Key Insights

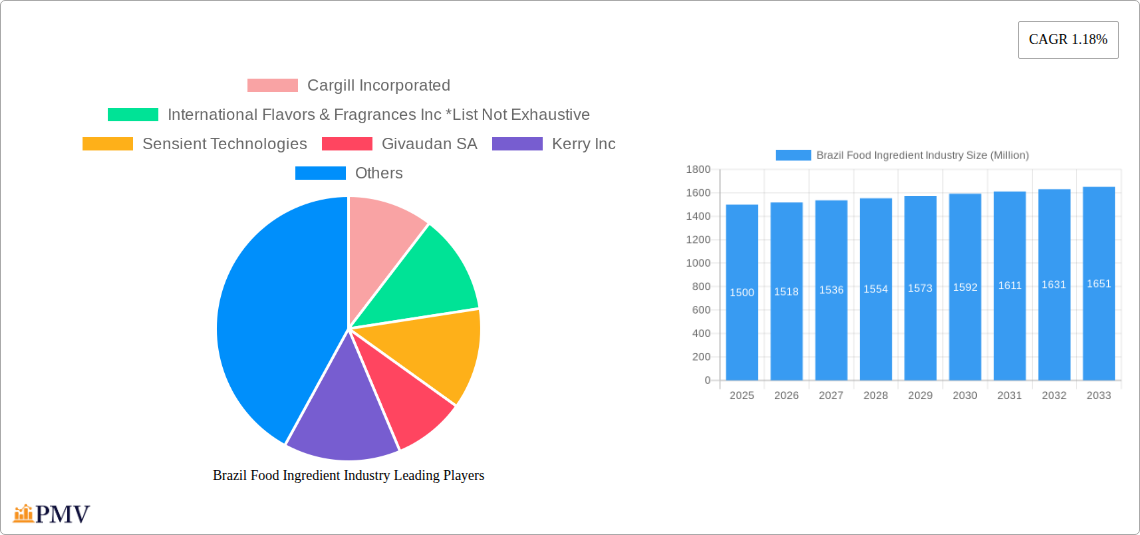

The Brazilian food ingredient market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by several key factors. The rising demand for processed and convenience foods, fueled by a growing and increasingly urbanized population, is a major catalyst. Consumers are also exhibiting a heightened preference for healthier and more natural food products, boosting the demand for clean-label ingredients like natural sweeteners and preservatives. Furthermore, the expansion of the food and beverage industry in Brazil, coupled with increasing investments in food processing technologies, is contributing to the market's expansion. The market is segmented by ingredient type (starch and sweeteners, flavors and colorants, etc.) and application (bakery, beverages, meat products, etc.), offering diverse growth opportunities across various sectors. Key players like Cargill, IFF, and Sensient Technologies are leveraging their established presence and innovation capabilities to capture significant market share.

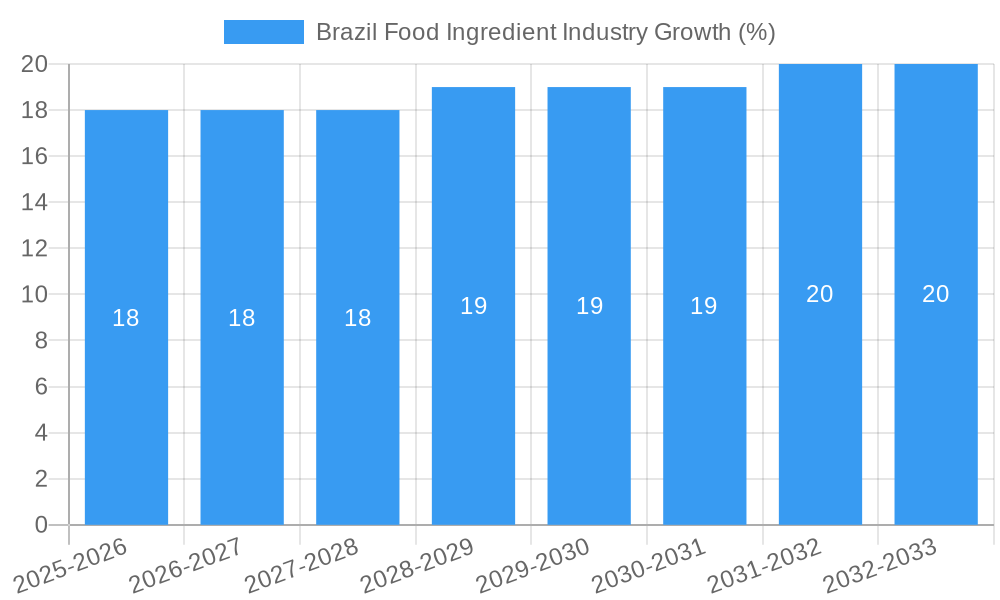

However, the market's growth trajectory is not without challenges. Economic volatility and fluctuations in raw material prices can impact profitability. Additionally, stringent regulatory frameworks and increasing consumer awareness regarding ingredient sourcing and sustainability could pose hurdles. Nevertheless, the overall outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 1.18% from 2025 to 2033. This sustained growth will be fueled by continued advancements in food technology, the exploration of novel ingredients, and a focus on catering to evolving consumer preferences. The strategic focus on product diversification and geographic expansion by major players will further shape the competitive landscape of the Brazilian food ingredient market in the coming years.

Brazil Food Ingredient Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil food ingredient industry, offering invaluable insights for businesses operating within or seeking to enter this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report presents a detailed overview of market structure, competitive dynamics, key trends, and future growth potential. The report incorporates extensive data, market sizing (in Millions), and forecasts to empower informed decision-making.

Brazil Food Ingredient Industry Market Structure & Competitive Dynamics

The Brazilian food ingredient market is characterized by a mix of multinational giants and local players, leading to a moderately concentrated market structure. Key players like Cargill Incorporated, Cargill Incorporated, International Flavors & Fragrances Inc, International Flavors & Fragrances Inc, Sensient Technologies, Givaudan SA, Kerry Inc, Archer Daniels Midland Company, Bunge Limited, Tate & Lyle PLC, Olam International, Koninklijke DSM NV, Associated British Foods PLC, and Ingredion Incorporated, hold significant market share, though the exact figures are proprietary and vary across segments. The market exhibits a robust innovation ecosystem, driven by consumer demand for healthier and more convenient food products.

Regulatory frameworks, while generally supportive of the industry, present certain challenges related to labeling, food safety, and sustainability. The presence of substitute ingredients and evolving consumer preferences add further layers of complexity to the competitive landscape. Mergers and acquisitions (M&A) are frequent, reflecting industry consolidation and the pursuit of synergistic opportunities. For example, ADM's acquisition of Deerland Probiotics & Enzymes (USD xx Million) significantly boosted its health and wellness portfolio. Total M&A deal value in the period 2019-2024 reached an estimated USD xx Million.

Brazil Food Ingredient Industry Industry Trends & Insights

The Brazilian food ingredient market is experiencing robust growth, driven by several key factors. The rising disposable incomes and changing dietary habits are fueling demand for processed foods, convenience foods, and healthier options. Technological advancements in food processing and preservation are creating opportunities for innovation, while evolving consumer preferences for natural, organic, and functional ingredients are reshaping product formulations. The market is witnessing a significant shift toward clean-label ingredients and reduced sugar and salt content. The CAGR for the period 2025-2033 is projected to be xx%, driven largely by increased demand for flavors and colorants in the confectionery and beverage sectors, which currently holds xx% market penetration. This growth, however, faces headwinds like economic fluctuations and volatile raw material prices.

Dominant Markets & Segments in Brazil Food Ingredient Industry

- Leading Region/Application: The Southeast region dominates the market due to its high population density and robust food processing industry. The largest application segments are Beverages and Bakery Products, driven by increasing consumer demand for ready-to-consume products.

- Dominant Type Segment: Starch and sweeteners constitute the largest segment by type, followed by flavors and colorants. This is attributed to their widespread use in various food and beverage applications.

- Key Drivers:

- Economic Policies: Government initiatives promoting food processing and agribusiness positively impact the industry.

- Infrastructure: Investments in logistics and transportation networks improve supply chain efficiency.

- Consumer Preferences: Growing demand for healthier and convenient foods fuels innovation and growth in specific segments, especially functional ingredients.

Detailed dominance analysis within each segment reveals a competitive landscape characterized by both intense price competition and differentiation based on product quality, innovation, and brand reputation.

Brazil Food Ingredient Industry Product Innovations

Recent product innovations highlight the growing focus on health and wellness. For example, Tate & Lyle's launch of Erytesse erythritol, a 70% sweetness sweetener with applications across several food categories, showcases the industry's drive to provide better-for-you options. Technological trends like the increased use of natural and sustainable ingredients, as well as improved functionalities (e.g., enhanced textures, longer shelf-life), are shaping new product development and impacting the competitive advantages of various companies.

Report Segmentation & Scope

The report segments the market by both ingredient type and application:

By Type: Starch and Sweeteners, Flavors and Colorants, Acidulants and Emulsifiers, Preservatives, Enzymes, Edible Oils and Fats, and Other Types. Each segment is analyzed based on its market size, growth projections, and competitive dynamics.

By Application: Bakery Products, Beverages, Meat, Poultry, and Seafood, Dairy Products, Confectionery, and Sweet and Savory Snacks. Each application segment is similarly analyzed for market size, growth trends, and competition. The projections show varied growth rates, reflecting the unique dynamics of each area.

Key Drivers of Brazil Food Ingredient Industry Growth

Several factors drive the growth of the Brazilian food ingredient industry. Rising disposable incomes lead to increased spending on processed foods. Technological advancements allow for the creation of new products and efficient production methods. Furthermore, supportive government policies and a growing population are fostering increased demand. The rising adoption of health and wellness trends is also a key driver of demand for specific types of ingredients, such as probiotics and natural sweeteners.

Challenges in the Brazil Food Ingredient Industry Sector

The industry faces challenges such as supply chain disruptions and regulatory hurdles impacting raw material sourcing and import/export operations. Increased competition from both domestic and international players necessitates continuous innovation and cost optimization. Fluctuations in raw material prices also pose a significant challenge to profitability and price stability, potentially affecting overall market growth by xx% in the short term, if not mitigated.

Leading Players in the Brazil Food Ingredient Industry Market

- Cargill Incorporated

- International Flavors & Fragrances Inc

- Sensient Technologies

- Givaudan SA

- Kerry Inc

- Archer Daniels Midland Company

- Bunge Limited

- Tate & Lyle PLC

- Olam International

- Koninklijke DSM NV

- Associated British Foods PLC

- Ingredion Incorporated

Key Developments in Brazil Food Ingredient Industry Sector

- November 2022: Tate & Lyle Plc launched Erytesse erythritol, a new sweetener with significant market potential across various food categories. This launch demonstrates the ongoing push towards healthier and more functional ingredients.

- November 2021: Archer Daniels Midland (ADM) Company acquired Deerland Probiotics & Enzymes, expanding its portfolio of health and wellness products and strengthening its competitive position. This M&A activity underscores the industry’s consolidation trend.

- May 2021: Ingredion partnered with Amyris Inc., securing exclusive rights to sell a zero-calorie sweetener, further enhancing its product offerings in the rapidly growing natural sweetener segment.

Strategic Brazil Food Ingredient Industry Market Outlook

The Brazilian food ingredient market presents significant growth opportunities. Continued investments in R&D, a focus on sustainable and natural ingredients, and strategic partnerships will be key to success. The market’s increasing sophistication and demand for specialized ingredients will allow for companies to capture significant market share by focusing on niche segments and leveraging technological advantages. The future outlook suggests sustained growth, driven by a confluence of factors, creating a lucrative environment for both established and emerging players.

Brazil Food Ingredient Industry Segmentation

-

1. Type

- 1.1. Starch and Sweeteners

- 1.2. Flavors and Colorants

- 1.3. Acidulants and Emulsifiers

- 1.4. Preservatives

- 1.5. Enzymes

- 1.6. Edible Oils and Fats

- 1.7. Other Types

-

2. Application

- 2.1. Bakery Products

- 2.2. Beverages

- 2.3. Meat. Poultry, and Seafood

- 2.4. Dairy Products

- 2.5. Confectionery

- 2.6. Sweet and Savory Snacks

Brazil Food Ingredient Industry Segmentation By Geography

- 1. Brazil

Brazil Food Ingredient Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Growing Demand for Natural Food Colorants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Food Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Starch and Sweeteners

- 5.1.2. Flavors and Colorants

- 5.1.3. Acidulants and Emulsifiers

- 5.1.4. Preservatives

- 5.1.5. Enzymes

- 5.1.6. Edible Oils and Fats

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery Products

- 5.2.2. Beverages

- 5.2.3. Meat. Poultry, and Seafood

- 5.2.4. Dairy Products

- 5.2.5. Confectionery

- 5.2.6. Sweet and Savory Snacks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors & Fragrances Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sensient Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Givaudan SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kerry Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Archer Daniels Midland Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bunge Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olam International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Koninklijke DSM NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Associated British Foods PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ingredion Incorporated

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Brazil Food Ingredient Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Food Ingredient Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Food Ingredient Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Food Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Brazil Food Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Brazil Food Ingredient Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Food Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Food Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Brazil Food Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Brazil Food Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Food Ingredient Industry?

The projected CAGR is approximately 1.18%.

2. Which companies are prominent players in the Brazil Food Ingredient Industry?

Key companies in the market include Cargill Incorporated, International Flavors & Fragrances Inc *List Not Exhaustive, Sensient Technologies, Givaudan SA, Kerry Inc, Archer Daniels Midland Company, Bunge Limited, Tate & Lyle PLC, Olam International, Koninklijke DSM NV, Associated British Foods PLC, Ingredion Incorporated.

3. What are the main segments of the Brazil Food Ingredient Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Growing Demand for Natural Food Colorants.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

November 2022: Tate & Lyle Plc launched a new sweetener, Erytesse erythritol. The product has 70% sweetness and can be used in beverages, dairy, bakery, and confectionary industries. Erythritol fits well into Tate's existing portfolio and can be used alone or in combination with natural sweeteners, like stevia and monk fruit, and high-potency sweeteners, like sucralose.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Food Ingredient Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Food Ingredient Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Food Ingredient Industry?

To stay informed about further developments, trends, and reports in the Brazil Food Ingredient Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence