Key Insights

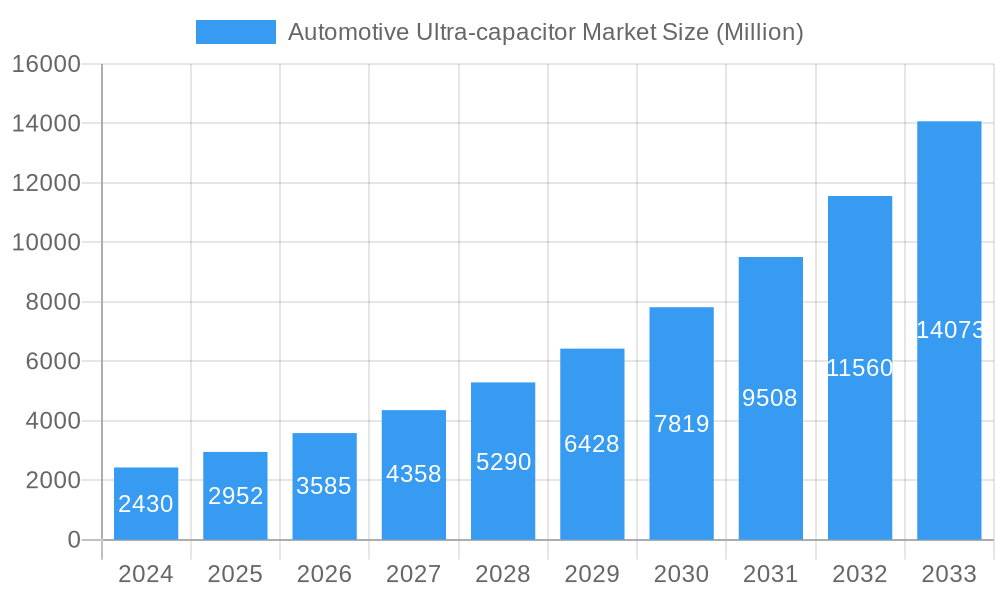

The global automotive ultra-capacitor market is poised for explosive growth, driven by the escalating demand for enhanced vehicle performance, fuel efficiency, and the rapid integration of advanced automotive technologies. With a market size estimated at approximately $2.43 billion in 2024, the industry is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 21.6% through 2033. This aggressive expansion is primarily fueled by the widespread adoption of start-stop systems in modern vehicles, which significantly reduce fuel consumption and emissions during idling periods. Furthermore, the increasing integration of regenerative braking systems, a cornerstone of electric and hybrid vehicle technology, plays a pivotal role in recapturing kinetic energy and improving overall efficiency, further solidifying the demand for high-performance ultra-capacitors. The burgeoning automotive sector, coupled with stringent environmental regulations and a growing consumer preference for sustainable transportation solutions, are collectively propelling this market to new heights.

Automotive Ultra-capacitor Market Market Size (In Billion)

The market's robust growth trajectory is also supported by a dynamic landscape of technological advancements and strategic initiatives from key industry players. Innovations in energy density, power delivery, and cycle life of ultra-capacitors are continuously enhancing their appeal for automotive applications, extending beyond conventional roles. Emerging applications in electric vehicle (EV) powertrains, advanced driver-assistance systems (ADAS), and onboard power management systems are opening new avenues for market penetration. While the market faces challenges related to initial cost and competition from battery technologies in certain segments, the superior power density, rapid charge/discharge capabilities, and extended lifespan of ultra-capacitors make them indispensable for specific automotive functions. The market is segmented across various applications and vehicle types, with passenger cars dominating due to mass-market adoption, and a strong push from commercial vehicles for efficiency gains. The supply chain is characterized by established players focusing on both OEM and aftermarket segments, ensuring broad market reach and accessibility.

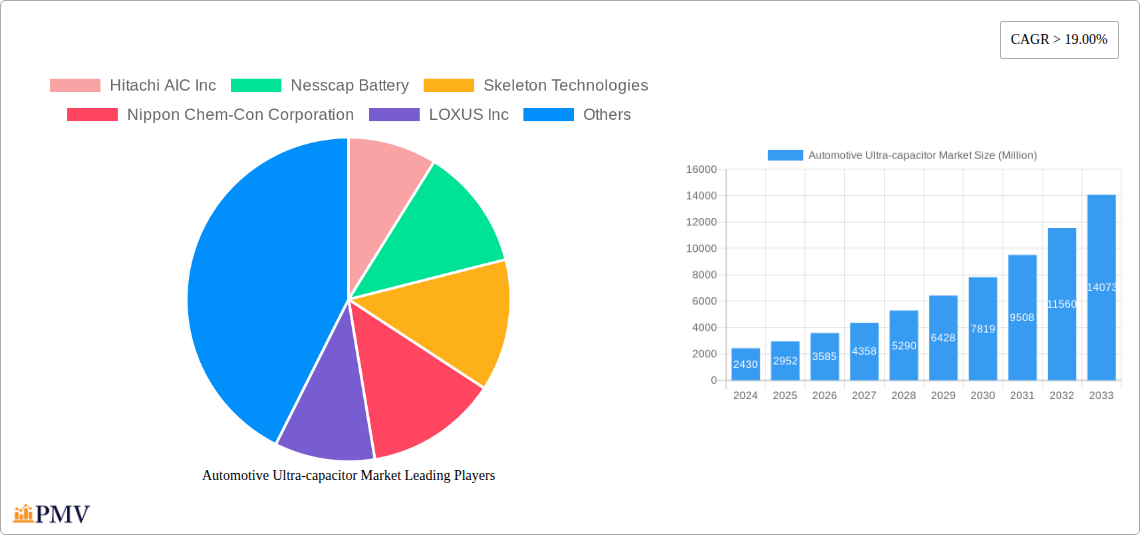

Automotive Ultra-capacitor Market Company Market Share

This in-depth market research report provides a definitive analysis of the global automotive ultra-capacitor market, meticulously examining its current state and projecting its trajectory through 2033. Leveraging historical data from 2019-2024 and establishing 2025 as the base and estimated year, the report forecasts significant growth during the 2025-2033 forecast period. We delve into critical market segments, emerging trends, technological advancements, and the competitive landscape, offering actionable insights for stakeholders seeking to capitalize on the burgeoning demand for advanced energy storage solutions in the automotive sector. This report is crucial for understanding the automotive energy storage market, electric vehicle (EV) components, and capacitor technology in vehicles.

Automotive Ultra-capacitor Market Market Structure & Competitive Dynamics

The automotive ultra-capacitor market exhibits a moderately concentrated structure, with a few key players holding significant market share. Innovation ecosystems are thriving, driven by intense R&D efforts focused on enhancing energy density, power density, and cycle life of automotive ultracapacitors. Regulatory frameworks are increasingly favoring technologies that improve fuel efficiency and reduce emissions, providing a tailwind for supercapacitor adoption in automotive applications. Product substitutes, primarily traditional batteries, face stiff competition from the superior power delivery and rapid charge/discharge capabilities of ultracapacitors, particularly in niche applications like start-stop systems and regenerative braking. End-user trends reveal a growing preference for electrified powertrains and advanced vehicle features, necessitating robust and efficient energy storage. Mergers and acquisitions (M&A) activities are present, albeit moderate, as companies seek to consolidate market position and acquire innovative technologies. For instance, the collaboration between Skeleton Technologies and Martinrea International Inc. signifies strategic partnerships aimed at scaling production and market penetration. While specific M&A deal values are proprietary, the trend indicates a consolidation of expertise and resources. The market share of leading players is estimated to be between 10% and 20%, with the top five accounting for over 50% of the global market.

Automotive Ultra-capacitor Market Industry Trends & Insights

The automotive ultra-capacitor market is experiencing robust growth, fueled by several intertwined trends. A primary market growth driver is the accelerating adoption of hybrid and electric vehicles (HEVs and EVs). Governments worldwide are implementing stringent emission standards and offering incentives for cleaner transportation, directly boosting the demand for advanced automotive energy storage solutions. Technological disruptions are at the forefront, with continuous innovation in supercapacitor materials and manufacturing processes leading to significant improvements in performance metrics. Companies are developing ultracapacitors with higher energy density, approaching the capabilities of batteries, while retaining their characteristic high power density and exceptionally long cycle life. This makes them ideal for applications demanding rapid power bursts and frequent charge-discharge cycles, such as regenerative braking systems and start-stop operation. Consumer preferences are shifting towards vehicles that offer enhanced fuel efficiency, lower running costs, and advanced features, all of which can be supported by ultracapacitor technology. Furthermore, the integration of automotive ultracapacitors with battery systems (hybrid energy storage) is becoming a significant trend, leveraging the strengths of both technologies to optimize performance and longevity. Competitive dynamics are characterized by fierce innovation and strategic alliances. The market penetration of ultracapacitors is steadily increasing, moving beyond niche applications to become integral components in mainstream automotive designs. The projected Compound Annual Growth Rate (CAGR) for the automotive ultra-capacitor market is expected to be in the high single digits, demonstrating significant expansion potential. The increasing focus on vehicle electrification is a key indicator, with projections suggesting that by 2030, a substantial portion of new vehicle sales will incorporate some form of electrified powertrain where automotive supercapacitors play a vital role. The development of advanced materials like graphene and carbon nanotubes is further enhancing the performance capabilities of ultracapacitors, making them a more attractive alternative to traditional power sources. The growing trend of autonomous driving and advanced driver-assistance systems (ADAS) also presents a new avenue for automotive ultracapacitor market growth, as these systems require reliable and rapid power delivery for their complex electronic modules.

Dominant Markets & Segments in Automotive Ultra-capacitor Market

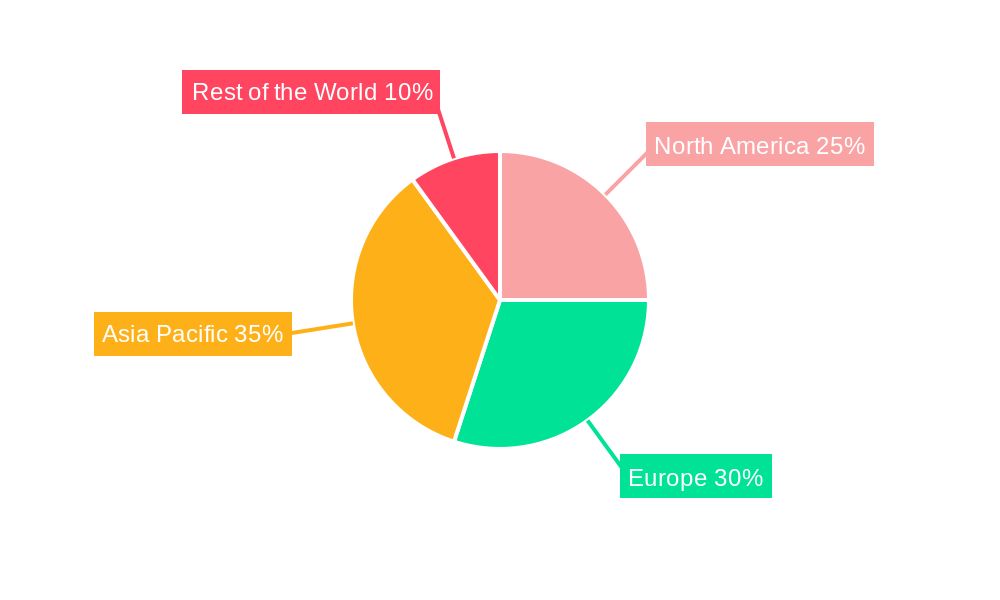

The automotive ultra-capacitor market is dominated by several key regions and segments, driven by a confluence of economic policies, infrastructure development, and technological adoption rates.

Leading Region:

- Asia-Pacific currently holds the dominant position in the automotive ultra-capacitor market. This leadership is attributed to:

- Robust Automotive Manufacturing Hubs: Countries like China, Japan, and South Korea are global centers for automotive production, including a significant proportion of EV and hybrid vehicle manufacturing. This proximity to major end-users drives high demand for automotive supercapacitor components.

- Supportive Government Policies: Favorable government initiatives, subsidies, and stringent emission regulations in the Asia-Pacific region are accelerating the adoption of electrified vehicles, thereby increasing the demand for advanced automotive energy storage solutions.

- Rapid Technological Adoption: The region demonstrates a high propensity for adopting new technologies, especially in the consumer electronics and automotive sectors, which translates to a quicker uptake of ultracapacitor technology in vehicles.

- Growing Middle Class and Disposable Income: Increasing disposable incomes in emerging economies within Asia are fueling the demand for personal vehicles, including newer, technologically advanced models that are more likely to feature ultracapacitors.

Dominant Application Segment:

- Start-stop Operation is a key application driving the automotive ultra-capacitor market.

- Fuel Efficiency Mandates: Increasingly stringent fuel economy standards globally necessitate technologies that reduce fuel consumption. Start-stop systems, enabled by ultracapacitors, significantly cut down fuel wastage during idling.

- Reduced Emissions: By minimizing engine idling, start-stop systems directly contribute to lower tailpipe emissions, aligning with global environmental goals.

- Extended Battery Life: Ultracapacitors can buffer the high current demands of engine restarts, reducing the strain on the conventional 12V battery and extending its lifespan.

- Driver Comfort: Seamless and rapid engine restarts provide a smoother and more comfortable driving experience.

Dominant Vehicle Type Segment:

- Passenger Car segment leads in the automotive ultra-capacitor market.

- High Production Volumes: Passenger cars constitute the largest segment of the global automotive market, offering a vast volume for automotive supercapacitor integration.

- Growing EV and Hybrid Penetration: The shift towards electrified powertrains is more pronounced in the passenger car segment, with numerous models incorporating advanced energy storage solutions.

- Demand for Advanced Features: Consumers are increasingly demanding sophisticated features like enhanced infotainment systems, advanced safety features, and improved performance, all of which can be powered and stabilized by ultracapacitors.

Dominant Sales Channel Segment:

- Original Equipment Manufacturer (OEM) remains the dominant sales channel.

- Direct Integration: OEMs have the strategic advantage of integrating automotive ultracapacitors directly into vehicle designs during the manufacturing process, allowing for optimized system performance and cost-efficiency.

- Large Volume Orders: OEMs place substantial orders, providing consistent demand and driving economies of scale for ultracapacitor manufacturers.

- Design Influence: OEMs' design choices and specifications heavily influence the types and quantities of ultracapacitors used, shaping market trends and product development.

Automotive Ultra-capacitor Market Product Innovations

Recent product innovations in the automotive ultra-capacitor market are focused on enhancing performance and expanding applications. Companies are developing ultracapacitors with significantly improved energy density and power density, making them more competitive with batteries. These advancements are crucial for enabling faster charging capabilities, greater energy recuperation from regenerative braking, and supporting the power demands of advanced automotive electronics. The integration of novel materials like advanced carbon structures and polymer electrolytes is leading to more compact, efficient, and cost-effective automotive supercapacitors. These innovations are directly addressing market needs for lightweight, durable, and high-performing energy storage solutions, particularly for electric vehicle (EV) components and hybrid systems.

Report Segmentation & Scope

This comprehensive report segments the automotive ultra-capacitor market based on critical parameters to provide a granular analysis.

- Application: The market is segmented into Start-stop Operation, Regenerative Braking System, and Other Applications, encompassing auxiliary power, power buffering for electronic systems, and advanced driver-assistance systems (ADAS). Each segment is analyzed for its market size, growth projections, and competitive dynamics.

- Vehicle Type: Segmentation includes Passenger Car and Commercial Vehicle. Analysis focuses on the specific demands and adoption rates of ultracapacitors within each vehicle category, with passenger cars currently representing the larger segment due to higher production volumes and faster electrification trends.

- Sales Channel: The market is divided into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM channel dominates due to direct integration during vehicle manufacturing, while the aftermarket is projected to grow as replacement parts and aftermarket upgrades gain traction.

Key Drivers of Automotive Ultra-capacitor Market Growth

The automotive ultra-capacitor market is propelled by several key drivers. The most significant is the escalating demand for enhanced fuel efficiency and reduced emissions, driven by global regulatory mandates and growing environmental consciousness. The rapid growth of the electric and hybrid vehicle sector is a paramount factor, as ultracapacitors are integral to their power management systems, particularly for regenerative braking and rapid acceleration. Technological advancements leading to higher energy density and power density in ultracapacitors are making them a more viable and attractive alternative to traditional batteries for specific applications. Furthermore, the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies requires robust and rapid power delivery, which ultracapacitors can efficiently provide.

Challenges in the Automotive Ultra-capacitor Market Sector

Despite the promising growth trajectory, the automotive ultra-capacitor market faces certain challenges. A primary barrier is the relatively higher cost per unit of energy storage compared to traditional lead-acid batteries, which can impact its widespread adoption in cost-sensitive vehicle segments. While energy density is improving, it still lags behind batteries, limiting their use as a primary energy source for long-range electric vehicles. Supply chain complexities and the sourcing of raw materials, particularly high-purity carbon materials, can also pose challenges. Intense competition from continually evolving battery technologies, which are also seeing rapid advancements in energy density and cost reduction, presents an ongoing competitive pressure. Overcoming these hurdles through continued innovation in materials science, manufacturing processes, and strategic partnerships will be crucial for unlocking the full potential of the automotive supercapacitor market.

Leading Players in the Automotive Ultra-capacitor Market Market

- Hitachi AIC Inc

- Nesscap Battery

- Skeleton Technologies

- Nippon Chem-Con Corporation

- LOXUS Inc

- LS Mtron Lt

- ELNA America Inc

- Nichicon Corporation

- Yunasko Ltd

- Maxwell Technologies

- Panasonic Corporation

Key Developments in Automotive Ultra-capacitor Market Sector

- July 2023: Samsung Electro-Mechanics introduced a multilayer ceramic capacitor applicable for Advanced Driver Assistance Systems (ADAS) in vehicles. The company developed an ultra-high capacitance 22 µF product of 4 V., indicating advancements in capacitor technology for critical automotive functions.

- May 2023: Skeleton Technologies and Martinrea International Inc. collaborated to target the supply of Skeleton's novel SuperBattery technology. The Effenco Hybrid Electric solution electrifies the onboard equipment utilizing a unique ultracapacitor-based technology to refuse collection vehicles, showcasing innovative applications of ultracapacitors in specialized commercial vehicles.

Strategic Automotive Ultra-capacitor Market Market Outlook

The strategic outlook for the automotive ultra-capacitor market is highly optimistic, driven by the accelerating global transition towards sustainable mobility. Future market potential is anchored in the continuous advancement of ultracapacitor technology, particularly in enhancing energy density to rival batteries for certain applications and improving cost-effectiveness. Strategic opportunities lie in the expanding integration of ultracapacitors within hybrid energy storage systems for EVs and HEVs, optimizing performance and battery longevity. The growing adoption of advanced safety and autonomous driving features in vehicles presents a significant growth accelerator, demanding the reliable and rapid power delivery that ultracapacitors excel at. Furthermore, the development of specialized ultracapacitors for niche applications, such as heavy-duty commercial vehicles and off-road equipment, will open new revenue streams. Collaborations between ultracapacitor manufacturers, automotive OEMs, and battery technology providers will be crucial for synergistic growth and the realization of next-generation automotive energy solutions.

Automotive Ultra-capacitor Market Segmentation

-

1. Application

- 1.1. Start-stop Operation

- 1.2. Regenerative Braking System

- 1.3. Other Applications

-

2. Vehicle Type

- 2.1. Passenger Car

- 2.2. Commercial Vehicle

-

3. Sales Channel

- 3.1. Original Equipment Manufacturer (OEM)

- 3.2. Aftermarket

Automotive Ultra-capacitor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Ultra-capacitor Market Regional Market Share

Geographic Coverage of Automotive Ultra-capacitor Market

Automotive Ultra-capacitor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. High Cost Associated With Product

- 3.4. Market Trends

- 3.4.1. Growing Stringent Emission Regulations and Increase in demand for Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Ultra-capacitor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Start-stop Operation

- 5.1.2. Regenerative Braking System

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Car

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Original Equipment Manufacturer (OEM)

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Ultra-capacitor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Start-stop Operation

- 6.1.2. Regenerative Braking System

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Car

- 6.2.2. Commercial Vehicle

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Original Equipment Manufacturer (OEM)

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Automotive Ultra-capacitor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Start-stop Operation

- 7.1.2. Regenerative Braking System

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Car

- 7.2.2. Commercial Vehicle

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Original Equipment Manufacturer (OEM)

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Automotive Ultra-capacitor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Start-stop Operation

- 8.1.2. Regenerative Braking System

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Car

- 8.2.2. Commercial Vehicle

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Original Equipment Manufacturer (OEM)

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Automotive Ultra-capacitor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Start-stop Operation

- 9.1.2. Regenerative Braking System

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Car

- 9.2.2. Commercial Vehicle

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Original Equipment Manufacturer (OEM)

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hitachi AIC Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nesscap Battery

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Skeleton Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nippon Chem-Con Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LOXUS Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LS Mtron Lt

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ELNA America Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nichicon Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yunasko Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Maxwell Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hitachi AIC Inc

List of Figures

- Figure 1: Global Automotive Ultra-capacitor Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Ultra-capacitor Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Automotive Ultra-capacitor Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Automotive Ultra-capacitor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Ultra-capacitor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Ultra-capacitor Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Ultra-capacitor Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Ultra-capacitor Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Automotive Ultra-capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Ultra-capacitor Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Automotive Ultra-capacitor Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Ultra-capacitor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Ultra-capacitor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Ultra-capacitor Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 15: Europe Automotive Ultra-capacitor Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 16: Europe Automotive Ultra-capacitor Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Automotive Ultra-capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Ultra-capacitor Market Revenue (undefined), by Application 2025 & 2033

- Figure 19: Asia Pacific Automotive Ultra-capacitor Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Automotive Ultra-capacitor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Ultra-capacitor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Ultra-capacitor Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 23: Asia Pacific Automotive Ultra-capacitor Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Asia Pacific Automotive Ultra-capacitor Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Ultra-capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Ultra-capacitor Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Rest of the World Automotive Ultra-capacitor Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Rest of the World Automotive Ultra-capacitor Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive Ultra-capacitor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive Ultra-capacitor Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 31: Rest of the World Automotive Ultra-capacitor Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 32: Rest of the World Automotive Ultra-capacitor Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Ultra-capacitor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 8: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 15: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 24: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: India Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 33: Global Automotive Ultra-capacitor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Ultra-capacitor Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Ultra-capacitor Market?

The projected CAGR is approximately 21.6%.

2. Which companies are prominent players in the Automotive Ultra-capacitor Market?

Key companies in the market include Hitachi AIC Inc, Nesscap Battery, Skeleton Technologies, Nippon Chem-Con Corporation, LOXUS Inc, LS Mtron Lt, ELNA America Inc, Nichicon Corporation, Yunasko Ltd, Maxwell Technologies, Panasonic Corporation.

3. What are the main segments of the Automotive Ultra-capacitor Market?

The market segments include Application, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Growing Stringent Emission Regulations and Increase in demand for Electric Vehicles.

7. Are there any restraints impacting market growth?

High Cost Associated With Product.

8. Can you provide examples of recent developments in the market?

July 2023: Samsung Electro-Mechanics introduced a multilayer ceramic capacitor applicable for Advanced Driver Assistance Systems (ADAS) in vehicles. The company developed an ultra-high capacitance 22 µF product of 4 V.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Ultra-capacitor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Ultra-capacitor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Ultra-capacitor Market?

To stay informed about further developments, trends, and reports in the Automotive Ultra-capacitor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence