Key Insights

The Asia-Pacific real estate brokerage market is a dynamic sector exhibiting robust growth. With a 2025 market size of $368.41 million and a Compound Annual Growth Rate (CAGR) of 4.21%, the market is projected to reach significant value by 2033. This expansion is fueled by several key drivers, including increasing urbanization across the region, rising disposable incomes leading to greater investment in property, and a surge in foreign direct investment in real estate development projects. The market is witnessing a shift towards technology adoption, with online platforms and proptech solutions gaining traction, enhancing efficiency and transparency in transactions. Government initiatives promoting infrastructure development and affordable housing further contribute to market growth. However, economic volatility and regulatory changes pose potential restraints.

Asia-Pacific Real Estate Brokerage Market Market Size (In Million)

The market is segmented by property type (residential, commercial, industrial), service type (sales brokerage, leasing brokerage, property management), and geographical location (e.g., China, India, Australia, Japan). Major players such as CBRE Group, JLL, Colliers International, Knight Frank, Savills, Cushman & Wakefield, and several regional and national firms dominate the market landscape. Competition is intense, characterized by mergers and acquisitions, strategic alliances, and a constant pursuit of innovation to enhance market share. The forecast period (2025-2033) anticipates continued expansion, driven by sustained economic growth in several key markets across the Asia-Pacific region and a growing preference for professional brokerage services. Further segmentation analysis would reveal specific growth opportunities within the different property types and services, highlighting regions with the most significant growth potential.

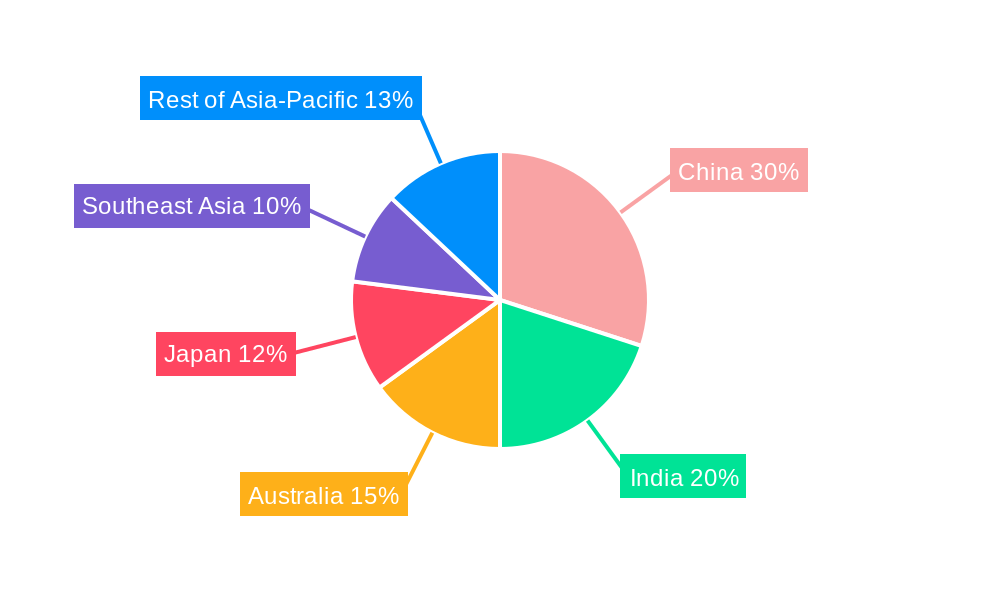

Asia-Pacific Real Estate Brokerage Market Company Market Share

Asia-Pacific Real Estate Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific real estate brokerage market, offering valuable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects across various segments.

Asia-Pacific Real Estate Brokerage Market Structure & Competitive Dynamics

The Asia-Pacific real estate brokerage market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Key players such as CBRE Group, JLL, Colliers International, Knight Frank, Savills, and Cushman & Wakefield, along with regional and national firms like Century 21 Real Estate, ERA Real Estate, RE/MAX, and Coldwell Banker, and 63 other companies, compete intensely. The market is characterized by a dynamic interplay of innovation ecosystems, evolving regulatory frameworks, and the emergence of proptech solutions acting as product substitutes. Mergers and acquisitions (M&A) are frequent, shaping the competitive landscape. For example, the recent acquisition of McGrath Limited by Knight Frank significantly altered the Australian residential market. While precise market share figures for individual companies vary across countries and segments, the top five firms likely control upwards of xx% of the overall market. Recent M&A deal values have ranged from tens to hundreds of Millions, reflecting the considerable investment in market consolidation.

- Market Concentration: Moderately concentrated, with top players controlling xx% of market share.

- Innovation Ecosystems: Rapid development of proptech solutions influencing brokerage services.

- Regulatory Frameworks: Varying regulations across countries impact market access and operations.

- Product Substitutes: Proptech platforms and online property portals offer alternative channels.

- End-User Trends: Increasing demand for digital services and personalized experiences.

- M&A Activities: Significant M&A activity driven by consolidation and expansion strategies.

Asia-Pacific Real Estate Brokerage Market Industry Trends & Insights

The Asia-Pacific real estate brokerage market is experiencing robust growth, driven by factors such as rapid urbanization, rising disposable incomes, and increasing foreign investment. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, significantly influenced by technological advancements and evolving consumer preferences. Technological disruptions, particularly the proliferation of online platforms and mobile applications, are transforming how brokerage services are delivered. The market penetration of digital tools is increasing steadily, and a growing number of consumers utilize online platforms for property searches and transactions. However, the market also faces challenges like fluctuating economic conditions and intense competition. The market penetration of digital platforms is projected to reach xx% by 2033. Consumer preferences increasingly favour personalized services, transparency, and efficient transactions. Competitive dynamics are characterized by strategic alliances, technological innovations, and expansion into new markets.

Dominant Markets & Segments in Asia-Pacific Real Estate Brokerage Market

While the entire Asia-Pacific region shows strong growth, specific markets demonstrate exceptional dominance. China, with its massive population and rapid economic development, remains a key driver of market growth, followed by other fast-growing economies like India, Australia and Singapore. The residential segment accounts for the largest share of the market, due to high demand for housing. The commercial segment, encompassing office and retail properties, also showcases considerable growth, reflecting ongoing expansion of business activities.

Key Drivers in Leading Markets:

- China: Rapid urbanization, robust economic growth, and government initiatives supporting real estate development.

- India: Booming population, rising middle class, and increasing investment in infrastructure.

- Australia: Strong economy, immigration, and favorable investment environment.

- Singapore: High demand for luxury and commercial properties, and strong foreign investment.

Dominance Analysis: The dominance of these markets is fuelled by a combination of economic policies, robust infrastructure development, a favorable regulatory environment, and a large and increasingly affluent population.

Asia-Pacific Real Estate Brokerage Market Product Innovations

The Asia-Pacific real estate brokerage market is witnessing significant product innovation. This includes the adoption of virtual tours, 3D modeling, advanced data analytics for property valuation and market forecasting, and AI-powered chatbots for customer support. These technological advancements enhance efficiency, improve customer experience, and create a competitive advantage. The market is rapidly adopting these innovations to meet evolving consumer demands.

Report Segmentation & Scope

This report segments the Asia-Pacific real estate brokerage market by several key factors:

- By Property Type: Residential, Commercial (Office, Retail, Industrial), and others

- Growth projections vary across segments, with residential currently holding the largest market share.

- By Service Type: Sales, Leasing, Property Management, and others

- Sales brokerage currently dominates, though leasing is seeing substantial growth.

- By Country: China, India, Australia, Singapore, Japan, South Korea, and others

- Market size and growth projections vary considerably by country, reflecting economic conditions and regulatory environments.

- By Company Size: Large, Medium, and Small

- Competitive dynamics differ significantly across company size categories.

Key Drivers of Asia-Pacific Real Estate Brokerage Market Growth

Several factors fuel the growth of the Asia-Pacific real estate brokerage market. These include rapid urbanization and population growth, creating high demand for housing and commercial spaces. Economic development and rising disposable incomes increase purchasing power. Furthermore, government policies supporting real estate development and infrastructure investments contribute significantly to the sector's expansion. Technological advancements, enabling greater efficiency and accessibility, are also key drivers.

Challenges in the Asia-Pacific Real Estate Brokerage Market Sector

The Asia-Pacific real estate brokerage market faces challenges, including regulatory hurdles varying across countries. Economic fluctuations can impact demand and investment. Intense competition from both established players and emerging proptech firms presents a continuous challenge, requiring constant innovation and adaptation. Supply chain disruptions in construction materials can also affect property development and market activity.

Leading Players in the Asia-Pacific Real Estate Brokerage Market Market

Key Developments in Asia-Pacific Real Estate Brokerage Market Sector

- June 2024: Knight Frank and Bayleys acquired a controlling stake in McGrath Limited, reshaping the Australian residential market.

- June 2024: REA Group completed its acquisition of Realtair, strengthening its agency services and digital offerings.

Strategic Asia-Pacific Real Estate Brokerage Market Outlook

The Asia-Pacific real estate brokerage market exhibits strong growth potential, driven by sustained economic development, urbanization, and technological innovation. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, embrace technological advancements, and navigate the increasingly competitive landscape. Expansion into new markets, strategic alliances, and the development of innovative services will be critical for success.

Asia-Pacific Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Southeast Asia

- 3.7. Rest of Asia-Pacific

Asia-Pacific Real Estate Brokerage Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. South Korea

- 6. Southeast Asia

- 7. Rest of Asia Pacific

Asia-Pacific Real Estate Brokerage Market Regional Market Share

Geographic Coverage of Asia-Pacific Real Estate Brokerage Market

Asia-Pacific Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.4. Market Trends

- 3.4.1. Demand for Residential Segment Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Southeast Asia

- 5.3.7. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Southeast Asia

- 5.4.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Residential

- 6.1.2. Non-Residential

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Sales

- 6.2.2. Rental

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Southeast Asia

- 6.3.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Residential

- 7.1.2. Non-Residential

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Sales

- 7.2.2. Rental

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Southeast Asia

- 7.3.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Residential

- 8.1.2. Non-Residential

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Sales

- 8.2.2. Rental

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Southeast Asia

- 8.3.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Residential

- 9.1.2. Non-Residential

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Sales

- 9.2.2. Rental

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Southeast Asia

- 9.3.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Residential

- 10.1.2. Non-Residential

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Sales

- 10.2.2. Rental

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Southeast Asia

- 10.3.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Southeast Asia Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Residential

- 11.1.2. Non-Residential

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Sales

- 11.2.2. Rental

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Southeast Asia

- 11.3.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Asia Pacific Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Residential

- 12.1.2. Non-Residential

- 12.2. Market Analysis, Insights and Forecast - by Service

- 12.2.1. Sales

- 12.2.2. Rental

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. Australia

- 12.3.5. South Korea

- 12.3.6. Southeast Asia

- 12.3.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 CBRE Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 JLL

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Colliers International

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Knight Frank

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Savills

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cushman & Wakefield

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Century 21 Real Estate

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ERA Real Estate

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 RE/MAX

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Coldwell Banker**List Not Exhaustive 6 3 Other Companie

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 CBRE Group

List of Figures

- Figure 1: Asia-Pacific Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 21: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 37: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 44: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 45: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 51: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 52: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 53: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 57: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 59: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Real Estate Brokerage Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Asia-Pacific Real Estate Brokerage Market?

Key companies in the market include CBRE Group, JLL, Colliers International, Knight Frank, Savills, Cushman & Wakefield, Century 21 Real Estate, ERA Real Estate, RE/MAX, Coldwell Banker**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Asia-Pacific Real Estate Brokerage Market?

The market segments include Type, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 368.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

6. What are the notable trends driving market growth?

Demand for Residential Segment Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: Knight Frank, a prominent global property consultancy, in collaboration with Bayleys, New Zealand's premier full-service real estate firm, successfully acquired McGrath Limited, a key player in the Australian residential real estate market. This acquisition, achieved through a controlling stake purchase via a scheme of arrangement, marks a significant milestone for both entities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence