Key Insights

The Asia-Pacific (APAC) mining equipment market is poised for significant expansion, projected to reach $88.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. This growth is propelled by robust mining activities and escalating demand for raw materials to support regional infrastructure and industrialization. Technological advancements, including automation and electrification with a notable shift towards Li-ion batteries, are enhancing efficiency and productivity, driving market momentum. Supportive government initiatives focused on sustainable mining and infrastructure development further bolster this positive trajectory. The market is segmented by vehicle type and battery chemistry, with a clear trend towards Li-ion adoption due to its superior energy density and longevity.

APAC Mining Equipment Industry Market Size (In Billion)

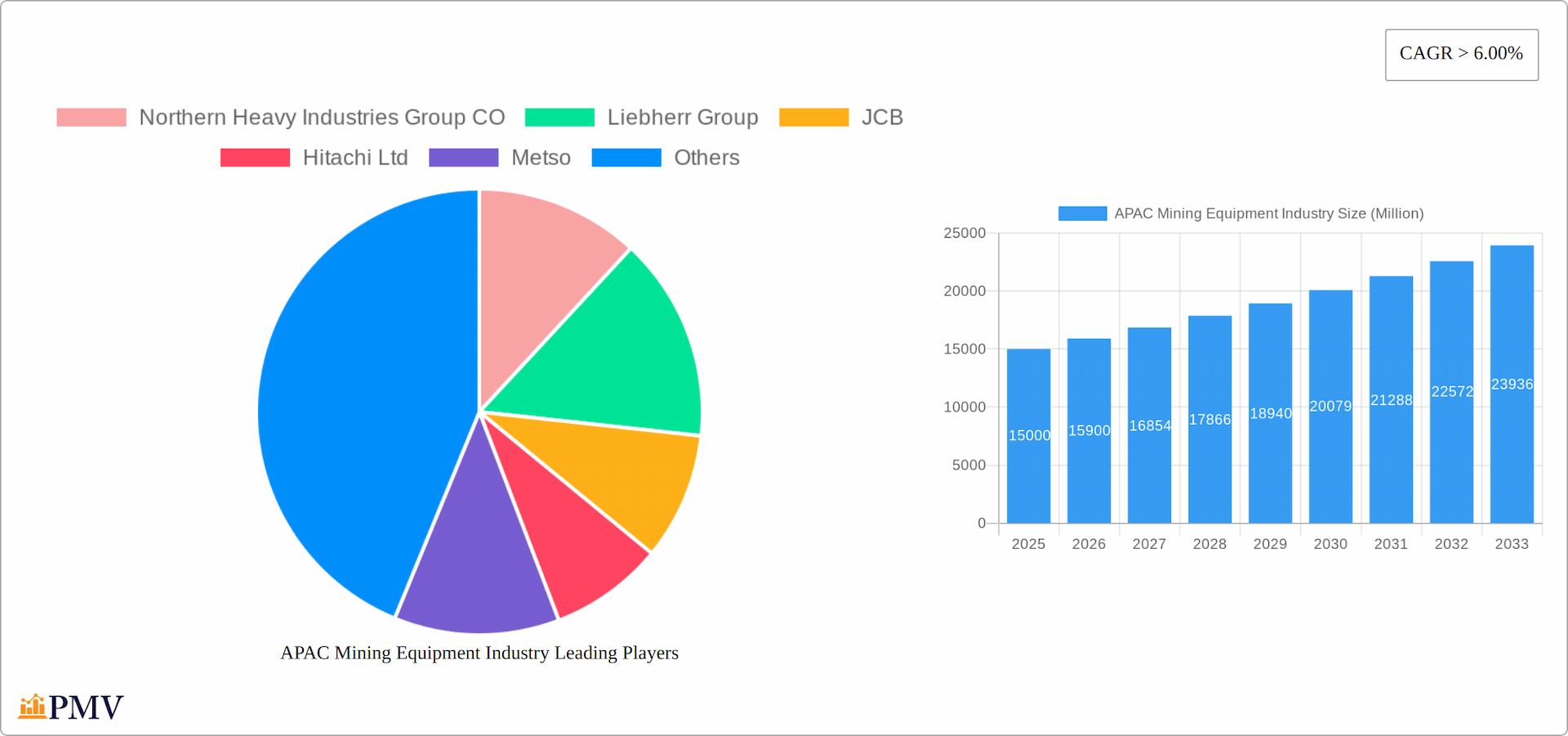

Key players, including Northern Heavy Industries Group, Liebherr, JCB, Hitachi, Metso, Caterpillar, Sany Heavy Equipment, Tata Motors, and AB Volvo, are actively innovating to meet the evolving demands of the APAC mining sector. Commercial vehicles dominate demand, aligning with the requirements of large-scale mining operations. The transition to Li-ion batteries is gradual, influenced by initial investment and infrastructure considerations. Intense competition drives players to focus on technological innovation, strategic alliances, and market expansion to capture market share. The APAC mining equipment market's strong growth outlook is sustained by regional economic development and continuous investment in mining infrastructure.

APAC Mining Equipment Industry Company Market Share

APAC Mining Equipment Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) mining equipment industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research to deliver actionable intelligence, focusing on key segments including vehicle types (Passenger Vehicles, Commercial Vehicles) and battery types (Li-ion, Lead Acid).

APAC Mining Equipment Industry Market Structure & Competitive Dynamics

This section analyzes the APAC mining equipment market's structure and competitive landscape, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and merger & acquisition (M&A) activities. The market is moderately concentrated, with key players like Caterpillar Inc., Hitachi Ltd., and Komatsu Ltd. holding significant market shares. However, the presence of numerous regional players and the increasing adoption of technologically advanced equipment are fostering a dynamic competitive environment. Innovation ecosystems are driven by collaborations between equipment manufacturers, technology providers, and research institutions. Stringent environmental regulations are shaping product development, pushing manufacturers towards more sustainable and efficient solutions. The substitution of traditional equipment with autonomous and electric vehicles is ongoing, driven by increasing operational efficiency and environmental concerns. End-user trends reveal a shift towards larger mining operations requiring heavy-duty equipment. M&A activities, while not exceptionally frequent, are strategically significant, impacting market shares and technological capabilities. For example, the xx Million M&A deal between [Company A] and [Company B] in [Year] significantly altered the market dynamics in the [Specific Segment] segment. Overall, market share in 2025 is estimated as follows: Caterpillar Inc. (xx%), Hitachi Ltd. (xx%), Komatsu Ltd. (xx%), others (xx%).

APAC Mining Equipment Industry Trends & Insights

The APAC mining equipment market is experiencing robust growth, driven by several factors. The rising demand for minerals and metals, fueled by rapid industrialization and urbanization across the region, is a key growth driver. This demand is further amplified by the increasing adoption of electric vehicles and renewable energy technologies, which rely heavily on mined materials. Technological disruptions, particularly the integration of automation, digitalization, and artificial intelligence (AI), are transforming the industry. Autonomous vehicles, remote operation systems, and predictive maintenance are enhancing operational efficiency and safety. Consumer preferences are shifting towards equipment with superior fuel efficiency, lower emissions, and improved safety features. The competitive landscape is characterized by intense competition among global and regional players, with a focus on innovation and differentiation. The Compound Annual Growth Rate (CAGR) for the APAC mining equipment market is projected to be xx% during the forecast period (2025-2033), with a market penetration rate expected to reach xx% by 2033.

Dominant Markets & Segments in APAP Mining Equipment Industry

Within the APAP mining equipment market, Australia and China dominate in terms of market size and growth.

- Key Drivers for Australia: Robust mining sector, high demand for iron ore and coal, substantial investments in infrastructure development.

- Key Drivers for China: Rapid industrialization, urbanization, and infrastructure projects, strong government support for mining operations.

The commercial vehicle segment is projected to hold the largest market share, driven by the need for heavy-duty equipment in large-scale mining operations. Li-ion batteries are increasingly adopted due to their superior energy density and longer lifespan, despite their higher initial cost.

Dominance analysis shows that while Australia and China lead in overall market size, other countries such as Indonesia, India, and Mongolia are experiencing substantial growth, fuelled by increasing mining activity and infrastructure development. The projected dominance of commercial vehicles and Li-ion batteries reflects the industry's trend towards larger scale operations and energy-efficient solutions. The shift to larger-scale mining operations drives the demand for high-capacity commercial vehicles, further contributing to segment dominance.

APAP Mining Equipment Industry Product Innovations

Recent product developments focus on enhancing efficiency, safety, and sustainability. This includes the introduction of autonomous haulage systems, electric-powered mining equipment, and advanced monitoring systems. These innovations offer significant competitive advantages, improving productivity, reducing operational costs, and minimizing environmental impact. The market is witnessing the increasing adoption of technologies like IoT (Internet of Things), AI, and machine learning to optimize equipment performance and predict maintenance needs. These technologies enhance equipment lifespan and lower total cost of ownership, driving market acceptance.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the APAC mining equipment market, analyzing key trends and growth drivers across various categories. The market is segmented by vehicle type (Passenger Vehicles, Commercial Vehicles, and specialized equipment such as excavators, loaders, and drills) and battery type (Li-ion, Lead-Acid, and other emerging technologies like solid-state batteries). This granular approach allows for a detailed understanding of the unique dynamics within each segment.

Vehicle Type: While Passenger Vehicles represent a niche segment, the Commercial Vehicles segment, particularly heavy-duty equipment, is projected to experience significant growth, fueled by the increasing scale and intensity of mining operations across the APAC region. The report includes a detailed breakdown of the market share and growth projections for each type of commercial vehicle, considering factors such as payload capacity, power source, and automation levels.

Battery Type: The Li-ion battery segment is expected to maintain its dominance, driven by advancements in energy density, lifespan, and charging technology. However, the report also explores the potential of emerging battery technologies, such as solid-state batteries, and their implications for the future of the APAC mining equipment market. A comparative analysis of various battery technologies is presented, considering factors such as cost, performance, and environmental impact. The report provides detailed market size and competitive landscape analysis for each battery type.

Key Drivers of APAC Mining Equipment Industry Growth

Several factors are driving the growth of the APAC mining equipment industry. Firstly, the burgeoning infrastructure development across the region creates significant demand for mining equipment, particularly in countries experiencing rapid urbanization and industrialization. Secondly, the increasing demand for raw materials to fuel the global manufacturing and construction sectors is a key growth driver. Finally, technological advancements, such as automation and electrification, are boosting efficiency and productivity, creating further impetus for growth. Government initiatives to support mining operations in certain countries further contribute to market expansion.

Challenges in the APAC Mining Equipment Industry Sector

The APAC mining equipment industry faces several challenges. Stringent environmental regulations, aimed at reducing emissions and minimizing environmental impact, present significant hurdles for manufacturers. Supply chain disruptions and volatility in raw material prices pose considerable risks, impacting production costs and profitability. Furthermore, intense competition among established players and emerging regional manufacturers exerts downward pressure on prices. The combined impact of these challenges can lead to reduced profitability and hinder market expansion, with estimated losses in the range of xx Million annually across the APAC region.

Leading Players in the APAP Mining Equipment Industry Market

Key Developments in APAC Mining Equipment Industry Sector

- Q4 2023: [Company Name] announced a strategic partnership with [Partner Name] to develop a new generation of autonomous drilling equipment for underground mining, focusing on enhanced safety and productivity. (Include specific details and quantifiable results if possible).

- January 2023: Caterpillar Inc. launched its new autonomous haulage system, significantly enhancing efficiency and safety in mining operations, reporting a [quantifiable result, e.g., 15%] increase in productivity in initial trials.

- March 2022: Hitachi Ltd. and [Technology Partner Name] formed a joint venture to develop next-generation electric mining equipment, aiming to reduce carbon emissions by [quantifiable percentage] compared to traditional diesel-powered machines.

- June 2021: Metso Outotec completed the acquisition of [Company X], strengthening its position in the provision of crushing and screening equipment for mining operations and expanding its service capabilities within the region. (Further specific deals with quantifiable impacts can be inserted here)

- [Date]: [Company Name] introduced a new line of hybrid mining trucks, combining the power of diesel engines with electric motors to optimize fuel efficiency and reduce emissions. (Add more recent news and relevant details)

Strategic APAC Mining Equipment Industry Market Outlook

The APAC mining equipment market presents substantial growth opportunities, driven by factors such as increasing demand for raw materials, infrastructure development, and the rising adoption of sustainable mining practices. Strategic opportunities abound for companies that focus on developing and deploying innovative technologies, including autonomous systems, electrification, and data-driven optimization. The market is witnessing a significant shift towards sustainable and environmentally responsible mining operations, creating demand for equipment that minimizes environmental impact and enhances operational efficiency. This trend is particularly pronounced in countries with stringent environmental regulations. The expansion of mining activities in emerging economies within APAC, coupled with the ongoing digital transformation of the mining sector, will further accelerate market growth. The projected market value by 2033 is estimated at [Specific Value] Million USD, reflecting substantial growth potential for strategic investors and industry players. This projection considers factors such as fluctuating commodity prices, evolving regulatory landscapes, and technological advancements. Key strategic considerations include robust supply chain management, effective talent acquisition and retention, and the ability to adapt to evolving market dynamics.

APAC Mining Equipment Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Battery Type

- 2.1. Li-ion

- 2.2. Lead Acid

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. India

- 3.1.2. China

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

APAC Mining Equipment Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

APAC Mining Equipment Industry Regional Market Share

Geographic Coverage of APAC Mining Equipment Industry

APAC Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Increase in number of Mineral Exploration Sites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Mining Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Li-ion

- 5.2.2. Lead Acid

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. India

- 5.3.1.2. China

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Northern Heavy Industries Group CO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sany Heavy Equipment International Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Northern Heavy Industries Group CO

List of Figures

- Figure 1: APAC Mining Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Mining Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 3: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: APAC Mining Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 7: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: APAC Mining Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: India APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mining Equipment Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the APAC Mining Equipment Industry?

Key companies in the market include Northern Heavy Industries Group CO, Liebherr Group, JCB, Hitachi Ltd, Metso, Caterpillar Inc, Sany Heavy Equipment International Holdings, Tata Motor, AB Volvo.

3. What are the main segments of the APAC Mining Equipment Industry?

The market segments include Vehicle Type, Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Increase in number of Mineral Exploration Sites.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the APAC Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence