Key Insights

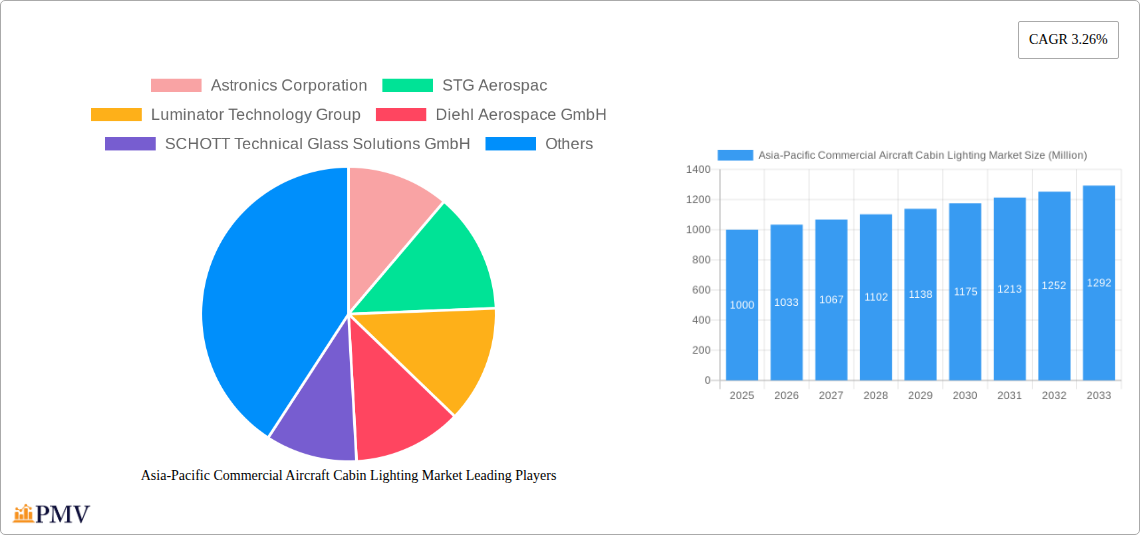

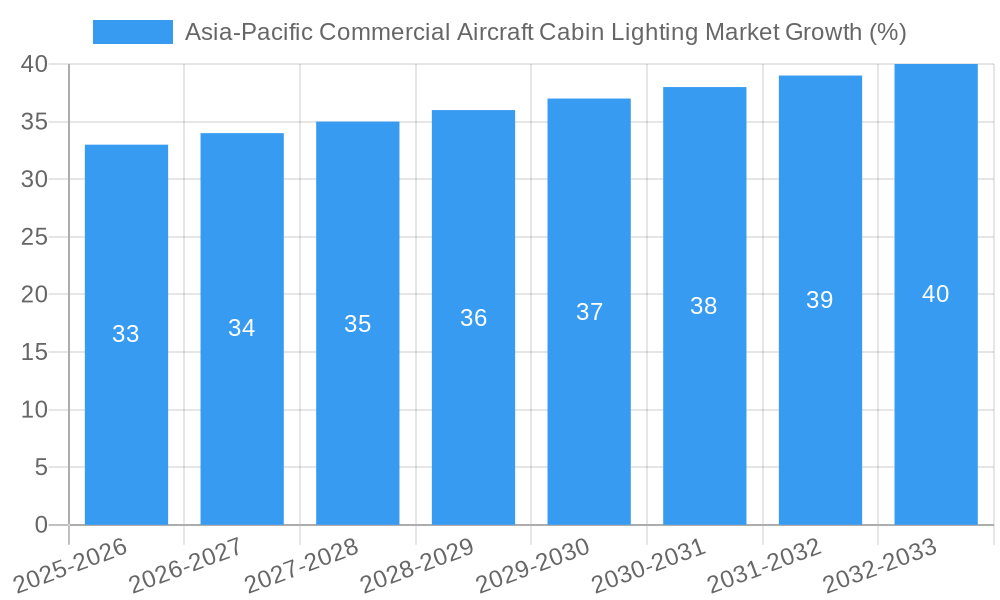

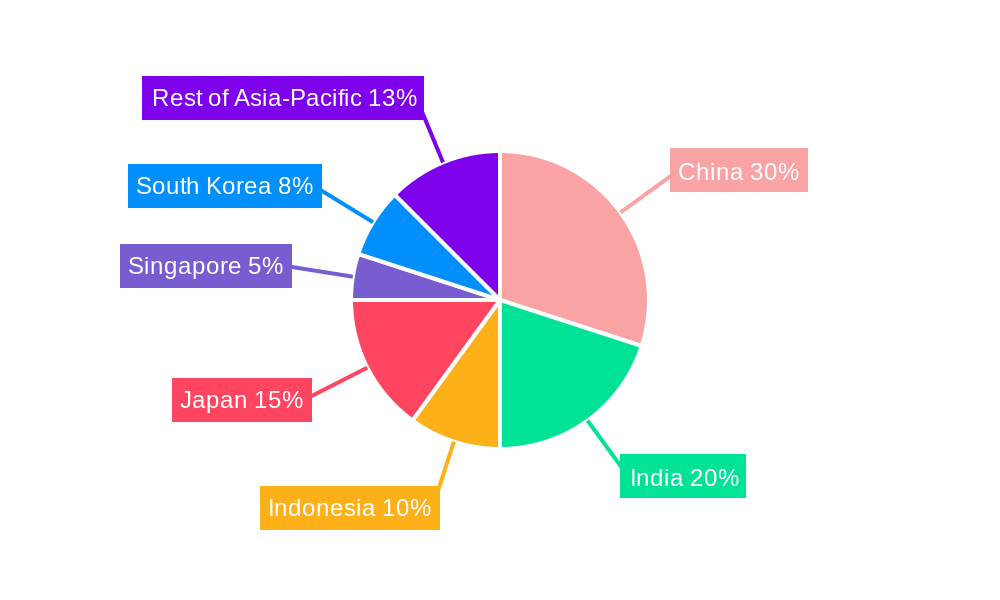

The Asia-Pacific commercial aircraft cabin lighting market is experiencing robust growth, driven by a surge in air travel within the region and a rising demand for enhanced passenger comfort and experience. The market's expansion is fueled by several key factors: increasing fleet modernization by airlines in countries like China, India, and Indonesia; the growing adoption of advanced lighting technologies like LED lighting, offering energy efficiency and aesthetic improvements; and the rising preference for customizable cabin ambiances to improve passenger well-being during flights. The 3.26% CAGR indicates a steady, predictable growth trajectory, likely influenced by consistent aircraft deliveries and investments in cabin upgrades. While the specific market size for 2025 isn't provided, considering a conservative estimate based on a market size "XX" (we will assume it is around $1 Billion for the sake of demonstration and subsequent calculations), we can project substantial growth. Segmentation by aircraft type (narrowbody and widebody) reflects different lighting needs and technological integrations, while regional variations (China, India, Indonesia, Japan, Singapore, South Korea, and the Rest of Asia-Pacific) highlight the uneven distribution of growth opportunities. Major players like Astronics Corporation, STG Aerospace, and Luminator Technology Group are key contributors to innovation and competition within this segment, constantly striving to improve energy efficiency, durability, and aesthetic appeal of cabin lighting systems.

The restraints on market growth include economic fluctuations that can impact airline investments, potential supply chain disruptions affecting component availability, and technological advancements that require consistent adaptation and upgrades. However, the long-term outlook remains positive, driven by the continuous expansion of the Asia-Pacific air travel market and a sustained focus on elevating passenger satisfaction through sophisticated and environmentally friendly cabin lighting solutions. This steady growth is expected to continue throughout the forecast period (2025-2033), promising lucrative opportunities for companies specializing in the design, manufacturing, and maintenance of commercial aircraft cabin lighting systems. The focus on sustainability and passenger experience will likely drive future innovation and differentiation in this dynamic market.

This in-depth report provides a comprehensive analysis of the Asia-Pacific commercial aircraft cabin lighting market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The report meticulously examines key segments, including aircraft type (narrowbody and widebody), and major countries (China, India, Indonesia, Japan, Singapore, South Korea, and the Rest of Asia-Pacific).

Asia-Pacific Commercial Aircraft Cabin Lighting Market Structure & Competitive Dynamics

The Asia-Pacific commercial aircraft cabin lighting market exhibits a moderately concentrated structure, with key players vying for market share. The market is characterized by a dynamic innovation ecosystem, driven by advancements in LED technology, smart lighting solutions, and passenger experience enhancements. Regulatory frameworks, primarily focused on safety and efficiency, significantly influence market dynamics. Product substitutes, while limited, include traditional incandescent and fluorescent lighting, although their market share is steadily declining. End-user trends toward enhanced passenger comfort and personalized lighting experiences are fueling market growth.

M&A activities have played a role in shaping the competitive landscape. While precise deal values are often undisclosed, several significant transactions have resulted in market consolidation. For example, xx Million in M&A activity was observed between 2021-2023, contributing to market concentration. Major players, including Astronics Corporation, STG Aerospace, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, and Collins Aerospace, hold significant market share. However, the exact market share distribution varies based on the specific segment and country.

Asia-Pacific Commercial Aircraft Cabin Lighting Market Industry Trends & Insights

The Asia-Pacific commercial aircraft cabin lighting market is experiencing robust growth, driven primarily by the burgeoning air travel sector and rising demand for enhanced passenger experiences. The market's Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), surpassing the global average. Technological disruptions, such as the adoption of advanced LED and fiber optic lighting systems, are reshaping the market, offering significant improvements in energy efficiency and aesthetic appeal. Consumer preferences increasingly favor personalized lighting options, mood-setting capabilities, and improved cabin ambience, driving the demand for sophisticated lighting solutions. Market penetration of LED lighting systems is rapidly increasing, exceeding xx% in 2025 and projected to reach xx% by 2033. Intense competition among established players and the emergence of innovative start-ups further fuel market dynamics.

Dominant Markets & Segments in Asia-Pacific Commercial Aircraft Cabin Lighting Market

China emerges as the dominant market within the Asia-Pacific region, driven by its rapidly expanding aviation industry and significant investments in airport infrastructure. The country's robust economic growth and expanding middle class contribute significantly to air travel demand.

- Key Drivers in China: Government support for aviation infrastructure development, increasing domestic air travel, and a focus on enhancing passenger experience.

India also presents a significant growth opportunity, fueled by its burgeoning economy and rapidly expanding domestic air travel market.

- Key Drivers in India: Government initiatives promoting air connectivity, rising disposable incomes, and the increasing adoption of budget airlines.

Narrowbody aircraft constitute the largest segment by aircraft type, driven by the high volume of short-haul flights within the Asia-Pacific region. However, the widebody segment is anticipated to experience faster growth due to increasing long-haul travel.

Asia-Pacific Commercial Aircraft Cabin Lighting Market Product Innovations

Recent years have witnessed significant product innovations, primarily focused on enhancing energy efficiency, passenger comfort, and design flexibility. The shift from traditional lighting technologies to energy-efficient LED and fiber optic systems dominates this trend. Smart lighting systems, offering personalized control and mood-setting capabilities, are gaining traction. These innovations provide competitive advantages by improving operational efficiency, reducing weight, and enhancing the overall passenger experience. The market is witnessing a trend towards integrated cabin lighting systems, which combine various lighting functions for seamless control and improved aesthetics.

Report Segmentation & Scope

This report segments the Asia-Pacific commercial aircraft cabin lighting market based on aircraft type (narrowbody and widebody) and country (China, India, Indonesia, Japan, Singapore, South Korea, and Rest of Asia-Pacific). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the narrowbody segment is estimated to hold xx Million market value in 2025, while the widebody segment is predicted to reach xx Million by 2033. The report also includes an analysis of individual countries' market characteristics, growth drivers, and challenges.

Key Drivers of Asia-Pacific Commercial Aircraft Cabin Lighting Market Growth

Several key factors propel the growth of this market. The significant expansion of air travel within the Asia-Pacific region, driven by economic growth and increasing disposable incomes, forms a primary driver. Technological advancements, specifically the adoption of energy-efficient and aesthetically appealing LED and fiber-optic lighting systems, contribute to market expansion. Furthermore, increasing emphasis on enhancing passenger comfort and experience through personalized lighting solutions fuels market demand. Stringent regulatory requirements mandating improved safety and efficiency also incentivize market participants to adopt advanced lighting technologies.

Challenges in the Asia-Pacific Commercial Aircraft Cabin Lighting Market Sector

Several challenges impede market growth. The high initial investment cost associated with adopting advanced lighting technologies can be a barrier for some airlines. Supply chain disruptions, particularly in the wake of global events, can impact the availability and cost of components. Intense competition among established players and the emergence of new entrants create a price-sensitive environment. Finally, complying with evolving safety and regulatory standards presents a significant challenge for market players.

Leading Players in the Asia-Pacific Commercial Aircraft Cabin Lighting Market Market

- Astronics Corporation

- STG Aerospace

- Luminator Technology Group

- Diehl Aerospace GmbH

- SCHOTT Technical Glass Solutions GmbH

- Collins Aerospace

Key Developments in Asia-Pacific Commercial Aircraft Cabin Lighting Market Sector

June 2022: Collins Aerospace launched its Hypergamut™ Lighting System, scheduled for entry into service in early 2024. This innovative system is expected to significantly enhance the passenger experience and improve the overall cabin ambience.

February 2021: Diehl Aviation secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner. This highlights the continued demand for high-quality lighting systems in widebody aircraft.

Strategic Asia-Pacific Commercial Aircraft Cabin Lighting Market Outlook

The Asia-Pacific commercial aircraft cabin lighting market presents substantial growth potential in the coming years. Continued expansion of air travel, technological advancements, and a focus on enhancing passenger experience will drive market growth. Strategic opportunities exist for companies that can offer innovative, energy-efficient, and cost-effective lighting solutions. The increasing adoption of smart lighting systems and the integration of advanced lighting technologies into broader cabin management systems will shape the future of the market.

Asia-Pacific Commercial Aircraft Cabin Lighting Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

Asia-Pacific Commercial Aircraft Cabin Lighting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Commercial Aircraft Cabin Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. China Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Astronics Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 STG Aerospac

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Luminator Technology Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Diehl Aerospace GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SCHOTT Technical Glass Solutions GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Collins Aerospace

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Astronics Corporation

List of Figures

- Figure 1: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Commercial Aircraft Cabin Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 13: Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia-Pacific Commercial Aircraft Cabin Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Commercial Aircraft Cabin Lighting Market?

The projected CAGR is approximately 3.26%.

2. Which companies are prominent players in the Asia-Pacific Commercial Aircraft Cabin Lighting Market?

Key companies in the market include Astronics Corporation, STG Aerospac, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, Collins Aerospace.

3. What are the main segments of the Asia-Pacific Commercial Aircraft Cabin Lighting Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Collins Aerospace launched its Hypergamut™ Lighting System which is scheduled for entry into service in early 2024.February 2021: Diehl Aviation has secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Commercial Aircraft Cabin Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Commercial Aircraft Cabin Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Commercial Aircraft Cabin Lighting Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Commercial Aircraft Cabin Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence