Key Insights

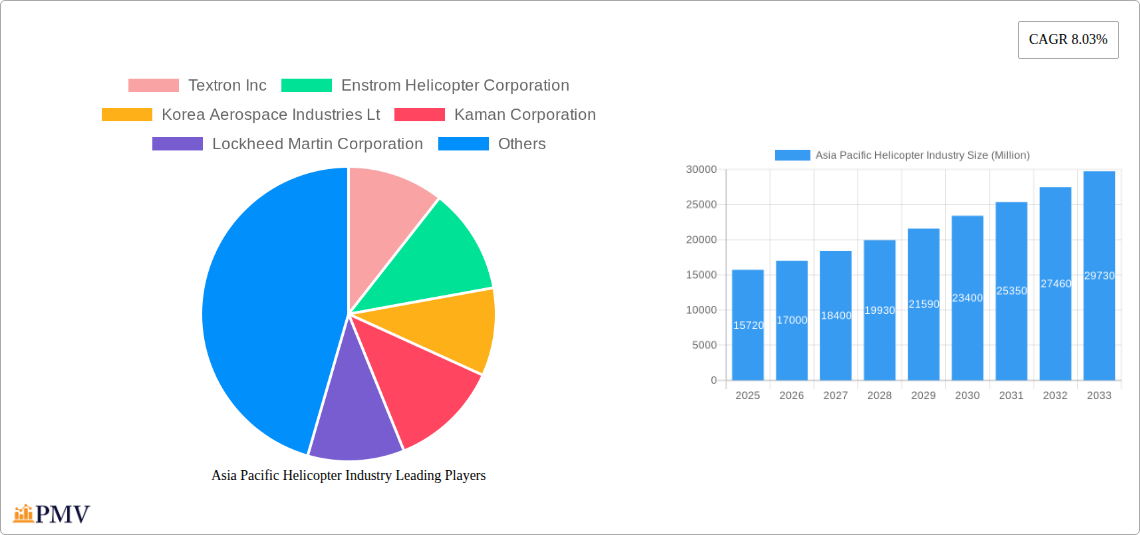

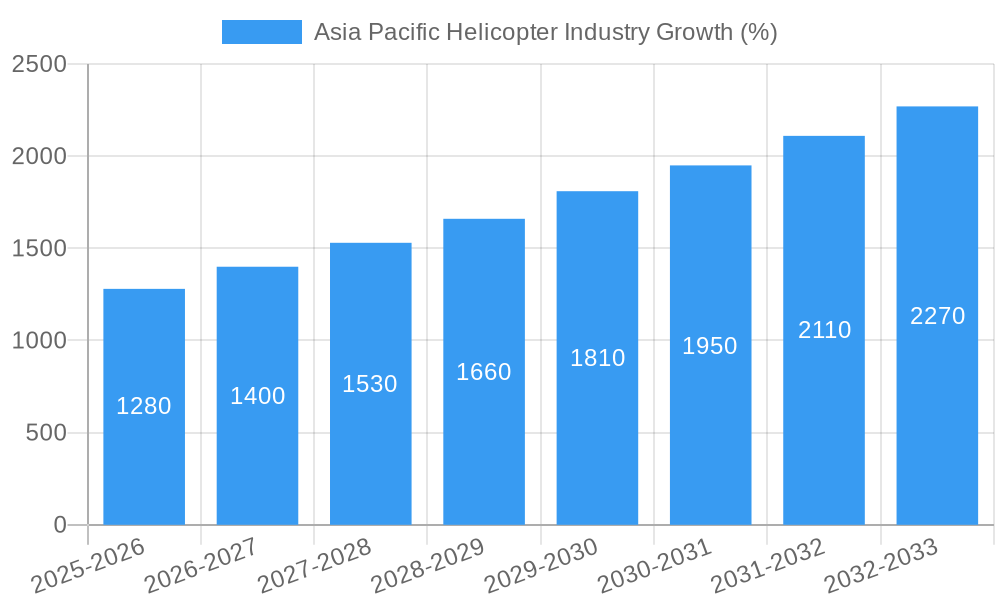

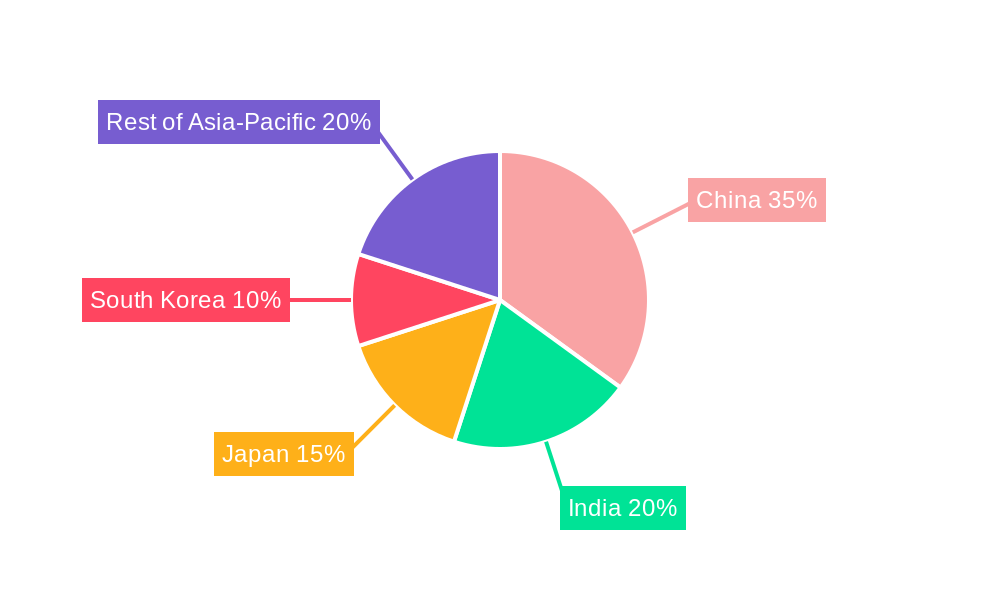

The Asia-Pacific helicopter market, valued at $15.72 billion in 2025, is projected to experience robust growth, driven by increasing demand from both military and civil sectors. The region's expanding economies, particularly in China, India, and South Korea, fuel significant investments in infrastructure development, disaster relief operations, and expanding air ambulance services. Furthermore, rising tourism and offshore oil & gas exploration activities contribute to the growing demand for helicopters. The market is segmented by maximum takeoff weight (light, medium, heavy) and application (military, civil & commercial). Growth in the civil and commercial segment is particularly pronounced, fueled by the burgeoning air tourism sector and increasing demand for corporate and private transportation. While regulatory hurdles and high maintenance costs present challenges, technological advancements such as the development of more fuel-efficient and technologically advanced helicopters are mitigating these restraints and driving market expansion. The consistent adoption of advanced technologies, coupled with governmental support for modernization of fleets within the military sector, suggests a sustained period of growth. Key players like Airbus SE, Boeing, and Leonardo S.p.A., along with regional manufacturers like Hindustan Aeronautics Limited, actively participate in the market, driving competition and innovation.

The forecast period (2025-2033) anticipates a compounded annual growth rate (CAGR) of 8.03%, projecting substantial market expansion. This growth is expected to be concentrated in the medium and heavy helicopter segments, reflecting a shift towards larger aircraft capable of handling heavier payloads and longer ranges. China's rapid economic development and substantial investment in its aviation infrastructure are poised to remain a major contributor to regional growth, while India's expanding market presents significant future potential. The increasing adoption of helicopter emergency medical services (HEMS) across the region also plays a crucial role in driving market expansion. Continued focus on safety and technological improvements, combined with strategic government initiatives, will be pivotal in shaping the future trajectory of the Asia-Pacific helicopter industry.

Asia Pacific Helicopter Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific helicopter industry, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this dynamic market. The report leverages a detailed analysis of market size and growth across various segments, enabling strategic decision-making and informed investments in the Asia Pacific helicopter market.

Asia Pacific Helicopter Industry Market Structure & Competitive Dynamics

The Asia Pacific helicopter market exhibits a moderately concentrated structure, with key players like The Boeing Company, Airbus SE, Textron Inc, Leonardo S p A, and Hindustan Aeronautics Limited holding significant market share. However, the presence of several regional players and emerging manufacturers fosters healthy competition. Innovation ecosystems vary across the region, with some countries demonstrating stronger research and development capabilities than others. Regulatory frameworks, including airworthiness certifications and operational guidelines, significantly impact market dynamics. Product substitutes, such as fixed-wing aircraft for certain applications, exert competitive pressure. End-user trends, particularly towards advanced technologies and customized solutions, drive market segmentation. The market has witnessed considerable M&A activity in recent years, with deal values ranging from USD xx Million to USD xx Million. This activity is primarily driven by expansion strategies and consolidation within the industry.

- Market Concentration: Moderate, with a few major players dominating.

- Innovation Ecosystems: Vary significantly across countries.

- Regulatory Frameworks: Stringent airworthiness and operational standards.

- Product Substitutes: Fixed-wing aircraft for specific tasks.

- End-User Trends: Increasing demand for advanced technologies and customization.

- M&A Activities: Significant activity, with deal values reaching USD xx Million.

Asia Pacific Helicopter Industry Industry Trends & Insights

The Asia Pacific helicopter industry is experiencing robust growth, driven primarily by increasing defense budgets, expanding civil aviation infrastructure, and rising demand for emergency medical services (EMS). The compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, such as the integration of autonomous flight systems and advanced materials, are reshaping the industry landscape. Consumer preferences are shifting toward fuel-efficient, technologically advanced helicopters with enhanced safety features. Intense competition among manufacturers pushes innovation and cost reduction, creating opportunities for both established and emerging players. Market penetration rates are expected to rise significantly in emerging markets. The industry is also focusing on improving customer service to provide better support to the growing number of users.

Dominant Markets & Segments in Asia Pacific Helicopter Industry

The Asia Pacific helicopter market is dominated by several key regions and segments. China, India, and Australia represent the largest national markets due to their substantial defense spending and expanding civil aviation sectors. Within segments, the Medium and Heavy Maximum Take-off Weight (MTOW) categories display the highest demand, driven by military procurement and civilian transport needs. The civil and commercial segment outpaces the military segment in terms of overall market size but military operations remain a significant factor for growth.

- Leading Regions: China, India, and Australia.

- Dominant MTOW Segments: Medium and Heavy.

- Leading Application Segment: Civil and Commercial.

Key Drivers:

- Economic growth: Strong economic growth fuels increased demand for helicopters across various sectors.

- Infrastructure development: Infrastructure projects such as pipelines and power lines are driving demand in the energy sector.

- Government policies: Government initiatives promoting air mobility and defense modernization are significant contributors to market growth.

- Tourism growth: Expanding tourism supports the growth in the civilian and commercial sectors.

Asia Pacific Helicopter Industry Product Innovations

Recent product innovations in the Asia Pacific helicopter industry center on enhanced safety features, improved fuel efficiency, increased payload capacity, and the integration of advanced technologies such as autonomous flight systems and sophisticated avionics. Manufacturers are focusing on developing helicopters tailored to specific regional needs and environmental conditions. These innovations are driven by intense competition and stringent regulatory requirements. This trend emphasizes the need for product customization to suit specific applications within the Asia Pacific region.

Report Segmentation & Scope

This report segments the Asia Pacific helicopter market by Maximum Take-Off Weight (MTOW) into Light, Medium, and Heavy categories, and by Application into Military, Civil, and Commercial sectors. Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. Light helicopters are expected to experience steady growth driven by EMS and private use, while Medium and Heavy categories will benefit from substantial military procurement and commercial air transportation demands. The Civil segment is anticipated to exhibit faster growth than the Military segment due to growing infrastructure development, tourism, and increasing emergency medical service requirements.

Key Drivers of Asia Pacific Helicopter Industry Growth

Several factors propel the growth of the Asia Pacific helicopter industry. These include increasing defense budgets across the region, the expansion of infrastructure projects requiring aerial support, rising demand for emergency medical services (EMS) helicopters, and a surge in tourism and related activities. Furthermore, supportive government policies promoting domestic manufacturing and infrastructure development further stimulate market growth. Technological advancements such as fuel-efficient engines and autonomous flight systems also contribute positively.

Challenges in the Asia Pacific Helicopter Industry Sector

Challenges faced by the Asia Pacific helicopter industry include stringent regulatory hurdles slowing down the certification process of new helicopters, supply chain disruptions impacting manufacturing and maintenance, and the intense competition among established and emerging manufacturers. Geopolitical instability in certain regions also creates uncertainties impacting helicopter operations and procurement decisions. These challenges impact overall growth and profitability in the sector. Further, fluctuations in fuel prices can influence operational costs.

Leading Players in the Asia Pacific Helicopter Industry Market

- Textron Inc

- Enstrom Helicopter Corporation

- Korea Aerospace Industries Ltd

- Kaman Corporation

- Lockheed Martin Corporation

- Airbus SE

- Robinson Helicopter Company

- Leonardo S p A

- ROSTEC

- Hindustan Aeronautics Limited

- The Boeing Company

Key Developments in Asia Pacific Helicopter Industry Sector

- June 2022: Boeing announced India's negotiation for AH-64E Apache and CH-47F(I) Chinook helicopters.

- March 2022: China's Rescue and Salvage Bureau ordered six Leonardo AW189 helicopters for maritime SAR operations.

- February 2022: The Indonesian Army received the final Bell 412 EPI helicopter under a USD 183 Million contract.

Strategic Asia Pacific Helicopter Industry Market Outlook

The Asia Pacific helicopter industry is poised for sustained growth, driven by the factors outlined earlier. Strategic opportunities exist for companies focused on technological innovation, customer service excellence, and expansion into emerging markets. Focus on sustainable technologies and customization for specific regional requirements will be crucial for success in this competitive landscape. The expanding infrastructure, rising tourism, and growing demand for essential services will significantly impact this development, making a strong forecast for the future.

Asia Pacific Helicopter Industry Segmentation

-

1. Maximum Take-off Weight

- 1.1. Light

- 1.2. Medium

- 1.3. Heavy

-

2. Application

- 2.1. Military

- 2.2. Civil and Commercial

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Vietnam

- 3.6. Philippines

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Rest of Asia-Pacific

Asia Pacific Helicopter Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Vietnam

- 6. Philippines

- 7. Indonesia

- 8. Thailand

- 9. Rest of Asia Pacific

Asia Pacific Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Demand for Military Helicopters is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 5.1.1. Light

- 5.1.2. Medium

- 5.1.3. Heavy

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Civil and Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Vietnam

- 5.3.6. Philippines

- 5.3.7. Indonesia

- 5.3.8. Thailand

- 5.3.9. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Vietnam

- 5.4.6. Philippines

- 5.4.7. Indonesia

- 5.4.8. Thailand

- 5.4.9. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6. China Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6.1.1. Light

- 6.1.2. Medium

- 6.1.3. Heavy

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Military

- 6.2.2. Civil and Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Vietnam

- 6.3.6. Philippines

- 6.3.7. Indonesia

- 6.3.8. Thailand

- 6.3.9. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 7. India Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 7.1.1. Light

- 7.1.2. Medium

- 7.1.3. Heavy

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Military

- 7.2.2. Civil and Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Vietnam

- 7.3.6. Philippines

- 7.3.7. Indonesia

- 7.3.8. Thailand

- 7.3.9. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 8. Japan Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 8.1.1. Light

- 8.1.2. Medium

- 8.1.3. Heavy

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Military

- 8.2.2. Civil and Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Vietnam

- 8.3.6. Philippines

- 8.3.7. Indonesia

- 8.3.8. Thailand

- 8.3.9. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 9. South Korea Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 9.1.1. Light

- 9.1.2. Medium

- 9.1.3. Heavy

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Military

- 9.2.2. Civil and Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Vietnam

- 9.3.6. Philippines

- 9.3.7. Indonesia

- 9.3.8. Thailand

- 9.3.9. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 10. Vietnam Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 10.1.1. Light

- 10.1.2. Medium

- 10.1.3. Heavy

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Military

- 10.2.2. Civil and Commercial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Vietnam

- 10.3.6. Philippines

- 10.3.7. Indonesia

- 10.3.8. Thailand

- 10.3.9. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 11. Philippines Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 11.1.1. Light

- 11.1.2. Medium

- 11.1.3. Heavy

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Military

- 11.2.2. Civil and Commercial

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. Vietnam

- 11.3.6. Philippines

- 11.3.7. Indonesia

- 11.3.8. Thailand

- 11.3.9. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 12. Indonesia Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 12.1.1. Light

- 12.1.2. Medium

- 12.1.3. Heavy

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Military

- 12.2.2. Civil and Commercial

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. South Korea

- 12.3.5. Vietnam

- 12.3.6. Philippines

- 12.3.7. Indonesia

- 12.3.8. Thailand

- 12.3.9. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 13. Thailand Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 13.1.1. Light

- 13.1.2. Medium

- 13.1.3. Heavy

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Military

- 13.2.2. Civil and Commercial

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. India

- 13.3.3. Japan

- 13.3.4. South Korea

- 13.3.5. Vietnam

- 13.3.6. Philippines

- 13.3.7. Indonesia

- 13.3.8. Thailand

- 13.3.9. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 14. Rest of Asia Pacific Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 14.1.1. Light

- 14.1.2. Medium

- 14.1.3. Heavy

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Military

- 14.2.2. Civil and Commercial

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. China

- 14.3.2. India

- 14.3.3. Japan

- 14.3.4. South Korea

- 14.3.5. Vietnam

- 14.3.6. Philippines

- 14.3.7. Indonesia

- 14.3.8. Thailand

- 14.3.9. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 15. China Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 16. Japan Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 17. India Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 18. South Korea Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 19. Taiwan Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 20. Australia Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 21. Rest of Asia-Pacific Asia Pacific Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Textron Inc

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 Enstrom Helicopter Corporation

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Korea Aerospace Industries Lt

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 Kaman Corporation

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Lockheed Martin Corporation

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 Airbus SE

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 Robinson Helicopter Company

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 Leonardo S p A

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 ROSTEC

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 Hindustan Aeronautics Limited

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.11 The Boeing Company

- 22.2.11.1. Overview

- 22.2.11.2. Products

- 22.2.11.3. SWOT Analysis

- 22.2.11.4. Recent Developments

- 22.2.11.5. Financials (Based on Availability)

- 22.2.1 Textron Inc

List of Figures

- Figure 1: Asia Pacific Helicopter Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Helicopter Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Helicopter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 3: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia Pacific Helicopter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 15: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 19: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 23: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 27: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 31: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 35: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 39: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 43: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 45: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Asia Pacific Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 47: Asia Pacific Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Asia Pacific Helicopter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 49: Asia Pacific Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Helicopter Industry?

The projected CAGR is approximately 8.03%.

2. Which companies are prominent players in the Asia Pacific Helicopter Industry?

Key companies in the market include Textron Inc, Enstrom Helicopter Corporation, Korea Aerospace Industries Lt, Kaman Corporation, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company, Leonardo S p A, ROSTEC, Hindustan Aeronautics Limited, The Boeing Company.

3. What are the main segments of the Asia Pacific Helicopter Industry?

The market segments include Maximum Take-off Weight, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Demand for Military Helicopters is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In June 2022, Torbjorn Sjogren, vice president, and general manager of International Government and Defence, at Boeing stated that India is in talks and negotiating for the AH-64E Apache attack helicopters and the Chinook CH-47F(I) heavy-lift helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Helicopter Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence