Key Insights

The Australia & New Zealand food flavor and enhancer market presents a compelling investment opportunity, driven by robust growth in the food and beverage sector. The market, while smaller than global giants like the US or China, benefits from a high per capita consumption of processed foods and a rising demand for convenient and flavorful food products. The 4.47% CAGR observed globally suggests a similar, if not slightly higher, growth trajectory for Australia & New Zealand due to the region's strong economy and preference for premium food experiences. Key drivers include increasing consumer demand for diverse flavors, particularly in the bakery and confectionery segments, along with the growth of the ready-to-eat and ready-to-drink sectors. The burgeoning health and wellness trends are also influencing the market, with a focus on natural and clean-label ingredients. While a precise market size for Australia & New Zealand isn't explicitly given, leveraging the global CAGR and considering the region's relatively high disposable incomes, a reasonable estimate would place the 2025 market value in the range of $150-200 million USD. This growth is likely further fueled by strong performance across all segments, including flavors (natural and nature-identical), flavor enhancers, and across applications like bakery, dairy, savory products and beverages.

Constraints could include fluctuations in raw material prices, stringent regulations concerning food additives, and potential economic slowdowns. However, the market's resilience is likely to outweigh these challenges given the ingrained consumer preference for flavorful and convenient foods in Australia and New Zealand. Established players like Givaudan, Kerry, and Symrise hold significant market share, but opportunities remain for smaller, niche players specializing in innovative and sustainable flavor solutions catering to the growing demand for clean-label products. The market is poised for continued expansion, with particular opportunities in developing unique flavor profiles tailored to local palates and preferences. Further research into specific product segment growth within the region could provide even greater market insight for potential investors.

Australia & New Zealand Food Flavor and Enhancer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia & New Zealand food flavor and enhancer market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, segmentation, competitive landscape, growth drivers, challenges, and future outlook. The report utilizes rigorous research methodologies and data analysis to provide accurate and actionable intelligence.

Australia & New Zealand Food Flavor and Enhancer Market Market Structure & Competitive Dynamics

The Australia & New Zealand food flavor and enhancer market presents a moderately consolidated structure, dominated by key players such as Givaudan, Kerry Inc., Takasago International Corporation, Symrise AG, Sensient Technologies Corporation, Ajinomoto Co. Inc., International Fragrance and Flavors Inc., and Firmenich International SA. These companies collectively hold a substantial market share, estimated at approximately [Insert Updated Percentage]% in 2025. However, the landscape is far from static, with a dynamic interplay of smaller, specialized players contributing to a vibrant competitive environment.

Innovation serves as a critical competitive differentiator, driving significant investment in R&D to create novel flavors and enhancers that align with evolving consumer preferences. The regulatory environment, reflecting stringent international food safety standards, plays a pivotal role in shaping product formulation and labeling practices. The market also witnesses the increasing adoption of substitutes, notably natural extracts and spice blends, although their penetration rates vary against established flavor and enhancer products. End-user trends, characterized by the growing demand for clean-label products and functional foods, are fundamentally reshaping market dynamics. Mergers and acquisitions (M&A) activity within the sector has shown moderate levels in the past five years (2019-2024), with a total deal value of approximately [Insert Updated Amount] Million. These transactions largely involve strategic acquisitions of smaller companies possessing specialized expertise or a strong regional presence.

- Market Concentration: Moderately Consolidated

- Innovation Ecosystem: Robust R&D Investment

- Regulatory Framework: Adherence to Stringent Food Safety Standards

- Product Substitutes: Growing Popularity of Natural Extracts and Spice Blends

- End-User Trends: Strong Demand for Clean Label and Functional Foods

- M&A Activity: Moderate Activity, totaling approximately [Insert Updated Amount] Million (2019-2024)

Australia & New Zealand Food Flavor and Enhancer Market Industry Trends & Insights

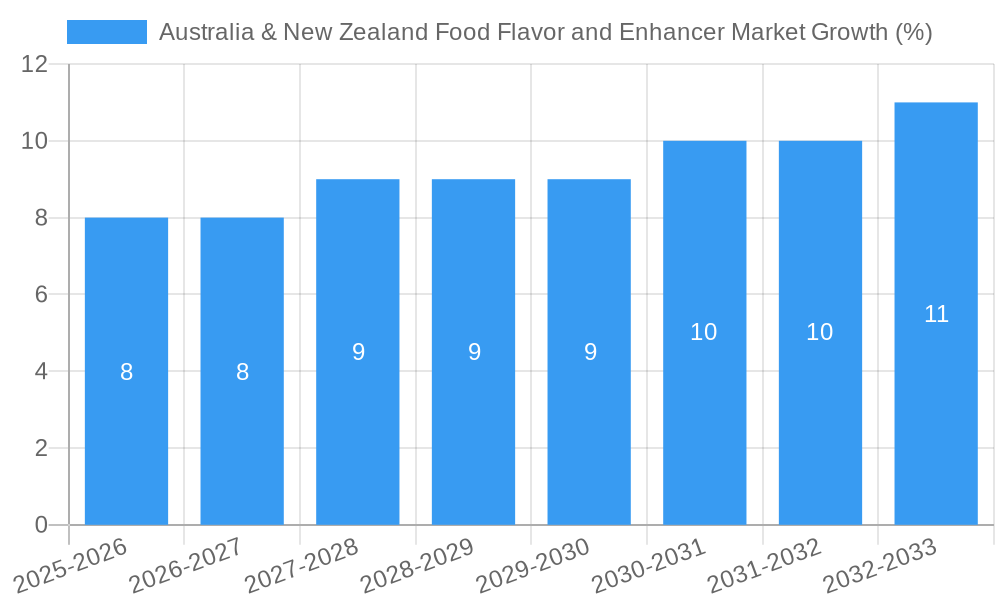

The Australia & New Zealand food flavor and enhancer market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The rising demand for processed and convenience foods is a major driver, as these products heavily rely on flavors and enhancers to enhance taste and appeal. Furthermore, the increasing popularity of diverse cuisines and global culinary trends is stimulating demand for a wider range of flavor profiles. Technological advancements in flavor creation, extraction, and delivery systems are further contributing to market expansion. Consumer preferences are shifting towards natural and clean-label products, creating opportunities for companies offering sustainably sourced and naturally derived flavor solutions. Finally, intense competition is driving innovation and pushing companies to develop superior flavor profiles and value-added services. Market penetration for clean label products, for example, is projected to reach xx% by 2033.

Dominant Markets & Segments in Australia & New Zealand Food Flavor and Enhancer Market

The Bakery and Confectionery segment holds a dominant position within the Australia & New Zealand food flavor and enhancer market, driven by the high consumption of these food categories. The beverages segment is also a significant contributor, with a substantial demand for flavored beverages.

- Leading Segment (By Application): Bakery and Confectionery

- Key Drivers (Bakery & Confectionery): High consumption rates, innovation in product development, demand for premium flavors.

- Leading Segment (By Product Type): Flavors

- Key Drivers (Flavors): Versatility, widespread applications across food categories.

The dominance of these segments is attributed to several factors:

- High Consumption Rates: Strong consumer demand for bakery, confectionery, and beverages in Australia and New Zealand.

- Innovation in Product Development: Continuous development of new flavor profiles and product formats.

- Demand for Premium Flavors: Growing preference for unique and high-quality flavor experiences.

- Robust Food Processing Industry: Well-established food processing sector in both countries.

Australia & New Zealand Food Flavor and Enhancer Market Product Innovations

Recent product development efforts strongly emphasize natural and clean-label flavors, focusing on mimicking natural taste profiles without resorting to artificial ingredients. A parallel trend involves increasing investment in sustainable sourcing and ethical production practices, enhancing consumer appeal and bolstering brand differentiation. Technological advancements are enabling the creation of sophisticated and nuanced flavor profiles tailored to meet the changing demands and evolving preferences of consumers. These innovations provide a distinct competitive advantage through superior flavor intensity, cost reductions, and enhanced sensory experiences for the end consumer.

Report Segmentation & Scope

This comprehensive report segments the Australia & New Zealand food flavor and enhancer market across two key dimensions: Application (Bakery and Confectionery, Dairy, Savory, Soups, Pastas and Noodles, Beverages, Others) and Product Type (flavors, nature-identical flavors, flavor enhancers). Each segment undergoes detailed analysis to assess its market size, growth trajectory, and competitive landscape. The report provides granular market size information for each segment and sub-segment, accompanied by in-depth competitive analyses that highlight leading players and their respective market strategies.

Key Drivers of Australia & New Zealand Food Flavor and Enhancer Market Growth

The growth of the Australia & New Zealand food flavor and enhancer market is propelled by several key factors: rising disposable incomes leading to increased spending on food and beverages; the expanding food processing industry demanding diverse flavor options; increased preference for convenience and processed foods; and government regulations promoting food safety and quality.

Challenges in the Australia & New Zealand Food Flavor and Enhancer Market Sector

The market faces challenges such as stringent regulatory requirements for food additives and flavorings, increasing input costs for raw materials, and intense competition from both domestic and international players. Furthermore, consumer preference for natural and clean label products can impact the market share of some flavor and enhancer types. These challenges impose constraints on market expansion, requiring companies to adopt flexible strategies to overcome them.

Leading Players in the Australia & New Zealand Food Flavor and Enhancer Market Market

- Givaudan

- Kerry Inc

- Takasago International Corporation

- Symrise AG

- Sensient Technologies Corporation

- Ajinomoto Co Inc

- International Fragrance and Flavors Inc

- Firmenich International SA

Key Developments in Australia & New Zealand Food Flavor and Enhancer Market Sector

- 2022 Q4: Givaudan launched a new range of natural flavors for the bakery segment.

- 2023 Q1: Kerry Inc acquired a smaller flavor company specializing in natural extracts.

- 2023 Q3: Symrise introduced a novel flavor enhancer targeting the dairy industry.

- (Further Developments to be added as available)

Strategic Australia & New Zealand Food Flavor and Enhancer Market Market Outlook

The Australia & New Zealand food flavor and enhancer market is poised for continued growth, driven by sustained demand for processed foods, increasing consumer preference for unique flavors, and ongoing innovation in flavor technology. Companies that focus on natural, sustainable, and clean-label solutions are likely to experience strong growth. Strategic partnerships, acquisitions, and technological advancements will be key to maintaining a competitive edge in this dynamic market.

Australia & New Zealand Food Flavor and Enhancer Market Segmentation

-

1. Product Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Synthetic Flavors

- 1.1.3. Nature identical Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Dairy

- 2.3. Savory

- 2.4. Soups, Pastas and Noodles

- 2.5. Beverages

- 2.6. Others

-

3. Product Type

-

3.1. Flavors

- 3.1.1. Natural Flavors

- 3.1.2. Synthetic Flavors

- 3.1.3. Nature identical Flavors

- 3.2. Flavor Enhancers

-

3.1. Flavors

-

4. Application

- 4.1. Bakery and Confectionery

- 4.2. Dairy

- 4.3. Savory

- 4.4. Soups, Pastas and Noodles

- 4.5. Beverages

- 4.6. Others

Australia & New Zealand Food Flavor and Enhancer Market Segmentation By Geography

- 1. Australia

Australia & New Zealand Food Flavor and Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Escalating Demand for Plant Derived Food Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Synthetic Flavors

- 5.1.1.3. Nature identical Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy

- 5.2.3. Savory

- 5.2.4. Soups, Pastas and Noodles

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Flavors

- 5.3.1.1. Natural Flavors

- 5.3.1.2. Synthetic Flavors

- 5.3.1.3. Nature identical Flavors

- 5.3.2. Flavor Enhancers

- 5.3.1. Flavors

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Bakery and Confectionery

- 5.4.2. Dairy

- 5.4.3. Savory

- 5.4.4. Soups, Pastas and Noodles

- 5.4.5. Beverages

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 8. India Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Australia & New Zealand Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Givaudan

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kerry Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Takasago International Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Symrise AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sensient Technologies Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ajinomoto Co Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 International Fragrance and Flavors Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Firmenich International SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Givaudan

List of Figures

- Figure 1: Australia & New Zealand Food Flavor and Enhancer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia & New Zealand Food Flavor and Enhancer Market Share (%) by Company 2024

List of Tables

- Table 1: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Australia & New Zealand Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Australia & New Zealand Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia & New Zealand Food Flavor and Enhancer Market?

The projected CAGR is approximately 4.47%.

2. Which companies are prominent players in the Australia & New Zealand Food Flavor and Enhancer Market?

Key companies in the market include Givaudan, Kerry Inc, Takasago International Corporation, Symrise AG, Sensient Technologies Corporation, Ajinomoto Co Inc *List Not Exhaustive, International Fragrance and Flavors Inc, Firmenich International SA.

3. What are the main segments of the Australia & New Zealand Food Flavor and Enhancer Market?

The market segments include Product Type, Application, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Escalating Demand for Plant Derived Food Ingredients.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia & New Zealand Food Flavor and Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia & New Zealand Food Flavor and Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia & New Zealand Food Flavor and Enhancer Market?

To stay informed about further developments, trends, and reports in the Australia & New Zealand Food Flavor and Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence