Key Insights

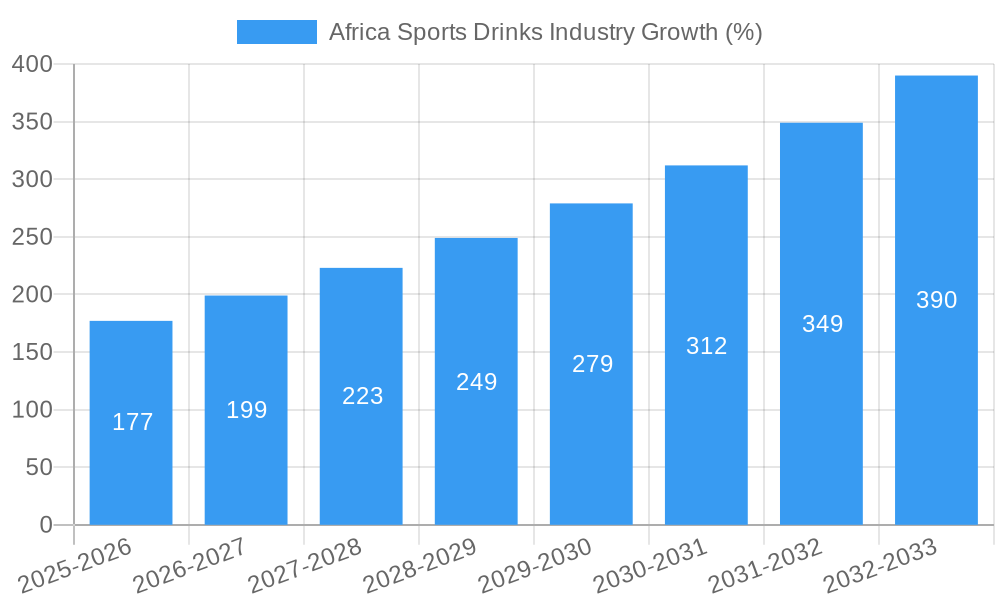

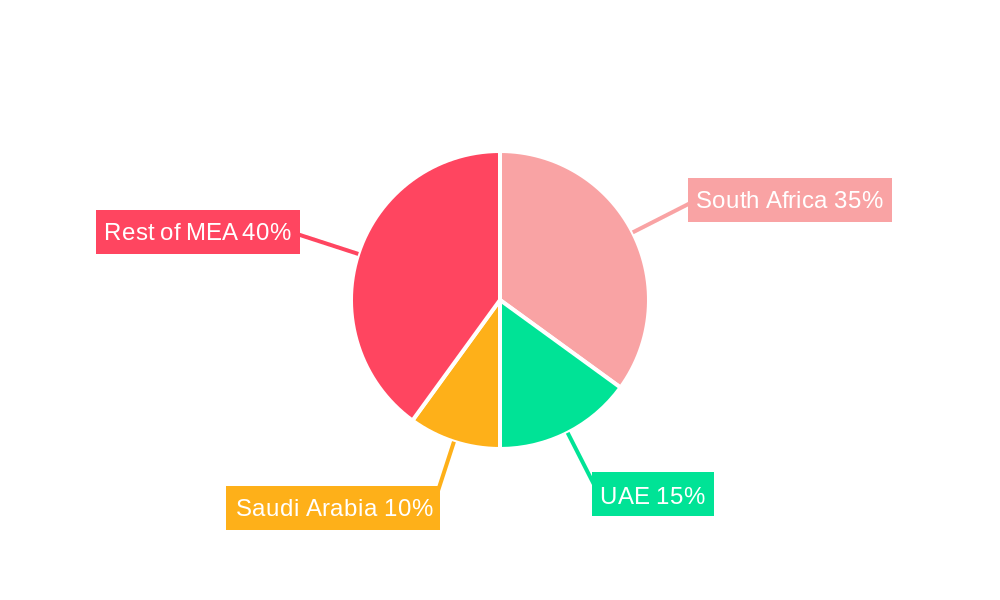

The African sports drinks market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.55% from 2025 to 2033. This surge is driven by several key factors. Firstly, a rising health-conscious population increasingly prioritizes hydration and electrolyte replenishment, particularly among athletes and fitness enthusiasts. Secondly, the growing popularity of sports and fitness activities across the continent fuels demand. The increasing urbanization and rising disposable incomes also contribute significantly, enabling greater access to premium sports drinks. Finally, innovative product development, encompassing electrolyte-enhanced waters, protein-based drinks, and varied packaging options (PET bottles, cans, aseptic packages), caters to diverse consumer preferences and enhances market appeal. Growth is particularly strong in regions with established sporting cultures and higher per capita incomes, like South Africa and the UAE.

However, certain challenges persist. Pricing pressures from competing beverage categories and the fluctuating availability of raw materials can impede growth. Furthermore, distribution infrastructure limitations, especially in rural areas, restrict market penetration. Nevertheless, the long-term outlook remains positive. Strategic partnerships between manufacturers and retailers, coupled with targeted marketing campaigns highlighting the health and performance benefits of sports drinks, will be crucial in further driving market expansion. The segment showing the most growth is likely the electrolyte-enhanced water category, given the current health trends and focus on natural ingredients. Major players like PepsiCo, Coca-Cola, and local brands are vying for market share through strategic product launches and expansion efforts, intensifying competition and shaping market dynamics.

Africa Sports Drinks Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Africa sports drinks industry, covering the period 2019-2033, with a focus on market size, growth drivers, competitive landscape, and future outlook. The report segments the market by soft drink type (Electrolyte-Enhanced Water, Hypertonic, Hypotonic, Isotonic, Protein-based Sport Drinks), packaging type (Aseptic packages, Metal Can, PET Bottles), and distribution channel (Convenience Stores, Online Retail, Specialty Stores, Supermarket/Hypermarket, Others). Key players such as Kingsley Beverages Limited, Aje Group, Tiger Brands Ltd, PepsiCo Inc, Oshee Polska Sp Z O O, Suntory Holdings Limited, The Coca-Cola Company, Thirsti Water (Pty) Ltd, Ekhamanzi Springs (Pty) Ltd, BOS Brands (Pty) Ltd, and Congo Brands are profiled, offering valuable insights into their strategies and market share. The report is essential for industry stakeholders, investors, and anyone seeking to understand this dynamic and growing market.

Africa Sports Drinks Industry Market Structure & Competitive Dynamics

The African sports drinks market exhibits a moderately concentrated structure, with a few multinational corporations and several regional players vying for market share. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI) which shows a value of xx, indicating a moderately concentrated market (calculation methodology detailed in the report). The industry's innovation ecosystem is characterized by a mix of established brands introducing new product variations and smaller, agile companies focusing on niche segments. Regulatory frameworks, varying across different African nations, significantly impact market access and product development. The market experiences competition from substitute products like water, fruit juices, and energy drinks, shaping consumer preferences. End-user trends favor healthier, functional beverages with low sugar content and natural ingredients. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values totaling approximately $xx Million between 2019 and 2024. Key M&A activities and their impact on market dynamics are analyzed in detail. The report includes a detailed breakdown of market share for key players, with xx% belonging to The Coca-Cola Company, xx% to PepsiCo, and the remaining xx% distributed amongst other players.

Africa Sports Drinks Industry Industry Trends & Insights

The Africa sports drinks market demonstrates robust growth, driven by increasing health consciousness, rising disposable incomes, and the expanding sports and fitness culture. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was xx%, and it is projected to be xx% from 2025-2033. Technological disruptions, such as improved packaging and enhanced product formulations, are further contributing to market expansion. Consumer preferences are shifting towards healthier options with lower sugar content and functional benefits, leading to the rise of electrolyte-enhanced waters and protein-based sports drinks. This trend also influences packaging choices, with a growing preference for PET bottles due to their convenience and recyclability. Market penetration of sports drinks in key African countries is also analyzed, with xx% market penetration in South Africa and xx% in Nigeria. Competitive dynamics are shaped by pricing strategies, brand loyalty, and the introduction of innovative products. The report offers further insights into these developments and their impact on the market's future trajectory.

Dominant Markets & Segments in Africa Sports Drinks Industry

Leading Region: South Africa dominates the African sports drinks market, driven by factors including a robust economy, developed infrastructure, and a high level of sports participation. Nigeria represents another key market with significant growth potential.

Leading Country: South Africa's dominance stems from its higher per capita income, extensive distribution networks, and the presence of major players.

Leading Segment (Soft Drink Type): Isotonic drinks currently hold the largest market share, owing to their popularity among athletes and fitness enthusiasts. However, Electrolyte-enhanced waters are gaining traction due to their health benefits.

Leading Segment (Packaging Type): PET bottles are the dominant packaging format due to their cost-effectiveness, convenience, and widespread availability.

Leading Segment (Distribution Channel): Supermarket/hypermarkets are the primary distribution channel, followed by convenience stores, reflecting widespread market access.

Key drivers for dominance in each segment are further explored:

- Economic Policies: Favorable government policies and investments in infrastructure are crucial for market expansion.

- Infrastructure: Effective transportation and distribution networks are vital for reaching diverse consumer segments.

- Consumer Behavior: Shifting preferences towards healthier options and increased sports participation contribute significantly.

Africa Sports Drinks Industry Product Innovations

Recent product innovations in the African sports drinks market focus on functional benefits, catering to consumer preferences for health and wellness. Companies are introducing sports drinks with enhanced electrolytes, added vitamins, and natural ingredients. Technological advancements in packaging are also noticeable, with a focus on sustainable and convenient options such as recyclable PET bottles and aseptic packages that extend shelf life. These developments enhance product shelf life and appeal, contributing to the market's expansion.

Report Segmentation & Scope

The report segments the African sports drinks market based on soft drink type, packaging type, and distribution channel.

Soft Drink Type: The market is segmented into Electrolyte-Enhanced Water, Hypertonic, Hypotonic, Isotonic, and Protein-based Sport Drinks, each with unique growth projections and competitive dynamics. The Isotonic segment is projected to witness the highest growth owing to increasing fitness trends.

Packaging Type: The report analyzes Aseptic packages, Metal Cans, and PET Bottles, with PET bottles holding a dominant share because of consumer preference.

Distribution Channel: Convenience Stores, Online Retail, Specialty Stores, Supermarket/Hypermarket, and Others are examined, with Supermarket/Hypermarkets maintaining a strong lead. Each segment’s growth is projected based on several factors, including consumer habits and retail infrastructure.

Key Drivers of Africa Sports Drinks Industry Growth

The growth of the African sports drinks market is driven by several factors: Rising disposable incomes are fueling increased spending on healthier beverages. The growing popularity of sports and fitness activities is expanding the consumer base for sports drinks. Furthermore, changing consumer preferences towards healthier, functional beverages are bolstering demand. Technological advancements in product formulation and packaging are also important.

Challenges in the Africa Sports Drinks Industry Sector

The African sports drinks market faces challenges such as fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions can affect product availability and distribution. Intense competition from established players and new entrants presents a challenge to market share. Furthermore, the regulatory environment varies across different countries, potentially creating hurdles for market entry and expansion. These challenges are quantified throughout the report using sales data from 2019-2024.

Leading Players in the Africa Sports Drinks Industry Market

- Kingsley Beverages Limited

- Aje Group

- Tiger Brands Ltd

- PepsiCo Inc

- Oshee Polska Sp Z O O

- Suntory Holdings Limited

- The Coca-Cola Company

- Thirsti Water (Pty) Ltd

- Ekhamanzi Springs (Pty) Ltd

- BOS Brands (Pty) Ltd

- Congo Brands

Key Developments in Africa Sports Drinks Industry Sector

April 2023: Congo LLC announced an USD 8.25 Million investment to relocate and expand its Louisville headquarters, creating 500 jobs. This signifies significant investment in the sector.

October 2022: Tiger Brands launched a "zero" sugar Energade variant, responding to consumer demand for healthier options and impacting market competition.

May 2022: Thirsti Water (Pty) Ltd secured a three-year hydration deal with SuperSport United, enhancing brand visibility and market penetration through sports sponsorships.

Strategic Africa Sports Drinks Industry Market Outlook

The future of the African sports drinks market is bright, with significant growth potential driven by continued economic development, rising health awareness, and the increasing popularity of sports and fitness. Strategic opportunities lie in expanding into underserved markets, developing innovative product offerings, and strengthening distribution networks. Focus on sustainable packaging and promoting healthier options will be key for success. The market's continued expansion is projected based on a robust forecasting model incorporating various macro and micro economic factors.

Africa Sports Drinks Industry Segmentation

-

1. Soft Drink Type

- 1.1. Electrolyte-Enhanced Water

- 1.2. Hypertonic

- 1.3. Hypotonic

- 1.4. Isotonic

- 1.5. Protein-based Sport Drinks

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Sub Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Retail

- 3.3. Specialty Stores

- 3.4. Supermarket/Hypermarket

- 3.5. Others

Africa Sports Drinks Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Sports Drinks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Sports Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Electrolyte-Enhanced Water

- 5.1.2. Hypertonic

- 5.1.3. Hypotonic

- 5.1.4. Isotonic

- 5.1.5. Protein-based Sport Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Retail

- 5.3.3. Specialty Stores

- 5.3.4. Supermarket/Hypermarket

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. UAE Africa Sports Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Africa Sports Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Africa Sports Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Africa Sports Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kingsley Beverages Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Aje Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tiger Brands Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PepsiCo Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Oshee Polska Sp Z O O

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Suntory Holdings Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Coca-Cola Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Thirsti Water (Pty) Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ekhamanzi Springs (Pty) Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BOS Brands (Pty) Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Congo Brands

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Kingsley Beverages Limited

List of Figures

- Figure 1: Africa Sports Drinks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Sports Drinks Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Sports Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Sports Drinks Industry Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Africa Sports Drinks Industry Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Africa Sports Drinks Industry Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 5: Africa Sports Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Sports Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Sports Drinks Industry Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 12: Africa Sports Drinks Industry Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 13: Africa Sports Drinks Industry Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 14: Africa Sports Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Sports Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Sports Drinks Industry?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the Africa Sports Drinks Industry?

Key companies in the market include Kingsley Beverages Limited, Aje Group, Tiger Brands Ltd, PepsiCo Inc, Oshee Polska Sp Z O O, Suntory Holdings Limited, The Coca-Cola Company, Thirsti Water (Pty) Ltd, Ekhamanzi Springs (Pty) Ltd, BOS Brands (Pty) Ltd, Congo Brands.

3. What are the main segments of the Africa Sports Drinks Industry?

The market segments include Soft Drink Type, Packaging Type, Sub Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Congo LLC to relocate, and expand Louisville headquarters with USD 8.25 million investment, creating 500 high-wage jobs. The company will relocate its Louisville headquarters to an existing 110,000-square-foot location at 13551 Triton Park Blvd., moving from its current 18,000-square-foot facility.October 2022: Tiger Brands also started producing a “zero” Energade variant, which is free from added sugar and contains very few calories. The product is available in the two classic flavors Lemon and Orange, in the practical 0.5L PET format.May 2022: To advertise its sports drinks, Thirsti Water (Pty) Ltd has expanded into football by signing a three-year hydration deal with SuperSport United.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Sports Drinks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Sports Drinks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Sports Drinks Industry?

To stay informed about further developments, trends, and reports in the Africa Sports Drinks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence