Key Insights

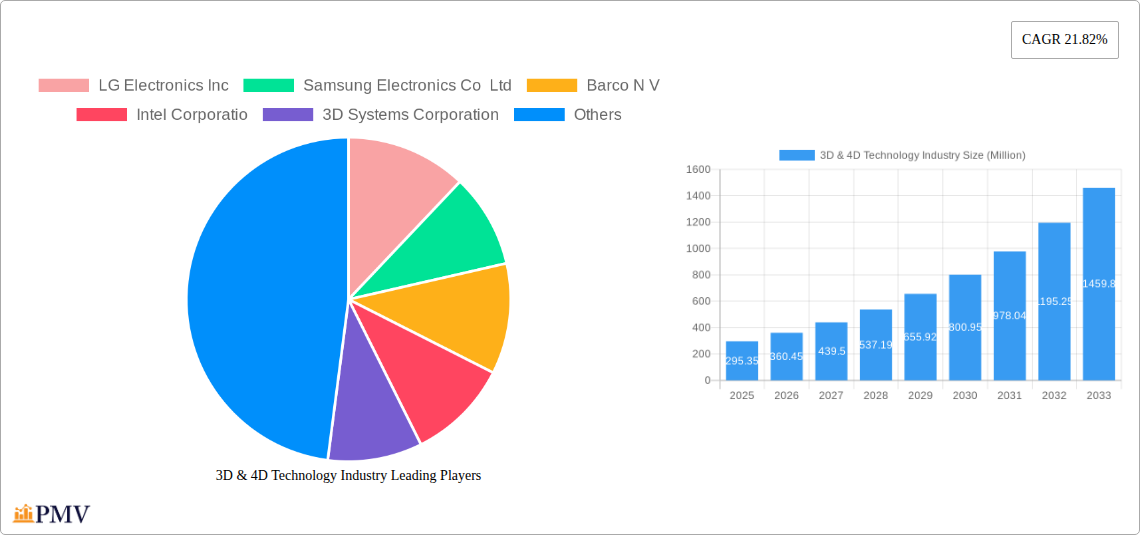

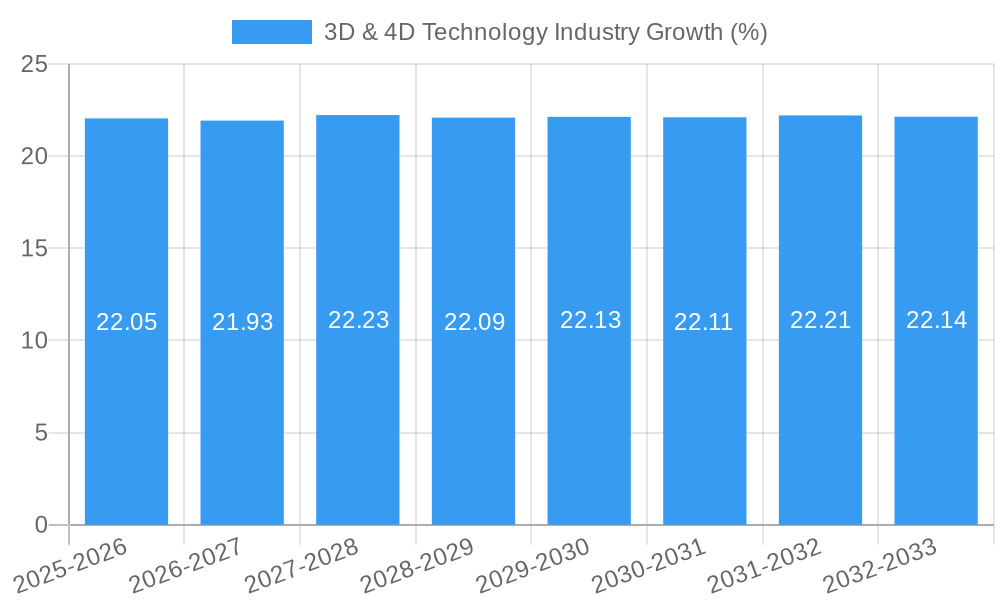

The global 3D & 4D Technology Industry is poised for explosive growth, projecting a **market size of *295.35* million** by 2025, and is anticipated to experience a remarkable **CAGR of *21.82%* through 2033. This robust expansion is driven by several key factors, including the increasing adoption of 3D sensors and integrated circuits across diverse sectors, the burgeoning demand for immersive entertainment and media experiences, and the transformative potential of 3D printing in healthcare and manufacturing. Advancements in augmented reality (AR) and virtual reality (VR) technologies are further fueling this growth, creating new avenues for gaming, education, and professional applications. The integration of 3D technologies into everyday devices and specialized industrial solutions underscores a fundamental shift in how we interact with digital and physical realms, making it a cornerstone of future technological innovation.

Despite the immense potential, the industry faces certain restraints, such as the high initial investment costs associated with advanced 3D hardware and software, and the ongoing need for skilled professionals to develop and implement these sophisticated solutions. However, these challenges are being addressed through continuous innovation and increasing accessibility. The market is segmented into various product categories, including 3D Sensors, 3D Integrated Circuits, 3D Transistors, and 3D Printers, alongside prominent applications like 3D Gaming and broader Other Products. Key end-user industries benefiting from this evolution include Healthcare, Entertainment & Media, and Education, among others. Leading global companies such as LG Electronics Inc., Samsung Electronics Co Ltd., Intel Corporation, and 3D Systems Corporation are at the forefront, driving research and development and shaping the competitive landscape. The pervasive influence of these technologies will likely see broad adoption across all major geographic regions.

This in-depth market research report provides a critical analysis of the 3D & 4D Technology Industry, encompassing additive manufacturing, 3D printing solutions, digital twins, augmented reality (AR), and virtual reality (VR) technologies. Covering the comprehensive Study Period 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this report is your definitive guide to understanding the market's evolution, key players, and lucrative opportunities. We delve into the 3D Sensors, 3D Integrated Circuits, 3D Transistors, 3D Printer markets, and explore their applications across Healthcare, Entertainment & Media, Education, and other vital end-user industries. Gain actionable insights into current and emerging trends, market dynamics, and strategic imperatives to navigate this rapidly expanding sector.

3D & 4D Technology Industry Market Structure & Competitive Dynamics

The 3D & 4D Technology Industry exhibits a dynamic market structure characterized by moderate to high concentration in specific segments, particularly within advanced 3D printing solutions and specialized 3D sensors. Innovation ecosystems are thriving, driven by significant R&D investments from leading companies and a growing network of startups focusing on novel applications and materials. Regulatory frameworks are evolving to address intellectual property rights, safety standards for 3D printed medical devices, and the ethical implications of digital twins. Product substitutes, while present in traditional manufacturing, are increasingly being outperformed by the flexibility and customization offered by 3D and 4D technologies. End-user trends are shifting towards greater adoption of personalized products, on-demand manufacturing, and immersive digital experiences. Mergers and acquisitions (M&A) activities are a key feature, with strategic deal values in the hundreds of millions of dollars, as larger players seek to acquire innovative technologies and expand their market reach. For instance, the acquisition of advanced 3D scanning companies by major industrial conglomerates highlights a trend towards vertical integration and comprehensive solution offerings.

- Market Concentration: High in specialized additive manufacturing hardware and software, moderate in broader 3D component markets.

- Innovation Ecosystems: Fueled by academic research, venture capital funding, and corporate R&D labs.

- Regulatory Frameworks: Emerging standards for materials, safety, and digital asset management.

- M&A Activities: Valued in the hundreds of millions of dollars, focusing on technology acquisition and market consolidation.

3D & 4D Technology Industry Industry Trends & Insights

The 3D & 4D Technology Industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) exceeding 18% over the forecast period. This expansion is primarily driven by the increasing demand for rapid prototyping, mass customization, and the creation of complex geometries previously unattainable with traditional manufacturing methods. Technological disruptions are at the forefront, with advancements in material science leading to stronger, more versatile, and biocompatible 3D printing filaments, resins, and powders. Furthermore, the integration of AI and machine learning is optimizing design processes, improving print quality, and enabling predictive maintenance for 3D printers. Consumer preferences are increasingly influenced by the desire for personalized products, from custom-fit prosthetics in healthcare to unique fashion accessories. The entertainment and media sector is leveraging 3D and 4D technologies for creating lifelike visual effects, interactive gaming environments, and immersive VR/AR experiences, driving significant market penetration in these areas. The convergence of 3D scanning and 3D printing is further democratizing manufacturing, allowing for the creation of digital twins of physical objects and environments for design, simulation, and maintenance. The ongoing digital transformation across industries is a key accelerator, pushing businesses to adopt advanced manufacturing and digital visualization tools to remain competitive. The development of more accessible and user-friendly 3D printer solutions is also broadening the appeal beyond industrial applications to prosumers and small businesses.

- Market Growth Drivers: Increased demand for customization, rapid prototyping, and complex designs.

- Technological Disruptions: Advancements in materials, AI integration, and the synergy between 3D scanning and printing.

- Consumer Preferences: Growing appetite for personalized products and immersive digital experiences.

- Competitive Dynamics: Intense R&D, strategic partnerships, and market consolidation.

- Market Penetration: Significant growth observed in healthcare, entertainment, and aerospace sectors.

Dominant Markets & Segments in 3D & 4D Technology Industry

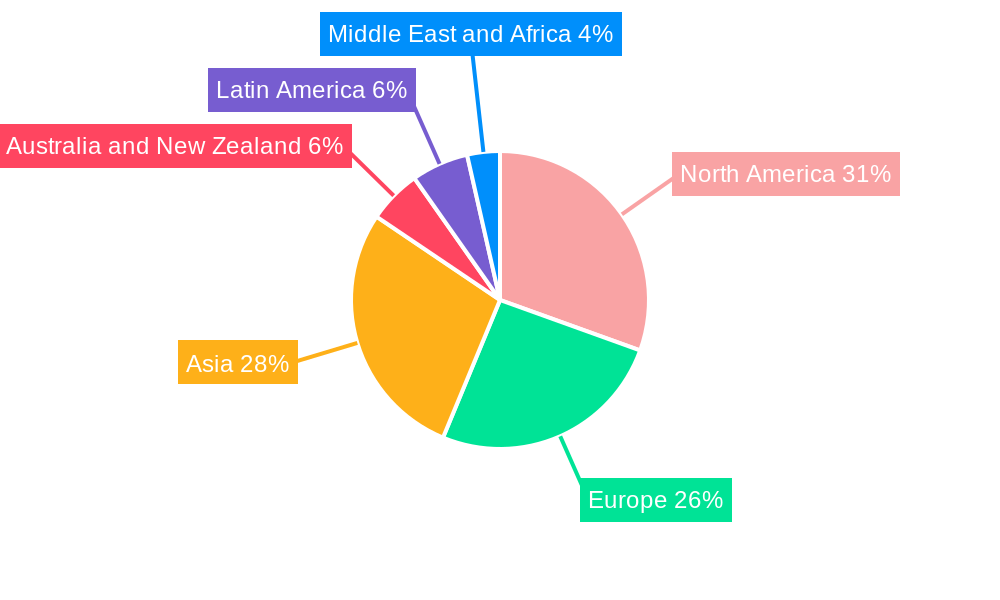

The 3D & 4D Technology Industry is dominated by North America, driven by its strong R&D infrastructure, significant government investment in advanced manufacturing, and a high concentration of key industry players. Within this region, the United States leads due to its established industrial base and early adoption of cutting-edge technologies. The 3D Printer segment is a primary revenue generator, encompassing a wide range of technologies from FDM to SLA and industrial metal printing, catering to diverse applications. The Healthcare end-user industry is a significant growth driver, utilizing 3D printing for prosthetics, implants, surgical guides, and pharmaceutical development. The Entertainment & Media sector is also a major consumer, leveraging 3D animation, VR/AR content creation, and the development of interactive gaming experiences.

- Leading Region: North America, particularly the United States.

- Key Drivers: Robust R&D funding, strong industrial base, early technology adoption, favorable economic policies.

- Dominant Product Segment: 3D Printer.

- Detailed Dominance: The widespread availability of diverse 3D printer technologies, from desktop to industrial-grade, coupled with their applications in rapid prototyping, custom manufacturing, and end-use part production, solidifies its leading position.

- Dominant End-User Industry: Healthcare.

- Detailed Dominance: The critical need for personalized medical solutions, including patient-specific implants, prosthetics, and anatomical models for surgical planning, drives substantial demand for 3D printing. Advances in biocompatible materials and regulatory approvals are further accelerating adoption.

- Emerging Segments: 3D Sensors and 3D Integrated Circuits are experiencing rapid growth due to their increasing integration into consumer electronics, automotive systems, and industrial automation, enabling more intelligent and interactive applications.

- Other Key Markets: Europe, particularly Germany and the UK, show strong adoption in industrial 3D printing and automotive applications. Asia-Pacific is emerging as a significant market, driven by increasing manufacturing capabilities and government initiatives supporting Industry 4.0.

3D & 4D Technology Industry Product Innovations

Product innovations in the 3D & 4D Technology Industry are rapidly transforming sectors. Advancements in materials, such as high-performance polymers and bio-inks, are enabling the printing of more durable, flexible, and biocompatible objects. The development of multi-material 3D printers allows for the creation of intricate objects with varied properties in a single print run. Digital twin technology, powered by advanced 3D scanning and simulation software, is revolutionizing product design, testing, and maintenance by creating virtual replicas of physical assets. These innovations offer significant competitive advantages by reducing lead times, enhancing design complexity, and enabling mass customization.

Report Segmentation & Scope

This comprehensive report segments the 3D & 4D Technology Industry into key product categories and end-user industries. The product segmentation includes 3D Sensors, 3D Integrated Circuits, 3D Transistors, 3D Printer, 3D Gaming, and Other Products. The end-user industry segmentation covers Healthcare, Entertainment & Media, Education, and Other End-user Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering a granular view of market opportunities. For instance, the 3D Printer segment is expected to witness substantial growth driven by industrial adoption and expanding applications. The Healthcare segment, valued in the billions, is projected to grow at a high CAGR due to the increasing demand for personalized medical devices and solutions.

Key Drivers of 3D & 4D Technology Industry Growth

Several key factors are propelling the growth of the 3D & 4D Technology Industry.

- Technological Advancements: Continuous innovation in materials, printer technology, and software, including AI-driven design optimization and advanced 3D scanning capabilities, fuels adoption.

- Growing Demand for Customization: Industries are increasingly seeking personalized products, from medical implants to consumer goods, which 3D printing excels at providing.

- Economic Benefits: Reduced manufacturing lead times, lower tooling costs, and the ability to produce complex parts on-demand contribute to significant cost savings and efficiency gains.

- Government Initiatives: Supportive policies and investments in advanced manufacturing and R&D by governments worldwide are fostering market expansion.

Challenges in the 3D & 4D Technology Industry Sector

Despite its rapid growth, the 3D & 4D Technology Industry faces several challenges.

- Scalability for Mass Production: While improving, scaling 3D printing to match the output of traditional mass manufacturing methods remains a hurdle for certain applications.

- Material Limitations: The range and performance of available materials, while expanding, still have limitations for highly demanding industrial applications.

- Regulatory Hurdles: Obtaining approvals for 3D printed medical devices and ensuring consistent quality control across different production environments can be complex.

- Skilled Workforce Shortage: A lack of adequately trained professionals in 3D design, operation, and post-processing can hinder widespread adoption.

- Initial Investment Costs: The upfront cost of high-end industrial 3D printers and associated software can be a barrier for smaller businesses.

Leading Players in the 3D & 4D Technology Industry Market

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Barco N V

- Intel Corporation

- 3D Systems Corporation

- Autodesk Inc

- Stratus's Inc

- Dolby Laboratories Inc

- Panasonic Corporation

- Sony Corporation

Key Developments in 3D & 4D Technology Industry Sector

- June 2023: Epic Games partnered with LVMH to modernize creative processes and offer immersive product discovery experiences, enabling virtual fitting rooms, fashion shows, and the development of digital twins.

- May 2023: Formlabs and Hawk Ridge Systems announced a strategic partnership to enhance North American access to digital manufacturing technologies, combining their expertise to accelerate product development cycles.

Strategic 3D & 4D Technology Industry Market Outlook

The strategic outlook for the 3D & 4D Technology Industry is exceptionally strong, driven by the ongoing digital transformation and the increasing demand for personalized, on-demand solutions. Key growth accelerators include the continued advancement of additive manufacturing materials, the integration of AI and machine learning for enhanced design and production efficiency, and the expanding applications of digital twins across various sectors. Opportunities abound in emerging markets, particularly in the customization of consumer goods, the acceleration of medical device innovation, and the creation of more immersive entertainment experiences. Strategic investments in research and development, coupled with a focus on expanding accessibility and affordability of 3D printing technologies, will be crucial for players to capitalize on the vast future potential of this dynamic industry.

3D & 4D Technology Industry Segmentation

-

1. Products

- 1.1. 3D Sensors

- 1.2. 3D Integrated Circuits

- 1.3. 3D Transistors

- 1.4. 3D Printer

- 1.5. 3D Gaming

- 1.6. Other Products

-

2. End-User Industry

- 2.1. Healthcare

- 2.2. Entertainment & Media

- 2.3. Education

- 2.4. Other End-user Industries

3D & 4D Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

3D & 4D Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of 3D Technology Across Various End-User Industries; Increasing Demand for 3D Technology in the Entertainment Industry; Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 3.3. Market Restrains

- 3.3.1. High Product Associated Costs and Availability of 3D Printing Materials

- 3.4. Market Trends

- 3.4.1. Increasing Applications of 3D Printing Across Various End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. 3D Sensors

- 5.1.2. 3D Integrated Circuits

- 5.1.3. 3D Transistors

- 5.1.4. 3D Printer

- 5.1.5. 3D Gaming

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Healthcare

- 5.2.2. Entertainment & Media

- 5.2.3. Education

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. 3D Sensors

- 6.1.2. 3D Integrated Circuits

- 6.1.3. 3D Transistors

- 6.1.4. 3D Printer

- 6.1.5. 3D Gaming

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Healthcare

- 6.2.2. Entertainment & Media

- 6.2.3. Education

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. Europe 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. 3D Sensors

- 7.1.2. 3D Integrated Circuits

- 7.1.3. 3D Transistors

- 7.1.4. 3D Printer

- 7.1.5. 3D Gaming

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Healthcare

- 7.2.2. Entertainment & Media

- 7.2.3. Education

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Asia 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. 3D Sensors

- 8.1.2. 3D Integrated Circuits

- 8.1.3. 3D Transistors

- 8.1.4. 3D Printer

- 8.1.5. 3D Gaming

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Healthcare

- 8.2.2. Entertainment & Media

- 8.2.3. Education

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Australia and New Zealand 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. 3D Sensors

- 9.1.2. 3D Integrated Circuits

- 9.1.3. 3D Transistors

- 9.1.4. 3D Printer

- 9.1.5. 3D Gaming

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Healthcare

- 9.2.2. Entertainment & Media

- 9.2.3. Education

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Latin America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. 3D Sensors

- 10.1.2. 3D Integrated Circuits

- 10.1.3. 3D Transistors

- 10.1.4. 3D Printer

- 10.1.5. 3D Gaming

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Healthcare

- 10.2.2. Entertainment & Media

- 10.2.3. Education

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. Middle East and Africa 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Products

- 11.1.1. 3D Sensors

- 11.1.2. 3D Integrated Circuits

- 11.1.3. 3D Transistors

- 11.1.4. 3D Printer

- 11.1.5. 3D Gaming

- 11.1.6. Other Products

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Healthcare

- 11.2.2. Entertainment & Media

- 11.2.3. Education

- 11.2.4. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Products

- 12. North America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA 3D & 4D Technology Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 LG Electronics Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Samsung Electronics Co Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Barco N V

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Intel Corporatio

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 3D Systems Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Autodesk Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Stratus's Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Dolby Laboratories Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Panasonic Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Sony Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global 3D & 4D Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: MEA 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: MEA 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 15: North America 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 16: North America 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: North America 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: North America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: North America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 21: Europe 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 22: Europe 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Europe 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 27: Asia 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 28: Asia 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Asia 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Asia 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 33: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 34: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 35: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 36: Australia and New Zealand 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Australia and New Zealand 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 39: Latin America 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 40: Latin America 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 41: Latin America 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 42: Latin America 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 43: Latin America 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by Products 2025 & 2033

- Figure 45: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by Products 2025 & 2033

- Figure 46: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 47: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 48: Middle East and Africa 3D & 4D Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa 3D & 4D Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D & 4D Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 3: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global 3D & 4D Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Belgium 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Netherland 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Nordics 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Southeast Asia 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Phillipes 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Singapore 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Thailandc 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Peru 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Chile 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Colombia 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Ecuador 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Venezuela 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: United States 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Canada 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Mexico 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: United Arab Emirates 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Saudi Arabia 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: South Africa 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa 3D & 4D Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 51: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 52: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 53: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 54: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 55: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 57: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 58: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 59: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 60: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 61: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 63: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 64: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 65: Global 3D & 4D Technology Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 66: Global 3D & 4D Technology Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 67: Global 3D & 4D Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D & 4D Technology Industry?

The projected CAGR is approximately 21.82%.

2. Which companies are prominent players in the 3D & 4D Technology Industry?

Key companies in the market include LG Electronics Inc, Samsung Electronics Co Ltd, Barco N V, Intel Corporatio, 3D Systems Corporation, Autodesk Inc, Stratus's Inc, Dolby Laboratories Inc, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the 3D & 4D Technology Industry?

The market segments include Products, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 295.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of 3D Technology Across Various End-User Industries; Increasing Demand for 3D Technology in the Entertainment Industry; Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology.

6. What are the notable trends driving market growth?

Increasing Applications of 3D Printing Across Various End-user Industries.

7. Are there any restraints impacting market growth?

High Product Associated Costs and Availability of 3D Printing Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Epic Games, the creators of Fortnite and Unreal Engine, and LVMH, a France-based luxury goods conglomerate, partnered to modernize the Group's creative process and offer clients new immersive product discovery experiences. Due to this strategic partnership with Epic, LVMH and its brands will be able to provide experiences like virtual fitting rooms and fashion shows, 360-degree product carousels, augmented reality, the development of digital twins, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D & 4D Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D & 4D Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D & 4D Technology Industry?

To stay informed about further developments, trends, and reports in the 3D & 4D Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence