Key Insights

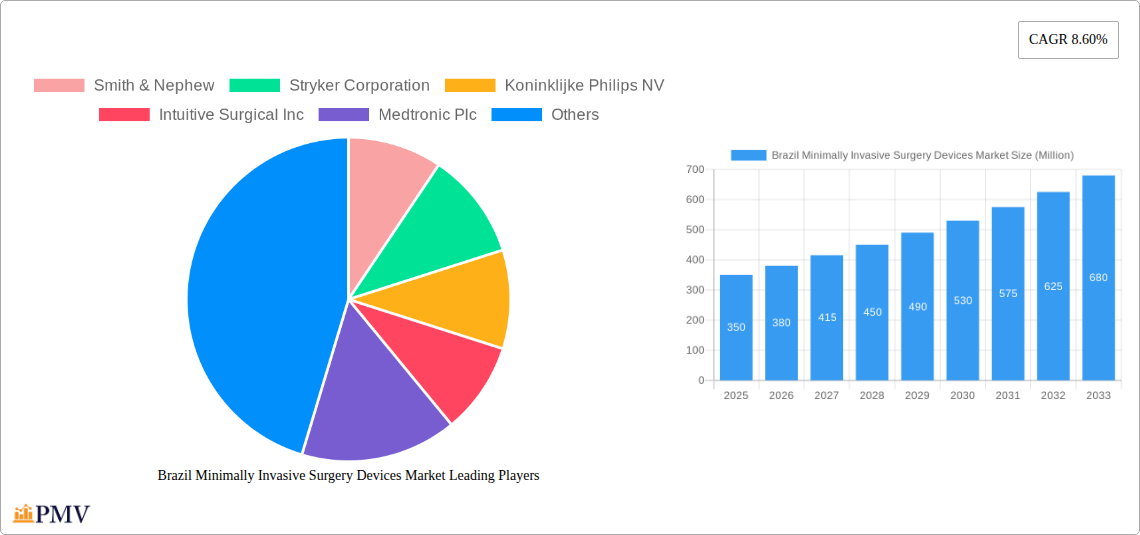

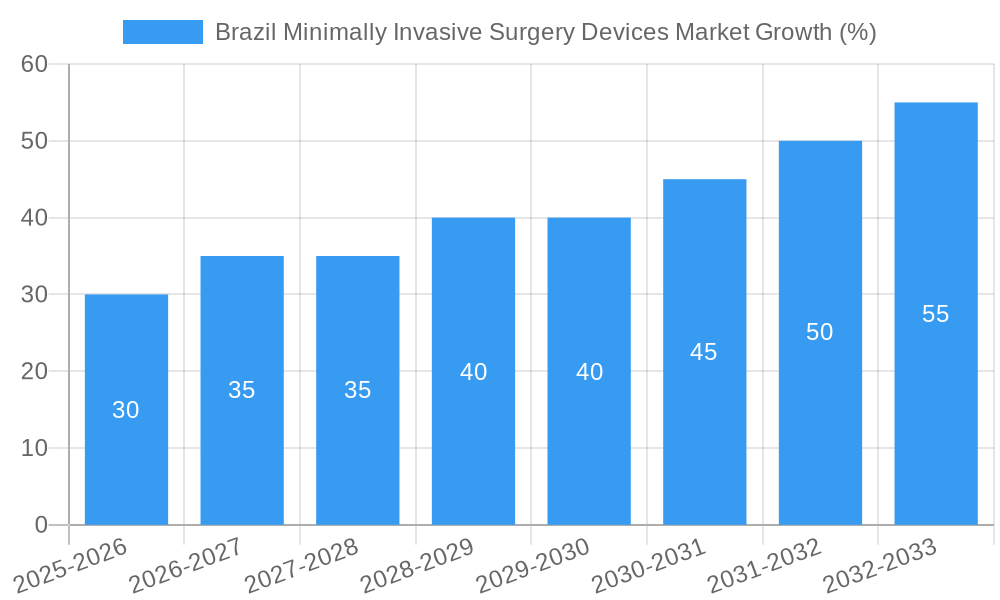

The Brazil minimally invasive surgery (MIS) devices market is experiencing robust growth, driven by a rising prevalence of chronic diseases necessitating MIS procedures, increasing adoption of advanced surgical techniques, and expanding healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 8.60% from 2019 to 2024 indicates a significant upward trajectory. While the precise market size for 2025 isn't provided, extrapolating from the historical CAGR and considering factors like economic growth in Brazil and ongoing investments in healthcare technology, a reasonable estimate for the 2025 market size would be in the range of $300-400 million. This is supported by the strong presence of major global players like Smith & Nephew, Stryker, and Medtronic, actively participating in the Brazilian market.

Growth is further fueled by the increasing demand across various surgical applications. Cardiovascular procedures, driven by the high prevalence of heart disease, represent a significant segment. Similarly, the growing incidence of gastrointestinal and orthopedic conditions contributes to market expansion. The segments comprising handheld instruments, endoscopic and laparoscopic devices, and monitoring and visualization devices are expected to witness above-average growth due to technological advancements enhancing precision and minimally invasive capabilities. However, challenges remain, including high costs associated with advanced MIS devices and a limited healthcare access in certain regions of Brazil, which may act as restraints on market growth to some extent. Nevertheless, the overall outlook for the Brazil MIS devices market remains positive, with significant potential for growth throughout the forecast period (2025-2033).

Brazil Minimally Invasive Surgery Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil minimally invasive surgery devices market, offering valuable insights for stakeholders across the medical device industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report forecasts market trends from 2025 to 2033, building upon historical data from 2019 to 2024. Key players analyzed include Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, and Abbott Laboratories. The market is segmented by product type (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laproscopic Devices, Monitoring and Visualization Devices, Ablation and Laser Based Devices, Others) and application (Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, Other Applications).

Brazil Minimally Invasive Surgery Devices Market Market Structure & Competitive Dynamics

The Brazilian minimally invasive surgery devices market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share. The market's innovation ecosystem is driven by both international players and a growing number of domestic companies focusing on specialized niches. The regulatory framework, overseen by ANVISA (Agência Nacional de Vigilância Sanitária), plays a crucial role in shaping market access and product approvals. The market also faces competition from substitute products, particularly in areas where less invasive techniques are emerging. End-user trends, such as increasing demand for advanced minimally invasive procedures and a growing preference for high-quality, reliable devices, are shaping market dynamics. Mergers and acquisitions (M&A) activity is moderate, with strategic partnerships and acquisitions aimed at expanding market reach and technological capabilities. Recent M&A deal values have been in the range of xx Million, although data availability is limited in this space. Market share data for individual companies is currently unavailable, but preliminary estimates suggest a xx% share for the top 5 players combined.

Brazil Minimally Invasive Surgery Devices Market Industry Trends & Insights

The Brazilian minimally invasive surgery devices market is experiencing robust growth, driven by factors such as increasing prevalence of chronic diseases, rising disposable incomes, improving healthcare infrastructure, and increasing adoption of minimally invasive surgical techniques. Technological advancements, including the development of sophisticated imaging systems, robotic surgery platforms, and advanced instrumentation, are further fueling market expansion. Consumer preferences are shifting towards less invasive procedures with shorter recovery times and improved cosmetic outcomes. The market is witnessing a trend towards greater specialization, with companies focusing on specific surgical areas to gain a competitive advantage. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033. This strong growth is partly fueled by government initiatives promoting healthcare access and investment in medical infrastructure. However, challenges such as reimbursement policies and affordability of advanced technologies remain.

Dominant Markets & Segments in Brazil Minimally Invasive Surgery Devices Market

Leading Segments: The Endoscopic and Laproscopic Devices segment currently dominates the market, driven by a high volume of procedures in various specialties, including general surgery, gynecology, and urology. The Electrosurgical Devices segment also holds a significant share due to widespread use in various minimally invasive procedures. The Orthopedic and Cardiovascular application segments are experiencing high growth and are projected to see significant expansion in coming years.

Key Drivers: The expansion of private healthcare facilities, increasing government investments in public healthcare infrastructure, and the growing awareness among patients about minimally invasive surgical options have been primary drivers of growth. Economic growth and rising disposable incomes play crucial roles in enhancing market prospects. Favorable government policies supporting the adoption of advanced medical technologies further boosts the market.

The South-Eastern region of Brazil constitutes the largest market, driven by high population density, a concentration of specialized medical facilities, and higher healthcare expenditure compared to other regions.

Brazil Minimally Invasive Surgery Devices Market Product Innovations

Recent product innovations include the development of smaller, more versatile surgical instruments, improved imaging systems for enhanced visualization during procedures, and robotic-assisted surgical platforms that enable greater precision and control. These innovations aim to improve surgical outcomes, reduce complications, and enhance patient experience. The market is witnessing a rise in single-use devices, addressing concerns regarding infection control and cost-effectiveness. The integration of digital technologies, such as AI and machine learning, holds significant potential for improving the efficiency and accuracy of minimally invasive surgical procedures. This innovation is directly addressing the market need for enhanced surgical precision and improved patient recovery outcomes.

Report Segmentation & Scope

By Product: The report segment the market by different types of devices including Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laproscopic Devices, Monitoring and Visualization Devices, Ablation and Laser Based Devices, and Others. Each segment's growth projection, market size, and competitive landscape are analyzed. The Endoscopic and Laproscopic Devices segment is projected to experience the highest CAGR.

By Application: The market is further segmented by application: Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, and Other Applications. Each application segment exhibits unique growth dynamics and competitive characteristics, shaped by specific clinical needs and technological advancements. The Orthopedic application segment shows significant potential for future expansion.

Key Drivers of Brazil Minimally Invasive Surgery Devices Market Growth

Technological advancements, particularly in robotics and imaging, are primary drivers. Economic growth and rising healthcare spending are crucial, alongside government initiatives aimed at improving healthcare infrastructure and access. Favorable regulatory policies promoting the adoption of advanced medical technologies further stimulate market expansion. The increasing prevalence of chronic diseases requiring minimally invasive procedures contributes significantly to market growth.

Challenges in the Brazil Minimally Invasive Surgery Devices Market Sector

Regulatory hurdles and stringent approval processes can delay product launches. Supply chain disruptions and dependence on imported devices can impact market stability. High costs of advanced technologies and limited reimbursement coverage can restrict market access, particularly in the public healthcare sector. Intense competition among established players and new entrants pose challenges to market share growth. The overall impact of these challenges could result in a reduction of market growth by approximately xx% over the forecast period.

Leading Players in the Brazil Minimally Invasive Surgery Devices Market Market

- Smith & Nephew

- Stryker Corporation

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Medtronic Plc

- Siemens Healthineers

- GE Healthcare

- Zimmer Biomet

- Olympus Corporation

- Abbott Laboratories

Key Developments in Brazil Minimally Invasive Surgery Devices Market Sector

- June 2022: GC Aesthetics, Inc. announces its expansion into the Brazilian market, planning to commercialize its full product portfolio. This development signifies increased competition and broadened product availability.

- January 2022: Spinologics Inc. and Importek launch Cervision, a cervical spine surgery positioning device, approved by ANVISA. This highlights the introduction of new, specialized technologies catering to specific surgical needs.

Strategic Brazil Minimally Invasive Surgery Devices Market Market Outlook

The Brazilian minimally invasive surgery devices market presents substantial growth opportunities over the forecast period. Continued technological innovation, increasing adoption of minimally invasive techniques, and growing healthcare investments provide a strong foundation for future expansion. Strategic partnerships, collaborations, and investments in R&D are expected to shape the market landscape. Focusing on addressing affordability concerns and expanding market access in underserved areas will be crucial for long-term success. The market is poised for significant growth driven by a confluence of favorable factors, presenting lucrative investment opportunities for both established players and new entrants.

Brazil Minimally Invasive Surgery Devices Market Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic and Laproscopic Devices

- 1.5. Monitoring and Visualization Devices

- 1.6. Ablation and Laser Based Devices

- 1.7. Others

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

Brazil Minimally Invasive Surgery Devices Market Segmentation By Geography

- 1. Brazil

Brazil Minimally Invasive Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Lack of Experienced Professionals; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Aesthetics Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Minimally Invasive Surgery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic and Laproscopic Devices

- 5.1.5. Monitoring and Visualization Devices

- 5.1.6. Ablation and Laser Based Devices

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stryker Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuitive Surgical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GE Healthcare

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zimmer Biomet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olympus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Brazil Minimally Invasive Surgery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Minimally Invasive Surgery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Region 2019 & 2032

- Table 3: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Products 2019 & 2032

- Table 4: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2019 & 2032

- Table 5: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2019 & 2032

- Table 7: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Region 2019 & 2032

- Table 9: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Country 2019 & 2032

- Table 11: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Products 2019 & 2032

- Table 12: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2019 & 2032

- Table 13: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2019 & 2032

- Table 15: Brazil Minimally Invasive Surgery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Minimally Invasive Surgery Devices Market?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Brazil Minimally Invasive Surgery Devices Market?

Key companies in the market include Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, Abbott Laboratories.

3. What are the main segments of the Brazil Minimally Invasive Surgery Devices Market?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Aesthetics Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Experienced Professionals; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In June 2022, GC Aesthetics, Inc., a privately-held medical technology company offering women's healthcare aesthetic and reconstructive solutions, announced its expansion goals for the Brazilian market. The company planned to commercialize all GC Aesthetics products and solutions in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Minimally Invasive Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Minimally Invasive Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Minimally Invasive Surgery Devices Market?

To stay informed about further developments, trends, and reports in the Brazil Minimally Invasive Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence