, covering market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025), to forecast market trends until 2033. It’s an essential resource for investors, developers, and industry professionals seeking a thorough understanding of this dynamic market. The report includes detailed analysis of major players like Construtora Tenda, Tegra Incorporadora, Even Construtora, MRV Engenharia, Privilégio Imóveis, Gafisa, Cyrela Brazil Realty, Lopes Consultoria de Imóveis, Multiplan Real Estate Company, and Direcional Engenharia.

Brazil Residential Real Estate Industry Market Structure & Competitive Dynamics

The Brazilian residential real estate market is characterized by a moderately concentrated structure with a few large players dominating the landscape. Market share data for 2024 indicates that the top five companies hold approximately xx% of the market, reflecting the consolidation witnessed over the past five years. Innovation ecosystems are emerging, particularly in areas like sustainable construction and technology-enabled real estate transactions. The regulatory framework, while evolving, still presents some challenges. Product substitutes, primarily rental properties and alternative housing solutions, are gaining traction, particularly among younger demographics. End-user trends are shifting towards higher-quality, sustainable, and technologically advanced properties, with an increasing emphasis on smart home features and amenities.

M&A activity has been significant in recent years, with deal values totaling approximately xx Million in 2024. Key drivers include the pursuit of economies of scale, expansion into new markets, and access to advanced technologies. Recent mergers and acquisitions have focused on enhancing vertical integration and expanding geographic reach. The following factors are driving market dynamics:

- Market Concentration: High concentration with a few major players.

- Innovation Ecosystems: Emerging focus on sustainable and tech-enabled solutions.

- Regulatory Frameworks: Evolving and presenting ongoing challenges.

- Product Substitutes: Increasing competition from rental and alternative housing options.

- End-User Trends: Growing demand for high-quality, sustainable, tech-integrated homes.

- M&A Activity: Significant activity with values reaching xx Million in 2024.

Brazil Residential Real Estate Industry Industry Trends & Insights

The Brazilian residential real estate market exhibits robust growth potential, driven by a combination of factors. The compound annual growth rate (CAGR) from 2019 to 2024 was xx%, and projections suggest a CAGR of xx% from 2025 to 2033. Key growth drivers include: a growing middle class, urbanization trends, government incentives for homeownership, and improving infrastructure in key regions. Technological disruptions are transforming the industry, with increasing adoption of digital tools for marketing, sales, and property management. Consumer preferences are evolving, reflecting a growing demand for sustainable, eco-friendly homes with high levels of energy efficiency, and a rise in demand for co-living spaces. Competitive dynamics are further characterized by increasing mergers and acquisitions, strategic alliances, and technological innovation. Market penetration of green building technologies is steadily increasing, with a projected xx% market penetration by 2033.

Dominant Markets & Segments in Brazil Residential Real Estate Industry

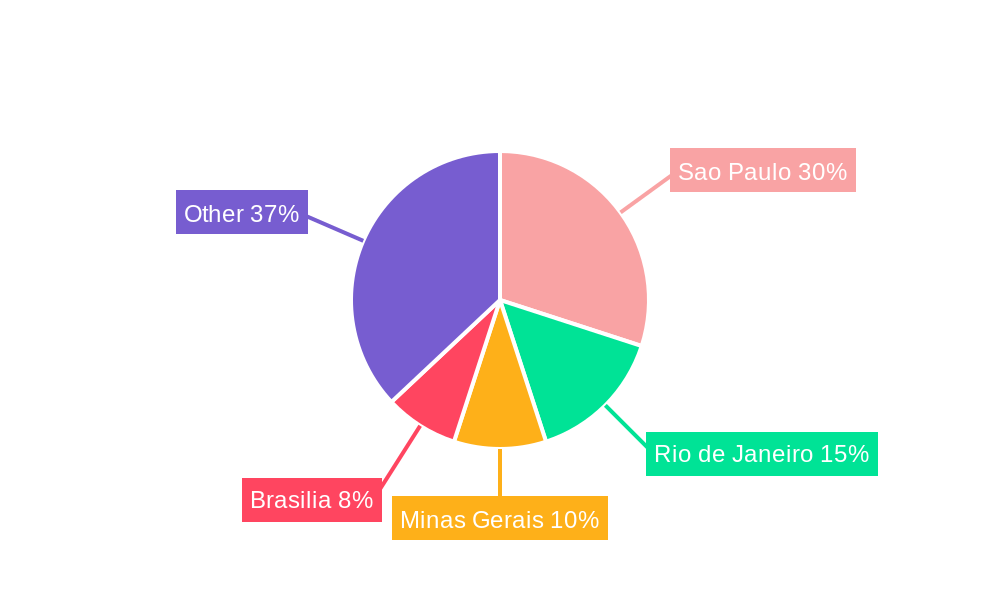

The Southeast region of Brazil dominates the residential real estate market, driven primarily by strong economic activity, a large population concentration in major cities such as São Paulo and Rio de Janeiro, and substantial infrastructure development.

- Key Drivers of Dominance:

- Robust economic activity in the region.

- High population density in major metropolitan areas.

- Significant infrastructure development and investment.

- Favorable government policies and incentives.

- Increased demand for high-quality residential spaces.

The dominance of the Southeast region is primarily attributable to factors such as economic strength, urbanization, and well-developed infrastructure. São Paulo, in particular, presents a robust market due to its status as the financial and economic hub of the nation. The region's strong economic activity and well-developed infrastructure create favorable conditions for sustained growth and high property values. The consistent flow of domestic and international investment, along with supportive government policies, further solidifies the Southeast region's leading position within the Brazilian residential real estate sector.

Brazil Residential Real Estate Industry Product Innovations

Recent product innovations focus on sustainability and technological integration. Developers are incorporating smart home technology, renewable energy sources, and eco-friendly building materials. These innovations address growing consumer preferences for sustainable and technologically advanced properties, offering competitive advantages in an increasingly competitive market. The focus is on providing higher-quality, more energy-efficient, and technologically advanced homes to meet evolving consumer needs.

Report Segmentation & Scope

This report segments the market by property type, including apartments, houses, and townhouses. Each segment demonstrates unique growth patterns and competitive dynamics. The apartment segment holds the largest market share, driven by urbanization and increased demand for compact living spaces. The housing market is also witnessing growth, particularly in suburban areas. Growth projections indicate a continued expansion for both segments in the forecast period (2025-2033), with xx Million projected for apartments and xx Million for houses. Market sizes will vary across regions based on regional growth drivers and market dynamics.

Key Drivers of Brazil Residential Real Estate Industry Growth

Several key factors propel growth in the Brazilian residential real estate sector. Economic growth, fueled by a growing middle class and increasing disposable incomes, is a major driver. Urbanization trends, coupled with ongoing infrastructure development, contribute significantly to increased demand. Government initiatives promoting homeownership, including financing schemes and tax incentives, further stimulate market activity. Finally, the adoption of technological advancements, resulting in improved construction efficiency and enhancing the customer experience, plays a crucial role in shaping industry growth.

Challenges in the Brazil Residential Real Estate Industry Sector

The Brazilian residential real estate sector faces challenges including high interest rates which impact affordability and mortgage access. Supply chain disruptions can cause delays and cost overruns. Furthermore, competition from established developers and new entrants exerts pressure on profit margins and requires continuous innovation. The macroeconomic environment greatly influences investor confidence and consequently affects market stability and development. These factors contribute to uncertainty and create hurdles for developers and investors alike. High construction costs and land scarcity add to existing challenges.

Leading Players in the Brazil Residential Real Estate Industry Market

- Construtora Tenda

- Tegra Incorporadora

- Even Construtora

- MRV Engenharia

- Privilégio Imóveis

- Gafisa

- Cyrela Brazil Realty

- Lopes Consultoria de Imóveis

- Multiplan Real Estate Company

- Direcional Engenharia

Key Developments in Brazil Residential Real Estate Industry Sector

December 2022: Even launched "Joaquim," a luxury residential project in the Brooklyn neighborhood of São Paulo, comprising 92 units with exceptional amenities. This highlights the trend towards high-end developments in prime locations.

August 2022: AMORA partnered with Even, expanding its property portfolio and facilitating financing for customers, demonstrating innovative approaches to property acquisition.

August 2022: Even formed a joint venture with Holding RFM (NewCo), expanding its reach into mid-sized projects in upscale areas, showcasing strategic expansion and market diversification.

Strategic Brazil Residential Real Estate Industry Market Outlook

The Brazilian residential real estate market presents significant growth potential, driven by ongoing urbanization, economic expansion, and evolving consumer preferences. Strategic opportunities exist in developing sustainable and technologically advanced housing solutions, targeting specific market segments, and capitalizing on infrastructure developments. Furthermore, strategic partnerships and mergers and acquisitions will likely play a crucial role in shaping the market landscape in the coming years. The continued focus on innovation and adapting to changing consumer needs will be pivotal for success in this dynamic and growing market.

Brazil Residential Real Estate Industry Segmentation

-

1. Market Segmentation

-

1.1. By Type

- 1.1.1. Villas and Landed Houses

- 1.1.2. Apartments and Condominiums

-

1.1. By Type

-

2. Type

- 2.1. Villas and Landed Houses

- 2.2. Apartments and Condominiums

Brazil Residential Real Estate Industry Segmentation By Geography

- 1. Brazil

Brazil Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. High-end Segment Growing in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Market Segmentation

- 5.1.1. By Type

- 5.1.1.1. Villas and Landed Houses

- 5.1.1.2. Apartments and Condominiums

- 5.1.1. By Type

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Villas and Landed Houses

- 5.2.2. Apartments and Condominiums

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Market Segmentation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Construtora Tenda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tegra Incorporadora

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Even Construtora

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MRV Engenharia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Privilegio Imoveis**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gafisa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cyrela Brazil Realty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lopes Consultoria de Imoveis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Multiplan Real Estate Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Direcional Engenharia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Construtora Tenda

List of Figures

- Figure 1: Brazil Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Residential Real Estate Industry Revenue Million Forecast, by Market Segmentation 2019 & 2032

- Table 3: Brazil Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Residential Real Estate Industry Revenue Million Forecast, by Market Segmentation 2019 & 2032

- Table 7: Brazil Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Brazil Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Residential Real Estate Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Brazil Residential Real Estate Industry?

Key companies in the market include Construtora Tenda, Tegra Incorporadora, Even Construtora, MRV Engenharia, Privilegio Imoveis**List Not Exhaustive, Gafisa, Cyrela Brazil Realty, Lopes Consultoria de Imoveis, Multiplan Real Estate Company, Direcional Engenharia.

3. What are the main segments of the Brazil Residential Real Estate Industry?

The market segments include Market Segmentation, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

High-end Segment Growing in the Country.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

December 2022: Even launched Joaquim, an undertaking located in a privileged area in the Brooklyn neighborhood. With 92 units, divided into two garden units and 90 with four bedrooms (168.50 m2), the project has leisure facilities that go beyond expectations, with a sports court, dry sauna, massage room, adult and children's pool and indoor pool with a lane of 25 m, safe storage, among others. The region is full of green areas, with the recently opened Bruno Covas Park, which borders the Pinheiros River, and Parque do Povo, which offer infrastructure for walking, exercising and cycling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Brazil Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence