Key Insights

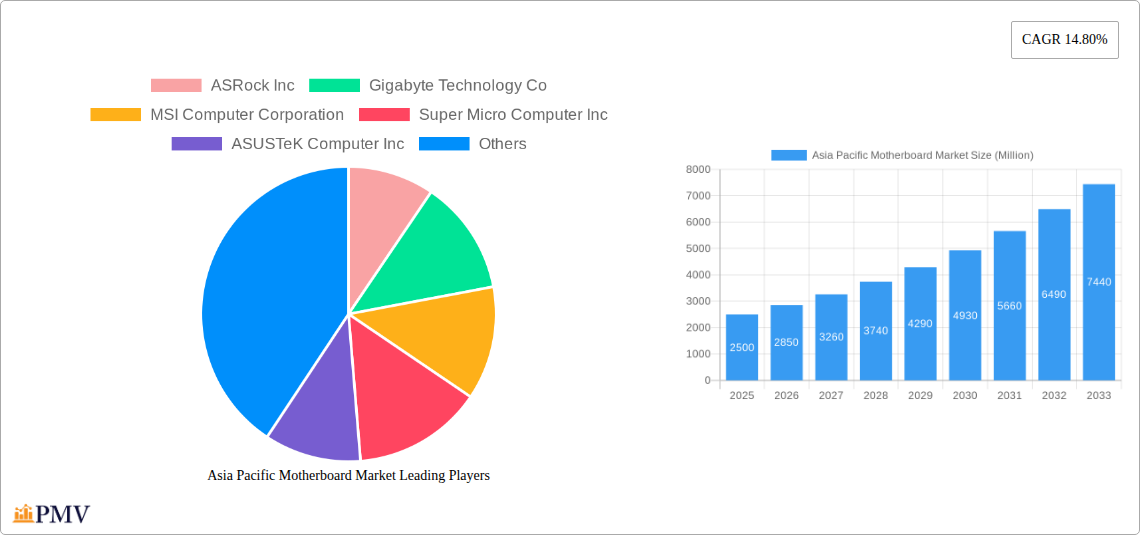

The Asia Pacific motherboard market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.80% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of high-performance computing (HPC) across various industries, including data centers and manufacturing, is significantly boosting demand for advanced motherboards. Furthermore, the burgeoning popularity of gaming and the growing need for enhanced graphics capabilities are driving the demand for high-end motherboards with superior features. The rising disposable incomes in several key APAC economies, coupled with increased awareness of technological advancements, contribute to the market's overall growth. The market is segmented by form factor (ATX, Micro-ATX, Mini ITX) and type of model (Industrial, Commercial). While ATX motherboards currently dominate the market share due to their versatility and expandability, the demand for compact Mini ITX models is rising owing to space constraints in modern systems and increasing popularity of small form factor PCs. The industrial segment is witnessing a higher growth rate than the commercial segment, driven by the increasing automation and digital transformation across industries. Key players like ASRock, Gigabyte, MSI, Super Micro, ASUS, Biostar, and Advantech are actively shaping the market landscape through innovation and aggressive expansion strategies. The competitive landscape is characterized by intense R&D activities focusing on improving performance, energy efficiency, and integrating advanced technologies.

The growth trajectory is, however, subject to certain restraints. Fluctuations in component prices, particularly semiconductor chips, could impact the overall market growth. Supply chain disruptions, particularly those related to raw materials, and geopolitical uncertainties could also pose challenges. Nevertheless, the long-term outlook for the Asia Pacific motherboard market remains positive, driven by technological advancements and sustained demand from key consumer and industrial segments. The growth will be largely concentrated in China, India, and Japan, which are experiencing rapid technological advancements and expanding digital infrastructure. South Korea and Taiwan, known for their strong electronics manufacturing base, are also expected to significantly contribute to the regional growth.

Asia Pacific Motherboard Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific motherboard market, offering valuable insights for businesses, investors, and stakeholders seeking to understand this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. The market size is expected to reach xx Million by 2033.

Asia Pacific Motherboard Market Market Structure & Competitive Dynamics

The Asia Pacific motherboard market exhibits a moderately concentrated structure, with several key players holding significant market share. The competitive landscape is characterized by intense innovation, driven by the constant demand for higher performance and advanced features. Regulatory frameworks, varying across different countries in the region, influence product design and manufacturing. The presence of substitute technologies, such as integrated graphics solutions, presents a challenge, though the demand for high-performance computing continues to fuel growth. End-user trends, particularly the increasing adoption of gaming PCs and high-performance computing systems, are pivotal market drivers. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Key players strategically leverage M&A to expand product portfolios and market reach. Market share analysis reveals that ASRock Inc, Gigabyte Technology Co, MSI Computer Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Inc, and Advantech Co Ltd are amongst the leading players, competing fiercely on price, features, and brand reputation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Innovation Ecosystem: Highly dynamic, with constant advancements in chipset technology, form factors, and cooling solutions.

- Regulatory Frameworks: Vary across countries, impacting product compliance and import/export regulations.

- Product Substitutes: Integrated graphics solutions and specialized embedded systems pose competitive pressure.

- M&A Activity: Moderate activity observed in recent years, with deal values averaging xx Million.

Asia Pacific Motherboard Market Industry Trends & Insights

The Asia Pacific motherboard market exhibits robust growth, driven by several key factors. The increasing adoption of personal computers (PCs) across various sectors, including gaming, content creation, and enterprise applications, fuels demand. Technological advancements such as the introduction of newer CPU and GPU platforms necessitate upgrades, thereby stimulating market expansion. Consumer preferences lean towards high-performance motherboards with advanced features like enhanced cooling solutions, increased bandwidth, and support for cutting-edge technologies. The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024 and is projected to maintain a CAGR of xx% during 2025-2033. Market penetration is high in developed economies like Japan, South Korea, and Australia, while significant growth potential remains in emerging markets like India and Southeast Asia. Competitive dynamics continue to shape the market, with key players investing heavily in R&D to gain a competitive edge through innovation.

Dominant Markets & Segments in Asia Pacific Motherboard Market

The ATX form factor dominates the market due to its versatility and compatibility with a wide range of components. China and Japan represent the leading markets in the region, driven by robust PC demand and a strong manufacturing base.

- Dominant Region: China, followed by Japan and South Korea.

- Dominant Form Factor: ATX

- Dominant Type of Model: Commercial (due to higher volume sales compared to industrial).

Key Drivers for China's dominance:

- Strong domestic PC manufacturing sector.

- Expanding e-commerce and digital economy.

- Government initiatives to promote technological advancement.

Key Drivers for Japan's dominance:

- High PC penetration rates in households and businesses.

- A mature technology sector with significant consumer electronics manufacturing.

- High disposable income and consumer demand for technologically advanced products.

Detailed Dominance Analysis: The dominance of China and Japan stems from their established technological infrastructure, robust PC adoption rates, and a mature electronics manufacturing ecosystem. These factors fuel substantial demand for motherboards, leading to higher market share compared to other Asian Pacific regions.

Asia Pacific Motherboard Market Product Innovations

Recent innovations in motherboards emphasize improved performance, energy efficiency, and enhanced connectivity. Key trends include the integration of advanced cooling solutions, support for high-bandwidth interfaces like PCIe 5.0 and DDR5 RAM, and incorporation of AI-powered features. Manufacturers focus on developing motherboards that cater to specific user needs, such as gaming, content creation, or professional applications. This product differentiation strategy contributes to maintaining a competitive edge in the market.

Report Segmentation & Scope

This report segments the Asia Pacific motherboard market based on form factor and type of model:

By Form Factor:

ATX: This segment holds the largest market share due to its versatility and wide compatibility, projected to grow at xx% CAGR during the forecast period. Competitive dynamics are characterized by intense competition among established players.

Micro-ATX: This segment caters to users requiring smaller form factor motherboards, with projected growth at xx% CAGR. Competition is mainly between manufacturers focusing on compact designs and high-performance components.

Mini ITX: This segment is focused on space-saving applications, with a projected growth at xx% CAGR driven by growing demand for compact and powerful PCs. High-end mini-ITX motherboards command premium pricing.

By Type of Model:

Industrial: This niche segment caters to industrial applications, characterized by high reliability and durability requirements, with a projected growth at xx% CAGR. The focus is on long-term reliability and specialized features for industrial settings.

Commercial: This segment comprises the largest portion of the market and is focused on standard PC applications, projected to grow at xx% CAGR due to widespread adoption in consumer and corporate segments. Competitive dynamics are intense, focusing on features, price-performance ratios, and brand recognition.

Key Drivers of Asia Pacific Motherboard Market Growth

Technological advancements in processors and graphics cards drive the demand for motherboards with compatible interfaces and higher bandwidth. The growing adoption of PCs in various sectors, particularly gaming and content creation, contributes significantly to market expansion. Favorable economic conditions in several Asian countries stimulate consumer spending on electronics, fueling market growth.

Challenges in the Asia Pacific Motherboard Market Sector

Supply chain disruptions and rising component costs pose significant challenges, impacting profitability and pricing. Intense competition among manufacturers necessitates continuous innovation to maintain a competitive edge. Regulatory hurdles and compliance requirements in various countries add complexity to the manufacturing and distribution process.

Leading Players in the Asia Pacific Motherboard Market Market

- ASRock Inc

- Gigabyte Technology Co

- MSI Computer Corporation

- Super Micro Computer Inc

- ASUSTeK Computer Inc

- Biostar Inc

- Advantech Co Ltd

Key Developments in Asia Pacific Motherboard Market Sector

- May 2022: Colorful Technology Company Limited launched the iGame Z690D5 Ultra motherboard, targeting gamers and content creators.

- July 2022: GIGABYTE won Red Dot and iF Design Awards for five motherboard products, highlighting its design innovation.

Strategic Asia Pacific Motherboard Market Market Outlook

The Asia Pacific motherboard market is poised for continued growth, driven by technological advancements and increasing PC adoption across various sectors. Strategic opportunities exist for manufacturers focusing on innovation, niche market segments, and efficient supply chain management. Expanding into emerging markets presents significant growth potential, while strategic partnerships and collaborations can enhance market reach and competitiveness.

Asia Pacific Motherboard Market Segmentation

-

1. Form

- 1.1. ATX

- 1.2. Micro-ATX

- 1.3. Mini ITX

-

2. Type

- 2.1. Industrial

- 2.2. Commercial

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

Asia Pacific Motherboard Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia Pacific Motherboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region

- 3.3. Market Restrains

- 3.3.1. High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market

- 3.4. Market Trends

- 3.4.1. China is expected to acquire a significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. ATX

- 5.1.2. Micro-ATX

- 5.1.3. Mini ITX

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. China Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. ATX

- 6.1.2. Micro-ATX

- 6.1.3. Mini ITX

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. India Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. ATX

- 7.1.2. Micro-ATX

- 7.1.3. Mini ITX

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Japan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. ATX

- 8.1.2. Micro-ATX

- 8.1.3. Mini ITX

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Rest of Asia Pacific Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. ATX

- 9.1.2. Micro-ATX

- 9.1.3. Mini ITX

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. China Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 ASRock Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Gigabyte Technology Co

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 MSI Computer Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Super Micro Computer Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 ASUSTeK Computer Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Biostar Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Advantech Co Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.1 ASRock Inc

List of Figures

- Figure 1: Asia Pacific Motherboard Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Motherboard Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Motherboard Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Motherboard Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 5: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Asia Pacific Motherboard Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia Pacific Motherboard Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 28: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 29: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 31: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 36: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 37: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 44: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 45: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 47: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 49: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 52: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 53: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 55: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 57: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Motherboard Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the Asia Pacific Motherboard Market?

Key companies in the market include ASRock Inc, Gigabyte Technology Co, MSI Computer Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Inc, Advantech Co Ltd.

3. What are the main segments of the Asia Pacific Motherboard Market?

The market segments include Form , Type , Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region.

6. What are the notable trends driving market growth?

China is expected to acquire a significant market share.

7. Are there any restraints impacting market growth?

High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market.

8. Can you provide examples of recent developments in the market?

May 2022 - Colorful Technology Company Limited, a manufacturer of motheboards in China announced the launch of iGame Z690D5 Ultra motherboard for the 12th generation Intel Core processors. The product is designed with respect to the gamers and content creators for building high-perfomance PC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Motherboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Motherboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Motherboard Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Motherboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence