Key Insights

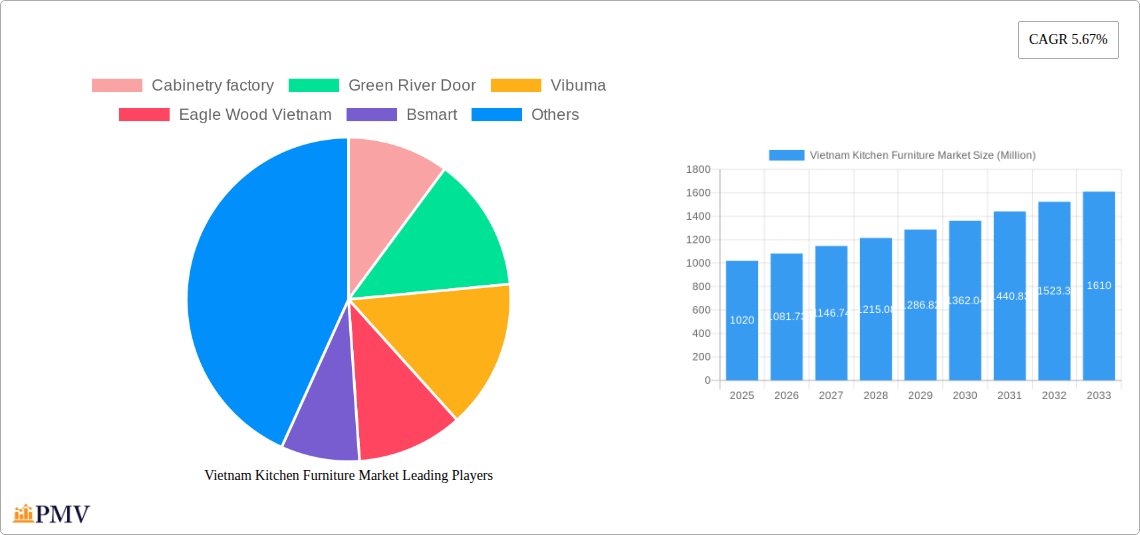

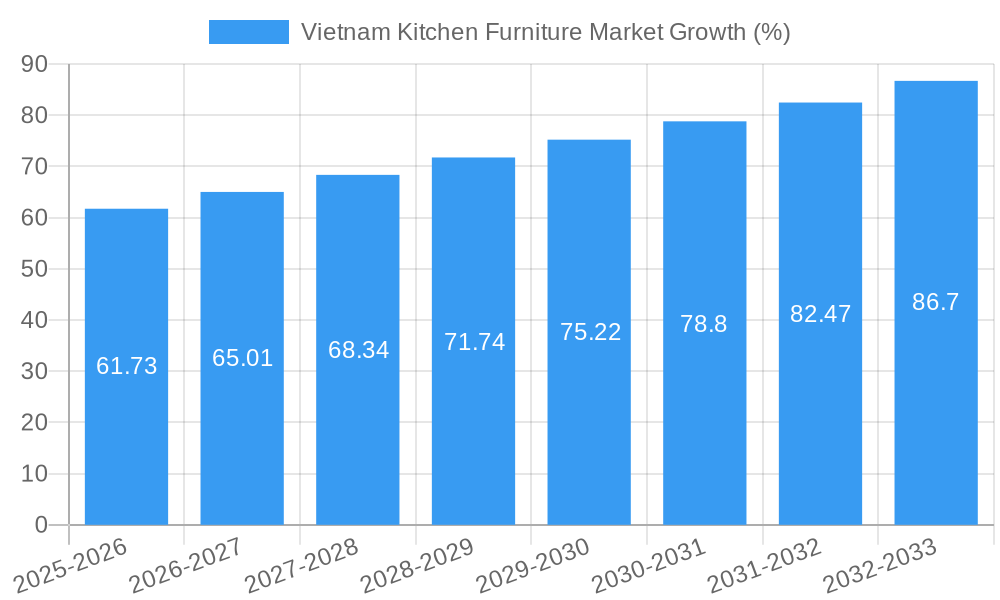

The Vietnam kitchen furniture market, valued at $1.02 billion in 2025, is projected to experience robust growth, driven by a rising middle class with increased disposable income and a preference for modern, stylish kitchens. This expanding consumer base fuels demand for high-quality kitchen cabinets, tables, and chairs, stimulating market expansion. The increasing popularity of e-commerce platforms offers convenient access to a wider range of products, further boosting market growth. While the market benefits from these positive trends, challenges remain. Supply chain disruptions and fluctuations in raw material prices, particularly timber, can impact production costs and profitability. Furthermore, competition from both domestic and international players necessitates continuous innovation and adaptation to evolving consumer preferences. The segment breakdown shows a strong demand across all furniture types, with kitchen cabinets likely representing the largest share, followed by tables and chairs. E-commerce is anticipated to be a rapidly growing distribution channel, mirroring global trends. Key players like Ikea, alongside established local manufacturers like Cabinetry Factory and Vietnam Blue Lake Furniture, are shaping the market landscape through competitive pricing, product diversification, and effective marketing strategies. The 5.67% CAGR projected through 2033 signifies a consistent and promising growth trajectory for this dynamic market.

The market's future hinges on addressing these challenges. Companies focusing on sustainable sourcing, efficient supply chains, and innovative designs catering to diverse consumer needs are poised for success. Government initiatives promoting sustainable manufacturing practices and fostering entrepreneurial growth in the furniture sector could further accelerate market expansion. Furthermore, investing in skilled labor and technological advancements in furniture production will be crucial for maintaining competitiveness and meeting the escalating demand. This includes embracing advanced manufacturing techniques like CNC machining and utilizing sustainable materials to appeal to environmentally conscious consumers. The market’s growth potential is significant, with a strong emphasis on adapting to the evolving needs of the Vietnamese consumer while navigating potential economic and logistical hurdles.

Vietnam Kitchen Furniture Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam kitchen furniture market, offering valuable insights for businesses, investors, and stakeholders. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by furniture type (kitchen cabinets, kitchen chairs, kitchen tables, and other furniture types) and distribution channel (supermarkets and hypermarkets, specialty stores, e-commerce, and other distribution channels). The report features detailed analysis of market size, growth drivers, challenges, competitive landscape, and key industry developments. The total market value is projected to reach xx Million by 2033.

Vietnam Kitchen Furniture Market Market Structure & Competitive Dynamics

The Vietnam kitchen furniture market exhibits a moderately fragmented structure, with a mix of large multinational corporations and smaller domestic players. Market concentration is relatively low, with no single entity commanding a dominant market share. However, leading players such as Ikea and Ixina exert significant influence through their brand recognition and established distribution networks. The market is characterized by an increasingly competitive landscape, driven by both domestic and international players vying for market share.

Innovation in design, materials, and manufacturing processes is a key driver of competition. The regulatory framework in Vietnam plays a role in influencing market dynamics, particularly concerning environmental standards and product safety regulations. The market also witnesses active M&A activity, with several recent deals signaling consolidation and expansion. For example, the xx Million deal between [Company A] and [Company B] in [Year] highlights the increasing strategic investments in the sector.

- Market Share: Ikea holds an estimated xx% market share, followed by Ixina at xx%, and other players comprising the remaining share.

- M&A Activity: The past five years have seen an increase in M&A activity, with a total estimated value of xx Million in deals.

- Product Substitutes: The primary substitutes include imported furniture and locally produced alternatives focusing on affordability.

- End-User Trends: Growing urbanization and a rise in disposable incomes are driving demand for modern and stylish kitchen furniture.

Vietnam Kitchen Furniture Market Industry Trends & Insights

The Vietnam kitchen furniture market is experiencing robust growth, driven by several key factors. The rising disposable incomes of the Vietnamese population, coupled with increasing urbanization and a preference for modern living spaces, are fueling demand for high-quality kitchen furniture. Technological advancements in furniture manufacturing are leading to more efficient and sustainable production processes. Consumers are also showing a preference for customized and eco-friendly options, impacting design trends and material choices. The market is witnessing a shift towards online sales through e-commerce platforms, further enhancing accessibility and convenience.

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is expected to be driven primarily by increasing consumer spending on home improvement and a growing preference for contemporary kitchen designs. The market penetration of modern kitchen furniture is also increasing, particularly in urban areas, demonstrating significant growth opportunities. The competitive landscape is dynamic, with both domestic and international players engaging in aggressive marketing and product innovation strategies.

Dominant Markets & Segments in Vietnam Kitchen Furniture Market

The kitchen cabinet segment dominates the Vietnam kitchen furniture market, representing approximately xx% of total market revenue. This is primarily due to the high demand for stylish and functional kitchen storage solutions in both urban and rural areas. The key drivers of this segment's dominance include increasing home ownership rates, rising urbanization, and a growing preference for modern kitchen designs.

Within distribution channels, specialty stores currently hold the largest market share, owing to their ability to offer a wide selection of products and personalized customer service. However, e-commerce is rapidly gaining traction, fueled by increasing internet penetration and the convenience of online shopping.

- By Furniture Type:

- Kitchen Cabinets: Dominant segment driven by home improvement spending and evolving design preferences.

- Kitchen Chairs & Tables: Strong growth predicted due to increasing disposable incomes.

- Other Furniture Types: Steady growth, encompassing kitchen islands, storage units, and other accessories.

- By Distribution Channel:

- Specialty Stores: Currently holds the largest market share due to personalized services.

- E-commerce: Rapidly expanding due to enhanced online access and convenience.

- Supermarkets & Hypermarkets: Smaller market share, primarily offering basic furniture items.

Vietnam Kitchen Furniture Market Product Innovations

Recent product innovations in the Vietnam kitchen furniture market include the integration of smart technology, such as automated storage solutions and integrated lighting systems. There is a growing emphasis on sustainable and eco-friendly materials, aligning with global trends towards environmentally conscious consumption. Manufacturers are also focusing on modular designs that offer flexibility and customization to meet individual consumer preferences. This focus on innovation ensures improved functionality, durability, and aesthetic appeal, catering to the evolving demands of the market.

Report Segmentation & Scope

This report offers a comprehensive segmentation of the Vietnam kitchen furniture market based on furniture type and distribution channel.

By Furniture Type: The report analyzes the market size, growth projections, and competitive dynamics within each segment (kitchen cabinets, kitchen chairs, kitchen tables, other furniture types). Market size projections range from xx Million for kitchen cabinets to xx Million for other furniture types by 2033.

By Distribution Channel: The report provides insights into the market size, growth rates, and competitive dynamics for each channel (supermarkets and hypermarkets, specialty stores, e-commerce, other distribution channels). E-commerce is predicted to show the highest growth rate.

Key Drivers of Vietnam Kitchen Furniture Market Growth

Several key factors contribute to the growth of the Vietnam kitchen furniture market. The rising disposable incomes and rapid urbanization are leading to increased demand for modern, aesthetically pleasing kitchen furniture. Government policies supporting economic development and infrastructure improvement create a conducive environment for market expansion. Additionally, technological advancements in manufacturing and design are driving innovation and enhancing product quality and affordability.

Challenges in the Vietnam Kitchen Furniture Market Sector

Despite the growth potential, the Vietnam kitchen furniture market faces challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from both domestic and international players necessitates continuous innovation and efficient operations to maintain a competitive edge. Furthermore, stringent environmental regulations may add to manufacturing costs.

Leading Players in the Vietnam Kitchen Furniture Market Market

- Cabinetry factory

- Green River Door

- Vibuma

- Eagle Wood Vietnam

- Bsmart

- Vietnam Blue Lake Furniture

- Star Marine Furniture Company Ltd

- Ixina

- Pacific Craftworks

- Ikea

Key Developments in Vietnam Kitchen Furniture Market Sector

- April 2023: Yoshimoto Sangyo Co., Ltd. and Vinh An Interior & Decor formed a strategic partnership, marking Yoshimoto's entry into the Vietnamese market. This signifies increased foreign investment in the sector.

- April 2022: Julius Blum opened its second store in Vietnam, further strengthening its presence and showcasing high-end hardware options. This demonstrates growth in the premium segment of the market.

Strategic Vietnam Kitchen Furniture Market Market Outlook

The Vietnam kitchen furniture market presents significant opportunities for growth. Continued economic development, rising urbanization, and a growing middle class will drive demand for higher-quality, modern kitchen furniture. Strategic investments in innovation, efficient supply chains, and effective marketing strategies will be crucial for businesses to capitalize on this market potential. The focus on sustainable and technologically advanced products will shape the future trajectory of the industry.

Vietnam Kitchen Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Kitchen Furniture Market Segmentation By Geography

- 1. Vietnam

Vietnam Kitchen Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Investments in Residential Sector is Boosting the Kitchen Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Kitchen Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cabinetry factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Green River Door

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vibuma

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Wood Vietnam

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bsmart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam Blue Lake Furniture**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Star Marine Furniture Company Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ixina

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pacific Craftworks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cabinetry factory

List of Figures

- Figure 1: Vietnam Kitchen Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Kitchen Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Kitchen Furniture Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Vietnam Kitchen Furniture Market?

Key companies in the market include Cabinetry factory, Green River Door, Vibuma, Eagle Wood Vietnam, Bsmart, Vietnam Blue Lake Furniture**List Not Exhaustive, Star Marine Furniture Company Ltd, Ixina, Pacific Craftworks, Ikea.

3. What are the main segments of the Vietnam Kitchen Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Investments in Residential Sector is Boosting the Kitchen Furniture Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2023: Yoshimoto Sangyo Co., Ltd. and Vinh An Interior & Decor formalized a strategic partnership with the signing of an agreement in the Vietnamese capital of Hanoi. This marked Yoshimoto's official entry into the Vietnamese market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Kitchen Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Kitchen Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Kitchen Furniture Market?

To stay informed about further developments, trends, and reports in the Vietnam Kitchen Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence