Key Insights

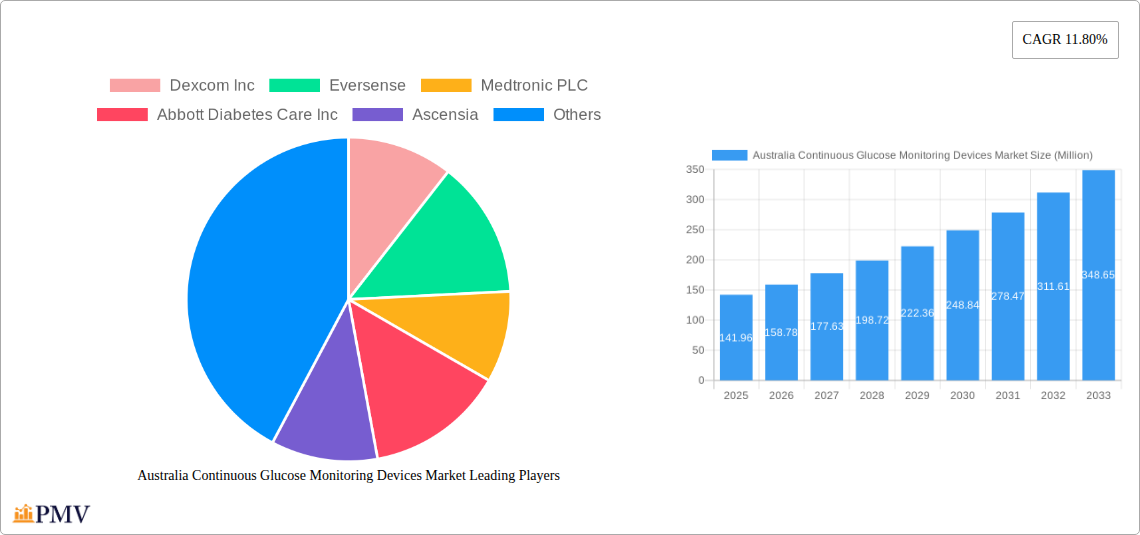

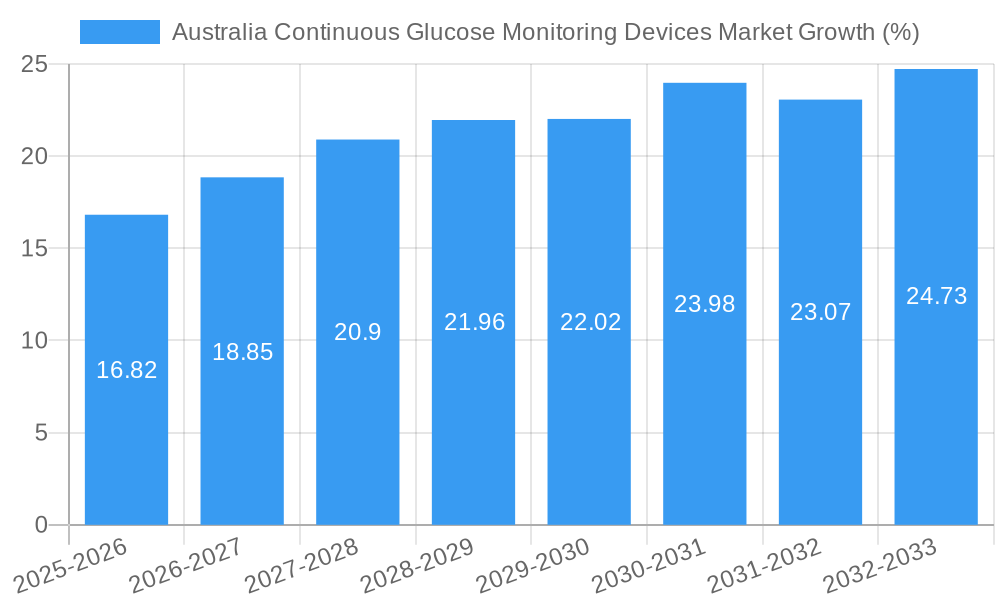

The Australian Continuous Glucose Monitoring (CGM) Devices market is experiencing robust growth, projected to reach a market size of $141.96 million in 2025, with a Compound Annual Growth Rate (CAGR) of 11.80% from 2025 to 2033. This significant expansion is driven by several key factors. Rising prevalence of diabetes, particularly type 1 and type 2, fuels demand for advanced glucose management solutions. The increasing adoption of minimally invasive CGM devices offering improved accuracy and convenience compared to traditional methods is another major contributor. Furthermore, government initiatives promoting diabetes management and technological advancements leading to smaller, more user-friendly devices are propelling market growth. The market is segmented by components (sensors, durables like receivers and transmitters), and geographically across key Australian provinces including New South Wales, Victoria, Queensland, South Australia, and Western Australia. Key players like Dexcom Inc, Eversense, Medtronic PLC, Abbott Diabetes Care Inc, and Ascensia are driving innovation and competition within the market, leading to improved product offerings and increased accessibility.

The market's future trajectory is expected to remain positive. Continued technological innovation, such as the development of integrated CGM systems with insulin pumps and improved data analytics capabilities, will likely enhance market appeal. Growing awareness about the benefits of early disease management and the rising geriatric population are additional factors contributing to the market's long-term growth. However, challenges such as high device costs, limited reimbursement coverage in certain regions, and potential sensor inaccuracies could somewhat temper growth. Nevertheless, the overall outlook for the Australian CGM devices market remains strong, reflecting a positive trend towards proactive diabetes management and technological advancements in healthcare. The robust growth projections indicate significant opportunities for manufacturers and stakeholders in the coming years.

Australia Continuous Glucose Monitoring (CGM) Devices Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australia Continuous Glucose Monitoring (CGM) Devices market, covering the period 2019-2033. It offers in-depth insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth prospects. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Key players like Dexcom Inc, Eversense, Medtronic PLC, Abbott Diabetes Care Inc, and Ascensia are analyzed, providing a complete picture of this dynamic market. The report is invaluable for businesses, investors, and stakeholders seeking to understand and capitalize on opportunities within the Australian CGM devices market.

Australia Continuous Glucose Monitoring Devices Market Market Structure & Competitive Dynamics

The Australian CGM devices market exhibits a moderately concentrated structure, with a few key players holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by technological advancements in sensor technology, data analytics, and integration with insulin delivery systems. Regulatory frameworks, primarily overseen by the Therapeutic Goods Administration (TGA), play a crucial role in market access and product approvals. While there are few direct substitutes for CGM devices, alternative blood glucose monitoring methods exist, posing some level of competitive pressure. End-user trends show a growing preference for accurate, user-friendly, and integrated CGM systems. Mergers and acquisitions (M&A) activity has been moderate, with deal values varying depending on the size and strategic fit of the acquired company. For instance, [Insert predicted M&A deal value, e.g., xx Million] was recorded in a recent transaction. Market share data reveals that [Insert predicted market share data, e.g., Dexcom holds approximately 30%, Medtronic 25%, and Abbott 20% of the market].

Australia Continuous Glucose Monitoring Devices Market Industry Trends & Insights

The Australian CGM devices market is experiencing robust growth, driven by several factors. Increasing prevalence of diabetes, particularly type 1 and type 2 diabetes, forms a major impetus for market expansion. Technological advancements, such as the development of more accurate, smaller, and easier-to-use sensors, are significantly impacting market penetration. Consumer preferences are shifting towards integrated systems that provide seamless data integration with smartphones and other health applications. Furthermore, favorable government policies, including initiatives to improve diabetes management and increased reimbursement coverage, are positively influencing market growth. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of [Insert predicted CAGR value, e.g., xx%] during the forecast period (2025-2033). The market penetration rate for CGM devices in Australia is expected to reach [Insert predicted market penetration, e.g., xx%] by 2033, driven by increased awareness and accessibility. Competitive dynamics are characterized by intense rivalry among major players, focusing on innovation, product differentiation, and strategic partnerships.

Dominant Markets & Segments in Australia Continuous Glucose Monitoring Devices Market

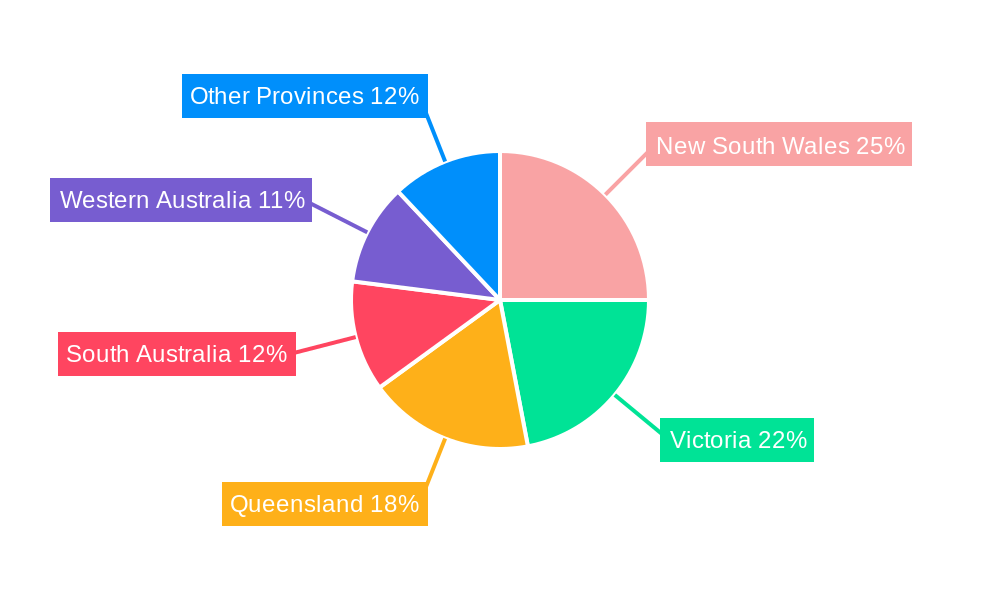

Leading Region/Province: New South Wales (NSW) and Victoria are currently the dominant markets for CGM devices in Australia, driven by higher diabetes prevalence, better healthcare infrastructure, and higher disposable income compared to other provinces.

Dominant Component Segment: Sensors represent the largest segment within the CGM devices market, owing to the consumable nature of sensors and the continuous need for replacement. Durables (receivers and transmitters) constitute a smaller but essential part of the market.

Key Drivers for Dominant Regions:

- NSW and Victoria: High population density, advanced healthcare infrastructure, strong presence of key players, and increased government initiatives supporting diabetes management contribute to their dominance.

- Queensland, South Australia, Western Australia: These regions are witnessing increasing growth, though at a slower pace compared to NSW and Victoria, driven by growing awareness and expanding healthcare facilities.

The detailed quantitative analysis presented in the full report provides specific market size estimations for each province (New South Wales, Victoria, Queensland, South Australia, Western Australia, and Other Provinces) for the forecast period.

Australia Continuous Glucose Monitoring Devices Market Product Innovations

The Australian CGM market is witnessing significant product innovations, characterized by the development of smaller, more accurate, and user-friendly sensors with improved wearability and longer lifespan. Integration with mobile applications and cloud-based data platforms enhances data accessibility and enables remote patient monitoring. These advancements are enhancing the overall patient experience and driving market growth. Competitive advantages are largely determined by sensor accuracy, ease of use, data analytics capabilities, and the extent of integration with other diabetes management technologies.

Report Segmentation & Scope

The report segments the Australian CGM devices market by component (Sensors and Durables – Receivers and Transmitters) and by provinces (New South Wales, Victoria, Queensland, South Australia, Western Australia, and Other Provinces). Each segment's growth projections, market size estimations, and competitive dynamics are thoroughly analyzed. The report offers a detailed breakdown of market size and growth forecasts for each segment throughout the study period (2019-2033). Competitive landscapes within each segment are also assessed, identifying key players and their respective market positions.

Key Drivers of Australia Continuous Glucose Monitoring Devices Market Growth

Several factors drive the growth of the Australian CGM devices market. Firstly, the rising prevalence of diabetes is a major driver, demanding more effective monitoring solutions. Secondly, technological advancements in sensor technology and data analytics continue to improve accuracy and convenience. Thirdly, government initiatives focusing on improved diabetes management and increased healthcare expenditure contribute significantly to market expansion. Finally, improved reimbursement policies and greater insurance coverage are making CGM devices more accessible to patients.

Challenges in the Australia Continuous Glucose Monitoring Devices Market Sector

The Australian CGM devices market faces challenges such as high device costs, potentially limiting access for some patients. Supply chain disruptions can affect product availability and pricing. Furthermore, intense competition among existing and emerging players creates pressure on pricing and margins. Finally, stringent regulatory requirements for product approvals and reimbursements pose some barriers to market entry for new players. The total impact of these challenges is estimated to [Insert predicted impact, e.g., negatively affect market growth by approximately xx%].

Leading Players in the Australia Continuous Glucose Monitoring Devices Market Market

- Dexcom Inc

- Eversense

- Medtronic PLC

- Abbott Diabetes Care Inc

- Ascensia

Key Developments in Australia Continuous Glucose Monitoring Devices Market Sector

July 2023: Dexcom Inc. and its Australian subsidiary, Australasian Medical and Scientific Ltd (AMSL Diabetes), secured Department of Veterans Affairs (DVA) approval for fully funded CGM and insulin pump systems, significantly increasing access for eligible veterans. This development is projected to boost market demand significantly in the coming years.

July 2022: The National Diabetes Services Scheme (NDSS) provided subsidized access to FreeStyle Libre 2 for all Australians with type 1 diabetes, drastically increasing market penetration and driving overall market growth.

Strategic Australia Continuous Glucose Monitoring Devices Market Market Outlook

The Australian CGM devices market presents significant growth potential. Continued technological advancements, increasing diabetes prevalence, and supportive government policies will propel market expansion. Strategic opportunities exist for companies focusing on innovative product development, improved data analytics, and seamless integration with other diabetes management solutions. Furthermore, expanding access to CGM devices through improved reimbursement and affordability initiatives will be crucial for market growth.

Australia Continuous Glucose Monitoring Devices Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables (Receivers and Transmitters)

-

2. Provinces (Quantative Analysis)

- 2.1. New South Wales

- 2.2. Victoria

- 2.3. Queensland

- 2.4. South Australia

- 2.5. Western Australia

- 2.6. Other Provinces

Australia Continuous Glucose Monitoring Devices Market Segmentation By Geography

- 1. Australia

Australia Continuous Glucose Monitoring Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables (Receivers and Transmitters)

- 5.2. Market Analysis, Insights and Forecast - by Provinces (Quantative Analysis)

- 5.2.1. New South Wales

- 5.2.2. Victoria

- 5.2.3. Queensland

- 5.2.4. South Australia

- 5.2.5. Western Australia

- 5.2.6. Other Provinces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dexcom Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eversense

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medtronic PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Diabetes Care Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Dexcom Inc

List of Figures

- Figure 1: Australia Continuous Glucose Monitoring Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Continuous Glucose Monitoring Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantative Analysis) 2019 & 2032

- Table 6: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Provinces (Quantative Analysis) 2019 & 2032

- Table 7: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 13: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantative Analysis) 2019 & 2032

- Table 14: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Provinces (Quantative Analysis) 2019 & 2032

- Table 15: Australia Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Continuous Glucose Monitoring Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Continuous Glucose Monitoring Devices Market?

The projected CAGR is approximately 11.80%.

2. Which companies are prominent players in the Australia Continuous Glucose Monitoring Devices Market?

Key companies in the market include Dexcom Inc, Eversense, Medtronic PLC, Abbott Diabetes Care Inc, Ascensia.

3. What are the main segments of the Australia Continuous Glucose Monitoring Devices Market?

The market segments include Component, Provinces (Quantative Analysis).

4. Can you provide details about the market size?

The market size is estimated to be USD 141.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

July 2023: Dexcom Inc. and its Australian subsidiary, Australasian Medical and Scientific Ltd (AMSL Diabetes), have announced that AMSL Diabetes has been approved by the Department of Veterans Affairs (DVA) to provide fully funded diabetes products, including Dexcom Continuous Glucose Monitoring and Tandem t: slim X2 Insulin Pump systems, to eligible DVA clients. This approval falls under the contract for mobility and functional support (MFS) and home modification products and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Continuous Glucose Monitoring Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Continuous Glucose Monitoring Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Continuous Glucose Monitoring Devices Market?

To stay informed about further developments, trends, and reports in the Australia Continuous Glucose Monitoring Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence