Key Insights

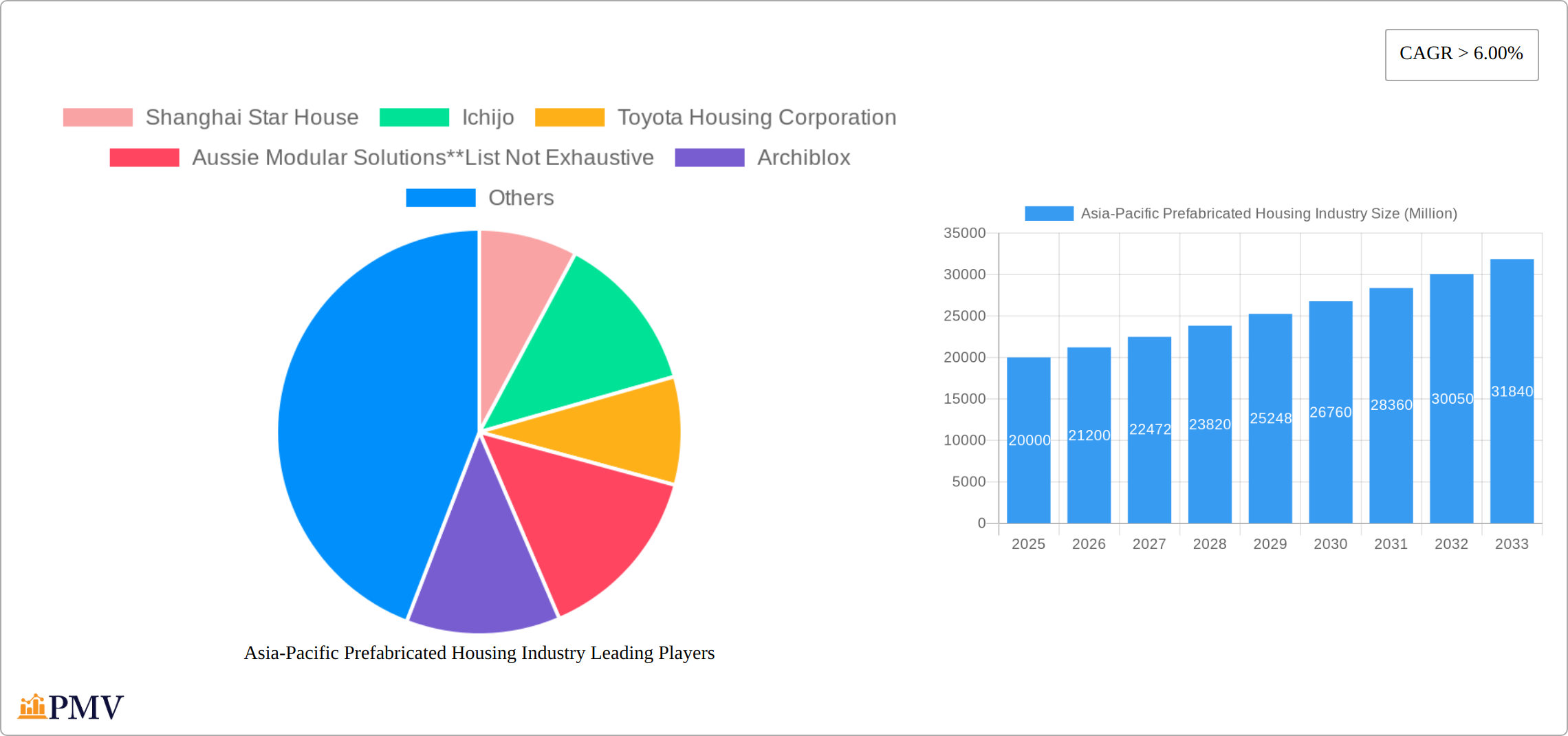

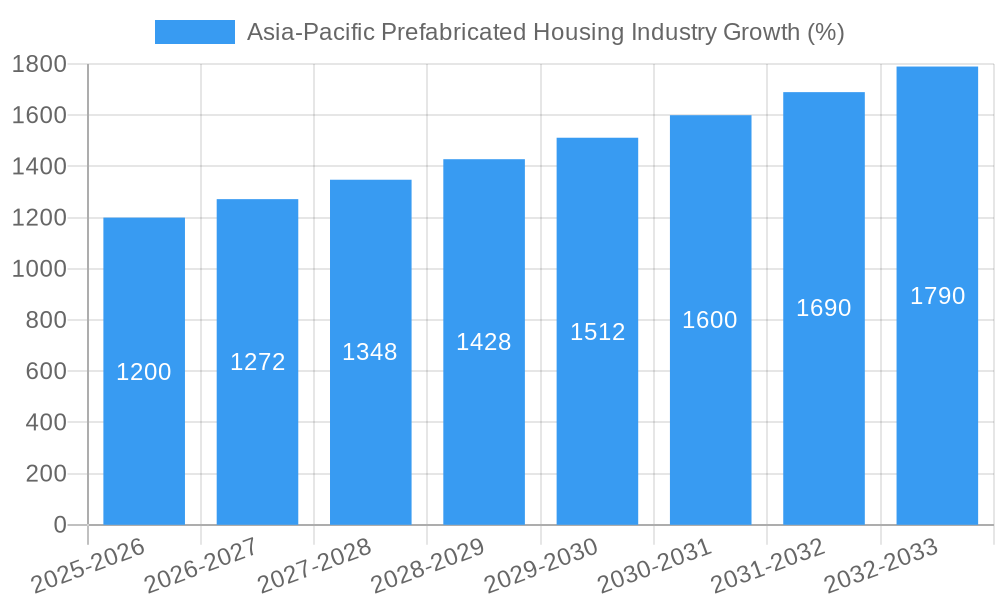

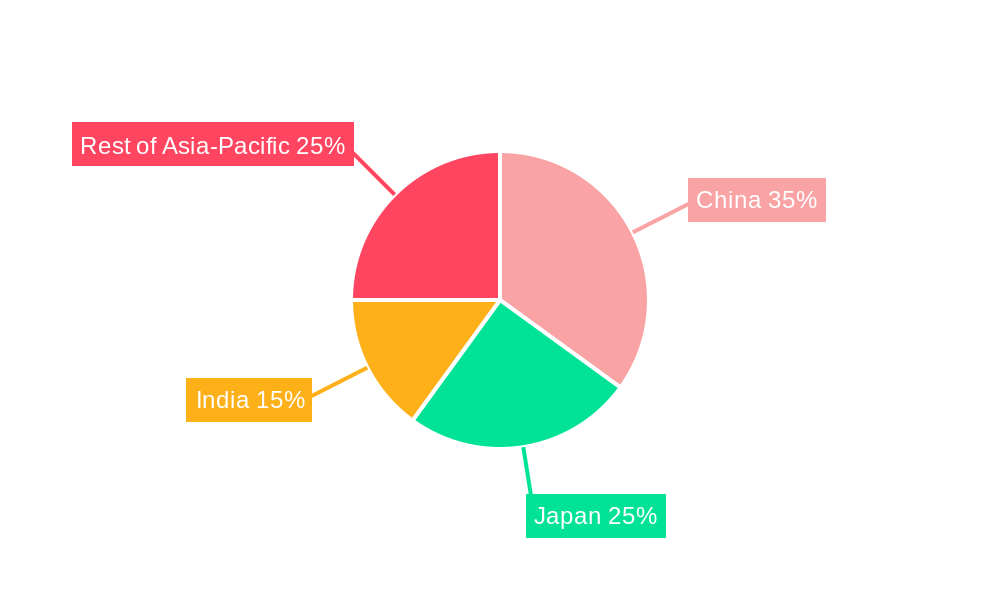

The Asia-Pacific prefabricated housing market is experiencing robust growth, driven by factors such as increasing urbanization, rising construction costs, and a growing need for affordable and sustainable housing solutions. The market, estimated at $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key trends: a surge in government initiatives promoting sustainable construction, technological advancements in prefabrication methods leading to improved efficiency and quality, and a heightened awareness among consumers regarding the environmental benefits of prefabricated homes. China, Japan, and India are the major contributors to market growth, reflecting their substantial housing needs and evolving construction landscapes. However, challenges remain, including regulatory hurdles in some regions, potential workforce shortages skilled in prefabrication techniques, and overcoming consumer perceptions related to the aesthetics and durability of prefabricated structures. The market is segmented by housing type (single-family and multi-family) and geographically across key Asian nations. Leading players like Shanghai Star House, Ichijo, and Sekisui House are shaping market dynamics through innovation and expansion, but the industry is also seeing the emergence of smaller, specialized players focusing on niche markets.

The segment breakdown further reveals that multi-family prefabricated housing is likely to witness faster growth compared to single-family units, driven by the increasing demand for affordable apartments in rapidly urbanizing areas. The Rest of Asia-Pacific region also presents significant growth opportunities, driven by improving infrastructure and increasing disposable incomes in developing economies. While challenges exist, the long-term outlook for the Asia-Pacific prefabricated housing market remains positive, with continued innovation and supportive government policies expected to stimulate further growth and adoption in the coming years. This growth trajectory is likely to be influenced by factors such as evolving building codes, advancements in material science, and the integration of smart home technologies within prefabricated units.

Asia-Pacific Prefabricated Housing Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Asia-Pacific prefabricated housing industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages rigorous research methodologies and incorporates real-world data to deliver actionable insights into market dynamics, growth drivers, challenges, and future opportunities. It features detailed segmentation by type (single-family, multi-family) and country (China, Japan, India, Rest of Asia-Pacific), profiling key players like Shanghai Star House, Ichijo, Toyota Housing Corporation, and more. The report also covers significant industry developments such as the launch of innovative housing units and the adoption of cutting-edge construction technologies. Discover the potential of this rapidly evolving market and gain a competitive edge with this in-depth analysis.

Asia-Pacific Prefabricated Housing Industry Market Structure & Competitive Dynamics

The Asia-Pacific prefabricated housing market exhibits a moderately concentrated structure with several large players holding significant market share. Key players such as Sekisui House, Daiwa House Industry, and Panasonic Homes dominate specific national markets. However, a significant number of smaller, regional players also contribute significantly to the overall market volume. The industry is characterized by a dynamic innovation ecosystem, driven by advancements in materials science, manufacturing technologies, and design methodologies. Regulatory frameworks vary across countries, influencing market access and operational efficiencies. Product substitutes, primarily conventional construction methods, continue to compete, but the increasing advantages of prefabrication—cost-effectiveness, speed, and sustainability—are gradually shifting market share.

End-user trends indicate a growing preference for sustainable, energy-efficient housing solutions, which is a key driver of demand for prefabricated structures. Mergers and acquisitions (M&A) activity within the sector has been relatively modest in recent years, with deal values averaging approximately xx Million USD annually. However, strategic partnerships and joint ventures are becoming increasingly prevalent as companies seek to expand their market reach and technological capabilities. Market share data indicates that the top five players collectively control approximately xx% of the market.

- Market Concentration: Moderately concentrated, with several large players and numerous smaller firms.

- Innovation Ecosystems: Active, driven by advancements in materials, manufacturing, and design.

- Regulatory Frameworks: Varied across countries, impacting market access.

- Product Substitutes: Conventional construction methods, but prefabrication's advantages are gaining traction.

- M&A Activity: Relatively modest, with average deal values around xx Million USD annually.

Asia-Pacific Prefabricated Housing Industry Industry Trends & Insights

The Asia-Pacific prefabricated housing market is experiencing robust growth, driven by several factors. Rapid urbanization and population growth, particularly in developing economies like India and China, are fueling significant housing demand. Government initiatives promoting affordable housing and sustainable construction practices further stimulate market expansion. Technological advancements, such as Building Information Modeling (BIM) and advanced manufacturing techniques, are enhancing efficiency and reducing construction times. Consumer preferences are shifting towards prefabricated homes due to their perceived cost-effectiveness, quicker construction times, and potential for higher quality. However, competitive dynamics remain intense, with established players and new entrants vying for market share through innovation and strategic partnerships. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Asia-Pacific Prefabricated Housing Industry

China holds the largest market share within the Asia-Pacific region, driven by massive urbanization, robust infrastructure development, and government support for affordable housing initiatives. Japan, with its advanced technological capabilities and established prefabricated housing industry, is another significant market. India's rapidly growing economy and burgeoning housing demand present substantial growth opportunities. The single-family segment currently dominates the market, but the multi-family segment is projected to experience faster growth rates due to increasing urbanization and the need for high-density housing solutions.

- Key Drivers for China: Massive urbanization, government support for affordable housing, robust infrastructure development.

- Key Drivers for Japan: Advanced technology, established industry, focus on efficiency and quality.

- Key Drivers for India: Rapid economic growth, increasing urbanization, substantial housing shortage.

- Key Drivers for Single-Family: Growing suburbanization, preference for individual homes.

- Key Drivers for Multi-Family: Increasing urbanization, need for high-density housing, cost-effectiveness.

Asia-Pacific Prefabricated Housing Industry Product Innovations

Recent product innovations focus on modular designs that allow for greater customization and flexibility. The use of sustainable materials, such as cross-laminated timber (CLT) and recycled materials, is gaining traction. Smart home technologies are being increasingly integrated into prefabricated homes, offering enhanced energy efficiency and convenience. These innovations provide competitive advantages in terms of cost, speed of construction, energy efficiency, and occupant comfort, making prefabricated housing a more attractive option for a broader range of consumers. The market is witnessing a shift towards prefabricated homes that are more aesthetically pleasing and customizable, addressing past concerns about standardization and limited design options.

Report Segmentation & Scope

This report segments the Asia-Pacific prefabricated housing market by type (single-family and multi-family) and by country (China, Japan, India, and Rest of Asia-Pacific). The single-family segment is characterized by a larger market size but slower growth compared to the multi-family segment. China holds the largest market share across both segments, owing to its vast population and rapid urbanization. Japan showcases a more mature market with a focus on high-quality and technologically advanced products. India presents a significant growth opportunity due to its expanding middle class and increasing housing demand. The Rest of Asia-Pacific segment encompasses diverse markets with varying growth rates and dynamics. Each segment's growth projections, market sizes, and competitive landscapes are meticulously analyzed within the report.

Key Drivers of Asia-Pacific Prefabricated Housing Industry Growth

Several key factors are driving the growth of the Asia-Pacific prefabricated housing industry. These include the increasing demand for affordable and sustainable housing solutions spurred by rapid urbanization and population growth. Government support through various housing policies and infrastructure initiatives significantly contributes to market expansion. Technological advancements like BIM and advanced manufacturing techniques improve efficiency, reduce construction times, and enhance product quality. The growing awareness of environmental concerns is driving demand for sustainable and eco-friendly building materials and construction methods. Finally, the increasing acceptance of prefabricated homes by consumers who appreciate their cost-effectiveness and speed of construction further accelerates market growth.

Challenges in the Asia-Pacific Prefabricated Housing Industry Sector

The Asia-Pacific prefabricated housing industry faces several challenges, including the standardization of building codes and regulations across different countries. Supply chain disruptions can impact construction timelines and costs. The competition from traditional construction methods still presents a challenge. Consumer perception and acceptance of prefabricated houses in certain regions require further attention. The availability of skilled labor for prefabricated construction remains an issue for some countries. These factors can have quantifiable impacts on project timelines, budgets, and ultimately, profitability.

Leading Players in the Asia-Pacific Prefabricated Housing Industry Market

- Shanghai Star House

- Ichijo

- Toyota Housing Corporation

- Aussie Modular Solutions

- Archiblox

- Anchor Homes

- Panasonic Homes

- Sekisui House

- Ausco Modular Construction

- Daiwa House Industry

Key Developments in Asia-Pacific Prefabricated Housing Industry Sector

- Jan 2023: Apex Modular, a joint venture in Sri Lanka, secured a contract to manufacture "coodo moon" housing units, signaling growing interest in innovative, adaptable housing solutions.

- Nov 2022: The Housing and Development Board (HDB) in Singapore implemented "beamless" flats in a BTO project, demonstrating the adoption of advanced construction technologies to improve design and efficiency.

Strategic Asia-Pacific Prefabricated Housing Industry Market Outlook

The Asia-Pacific prefabricated housing market is poised for significant growth, driven by continued urbanization, government support, and technological innovation. Strategic opportunities exist for companies focusing on sustainable and technologically advanced solutions. Expansion into emerging markets with high housing demand and partnerships to improve supply chain efficiencies are key strategies for success. The market's future hinges on overcoming challenges related to standardization, consumer perception, and labor availability. Companies that can successfully navigate these challenges and leverage emerging technologies will capture a significant share of the growing market.

Asia-Pacific Prefabricated Housing Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multifamily

Asia-Pacific Prefabricated Housing Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Prefabricated Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Housing Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multifamily

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Shanghai Star House

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ichijo

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Toyota Housing Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aussie Modular Solutions**List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Archiblox

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Anchor Homes

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Panasonic Homes

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sekisui House

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ausco Modular Construction

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Daiwa House Industry

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Shanghai Star House

List of Figures

- Figure 1: Asia-Pacific Prefabricated Housing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Prefabricated Housing Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Asia-Pacific Prefabricated Housing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia-Pacific Prefabricated Housing Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Prefabricated Housing Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Asia-Pacific Prefabricated Housing Industry?

Key companies in the market include Shanghai Star House, Ichijo, Toyota Housing Corporation, Aussie Modular Solutions**List Not Exhaustive, Archiblox, Anchor Homes, Panasonic Homes, Sekisui House, Ausco Modular Construction, Daiwa House Industry.

3. What are the main segments of the Asia-Pacific Prefabricated Housing Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Increasing Demand for Housing Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

Jan 2023: Apex Modular, a joint venture between JAT Property Group and Apex Asia Holdings in Sri Lanka, was recently appointed the Licensed Manufacturer for Estonian-based Mobile Module Supplier for LTG Lofts. Apex Modular was chosen as the most appropriately qualified and certified manufacturer for LTG's spectacular, retro-futuristic 'coodo moon' housing units for the Asian market, and it is expected to complete the first coodo Resort in Sri Lanka, which is set to open in Q2 2023. Coodo moon housing units are intended to become the most sought-after modern mobile home units, adaptable to a variety of regional climates and weather conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Prefabricated Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Prefabricated Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Prefabricated Housing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Prefabricated Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence