Key Insights

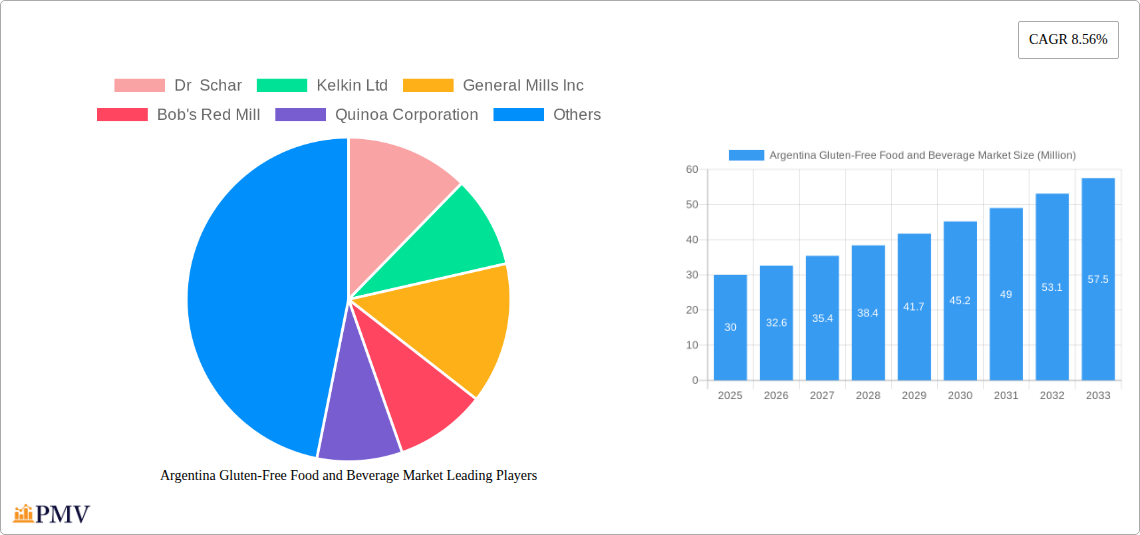

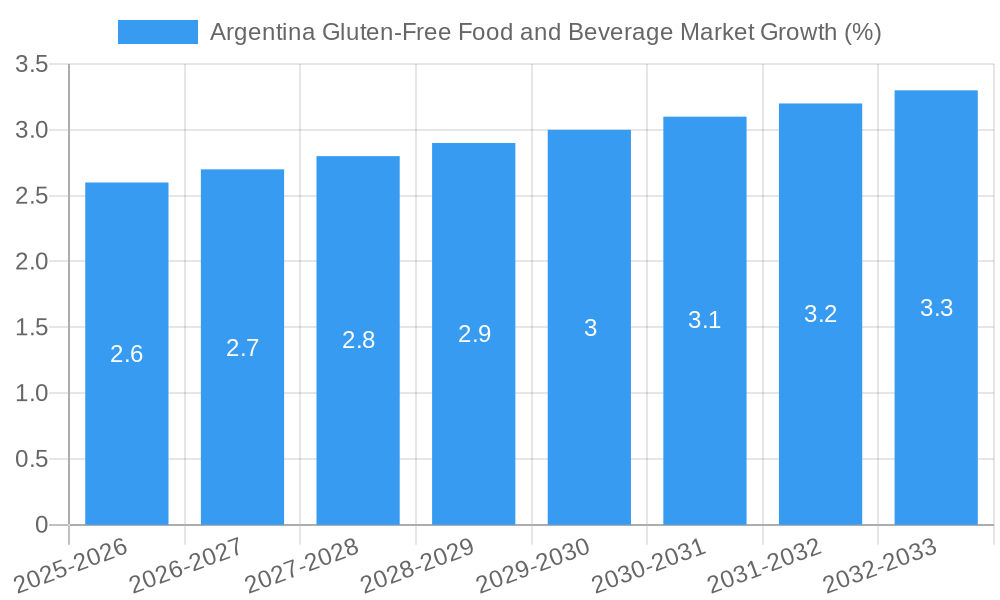

The Argentina gluten-free food and beverage market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 8.56% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of celiac disease and gluten intolerance within the Argentine population fuels increasing demand for specialized products. Furthermore, growing consumer awareness of the health benefits associated with gluten-free diets, such as improved digestion and weight management, is significantly contributing to market expansion. This trend is further amplified by a surge in disposable incomes and a shift towards healthier lifestyles among Argentinian consumers. The market is segmented by product type, encompassing beverages, bread products, cookies and snacks, condiments, seasonings and spreads, dairy and dairy substitutes, meat and meat substitutes, and other gluten-free products. Major players such as Dr. Schar, Kelkin Ltd, General Mills Inc, Bob's Red Mill, and Quinoa Corporation are actively competing in this dynamic market, offering a diverse range of products to cater to evolving consumer preferences. While precise market sizing for 2025 is not provided, considering the CAGR and assuming a reasonable 2024 market size based on global trends, the market value is likely in the tens of millions of USD.

The continued growth of the Argentina gluten-free market is expected to be influenced by several factors. Product innovation, including the development of tastier and more convenient gluten-free options, will be a key driver. The increasing availability of these products in supermarkets and specialized health food stores further enhances accessibility. However, challenges remain, including the relatively higher cost of gluten-free products compared to conventional alternatives, which may limit market penetration among certain consumer segments. Government initiatives promoting awareness of celiac disease and supporting the development of the gluten-free food industry could significantly influence market growth trajectory in the coming years. Furthermore, the potential for increased export opportunities for Argentinian gluten-free food products could also impact market expansion.

Argentina Gluten-Free Food and Beverage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Argentina gluten-free food and beverage market, offering valuable insights for businesses, investors, and stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. This report leverages rigorous data analysis to uncover key trends, challenges, and opportunities within this rapidly expanding market segment. The total market size in 2025 is estimated at XX Million, expected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Argentina Gluten-Free Food and Beverage Market Market Structure & Competitive Dynamics

The Argentina gluten-free food and beverage market is characterized by a moderately concentrated structure, with both international and domestic players vying for market share. Major companies such as Dr Schar, Kelkin Ltd, General Mills Inc, Bob's Red Mill, Quinoa Corporation, Cerealko, Molinos Rio de la Plata, and CeliGourmet (list not exhaustive) contribute significantly to the overall market volume. The market share of these players varies, with xx% held by the top three players in 2025. Innovation within the sector is driven by the need for healthier, tastier, and more affordable gluten-free options, leading to the development of novel ingredients and processing techniques. Regulatory frameworks, particularly regarding labeling and food safety, play a crucial role in shaping market dynamics. The presence of numerous product substitutes (e.g., traditional foods for individuals not strictly adhering to a gluten-free diet) necessitates continuous product innovation and differentiation. End-user trends toward increased health consciousness and awareness of celiac disease and gluten intolerance are major growth drivers. M&A activity in the sector has been relatively moderate, with a few notable deals valued at approximately XX Million in the last five years, primarily focusing on expanding product portfolios and geographical reach.

Argentina Gluten-Free Food and Beverage Market Industry Trends & Insights

The Argentina gluten-free food and beverage market is experiencing robust growth, fueled by several key factors. Rising awareness of celiac disease and gluten intolerance, coupled with increasing health consciousness among consumers, is driving demand for gluten-free products. Technological advancements in food processing and ingredient development are leading to the creation of more palatable and nutritious gluten-free alternatives. Consumer preferences are shifting towards convenient, ready-to-eat options, which is shaping product innovation and marketing strategies. Furthermore, the growing popularity of gluten-free diets among individuals without diagnosed conditions further fuels market expansion. The market's competitive dynamics are characterized by both price competition and product differentiation. Premium products emphasizing organic and ethically sourced ingredients command higher price points. The market penetration of gluten-free products is steadily increasing, with XX% of the total food and beverage market estimated in 2025. This growth trajectory is projected to continue, with a projected CAGR of XX% during the forecast period.

Dominant Markets & Segments in Argentina Gluten-Free Food and Beverage Market

While precise regional data is limited, the Buenos Aires metropolitan area likely constitutes the most dominant market segment due to its higher population density, greater purchasing power, and higher awareness of health-conscious consumption.

- Key Drivers for Dominance:

- High concentration of consumers with celiac disease or gluten intolerance.

- Larger retail infrastructure and distribution networks enabling wider product availability.

- Higher disposable incomes compared to other regions.

By product type, the Bread Products segment is currently the largest, holding approximately xx% of market share in 2025 driven by the staple nature of bread in Argentinian cuisine and the significant demand for gluten-free alternatives. The Cookies and Snacks segment also holds a significant market share, driven by a growing demand for convenient and palatable gluten-free options. Other segments like Beverages, Dairy/Dairy Substitutes, and Condiments/Seasonings/Spreads show considerable potential for future growth, fueled by innovation and expanding consumer base.

Argentina Gluten-Free Food and Beverage Market Product Innovations

Recent innovations focus on improving the taste, texture, and nutritional value of gluten-free products. New ingredient formulations, employing alternative flours and starches, are addressing past shortcomings in product quality. Technological advancements in extrusion and baking processes are enhancing product texture and shelf life. The market is also witnessing the emergence of fortified gluten-free products enriched with vitamins and minerals to address potential nutritional deficiencies. These improvements are enhancing market fit and competitiveness.

Report Segmentation & Scope

The report segments the Argentina gluten-free food and beverage market by product type:

- Beverages: This segment includes gluten-free beers, juices, and other beverages. It's projected to grow at a CAGR of XX% during the forecast period.

- Bread Products: This is the largest segment, encompassing various gluten-free bread, rolls, and buns. Growth is anticipated at a CAGR of XX%.

- Cookies and Snacks: This segment includes gluten-free cookies, crackers, and snack bars. It’s anticipated to experience robust growth, at a CAGR of XX%.

- Condiments, Seasonings, and Spreads: This segment includes gluten-free sauces, dressings, and spreads. Growth is anticipated at a CAGR of XX%.

- Dairy/Dairy Substitutes: This segment comprises gluten-free milk alternatives and yogurt. Projected growth is at a CAGR of XX%.

- Meat/Meat Substitutes: This segment includes gluten-free meat products and plant-based alternatives. Growth is projected at a CAGR of XX%.

- Other Gluten-Free Products: This category encompasses other gluten-free food items not explicitly mentioned above. Growth is projected at a CAGR of XX%.

Each segment's competitive landscape is analyzed, considering key players, their market share, and strategic moves.

Key Drivers of Argentina Gluten-Free Food and Beverage Market Growth

Several factors contribute to the market's robust growth. Rising awareness of celiac disease and gluten intolerance among consumers is a primary driver, demanding more product availability. The increasing health consciousness within the Argentinian population further stimulates demand for gluten-free options. Technological advancements in food processing and ingredient technology are enhancing product quality and appeal, widening consumer acceptance. Government regulations concerning food labeling and food safety also support industry growth, boosting consumer trust and market transparency.

Challenges in the Argentina Gluten-Free Food and Beverage Market Sector

The market faces challenges including the relatively higher cost of gluten-free ingredients and production compared to conventional food products, impacting affordability. Supply chain limitations for specialized ingredients can sometimes lead to shortages and price fluctuations. Intense competition from both established and emerging players requires continuous product innovation and effective marketing strategies to maintain market share. Furthermore, educating consumers about the benefits of gluten-free products and dispelling misconceptions remains a significant hurdle.

Leading Players in the Argentina Gluten-Free Food and Beverage Market Market

- Dr Schar

- Kelkin Ltd

- General Mills Inc

- Bob's Red Mill

- Quinoa Corporation

- Cerealko

- Molinos Rio de la Plata

- CeliGourmet

Key Developments in Argentina Gluten-Free Food and Beverage Market Sector

- 2022 Q4: Launch of a new line of gluten-free pasta by Molinos Rio de la Plata.

- 2023 Q1: Acquisition of a small gluten-free bakery by CeliGourmet.

- 2023 Q3: Introduction of a new range of gluten-free snacks by General Mills Inc. (Further developments to be added upon data availability)

Strategic Argentina Gluten-Free Food and Beverage Market Market Outlook

The Argentina gluten-free food and beverage market exhibits significant growth potential driven by ongoing increases in celiac disease diagnoses and growing health consciousness. Strategic opportunities lie in expanding product portfolios to cater to diverse consumer preferences, focusing on innovative product development to address taste and texture concerns, and strengthening distribution networks to enhance product availability. Investing in research and development to create affordable, high-quality gluten-free products is crucial for long-term success. Furthermore, effective marketing campaigns highlighting the health benefits and versatility of gluten-free products can accelerate market expansion.

Argentina Gluten-Free Food and Beverage Market Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Bread Products

- 1.3. Cookies and Snacks

- 1.4. Condiments, Seasonings and Spreads

- 1.5. Dairy/Dairy Substitutes

- 1.6. Meat/Meat Substitutes

- 1.7. Other Gluten Products

Argentina Gluten-Free Food and Beverage Market Segmentation By Geography

- 1. Argentina

Argentina Gluten-Free Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Gluten free Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Gluten-Free Food and Beverage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Bread Products

- 5.1.3. Cookies and Snacks

- 5.1.4. Condiments, Seasonings and Spreads

- 5.1.5. Dairy/Dairy Substitutes

- 5.1.6. Meat/Meat Substitutes

- 5.1.7. Other Gluten Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dr Schar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kelkin Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bob's Red Mill

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quinoa Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cerealko

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Molinos Rio de la Plata

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CeliGourmet*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dr Schar

List of Figures

- Figure 1: Argentina Gluten-Free Food and Beverage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Gluten-Free Food and Beverage Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Argentina Gluten-Free Food and Beverage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Gluten-Free Food and Beverage Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the Argentina Gluten-Free Food and Beverage Market?

Key companies in the market include Dr Schar, Kelkin Ltd, General Mills Inc, Bob's Red Mill, Quinoa Corporation, Cerealko, Molinos Rio de la Plata, CeliGourmet*List Not Exhaustive.

3. What are the main segments of the Argentina Gluten-Free Food and Beverage Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

Growing Demand for Gluten free Food and Beverages.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Gluten-Free Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Gluten-Free Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Gluten-Free Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Argentina Gluten-Free Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence