Key Insights

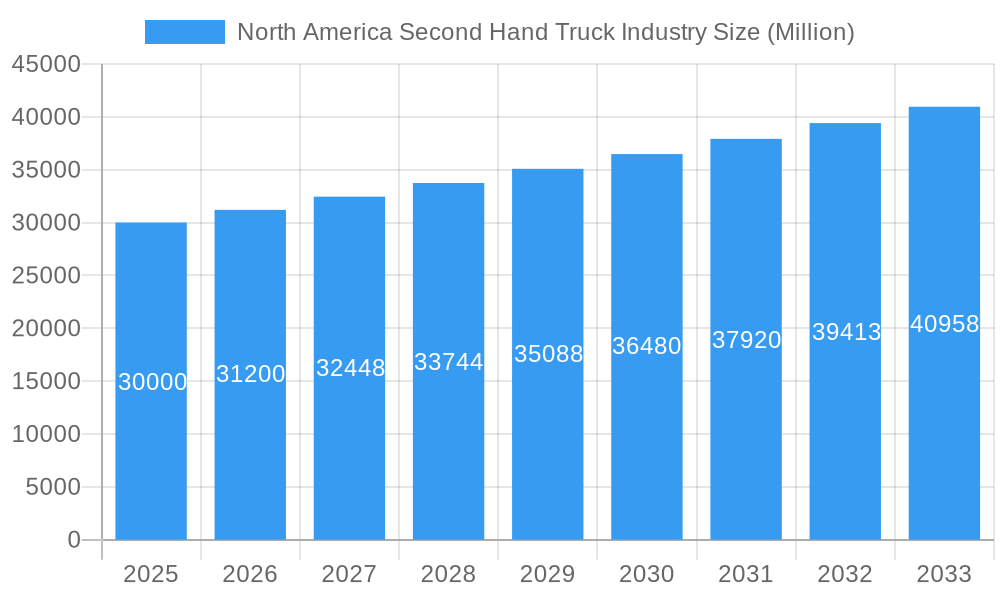

The North American used truck market is poised for significant expansion, projected to reach $16103.28 million by 2024, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This robust growth is propelled by increasing freight transportation demand driven by e-commerce and supply chain complexities. Cost-effectiveness, offering a lower initial investment than new vehicles, appeals strongly to businesses of all sizes. Modern advancements in truck technology and extended vehicle lifespans enhance the availability and quality of used trucks. The market is segmented by vehicle type: light-duty, medium-duty, and heavy-duty, with heavy-duty trucks leading demand due to their critical role in long-haul operations. Intense competition among key players like Arrow Truck Sales, Gordon Truck Centers, and major OEMs ensures a dynamic landscape focused on diverse inventory and service offerings.

North America Second Hand Truck Industry Market Size (In Billion)

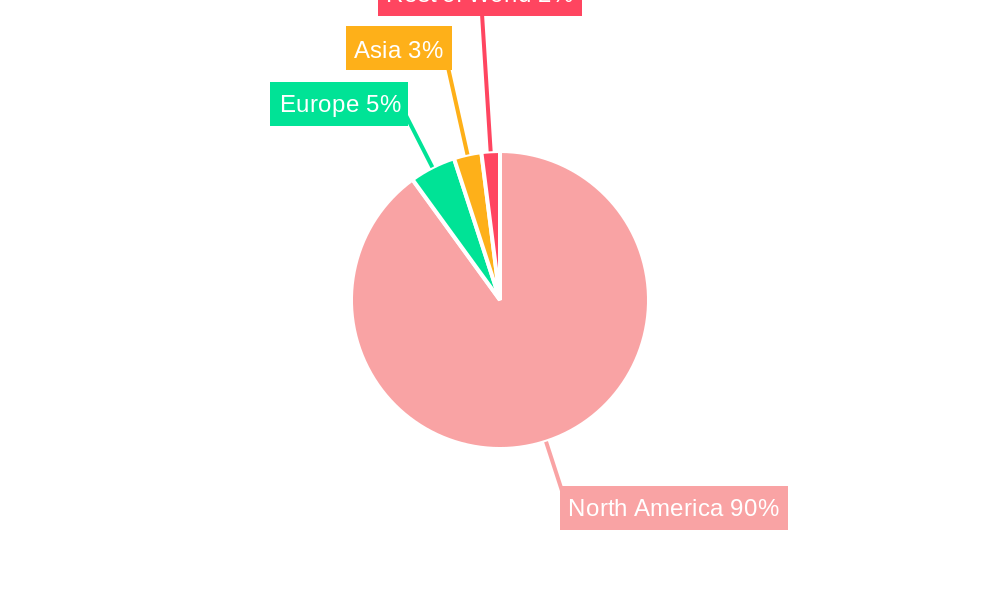

Geographically, the United States dominates the North American market, with Canada and Mexico exhibiting steady growth potential. Evolving emissions standards and fuel efficiency regulations may influence market trajectories. Macroeconomic conditions and new truck pricing will continue to shape used truck supply and demand. The adoption of online sales platforms and advanced data analytics is enhancing operational efficiency and customer satisfaction, indicating a positive market outlook despite potential economic volatility.

North America Second Hand Truck Industry Company Market Share

North America Second Hand Truck Industry: Market Analysis & Forecast, 2019-2033

This comprehensive report provides an in-depth analysis of the North America second-hand truck industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers.

Note: Where specific numerical data (e.g., market size, CAGR, M&A deal values) is unavailable, estimated values (marked as "xx Million") are provided based on industry trends and available data.

North America Second Hand Truck Industry Market Structure & Competitive Dynamics

The North American second-hand truck market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and smaller regional players. Market concentration is influenced by factors such as brand reputation, dealership network strength, and access to inventory. Major players, including General Motors Company, Volvo AB Class B, Paccar Inc, Ford Motor Company, and Isuzu Motor Ltd, hold significant market share, but numerous independent dealers and smaller businesses contribute significantly to the overall volume. Innovation within the industry centers around technology integration, including telematics and data analytics for vehicle condition assessment and optimized pricing strategies. Regulatory frameworks, encompassing emissions standards and safety regulations, significantly impact the market. Product substitutes, such as leasing options and alternative transportation modes, create competitive pressures. End-user trends, driven by factors like e-commerce growth, fuel efficiency requirements, and evolving transportation needs, influence demand. M&A activities have been observed, but deal values vary widely. In 2022, an estimated xx Million was invested in M&A activities, predominantly focused on expanding dealership networks and acquiring specialized inventory.

- Market Share (Estimated 2025): General Motors: xx%; Volvo AB Class B: xx%; Paccar Inc: xx%; Ford Motor Company: xx%; Others: xx%

- M&A Activity (2019-2024): xx deals, total estimated value xx Million.

North America Second Hand Truck Industry Industry Trends & Insights

The North America second-hand truck market is experiencing significant growth, driven by several key factors. Increased demand for transportation services fueled by e-commerce expansion is a primary driver. The aging of existing truck fleets necessitates replacements, leading to high demand in the secondary market. Technological advancements in vehicle diagnostics and condition monitoring improve the quality and reliability of used trucks, boosting consumer confidence. Consumer preferences are shifting towards fuel-efficient models and trucks equipped with advanced safety features. Economic factors, including fluctuating fuel prices and interest rates, influence buyer behavior. However, supply chain disruptions, particularly those related to semiconductor availability, continue to constrain the market. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million by 2033. Market penetration of telematics and other advanced technologies is gradually increasing, though adoption rates vary across vehicle types and regions.

Dominant Markets & Segments in North America Second Hand Truck Industry

The heavy-duty truck segment dominates the North American second-hand truck market, driven by the high demand for freight transportation. The United States remains the largest market within North America, benefiting from its extensive transportation infrastructure and robust economy.

Key Drivers of Heavy-Duty Truck Segment Dominance:

- Strong Logistics Sector: The significant presence of the e-commerce and manufacturing industries creates robust demand for heavy-duty trucks in freight transport.

- Developed Infrastructure: A well-developed highway network facilitates the efficient movement of goods, boosting the need for heavy-duty trucking.

- Government Regulations: While regulations impact costs, they also drive demand for reliable and compliant heavy-duty trucks.

Regional Analysis:

The US market's size and economic activity significantly impact the second-hand truck market. While Canada and Mexico have growing markets, their size and economic dynamism lag behind the US.

North America Second Hand Truck Industry Product Innovations

Recent product developments have focused on improving the quality and reliability of used trucks. Advanced diagnostics and refurbishment techniques are enhancing the condition of pre-owned vehicles. Telematics integration is becoming increasingly prevalent, providing data-driven insights into vehicle performance and maintenance needs. This improves transparency and trust in the used market. These innovations align with consumer demand for well-maintained and technologically equipped trucks. The market is also seeing the introduction of certified pre-owned programs by some manufacturers, increasing consumer confidence.

Report Segmentation & Scope

This report segments the North American second-hand truck market by vehicle type:

Light-Duty Trucks: This segment exhibits moderate growth, driven by demand from small businesses and individual consumers. Market size is projected at xx Million in 2025, with a CAGR of xx% during the forecast period. Competitive dynamics are influenced by a wide range of brands and price points.

Medium-Duty Trucks: This segment is experiencing steady growth, driven by demand from delivery services and local transportation businesses. Market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. Competition is relatively intense among established manufacturers.

Heavy-Duty Trucks: This segment dominates the market, driven by the high demand from the freight and logistics industry. Market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. The market is characterized by significant competition among major manufacturers.

Key Drivers of North America Second Hand Truck Industry Growth

Several factors are propelling the growth of the North American second-hand truck industry. The continuous expansion of the e-commerce sector fuels demand for reliable transportation solutions. The aging of existing truck fleets necessitates replacements, driving up the demand for used trucks. Technological advancements such as improved vehicle diagnostics are increasing the overall quality and lifespan of second-hand trucks. Government incentives and policies encouraging the adoption of fuel-efficient vehicles indirectly contribute to growth by increasing the availability of used models. Finally, fluctuating new truck prices also drive demand toward more affordable used options.

Challenges in the North America Second Hand Truck Industry Sector

The industry faces several challenges. Supply chain disruptions, particularly in the availability of parts and components, impact the refurbishment and maintenance of used trucks, reducing supply. Fluctuations in fuel prices significantly affect the operating costs of trucking businesses, impacting demand for used trucks. Stringent emission regulations and safety standards impose increased costs on maintaining and upgrading used vehicles, creating barriers to market entry for smaller players. Increasing competition, particularly from larger dealerships and online marketplaces, puts pressure on margins for smaller operators. These factors constrain market growth and profitability.

Leading Players in the North America Second Hand Truck Industry Market

- Arrow Truck Sales Inc

- Gordon Truck Centers Inc

- General Motors Company

- Volvo AB Class B

- Truckworld

- Isuzu Motor Ltd

- Paccar Inc

- International Used Trucks

- Ryder System Inc

- Ford Motor Company

Key Developments in North America Second Hand Truck Industry Sector

- 2022 Q3: Increased investment in online platforms for used truck sales.

- 2023 Q1: Several major manufacturers launched certified pre-owned truck programs.

- 2024 Q2: Several significant M&A transactions reshaped the market landscape.

Strategic North America Second Hand Truck Industry Market Outlook

The North American second-hand truck market holds substantial growth potential driven by continuing e-commerce expansion and fleet renewal needs. Strategic opportunities exist for businesses that leverage technology to enhance the quality, transparency, and efficiency of the used truck market. Focusing on providing certified pre-owned trucks with integrated telematics solutions and superior customer service presents significant competitive advantages. Furthermore, capitalizing on the increasing demand for fuel-efficient and environmentally friendly used trucks positions businesses for long-term success. The market is likely to see further consolidation, with larger players acquiring smaller dealerships.

North America Second Hand Truck Industry Segmentation

-

1. Vehicle Type

- 1.1. Light-duty Truck

- 1.2. Medium-duty Truck

- 1.3. Heavy-duty Truck

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Second Hand Truck Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Second Hand Truck Industry Regional Market Share

Geographic Coverage of North America Second Hand Truck Industry

North America Second Hand Truck Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure May Hamper the growth of the Market

- 3.4. Market Trends

- 3.4.1. Heavy Duty Trucks will Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light-duty Truck

- 5.1.2. Medium-duty Truck

- 5.1.3. Heavy-duty Truck

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light-duty Truck

- 6.1.2. Medium-duty Truck

- 6.1.3. Heavy-duty Truck

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light-duty Truck

- 7.1.2. Medium-duty Truck

- 7.1.3. Heavy-duty Truck

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light-duty Truck

- 8.1.2. Medium-duty Truck

- 8.1.3. Heavy-duty Truck

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Arrow Truck Sales Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Gordon Truck Centers Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo AB Class B

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Truckworld

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Isuzu Motor Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Paccar Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Used Trucks

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ryder System Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ford Motor Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arrow Truck Sales Inc

List of Figures

- Figure 1: North America Second Hand Truck Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Second Hand Truck Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: North America Second Hand Truck Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Second Hand Truck Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Second Hand Truck Industry?

Key companies in the market include Arrow Truck Sales Inc, Gordon Truck Centers Inc, General Motors Company, Volvo AB Class B, Truckworld, Isuzu Motor Ltd, Paccar Inc, International Used Trucks, Ryder System Inc, Ford Motor Company.

3. What are the main segments of the North America Second Hand Truck Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16103.28 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicles are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Heavy Duty Trucks will Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure May Hamper the growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Second Hand Truck Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Second Hand Truck Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Second Hand Truck Industry?

To stay informed about further developments, trends, and reports in the North America Second Hand Truck Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence