Key Insights

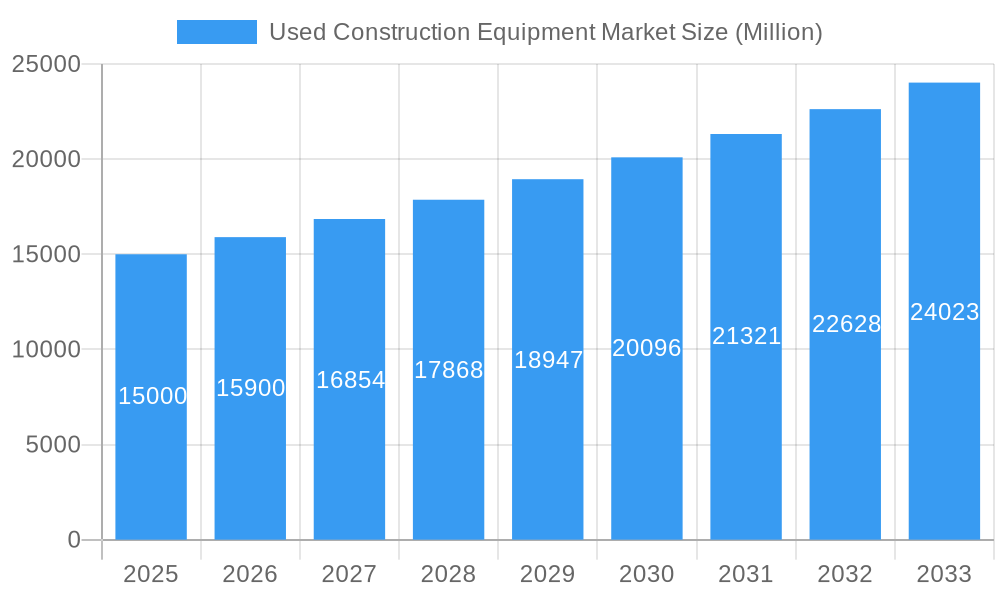

The global used construction equipment market, valued at approximately 131.38 billion in 2024, is projected for substantial expansion, forecasting a compound annual growth rate (CAGR) of 5.13% through 2033. This upward trajectory is attributed to several key drivers. Primarily, the escalating need for economical equipment solutions within the construction sector significantly boosts demand for pre-owned machinery. Contractors and smaller enterprises frequently select used equipment to reduce initial capital outlay while securing essential operational tools. Secondly, technological progress and refined refurbishment methodologies have markedly enhanced the longevity and dependability of used construction equipment, improving its market appeal as a viable alternative to new purchases. Thirdly, a growing emphasis on sustainability and carbon footprint reduction in construction operations is influencing market dynamics. Properly maintained used equipment can mitigate the environmental impact associated with new machinery production. Lastly, volatile new equipment pricing and supply chain complexities further solidify the position of used equipment as a more predictable and accessible option.

Used Construction Equipment Market Market Size (In Billion)

Conversely, certain market restraints are present. The availability of qualified technicians for maintenance and repair, which can fluctuate geographically, presents a challenge. Furthermore, buyer confidence may be affected by concerns regarding the condition and remaining operational life of used equipment. Market segmentation indicates robust demand across various product categories, including excavators, cranes, material handlers, and telescopic handlers. While internal combustion engines currently lead the drive type segment, electric and hybrid alternatives are expected to witness considerable growth, propelled by stringent environmental regulations and technological innovation. Geographic analysis highlights significant market presence in North America, Europe, and the Asia-Pacific region, corresponding to high construction activity levels. Prominent market participants, including Caterpillar, John Deere, Komatsu, Kobelco, Volvo CE, Liebherr, Manitou, Hitachi, Mitsubishi Heavy Industries, and Terex, actively compete within this evolving landscape, continuously adjusting their strategies to align with shifting consumer preferences.

Used Construction Equipment Market Company Market Share

Used Construction Equipment Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global used construction equipment market from 2019 to 2033, offering invaluable insights for industry stakeholders. The study covers market size, segmentation, competitive landscape, key growth drivers, challenges, and future outlook, equipping readers with actionable intelligence to navigate this dynamic sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033.

Used Construction Equipment Market Market Structure & Competitive Dynamics

The used construction equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key players like Caterpillar Inc., Komatsu, and Volvo CE dominate through brand recognition, extensive distribution networks, and established service capabilities. However, the market also features numerous smaller players and regional specialists, creating a competitive landscape with varied levels of market share. The estimated market share for Caterpillar Inc. in 2025 is 20%, while Komatsu and Volvo CE hold approximately 15% and 12% respectively. The remaining share is distributed among other participants, including Kobelco Construction Machinery, Manitou BF, John Deere & Co, Hitachi Construction Machinery, Liebherr International, Mitsubishi Heavy Industries Ltd, and Terex Corporation.

Innovation ecosystems are primarily driven by technological advancements in equipment design, engine technology (internal combustion, electric, hybrid), and digital platforms enhancing the buying and selling processes. Regulatory frameworks, varying across regions, impact equipment standards, emissions regulations, and safety protocols, influencing the demand and supply of used equipment. Product substitutes, while limited, include renting equipment, leading to a complex interplay between ownership and rental models. End-user trends show a preference for cost-effective, reliable, and readily available used equipment, particularly among smaller contractors and developing economies. M&A activities are prevalent, with deal values reaching xx Million in 2024. Consolidation amongst rental companies and equipment dealers is noteworthy.

Used Construction Equipment Market Industry Trends & Insights

The used construction equipment market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Increased infrastructure development projects globally, particularly in emerging economies, fuel strong demand for both new and used equipment. The rising adoption of digital platforms like Maxim Marketplace and Kobelco Used Crane Finder is streamlining the buying and selling process, boosting market transparency and efficiency. Technological disruptions, such as the introduction of electric and hybrid construction equipment, are gradually influencing the used equipment market, although internal combustion engine models continue to dominate. Consumer preferences increasingly emphasize fuel efficiency, lower operational costs, and advanced safety features. Competitive dynamics are shaped by the strategies of major players focused on fleet modernization, expansion into online sales channels, and the provision of comprehensive after-sales services. Market penetration of online platforms is steadily increasing, exceeding 15% in developed economies in 2025 and showing significant growth potential in developing regions.

Dominant Markets & Segments in Used Construction Equipment Market

North America currently dominates the used construction equipment market, driven by robust infrastructure spending and a large construction sector. Europe and Asia-Pacific follow as significant regional markets.

Key Drivers by Segment:

- Product Type:

- Excavator: High demand from various construction activities and infrastructure projects.

- Loader and Backhoe: Versatile applications across different industries.

- Crane: Essential for large-scale construction projects, particularly in urban areas.

- Material Handling Equipment: Increased logistics and warehousing activities across the supply chain.

- Drive Type:

- Internal Combustion Engine: Currently dominating due to cost-effectiveness and widespread availability.

- Electric and Hybrid: Growing gradually, driven by environmental regulations and technological advancements.

The dominance of North America stems from several factors including favorable economic policies that support infrastructure development, a well-developed construction industry, and relatively high replacement rates of older equipment. Asia-Pacific is experiencing rapid growth, fueled by sustained infrastructure investment and urbanization, although it still lags behind North America in market size.

Used Construction Equipment Market Product Innovations

Recent innovations focus on improving fuel efficiency, enhancing safety features, and incorporating advanced technologies like telematics for remote monitoring and equipment management. These advancements offer competitive advantages by increasing operational efficiency, reducing maintenance costs, and improving equipment lifespan. The integration of digital platforms for equipment sales and rental is revolutionizing the market, offering improved transparency and convenience for buyers and sellers. The emergence of electric and hybrid models marks a significant shift towards environmentally sustainable solutions.

Report Segmentation & Scope

This report segments the used construction equipment market by product type (Crane, Telescopic Handler, Excavator, Material Handling Equipment, Loader and Backhoe, Others) and drive type (Internal Combustion Engine, Electric, Hybrid). Growth projections for each segment vary based on factors like technological advancements, adoption rates, and end-user preferences. Market sizes are provided for each segment, highlighting the relative contribution of each to the overall market. Competitive dynamics within each segment differ, reflecting variations in technology, competition, and regional demand.

Key Drivers of Used Construction Equipment Market Growth

The used construction equipment market is fueled by several key drivers: Firstly, the increasing global demand for infrastructure development projects is a significant catalyst. Secondly, the relatively lower cost of used equipment compared to new equipment appeals strongly to budget-conscious contractors. Thirdly, technological improvements are leading to greater efficiency and durability of used equipment, and the emergence of digital sales platforms has improved market access and transparency.

Challenges in the Used Construction Equipment Market Sector

The used construction equipment market faces challenges like fluctuations in commodity prices, affecting equipment valuations. Furthermore, inconsistencies in equipment quality and condition can create difficulties for buyers. The impact of regulations on emissions and safety can also impact the value and marketability of older equipment, while supply chain disruptions have affected the availability of parts and services.

Leading Players in the Used Construction Equipment Market Market

Key Developments in Used Construction Equipment Market Sector

- January 2021: Kobelco Cranes launched the Kobelco Used Crane Finder service, enhancing market accessibility.

- November 2022: Maxim Crane Works L.P. launched Maxim Marketplace™, a dedicated online platform for used equipment sales, improving market efficiency.

- December 2022: MyCrane, a Dubai-based online crane rental service, expanded to the United States, further disrupting the traditional rental and sales model.

Strategic Used Construction Equipment Market Market Outlook

The future of the used construction equipment market is promising, driven by continuous infrastructure development globally and the growing adoption of digital technologies. Strategic opportunities lie in the expansion of online marketplaces, focusing on equipment refurbishment and providing comprehensive after-sales services. The market will continue to evolve, with a gradual shift towards more sustainable and technologically advanced equipment, though internal combustion engine models will likely remain prominent for the foreseeable future.

Used Construction Equipment Market Segmentation

-

1. Product Type

- 1.1. Crane

- 1.2. Telescopic Handler

- 1.3. Excavator

- 1.4. Material Handling Equipment

- 1.5. Loader and Backhoe

- 1.6. Others

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

- 2.3. Hybrid

Used Construction Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Used Construction Equipment Market Regional Market Share

Geographic Coverage of Used Construction Equipment Market

Used Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Forklift; Others

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption; Others

- 3.4. Market Trends

- 3.4.1. High Cost of New Construction Equipment is driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handler

- 5.1.3. Excavator

- 5.1.4. Material Handling Equipment

- 5.1.5. Loader and Backhoe

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Crane

- 6.1.2. Telescopic Handler

- 6.1.3. Excavator

- 6.1.4. Material Handling Equipment

- 6.1.5. Loader and Backhoe

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Crane

- 7.1.2. Telescopic Handler

- 7.1.3. Excavator

- 7.1.4. Material Handling Equipment

- 7.1.5. Loader and Backhoe

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Crane

- 8.1.2. Telescopic Handler

- 8.1.3. Excavator

- 8.1.4. Material Handling Equipment

- 8.1.5. Loader and Backhoe

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of World Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Crane

- 9.1.2. Telescopic Handler

- 9.1.3. Excavator

- 9.1.4. Material Handling Equipment

- 9.1.5. Loader and Backhoe

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kobelco Construction Machinery

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo CE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Manitou BF

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 John Deere & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machiner

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Komatsu

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Liebherr International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global Used Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: Europe Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of World Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of World Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Rest of World Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Rest of World Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of World Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global Used Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 9: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 15: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Construction Equipment Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Used Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Volvo CE, Manitou BF, John Deere & Co, Caterpillar Inc, Hitachi Construction Machiner, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Terex Corporation.

3. What are the main segments of the Used Construction Equipment Market?

The market segments include Product Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Forklift; Others.

6. What are the notable trends driving market growth?

High Cost of New Construction Equipment is driving the growth of the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruption; Others.

8. Can you provide examples of recent developments in the market?

December 2022: MyCrane, a Dubai-based online crane rental service, has opened a branch in the United States. It is a new digital platform launched to disrupt and streamline the crane rental procurement process. It also provides the option to buy and sell cranes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Used Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence