Key Insights

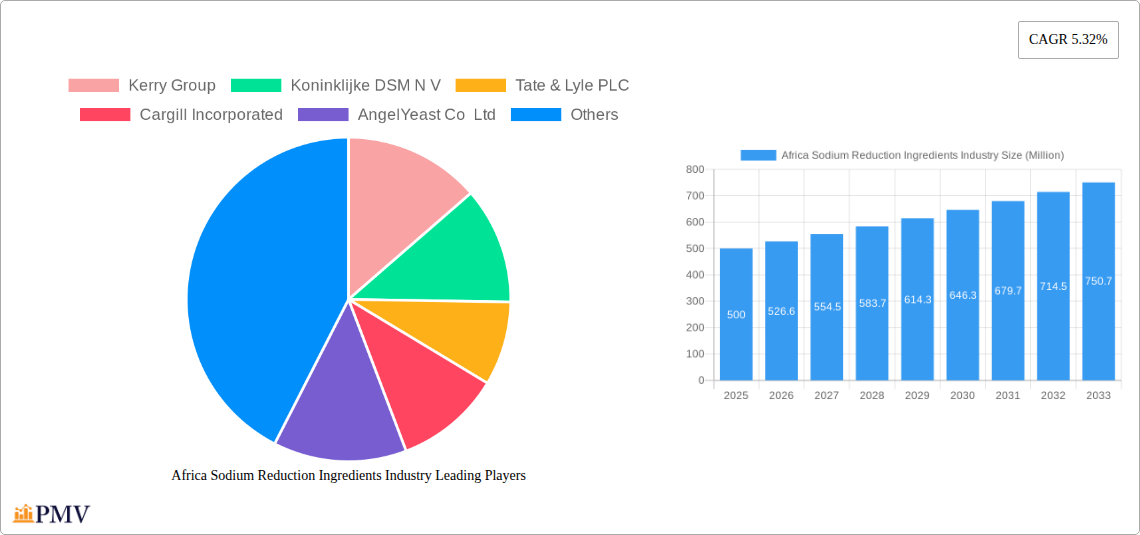

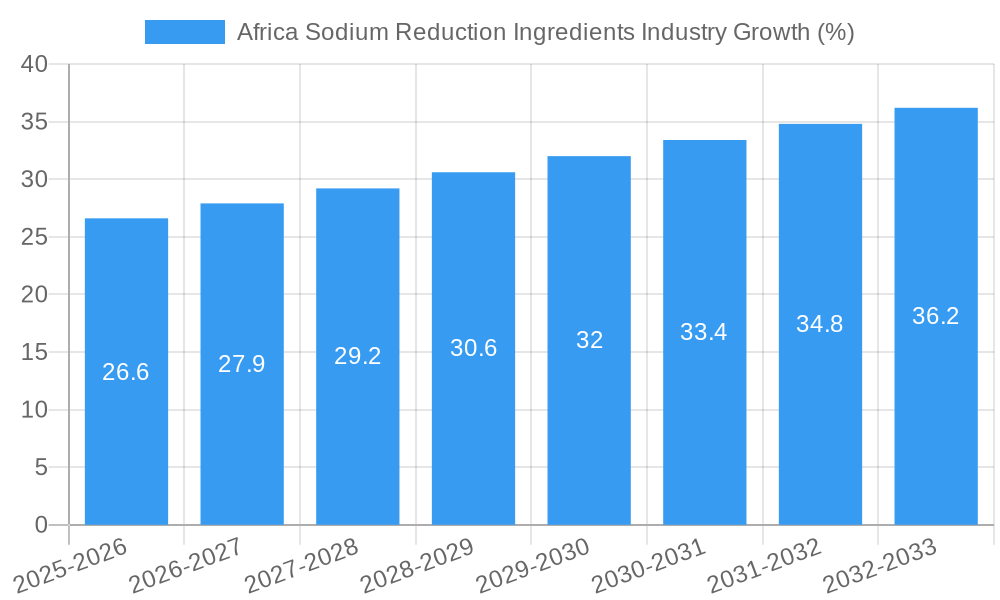

The African sodium reduction ingredients market, while currently exhibiting moderate growth, presents significant untapped potential. The market's value in 2025 is estimated at $500 million (a logical estimation considering the global market and Africa's growing population and food processing sector). A Compound Annual Growth Rate (CAGR) of 5.32% from 2025 to 2033 projects a market value exceeding $750 million by 2033. This growth is primarily driven by increasing health consciousness among consumers, a rising prevalence of diet-related diseases like hypertension, and stringent government regulations promoting healthier food options across the continent. Furthermore, the expanding food processing and manufacturing sectors in several African countries create a high demand for sodium reduction ingredients, particularly in processed foods, bakery, and meat products. Key players like Kerry Group, DSM, Tate & Lyle, Cargill, and Angel Yeast are already present, albeit with varying levels of market penetration, suggesting opportunities for expansion and diversification.

However, challenges remain. Infrastructure limitations, fluctuating raw material prices, and the relatively low purchasing power in several African markets pose constraints to market expansion. Overcoming these challenges requires strategic partnerships with local businesses, investment in efficient distribution networks, and the development of affordable, yet effective sodium reduction solutions tailored to local tastes and preferences. The segment showing the fastest growth is likely to be the food processing segment, reflecting the increasing demand for healthier processed foods. Further research into consumer preferences, specific regional needs, and emerging technologies within the food and beverage sector in each sub-Saharan country would provide a deeper understanding of market dynamics and unlock further growth opportunities.

Africa Sodium Reduction Ingredients Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Africa Sodium Reduction Ingredients industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive research to forecast market trends and identify lucrative opportunities. The report features in-depth analysis of market structure, competitive dynamics, dominant segments, and key growth drivers, equipping businesses with actionable intelligence to inform strategic decision-making.

Africa Sodium Reduction Ingredients Industry Market Structure & Competitive Dynamics

The Africa sodium reduction ingredients market is characterized by moderate concentration, with several key players vying for market share. The market share of the top five players – Kerry Group, Koninklijke DSM N.V., Tate & Lyle PLC, Cargill Incorporated, and Angel Yeast Co Ltd – collectively accounts for approximately xx% of the total market in 2025, estimated at $xx Million. However, the market also exhibits significant fragmentation due to the presence of numerous smaller, regional players. Innovation within the industry focuses primarily on developing healthier, more palatable alternatives to sodium, spurred by growing health consciousness amongst consumers. Regulatory frameworks, particularly those promoting healthier food options, play a significant role in shaping industry dynamics. The substitution of sodium with potassium chloride and other salts, alongside natural flavor enhancers, constitutes a significant competitive landscape aspect. End-user trends reveal a growing preference for foods with lower sodium content, pushing manufacturers to innovate and adapt. M&A activity within the sector remains relatively limited, but sporadic deals averaging $xx Million in value, primarily focus on expanding product portfolios and market reach.

Africa Sodium Reduction Ingredients Industry Industry Trends & Insights

The Africa sodium reduction ingredients market is projected to witness substantial growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing consumer awareness of the health risks associated with high sodium intake, coupled with rising prevalence of hypertension and cardiovascular diseases across the continent. Technological advancements in ingredient formulation are contributing significantly, facilitating the development of sodium-reduced products with improved taste and texture. Consumer preferences are shifting towards healthier food choices, with a growing demand for low-sodium options across various food categories. This trend is accelerating due to increasing disposable incomes and changing lifestyles in several African countries. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of new entrants, leading to innovation and price competition. Market penetration of sodium reduction ingredients remains relatively low, however, it is predicted to reach xx% by 2033, indicating considerable growth potential.

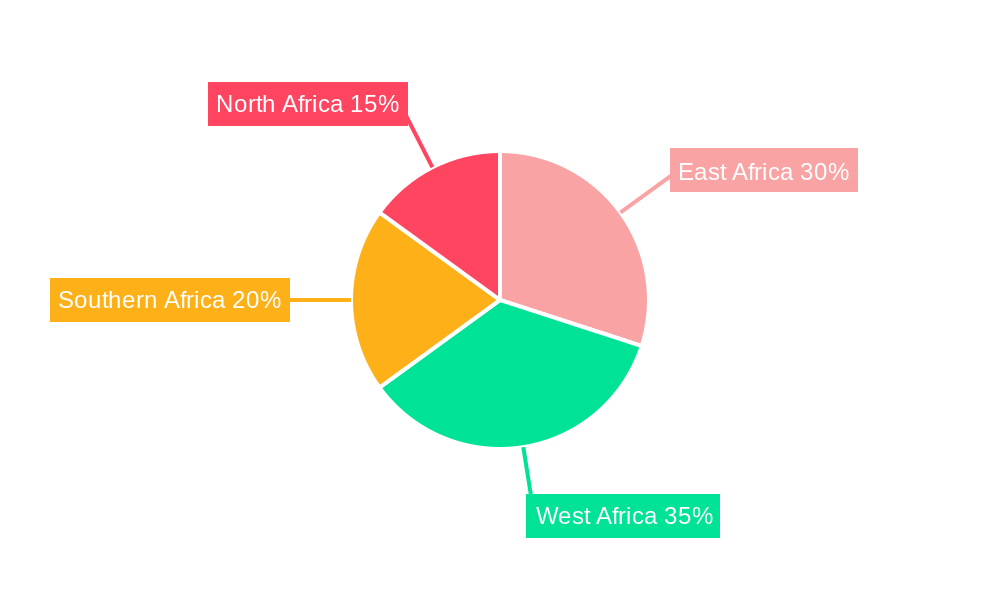

Dominant Markets & Segments in Africa Sodium Reduction Ingredients Industry

Within the African market, the xx region exhibits dominance due to several key factors.

- Robust Economic Growth: Strong economic growth in xx fuels increased disposable income, driving demand for processed foods and, consequently, sodium reduction ingredients.

- Favorable Regulatory Environment: Pro-health government policies and initiatives in xx support the adoption of sodium reduction strategies.

- Developed Infrastructure: Relatively well-developed food processing infrastructure in xx facilitates the efficient production and distribution of sodium-reduction ingredients.

This dominance is further reinforced by higher consumer awareness about health and wellness, creating a higher demand for processed foods with reduced sodium. This region's leadership is likely to continue throughout the forecast period, although other regions, notably xx and xx, are predicted to witness significant growth, particularly as health concerns become more prevalent and governmental support for health increases.

Africa Sodium Reduction Ingredients Industry Product Innovations

Recent innovations in the African sodium reduction ingredients market revolve around developing more effective and palatable substitutes for sodium. This includes the advancement of natural and mineral-based salt alternatives alongside technological improvements in masking unwanted tastes, enhancing food flavors, and improving product texture. These innovations are primarily focused on addressing consumer demand for healthier foods, while maintaining appealing taste and texture and improving their commercial viability within African markets. The ability to offer superior sensory attributes while maintaining lower sodium content is a significant competitive advantage, driving market growth and customer satisfaction.

Report Segmentation & Scope

This report segments the Africa sodium reduction ingredients market based on several key factors, including ingredient type (potassium chloride, other minerals, natural flavor enhancers), application (processed meats, bakery, dairy, snacks), and region (North Africa, Sub-Saharan Africa). Each segment exhibits unique growth trajectories and competitive dynamics. Growth projections vary across segments, reflecting differences in consumer preferences, regulatory environments, and market maturity. For example, the potassium chloride segment is projected to witness higher growth due to increased adoption, whereas natural flavor enhancers may see slower growth due to higher costs and consumer acceptance complexities.

Key Drivers of Africa Sodium Reduction Ingredients Industry Growth

The growth of the Africa sodium reduction ingredients market is primarily propelled by several crucial factors: rising prevalence of hypertension and cardiovascular diseases, increasing health consciousness among consumers, favorable government regulations supporting sodium reduction initiatives, and technological advances in developing superior sodium substitutes. Government health initiatives and health advocacy campaigns coupled with rising income levels and changing lifestyles further intensify demand for healthier food choices.

Challenges in the Africa Sodium Reduction Ingredients Industry Sector

The Africa sodium reduction ingredients industry faces certain challenges: The high cost of some sodium reduction ingredients compared to sodium chloride can create price sensitivity, impacting consumer adoption. Supply chain constraints, particularly in remote areas, can also hinder market penetration. Further, consumer education and awareness building are essential to overcome misconceptions regarding taste and functionality, particularly in relation to the established palate for high-sodium foods. Finally, the regulatory landscape varies across African nations, requiring companies to navigate diverse standards and labeling requirements.

Leading Players in the Africa Sodium Reduction Ingredients Industry Market

- Kerry Group

- Koninklijke DSM N.V.

- Tate & Lyle PLC

- Cargill Incorporated

- Angel Yeast Co Ltd

- Givaudan *List Not Exhaustive

Key Developments in Africa Sodium Reduction Ingredients Industry Sector

- January 2023: Kerry Group launches a new range of sodium-reducing solutions tailored to the African market.

- June 2022: The government of xx introduces stricter regulations on sodium content in processed foods.

- October 2021: Cargill Incorporated invests in expanding its production capacity for sodium reduction ingredients in xx.

These developments illustrate the increasing focus on healthier eating habits and the evolving regulatory landscape that significantly influences the market’s trajectory.

Strategic Africa Sodium Reduction Ingredients Industry Market Outlook

The Africa sodium reduction ingredients market presents a significant growth opportunity for both established players and new entrants. Continued innovation in ingredient technology, coupled with expanding consumer awareness and supportive government policies, will drive market expansion. Companies that successfully adapt to evolving consumer preferences, navigate the regulatory landscape, and optimize supply chains are poised to capitalize on this considerable market potential. The long-term outlook remains positive, with strong growth potential across diverse segments and regions.

Africa Sodium Reduction Ingredients Industry Segmentation

-

1. Product Type

- 1.1. Amino Acids and Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Other Product Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Condiments, Seasonings and Sauces

- 2.3. Dairy and Frozen Foods

- 2.4. Meat and Meat Products

- 2.5. Snacks

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

- 3.3. Algeria

- 3.4. Rest of Africa

Africa Sodium Reduction Ingredients Industry Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Algeria

- 4. Rest of Africa

Africa Sodium Reduction Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Utilization of Mineral Salts as Sodium Reduction Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids and Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Condiments, Seasonings and Sauces

- 5.2.3. Dairy and Frozen Foods

- 5.2.4. Meat and Meat Products

- 5.2.5. Snacks

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.3.3. Algeria

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Algeria

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Amino Acids and Glutamates

- 6.1.2. Mineral Salts

- 6.1.3. Yeast Extracts

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery and Confectionery

- 6.2.2. Condiments, Seasonings and Sauces

- 6.2.3. Dairy and Frozen Foods

- 6.2.4. Meat and Meat Products

- 6.2.5. Snacks

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.3.3. Algeria

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Nigeria Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Amino Acids and Glutamates

- 7.1.2. Mineral Salts

- 7.1.3. Yeast Extracts

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery and Confectionery

- 7.2.2. Condiments, Seasonings and Sauces

- 7.2.3. Dairy and Frozen Foods

- 7.2.4. Meat and Meat Products

- 7.2.5. Snacks

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.3.3. Algeria

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Algeria Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Amino Acids and Glutamates

- 8.1.2. Mineral Salts

- 8.1.3. Yeast Extracts

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery and Confectionery

- 8.2.2. Condiments, Seasonings and Sauces

- 8.2.3. Dairy and Frozen Foods

- 8.2.4. Meat and Meat Products

- 8.2.5. Snacks

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Nigeria

- 8.3.3. Algeria

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Africa Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Amino Acids and Glutamates

- 9.1.2. Mineral Salts

- 9.1.3. Yeast Extracts

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery and Confectionery

- 9.2.2. Condiments, Seasonings and Sauces

- 9.2.3. Dairy and Frozen Foods

- 9.2.4. Meat and Meat Products

- 9.2.5. Snacks

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Nigeria

- 9.3.3. Algeria

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kerry Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Koninklijke DSM N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tate & Lyle PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cargill Incorporated

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AngelYeast Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Givaudan*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Kerry Group

List of Figures

- Figure 1: Global Africa Sodium Reduction Ingredients Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 3: South Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: South Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 5: South Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 6: South Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Geography 2024 & 2032

- Figure 7: South Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 8: South Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Nigeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Nigeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Nigeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: Nigeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: Nigeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Geography 2024 & 2032

- Figure 15: Nigeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Nigeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Nigeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Algeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Algeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Algeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Algeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Algeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Geography 2024 & 2032

- Figure 23: Algeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Algeria Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Algeria Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Geography 2024 & 2032

- Figure 31: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of Africa Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global Africa Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Sodium Reduction Ingredients Industry?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Africa Sodium Reduction Ingredients Industry?

Key companies in the market include Kerry Group, Koninklijke DSM N V, Tate & Lyle PLC, Cargill Incorporated, AngelYeast Co Ltd, Givaudan*List Not Exhaustive.

3. What are the main segments of the Africa Sodium Reduction Ingredients Industry?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Utilization of Mineral Salts as Sodium Reduction Ingredients.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Sodium Reduction Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Sodium Reduction Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Sodium Reduction Ingredients Industry?

To stay informed about further developments, trends, and reports in the Africa Sodium Reduction Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence