Key Insights

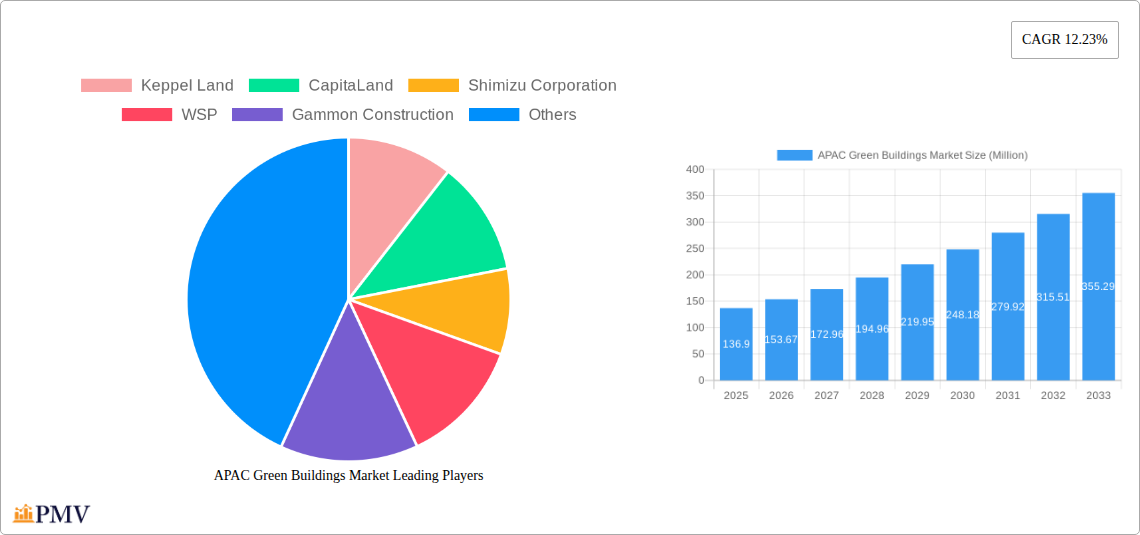

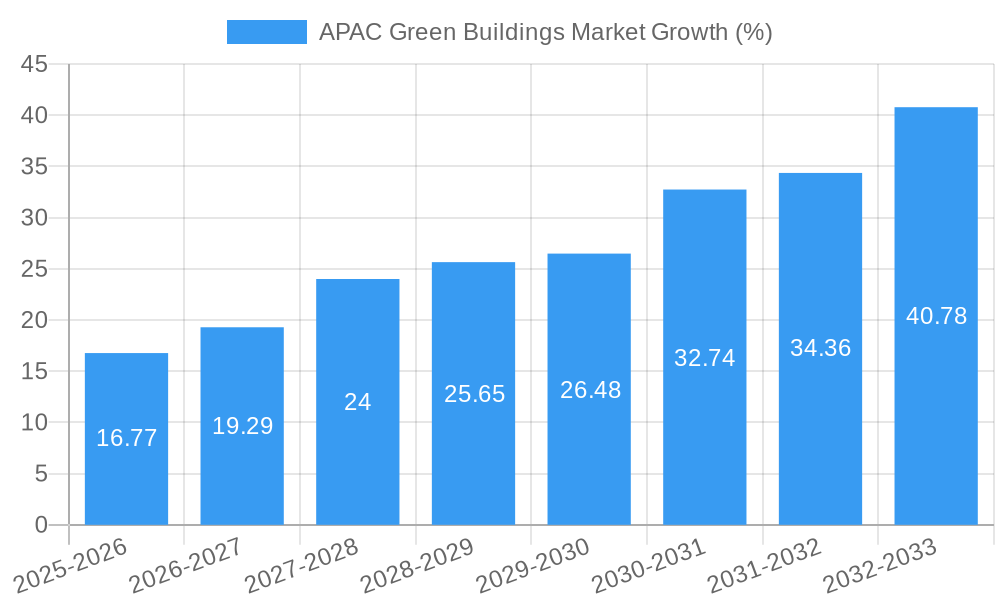

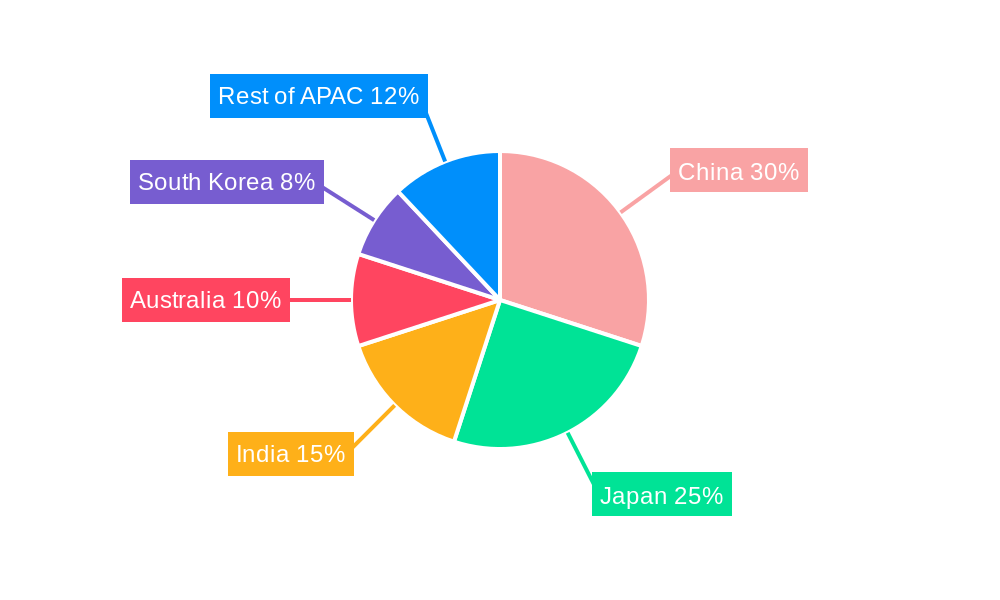

The APAC green buildings market is experiencing robust growth, projected to reach a market size of $136.90 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.23%. This expansion is fueled by several key drivers. Increasing government regulations promoting sustainable construction practices across countries like China, Japan, India, Australia and South Korea are significantly influencing market growth. Growing environmental awareness among consumers and businesses, coupled with a rising demand for energy-efficient and environmentally friendly buildings, further bolsters market expansion. Technological advancements in green building materials and construction techniques, such as the integration of solar systems and improved building insulation, are also contributing factors. The market is segmented by product type (exterior, interior, and others like building and solar systems) and end-user (residential, office, retail, institutional, and others). The dominance of specific segments varies across regions. For example, the residential sector is likely to be a significant driver in high-population growth areas like India and China, while the office and institutional segments might hold greater prominence in developed economies like Japan and Australia. Competitive landscape analysis reveals key players including Keppel Land, CapitaLand, Shimizu Corporation, WSP, Gammon Construction, Obayashi Corporation, Sun Hung Kai Properties, Lendlease, Swire Properties, and Sino Group, among others, contributing to market dynamism through innovation and project development.

Looking ahead to 2033, the APAC green buildings market is poised for continued expansion, driven by sustained government support, technological advancements, and a burgeoning demand for sustainable infrastructure. Challenges may include initial higher upfront costs associated with green building technologies and a potential skills gap in the workforce for specialized green construction practices. However, long-term cost savings in energy consumption and reduced environmental impact are expected to outweigh these challenges, ensuring the market's sustained trajectory. Regional variations in growth rates will likely persist, mirroring differences in economic development, regulatory frameworks, and consumer preferences. Strategic partnerships between developers, technology providers, and governments will play a pivotal role in unlocking the full potential of this market.

APAC Green Buildings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) green buildings market, covering the period from 2019 to 2033. With a focus on market size, growth drivers, challenges, and key players, this report offers invaluable insights for businesses, investors, and policymakers involved in the sustainable construction sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects the market outlook through the forecast period (2025-2033). The total market value is expected to reach xx Million by 2033.

APAC Green Buildings Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the APAC green buildings market, examining market concentration, innovation ecosystems, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller specialized firms. Key players include Keppel Land, CapitaLand, Shimizu Corporation, WSP, Gammon Construction, Obayashi Corporation, Sun Hung Kai Properties, Lendlease, Swire Properties, and Sino Group, along with 73 other companies.

Market concentration is moderate, with a few dominant players holding significant market share, but numerous smaller companies actively participating. Innovation is driven by advancements in building materials, technologies like solar systems and building management systems (BMS), and increasing demand for sustainable solutions. Regulatory frameworks vary across APAC nations, impacting the adoption of green building practices and influencing the market dynamics. The market also witnesses continuous M&A activities and strategic partnerships, with deal values reaching xx Million in recent years. Examples of such activities include:

- Increased focus on sustainable procurement policies by governments across APAC.

- Consolidation among smaller companies through acquisitions by larger players.

- Joint ventures to develop innovative green building technologies.

- Strategic partnerships for technology licensing and distribution.

APAC Green Buildings Market Industry Trends & Insights

The APAC green buildings market is experiencing significant growth, driven by increasing environmental awareness, stringent government regulations, and rising demand for energy-efficient buildings. The market’s Compound Annual Growth Rate (CAGR) during the forecast period is estimated to be xx%. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and Internet of Things (IoT) technologies, are further propelling the market's expansion. Consumer preferences are shifting towards sustainable and environmentally friendly buildings, creating a growing demand for green building materials and technologies. The market penetration of green building certifications like LEED and Green Mark is increasing, further boosting market growth. Competitive dynamics are shaped by innovation, pricing strategies, and brand reputation, leading to continuous improvement in the quality and affordability of green building solutions.

Dominant Markets & Segments in APAC Green Buildings Market

The APAC green building market is dominated by China and other rapidly developing economies within the region. The residential and office segments represent the largest portions of the market, driven by increasing urbanization and the construction of new buildings.

By Product:

- Exterior Products: This segment is experiencing significant growth due to increasing demand for energy-efficient facades and roofing systems. Key drivers include government incentives and building codes promoting energy efficiency.

- Interior Products: Growing demand for eco-friendly interior design materials and sustainable furnishings is driving this market. Consumer preferences for healthy indoor environments are significant factors.

- Other Products (Building Systems, Solar Systems, etc.): This segment is marked by rapid innovation, with rising adoption of renewable energy systems and smart building technologies. Government support for renewable energy is driving growth.

By End User:

- Residential: The residential segment is expanding due to the increasing demand for eco-friendly housing and rising awareness of environmental sustainability among homebuyers.

- Office: Businesses are adopting green building practices to attract and retain talent, while governments are also mandating energy efficiency standards for office buildings.

- Retail: The retail sector is seeing increased adoption of green building practices to improve brand image and reduce operational costs.

- Institutional: Governments and educational institutions are increasingly adopting green building principles, leading to significant growth in this sector.

- Other End Users: This segment includes healthcare, hospitality, and industrial facilities, all of which are showing increased adoption of green building technologies and solutions.

APAC Green Buildings Market Product Innovations

The APAC green buildings market is witnessing continuous product innovation, focusing on enhancing energy efficiency, reducing carbon footprint, and improving indoor environmental quality. New materials with improved thermal performance and recycled content are being developed. Smart building technologies that optimize energy consumption and improve building management are gaining traction. These innovations are driven by a need for cost-effective and sustainable solutions to meet the growing demand for green buildings.

Report Segmentation & Scope

This report segments the APAC green buildings market by product type (exterior products, interior products, and other products, including building systems and solar systems) and by end-user (residential, office, retail, institutional, and other end users). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed, revealing valuable insights into the market’s future trajectory. The report provides detailed market size estimations and growth forecasts for each segment, identifying market leaders and emerging players in each sector.

Key Drivers of APAC Green Buildings Market Growth

Several factors drive the growth of the APAC green buildings market. Stringent government regulations promoting energy efficiency and sustainability are significant catalysts. Growing environmental awareness among consumers and businesses creates substantial demand for green buildings. Technological advancements in building materials and smart building technologies are further enhancing the appeal and feasibility of green building projects. Economic incentives like tax breaks and subsidies encourage investment in green building projects.

Challenges in the APAC Green Buildings Market Sector

Despite significant growth potential, the APAC green buildings market faces several challenges. The high initial cost of implementing green building technologies can be a barrier for some developers and building owners. Supply chain disruptions and the availability of eco-friendly materials can also pose constraints. Furthermore, a lack of awareness and skilled labor in some regions can slow down adoption rates. These factors, along with regulatory inconsistencies across different APAC nations, contribute to market challenges.

Leading Players in the APAC Green Buildings Market Market

- Keppel Land

- CapitaLand

- Shimizu Corporation

- WSP

- Gammon Construction

- Obayashi Corporation

- Sun Hung Kai Properties

- Lendlease

- Swire Properties

- Sino Group

- 73 Other Companies

Key Developments in APAC Green Buildings Market Sector

- April 2023: Starbucks unveils its first greener stores in Asia-Pacific, showcasing the increasing corporate commitment to sustainability and driving demand for green building solutions. This initiative demonstrates the growing market adoption of green building practices among large corporations.

- February 2023: GHD partners with the GBCA, highlighting the growing collaboration between industry players and organizations promoting sustainable building practices. This partnership indicates a growing commitment towards circular economy principles within the APAC green building market.

Strategic APAC Green Buildings Market Outlook

The APAC green buildings market holds significant growth potential driven by supportive government policies, technological advancements, and heightened environmental awareness. Strategic opportunities exist for companies focusing on innovative green building materials, smart building technologies, and sustainable construction practices. The market is expected to experience a substantial increase in demand for energy-efficient and environmentally friendly buildings across various sectors. Investment in research and development of sustainable technologies and workforce training will be key for capitalizing on the market's potential.

APAC Green Buildings Market Segmentation

-

1. Product

- 1.1. Exterior Products

- 1.2. Interior products

- 1.3. Other Pr

-

2. End User

- 2.1. Residential

- 2.2. Office

- 2.3. Retail

- 2.4. Institutional

- 2.5. Other End Users

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of APAC

APAC Green Buildings Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of APAC

APAC Green Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy Efficiency in Construction Driving the Market; Flexibility and Customization Options Driving the Market

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Suitable Land for Construction Hindering the Market; Lower Quality Compared to Traditional Construction

- 3.4. Market Trends

- 3.4.1. The Commercial Segment’s Increasing Demand for Green Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Exterior Products

- 5.1.2. Interior products

- 5.1.3. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Office

- 5.2.3. Retail

- 5.2.4. Institutional

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of APAC

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Exterior Products

- 6.1.2. Interior products

- 6.1.3. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Office

- 6.2.3. Retail

- 6.2.4. Institutional

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Exterior Products

- 7.1.2. Interior products

- 7.1.3. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Office

- 7.2.3. Retail

- 7.2.4. Institutional

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Exterior Products

- 8.1.2. Interior products

- 8.1.3. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Office

- 8.2.3. Retail

- 8.2.4. Institutional

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Exterior Products

- 9.1.2. Interior products

- 9.1.3. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Office

- 9.2.3. Retail

- 9.2.4. Institutional

- 9.2.5. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Exterior Products

- 10.1.2. Interior products

- 10.1.3. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Office

- 10.2.3. Retail

- 10.2.4. Institutional

- 10.2.5. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of APAC APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Exterior Products

- 11.1.2. Interior products

- 11.1.3. Other Pr

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Office

- 11.2.3. Retail

- 11.2.4. Institutional

- 11.2.5. Other End Users

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Rest of APAC

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. China APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Japan APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. India APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. South Korea APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of APAC APAC Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Keppel Land

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 CapitaLand

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Shimizu Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 WSP

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Gammon Construction

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Obayashi Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Sun Hung Kai Properties**List Not Exhaustive 7 3 Other Companie

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Lendlease

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Swire Properties

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Sino Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Keppel Land

List of Figures

- Figure 1: Global APAC Green Buildings Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 3: China APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Japan APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Japan APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: India APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 7: India APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South Korea APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South Korea APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of APAC APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of APAC APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: China APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 15: China APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: China APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 17: China APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: China APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: China APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: China APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 21: China APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Japan APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Japan APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Japan APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Japan APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Japan APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 27: Japan APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 28: Japan APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Japan APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: India APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 31: India APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: India APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 33: India APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: India APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: India APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: India APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 37: India APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Australia APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 39: Australia APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 40: Australia APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Australia APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Australia APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 43: Australia APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Australia APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Australia APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: South Korea APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 47: South Korea APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 48: South Korea APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 49: South Korea APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: South Korea APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 51: South Korea APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 52: South Korea APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 53: South Korea APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Rest of APAC APAC Green Buildings Market Revenue (Million), by Product 2024 & 2032

- Figure 55: Rest of APAC APAC Green Buildings Market Revenue Share (%), by Product 2024 & 2032

- Figure 56: Rest of APAC APAC Green Buildings Market Revenue (Million), by End User 2024 & 2032

- Figure 57: Rest of APAC APAC Green Buildings Market Revenue Share (%), by End User 2024 & 2032

- Figure 58: Rest of APAC APAC Green Buildings Market Revenue (Million), by Geography 2024 & 2032

- Figure 59: Rest of APAC APAC Green Buildings Market Revenue Share (%), by Geography 2024 & 2032

- Figure 60: Rest of APAC APAC Green Buildings Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Rest of APAC APAC Green Buildings Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global APAC Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: APAC Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 27: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 35: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global APAC Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 39: Global APAC Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Global APAC Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global APAC Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Green Buildings Market?

The projected CAGR is approximately 12.23%.

2. Which companies are prominent players in the APAC Green Buildings Market?

Key companies in the market include Keppel Land, CapitaLand, Shimizu Corporation, WSP, Gammon Construction, Obayashi Corporation, Sun Hung Kai Properties**List Not Exhaustive 7 3 Other Companie, Lendlease, Swire Properties, Sino Group.

3. What are the main segments of the APAC Green Buildings Market?

The market segments include Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Energy Efficiency in Construction Driving the Market; Flexibility and Customization Options Driving the Market.

6. What are the notable trends driving market growth?

The Commercial Segment’s Increasing Demand for Green Buildings.

7. Are there any restraints impacting market growth?

Limited Availability of Suitable Land for Construction Hindering the Market; Lower Quality Compared to Traditional Construction.

8. Can you provide examples of recent developments in the market?

April 2023: The world’s largest coffee company, Starbucks, has unveiled its first greener stores in Asia-Pacific as a part of a global rollout of its greener store framework that has grown to more than 3,500 locations across 20 markets. The five new greener stores, located in Singapore (Singapore), Thailand (Thailand), and Vietnam (Vietnam), are among the first in Starbucks Asia-Pacific region. More than 20 other Starbucks stores are expected to receive greener store certifications later this year. With this latest round of certifications, Starbucks is well on track to reaching its goal of having 10,000 greener stores worldwide by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Green Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Green Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Green Buildings Market?

To stay informed about further developments, trends, and reports in the APAC Green Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence