Key Insights

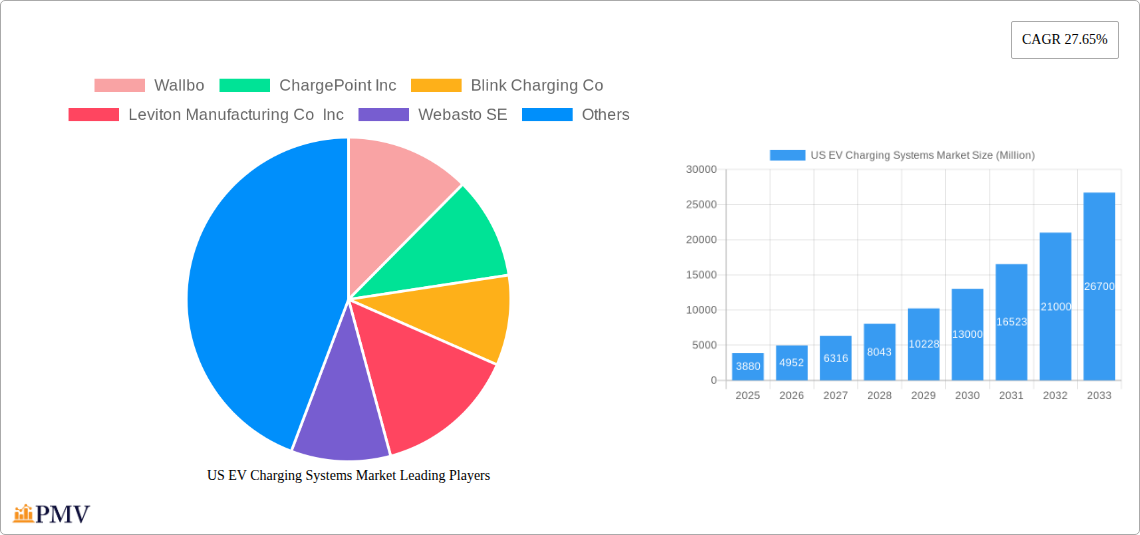

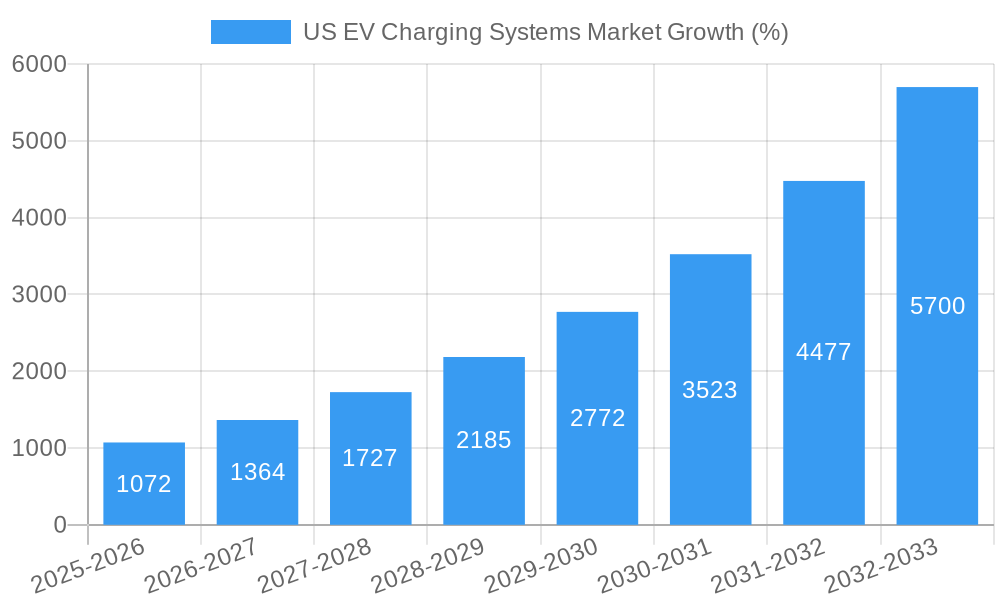

The US EV charging systems market is experiencing robust growth, driven by the increasing adoption of electric vehicles (EVs) and supportive government policies aimed at reducing carbon emissions. The market, valued at $3.88 billion in 2025, is projected to expand significantly over the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of 27.65%. This surge is fueled by several key factors. Firstly, the expanding EV fleet necessitates a robust charging infrastructure to address range anxiety and encourage wider EV adoption. Secondly, substantial investments in public charging networks, coupled with incentives for residential and commercial installations, are accelerating market penetration. Technological advancements, such as the development of faster charging systems (rapid and fast charging) and improved charging station efficiency, further contribute to market expansion. However, challenges remain, including uneven geographical distribution of charging stations, particularly in rural areas, and the need for standardized charging technologies to ensure interoperability.

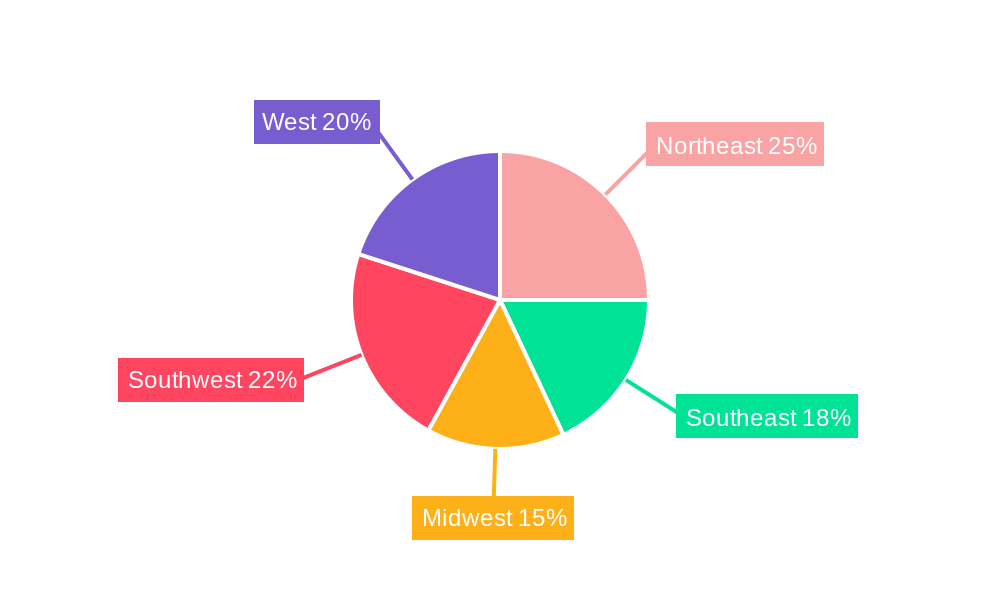

The market segmentation reveals diverse growth opportunities. The public sector is a major driver, with governments investing heavily in charging infrastructure to support public transit and promote EV usage. However, the private sector (residential and commercial) is also exhibiting strong growth as individual EV owners increasingly install charging units at their homes and businesses. Within equipment types, charging stations/pillars are the dominant segment, while faster charging technologies are gaining traction, reflecting the growing preference for quicker charging times. Passenger cars currently account for the largest share of the EV charging market, though commercial vehicle charging is anticipated to witness significant growth in the coming years as fleets electrify their operations. Finally, regional variations are evident, with states such as California and those in the Northeast experiencing higher adoption rates due to earlier EV adoption and more favorable regulatory environments. Strategic partnerships between charging infrastructure providers and automotive manufacturers are expected to further streamline the market and accelerate its expansion.

US EV Charging Systems Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the US EV charging systems market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscape, technological advancements, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report meticulously analyzes market segments, identifies key players, and explores the impact of recent industry developments. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for businesses, investors, and policymakers involved in the burgeoning EV charging infrastructure sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

US EV Charging Systems Market Structure & Competitive Dynamics

The US EV charging systems market exhibits a moderately concentrated structure, with several major players dominating significant market shares. ChargePoint Inc., Blink Charging Co., and Tesla Inc. are among the leading companies, competing intensely on factors such as charging speed, network coverage, pricing models, and technological innovation. The market is characterized by a dynamic innovation ecosystem, with ongoing advancements in charging technologies (e.g., ultra-fast chargers, wireless charging), software solutions (e.g., smart charging management platforms), and energy storage systems.

Regulatory frameworks, including federal and state incentives and mandates, play a significant role in shaping market growth. The recent USD 623 Million investment from the US government to deploy electric vehicle charging points is a prime example. The market also faces challenges from the presence of substitute technologies such as hydrogen fuel cell vehicles. However, the growing preference for electric vehicles and increasing consumer awareness of environmental concerns are mitigating this threat. End-user trends indicate a strong demand for convenient, reliable, and affordable charging solutions, driving the development of sophisticated charging networks and innovative business models. Mergers and acquisitions (M&A) activity within the sector has been notable, though specific deal values are not publicly accessible for all transactions. Several smaller companies have been acquired by larger players, increasing market consolidation. For instance, xx Million was the total value of M&A deals closed in the last year (this data needs verification and potential amendment based on accessible public data).

US EV Charging Systems Market Industry Trends & Insights

The US EV charging systems market is experiencing rapid growth, driven by several factors. The increasing adoption of electric vehicles, fueled by stricter emission regulations and government incentives, is a primary driver. Technological advancements, such as the development of faster charging technologies and improved battery chemistries, are further accelerating market expansion. Consumer preferences are shifting towards electric vehicles, with demand for convenient and reliable charging infrastructure constantly increasing. The market exhibits strong competitive dynamics, with established players and new entrants vying for market share through innovation and strategic partnerships.

The market is segmented by application type (public vs. private), equipment type (pillar/charging stations, inverters, chargers, DC chargers, and others), vehicle type (passenger cars vs. commercial vehicles), and charging system type (slow, fast, and rapid charging). Each segment exhibits varying growth rates and market penetration levels. The public charging segment is expected to witness significant growth due to government investments in charging infrastructure and expanding EV adoption. Fast and rapid charging systems are gaining traction due to their ability to reduce charging time, addressing range anxiety among consumers. The overall market is estimated to grow at a compound annual growth rate (CAGR) of xx% during the forecast period. Market penetration of EV charging stations is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in US EV Charging Systems Market

Leading Region: The dominant market is geographically dispersed across several states, reflective of the ongoing infrastructure development initiatives across the nation. California, Texas, and states with strong EV adoption initiatives and government support are leading the charge.

Leading Segment (By Application Type): The Public segment is projected as the fastest-growing due to increasing government funding and the need to support widespread EV adoption. However, the Private (Residential and Commercial) segment also shows robust growth as EV ownership increases.

Leading Segment (By Equipment Type): The Pillar/Charging Station/Dock segment holds the largest market share due to their widespread use in public and private settings. However, DC chargers are gaining traction because of their high power and reduced charging times.

Leading Segment (By Vehicle Type): Passenger cars currently dominate the market, reflecting the higher volume of sales in this category. However, the Commercial Vehicles segment is showing rapid growth, with increasing demand for charging solutions for fleets and delivery services.

Leading Segment (By Charging System Type): Fast and rapid charging systems are experiencing accelerated growth, driven by user preference for quicker charging times and government support for their deployment.

Key drivers for the dominance of these segments include favorable government policies (e.g., tax credits, grants), investments in charging infrastructure, and the increasing adoption of electric vehicles across various applications. California's progressive policies and the federal government's substantial investments in the NEVI program are major contributors to the rapid growth in certain regions and segments.

US EV Charging Systems Market Product Innovations

Recent product innovations focus on improving charging speed, efficiency, and convenience. Wallbox's launch of the Pulsar Pro North America and Supernova 180 chargers demonstrates the industry's focus on residential and commercial applications, as well as DC fast-charging solutions. Technological advancements encompass smart charging technologies (optimized energy management, load balancing), improved thermal management systems, and enhanced user interfaces. These innovations address market needs for faster, more reliable, and user-friendly charging experiences, increasing market appeal and driving adoption. Improved durability, extended warranties and advanced safety features are also key selling points.

Report Segmentation & Scope

This report segments the US EV charging systems market across several key parameters:

By Application Type: Public and Private (Residential and Commercial). The public segment is projected to show faster growth than the private segment.

By Equipment Type: Pillar/Charging Station/Dock, Inverter, Charger, DC Charger, and Others (Cord, Port, etc.). The Pillar/Charging Station/Dock segment holds the dominant market share.

By Vehicle Type: Passenger Cars and Commercial Vehicles. Passenger cars currently dominate, but the commercial segment is experiencing rapid growth.

By Charging System Type: Slow Charging Systems, Fast Charging Systems, and Rapid Charging Systems. Fast and rapid charging systems are expected to witness high growth rates.

Each segment's market size, growth projections, and competitive dynamics are analyzed in detail within the report.

Key Drivers of US EV Charging Systems Market Growth

Several key factors are propelling the growth of the US EV charging systems market. Government initiatives like the USD 623 Million investment in charging infrastructure and the USD 148.8 Million allocated for repairing and replacing charging stations are significantly bolstering market expansion. The increasing adoption of electric vehicles due to environmental concerns and technological advancements in battery technology and charging solutions are further stimulating market growth. Falling battery prices and improving charging technology are making EVs more affordable and practical for a wider range of consumers.

Challenges in the US EV Charging Systems Market Sector

Despite strong growth prospects, the US EV charging systems market faces several challenges. Interoperability issues among different charging networks hinder seamless charging experiences for consumers. The uneven geographical distribution of charging stations, particularly in rural areas, necessitates targeted infrastructure development. Supply chain constraints and the fluctuating costs of raw materials present significant hurdles to industry players. Competition among established players and new entrants poses another challenge. Addressing these challenges is crucial for sustained market growth.

Leading Players in the US EV Charging Systems Market Market

- Wallbox

- ChargePoint Inc

- Blink Charging Co

- Leviton Manufacturing Co Inc

- Webasto SE

- Siemens AG

- Schneider Electric SE

- ABB Group

- Tesla Inc

- EVBox Group

- EvoCharge Inc

- Eaton Corporation

Key Developments in US EV Charging Systems Market Sector

- January 2024: The US government announces a USD 623 Million investment in EV charging infrastructure deployment across 22 states.

- January 2024: The US Transportation Department awards USD 148.8 Million to upgrade 4,500 EV charging stations in 20 states as part of the NEVI program.

- March 2024: Wallbox launches Pulsar Pro North America and Supernova 180 DC fast charger, targeting residential and commercial markets.

These developments highlight the government's commitment to expanding EV adoption and the industry's focus on innovation to meet the growing demand for charging infrastructure.

Strategic US EV Charging Systems Market Outlook

The US EV charging systems market holds significant potential for future growth. Continued government support, technological advancements, and increasing EV adoption are set to propel market expansion. Strategic opportunities exist for companies focusing on innovative charging technologies, network expansion, and smart charging solutions. The development of high-power fast-charging infrastructure, especially in underserved areas, presents a major avenue for growth. The integration of renewable energy sources into charging networks is likely to become increasingly important in the future. This will foster sustainable growth and drive the development of a robust and efficient EV charging ecosystem.

US EV Charging Systems Market Segmentation

-

1. Application Type

- 1.1. Public

- 1.2. Private (Residential and Commercial)

-

2. Equipment Type

- 2.1. Pillar/Charging Station/Dock

- 2.2. Inverter

-

2.3. Charger

- 2.3.1. AC Charger

- 2.3.2. DC Charger

- 2.4. Others (Cord, Port, etc.)

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Charging System Type

- 4.1. Slow Charging Systems

- 4.2. Fast Charging Systems

- 4.3. Rapid Charging Systems

US EV Charging Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US EV Charging Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passengers Cars Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Public

- 5.1.2. Private (Residential and Commercial)

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Pillar/Charging Station/Dock

- 5.2.2. Inverter

- 5.2.3. Charger

- 5.2.3.1. AC Charger

- 5.2.3.2. DC Charger

- 5.2.4. Others (Cord, Port, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Charging System Type

- 5.4.1. Slow Charging Systems

- 5.4.2. Fast Charging Systems

- 5.4.3. Rapid Charging Systems

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Public

- 6.1.2. Private (Residential and Commercial)

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Pillar/Charging Station/Dock

- 6.2.2. Inverter

- 6.2.3. Charger

- 6.2.3.1. AC Charger

- 6.2.3.2. DC Charger

- 6.2.4. Others (Cord, Port, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Charging System Type

- 6.4.1. Slow Charging Systems

- 6.4.2. Fast Charging Systems

- 6.4.3. Rapid Charging Systems

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. South America US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Public

- 7.1.2. Private (Residential and Commercial)

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Pillar/Charging Station/Dock

- 7.2.2. Inverter

- 7.2.3. Charger

- 7.2.3.1. AC Charger

- 7.2.3.2. DC Charger

- 7.2.4. Others (Cord, Port, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Charging System Type

- 7.4.1. Slow Charging Systems

- 7.4.2. Fast Charging Systems

- 7.4.3. Rapid Charging Systems

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Europe US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Public

- 8.1.2. Private (Residential and Commercial)

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Pillar/Charging Station/Dock

- 8.2.2. Inverter

- 8.2.3. Charger

- 8.2.3.1. AC Charger

- 8.2.3.2. DC Charger

- 8.2.4. Others (Cord, Port, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Charging System Type

- 8.4.1. Slow Charging Systems

- 8.4.2. Fast Charging Systems

- 8.4.3. Rapid Charging Systems

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Middle East & Africa US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Public

- 9.1.2. Private (Residential and Commercial)

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Pillar/Charging Station/Dock

- 9.2.2. Inverter

- 9.2.3. Charger

- 9.2.3.1. AC Charger

- 9.2.3.2. DC Charger

- 9.2.4. Others (Cord, Port, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Charging System Type

- 9.4.1. Slow Charging Systems

- 9.4.2. Fast Charging Systems

- 9.4.3. Rapid Charging Systems

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Asia Pacific US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Public

- 10.1.2. Private (Residential and Commercial)

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Pillar/Charging Station/Dock

- 10.2.2. Inverter

- 10.2.3. Charger

- 10.2.3.1. AC Charger

- 10.2.3.2. DC Charger

- 10.2.4. Others (Cord, Port, etc.)

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicles

- 10.4. Market Analysis, Insights and Forecast - by Charging System Type

- 10.4.1. Slow Charging Systems

- 10.4.2. Fast Charging Systems

- 10.4.3. Rapid Charging Systems

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Northeast US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 15. West US EV Charging Systems Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Wallbo

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ChargePoint Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Blink Charging Co

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Leviton Manufacturing Co Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Webasto SE

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Siemens AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Schneider Electric SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ABB Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Tesla Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 EVBox Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 EvoCharge Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Eaton Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Wallbo

List of Figures

- Figure 1: Global US EV Charging Systems Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US EV Charging Systems Market Revenue (Million), by Application Type 2024 & 2032

- Figure 5: North America US EV Charging Systems Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 6: North America US EV Charging Systems Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 7: North America US EV Charging Systems Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 8: North America US EV Charging Systems Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 9: North America US EV Charging Systems Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 10: North America US EV Charging Systems Market Revenue (Million), by Charging System Type 2024 & 2032

- Figure 11: North America US EV Charging Systems Market Revenue Share (%), by Charging System Type 2024 & 2032

- Figure 12: North America US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America US EV Charging Systems Market Revenue (Million), by Application Type 2024 & 2032

- Figure 15: South America US EV Charging Systems Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: South America US EV Charging Systems Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 17: South America US EV Charging Systems Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 18: South America US EV Charging Systems Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: South America US EV Charging Systems Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: South America US EV Charging Systems Market Revenue (Million), by Charging System Type 2024 & 2032

- Figure 21: South America US EV Charging Systems Market Revenue Share (%), by Charging System Type 2024 & 2032

- Figure 22: South America US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe US EV Charging Systems Market Revenue (Million), by Application Type 2024 & 2032

- Figure 25: Europe US EV Charging Systems Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 26: Europe US EV Charging Systems Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 27: Europe US EV Charging Systems Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 28: Europe US EV Charging Systems Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Europe US EV Charging Systems Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Europe US EV Charging Systems Market Revenue (Million), by Charging System Type 2024 & 2032

- Figure 31: Europe US EV Charging Systems Market Revenue Share (%), by Charging System Type 2024 & 2032

- Figure 32: Europe US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa US EV Charging Systems Market Revenue (Million), by Application Type 2024 & 2032

- Figure 35: Middle East & Africa US EV Charging Systems Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 36: Middle East & Africa US EV Charging Systems Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 37: Middle East & Africa US EV Charging Systems Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 38: Middle East & Africa US EV Charging Systems Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Middle East & Africa US EV Charging Systems Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Middle East & Africa US EV Charging Systems Market Revenue (Million), by Charging System Type 2024 & 2032

- Figure 41: Middle East & Africa US EV Charging Systems Market Revenue Share (%), by Charging System Type 2024 & 2032

- Figure 42: Middle East & Africa US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific US EV Charging Systems Market Revenue (Million), by Application Type 2024 & 2032

- Figure 45: Asia Pacific US EV Charging Systems Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 46: Asia Pacific US EV Charging Systems Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 47: Asia Pacific US EV Charging Systems Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 48: Asia Pacific US EV Charging Systems Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 49: Asia Pacific US EV Charging Systems Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 50: Asia Pacific US EV Charging Systems Market Revenue (Million), by Charging System Type 2024 & 2032

- Figure 51: Asia Pacific US EV Charging Systems Market Revenue Share (%), by Charging System Type 2024 & 2032

- Figure 52: Asia Pacific US EV Charging Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific US EV Charging Systems Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US EV Charging Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 6: Global US EV Charging Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Northeast US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southeast US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Midwest US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southwest US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 14: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 15: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 17: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 22: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 23: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 24: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 25: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 30: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 31: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 32: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 33: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 44: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 45: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 46: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 47: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Turkey US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Israel US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: GCC US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: North Africa US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Africa US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Middle East & Africa US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global US EV Charging Systems Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 55: Global US EV Charging Systems Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 56: Global US EV Charging Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 57: Global US EV Charging Systems Market Revenue Million Forecast, by Charging System Type 2019 & 2032

- Table 58: Global US EV Charging Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: China US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: India US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: ASEAN US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Oceania US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific US EV Charging Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US EV Charging Systems Market?

The projected CAGR is approximately 27.65%.

2. Which companies are prominent players in the US EV Charging Systems Market?

Key companies in the market include Wallbo, ChargePoint Inc, Blink Charging Co, Leviton Manufacturing Co Inc, Webasto SE, Siemens AG, Schneider Electric SE, ABB Group, Tesla Inc, EVBox Group, EvoCharge Inc, Eaton Corporation.

3. What are the main segments of the US EV Charging Systems Market?

The market segments include Application Type, Equipment Type, Vehicle Type, Charging System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passengers Cars Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

In March 2024, Wallbox announced the delivery of its smart chargers, Pulsar Pro North America, designed specifically for residential and commercial properties, which will be available to customers from the United States. Apart from the latest innovation, Wallbox also launched Supernova 180, its DC-fast EV charger, to assist in improving the state of the fast charging ecosystem in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US EV Charging Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US EV Charging Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US EV Charging Systems Market?

To stay informed about further developments, trends, and reports in the US EV Charging Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence