Key Insights

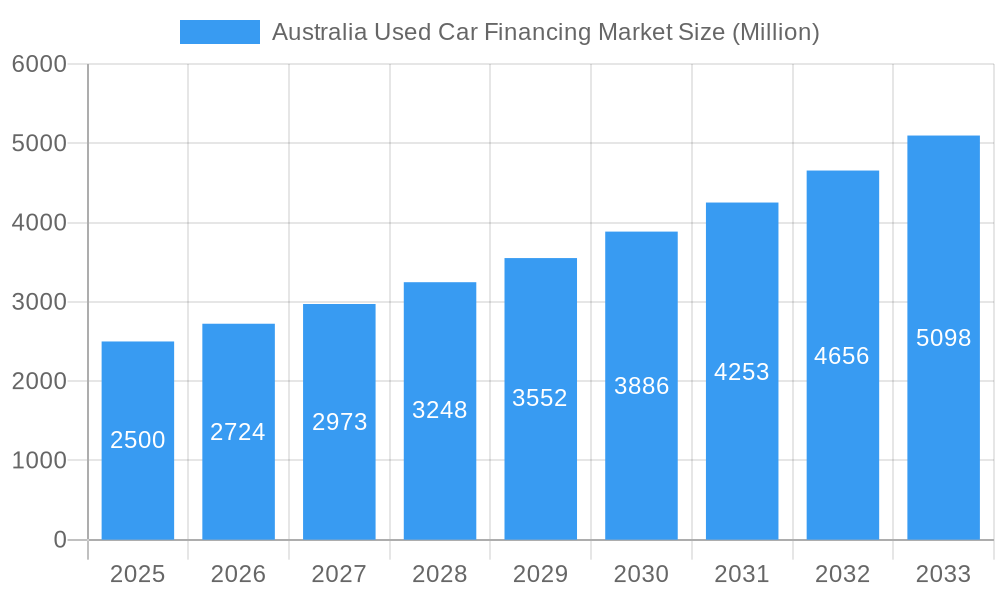

The Australian used car financing market, projected at $8.38 billion in 2025, is set for substantial expansion. Forecasted at a compound annual growth rate (CAGR) of 3.3% from 2025 to 2033, this growth is attributed to several key drivers. The increasing affordability of used vehicles compared to new models significantly boosts demand. Furthermore, the proliferation of online used car platforms and simplified financing processes enhances consumer accessibility. Competitive financing offers from original equipment manufacturers (OEMs), banks, and non-banking financial companies (NBFCs) are attracting a wider borrower base. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs) and financier. Key players include Motoroma, Australia and New Zealand Banking Group, and Pepper Money, alongside numerous other banks, NBFCs, and dealerships.

Australia Used Car Financing Market Market Size (In Billion)

While potential challenges like interest rate volatility and economic uncertainty exist, the sustained demand for used vehicles and continuous innovation in financing solutions underpin a positive market outlook. Growth is expected to be strongest in the SUV segment, driven by consumer preferences. Established financial institutions will likely retain a significant market share, though online lenders and fintech innovations pose increasing competition. The domestic Australian market presents ample opportunities for expansion through strategic marketing and tailored financing. The historical period (2019-2024) likely experienced considerable fluctuations influenced by economic conditions and supply chain disruptions. Future forecasts must incorporate evolving consumer behavior and regulatory changes within the Australian automotive sector.

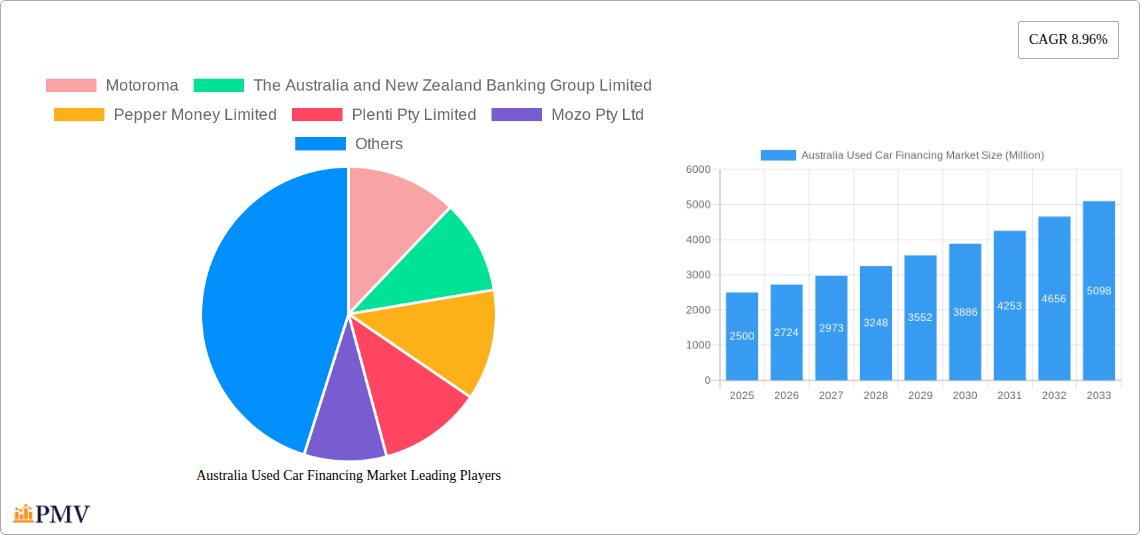

Australia Used Car Financing Market Company Market Share

Australia Used Car Financing Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the Australian used car financing market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, emerging trends, and future growth potential. The analysis incorporates detailed segmentation by car type (Hatchbacks, Sedans, SUVs, MPVs) and financier type (OEMs, Banks, NBFCs), offering a granular understanding of this dynamic market. The report’s findings are supported by robust data, market sizing, and forecasts, ensuring informed strategic planning.

Australia Used Car Financing Market Market Structure & Competitive Dynamics

The Australian used car financing market exhibits a moderately concentrated structure, with several key players vying for market share. The market’s competitive landscape is shaped by factors including innovation in lending technologies, the evolving regulatory framework, the availability of substitute financing options (e.g., peer-to-peer lending), and evolving consumer preferences for diverse financing solutions. Major players are engaged in mergers and acquisitions (M&A) to expand their market presence and product offerings, impacting overall market concentration. For example, in 2023, the M&A deal value reached approximately $xx Million, resulting in a xx% shift in market share for leading players.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Ecosystem: Characterized by fintech innovation in lending platforms and digital processes, driving efficiency and accessibility.

- Regulatory Framework: Subject to Australian Consumer Credit Protection laws and ongoing regulatory scrutiny impacting lending practices and compliance.

- Product Substitutes: Competition from peer-to-peer lending platforms and alternative financing options present a challenge to traditional lenders.

- End-User Trends: Growing preference for online financing solutions and flexible repayment options influence market dynamics.

- M&A Activities: Ongoing consolidation and strategic acquisitions are reshaping the competitive landscape.

Australia Used Car Financing Market Industry Trends & Insights

The Australian used car financing market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing vehicle ownership rates, and favorable government policies promoting auto sales contribute significantly to market expansion. Technological advancements, such as the proliferation of online lending platforms and mobile apps, enhance accessibility and convenience for borrowers. This trend is further fueled by evolving consumer preferences for flexible financing options, personalized loan packages, and seamless digital experiences. Competitive pressure among lenders also pushes for innovative products and services. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

Dominant Markets & Segments in Australia Used Car Financing Market

The Australian used car financing market showcases strong performance across various segments. While data varies on specific market share of various segments, several key trends stand out:

- Leading Region: New South Wales and Victoria are expected to maintain their dominance due to higher population density and economic activity.

- Dominant Car Type: SUVs and MPVs are experiencing high growth due to increased demand for family vehicles and lifestyle choices. This segment is projected to capture xx% of market share by 2033.

- Leading Financier: Banks currently hold the largest share of the market, owing to their established infrastructure, extensive customer base, and brand recognition. However, NBFCs are experiencing rapid growth by offering niche and specialized products catering to specific customer segments.

Key Drivers:

- Economic Policies: Government incentives and supportive financial policies encourage vehicle purchases and financing.

- Infrastructure: Well-developed transportation networks and urban infrastructure support vehicle usage.

- Consumer Confidence: Positive economic outlook and rising consumer confidence boost purchasing decisions.

Australia Used Car Financing Market Product Innovations

The market is witnessing significant product innovations, primarily focused on enhancing convenience and accessibility for borrowers. Online platforms, mobile apps, and digital loan processing systems streamline application and approval processes. Personalized loan offerings based on individual credit profiles and risk assessments have also gained popularity. These developments improve transparency, reduce processing times, and expand access to finance, strengthening market competitiveness.

Report Segmentation & Scope

This report segments the Australian used car financing market based on car type (Hatchbacks, Sedans, Sports Utility Vehicles, Multi-Purpose Vehicles) and financier type (OEMs, Banks, NBFCs). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The forecast period is from 2025 to 2033. The report also assesses the growth of each sub-segment within these categories. For example, the SUV segment is predicted to experience significant growth, driven by consumer preference, while the NBFC segment will likely continue its expansion through innovative product offerings.

Key Drivers of Australia Used Car Financing Market Growth

Several factors fuel the growth of the Australian used car financing market. These include increasing consumer demand for vehicles, supportive government policies, the expansion of digital lending platforms that enhance accessibility, and the competitive landscape that promotes product innovation and affordability. The rising adoption of online channels simplifies the application and approval process, making financing more convenient.

Challenges in the Australia Used Car Financing Market Sector

The sector faces challenges including fluctuating interest rates, stringent lending regulations impacting credit accessibility, the rising cost of vehicles and inflation increasing the risk of loan defaults. Competition among lenders keeps margins under pressure, necessitating efficient operational models.

Leading Players in the Australia Used Car Financing Market Market

- Motoroma

- The Australia and New Zealand Banking Group Limited

- Pepper Money Limited

- Plenti Pty Limited

- Mozo Pty Ltd

- OzCar Pty Ltd

- Wisr Finance Pty Ltd

- Adelaide Vehicle Centre

- LSH Auto Australia

- National Australian Bank

- Heatland Motors

- Quantum Savvy Pty Ltd

- Dutton Group

Key Developments in Australia Used Car Financing Market Sector

- Jan 2023: Pepper Money launched a new digital lending platform.

- Mar 2024: National Australian Bank partnered with a fintech company to offer innovative financing solutions.

- Oct 2024: A significant merger occurred between two smaller NBFCs consolidating market share. (Specific details on mergers and acquisitions are limited at this point)

Strategic Australia Used Car Financing Market Market Outlook

The Australian used car financing market presents significant growth opportunities over the coming years. Sustained economic growth, evolving consumer preferences for online channels, and continued innovation in lending technologies are expected to drive market expansion. Strategic partnerships between traditional financial institutions and fintech companies will likely play a key role in shaping future market dynamics. Focusing on providing customer-centric digital experiences and customized financial solutions is crucial for players seeking success in this competitive landscape.

Australia Used Car Financing Market Segmentation

-

1. Car Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicle

- 1.4. Multi-Purpose Vehicle

-

2. Financier

- 2.1. OEM

- 2.2. Banks

- 2.3. NBFC's

Australia Used Car Financing Market Segmentation By Geography

- 1. Australia

Australia Used Car Financing Market Regional Market Share

Geographic Coverage of Australia Used Car Financing Market

Australia Used Car Financing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OEM Based Financing Gaining Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicle

- 5.1.4. Multi-Purpose Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Financier

- 5.2.1. OEM

- 5.2.2. Banks

- 5.2.3. NBFC's

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Motoroma

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Australia and New Zealand Banking Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pepper Money Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plenti Pty Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mozo Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OzCar Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wisr Finance Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adelaide Vehicle Centre

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LSH Auto Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 National Australian Bank*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Heatland Motors

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Quantum Savvy Pty Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dutton Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Motoroma

List of Figures

- Figure 1: Australia Used Car Financing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Used Car Financing Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 2: Australia Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 3: Australia Used Car Financing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Australia Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 5: Australia Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 6: Australia Used Car Financing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Used Car Financing Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Australia Used Car Financing Market?

Key companies in the market include Motoroma, The Australia and New Zealand Banking Group Limited, Pepper Money Limited, Plenti Pty Limited, Mozo Pty Ltd, OzCar Pty Ltd, Wisr Finance Pty Ltd, Adelaide Vehicle Centre, LSH Auto Australia, National Australian Bank*List Not Exhaustive, Heatland Motors, Quantum Savvy Pty Ltd, Dutton Group.

3. What are the main segments of the Australia Used Car Financing Market?

The market segments include Car Type, Financier.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OEM Based Financing Gaining Momentum.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Used Car Financing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Used Car Financing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Used Car Financing Market?

To stay informed about further developments, trends, and reports in the Australia Used Car Financing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence