Key Insights

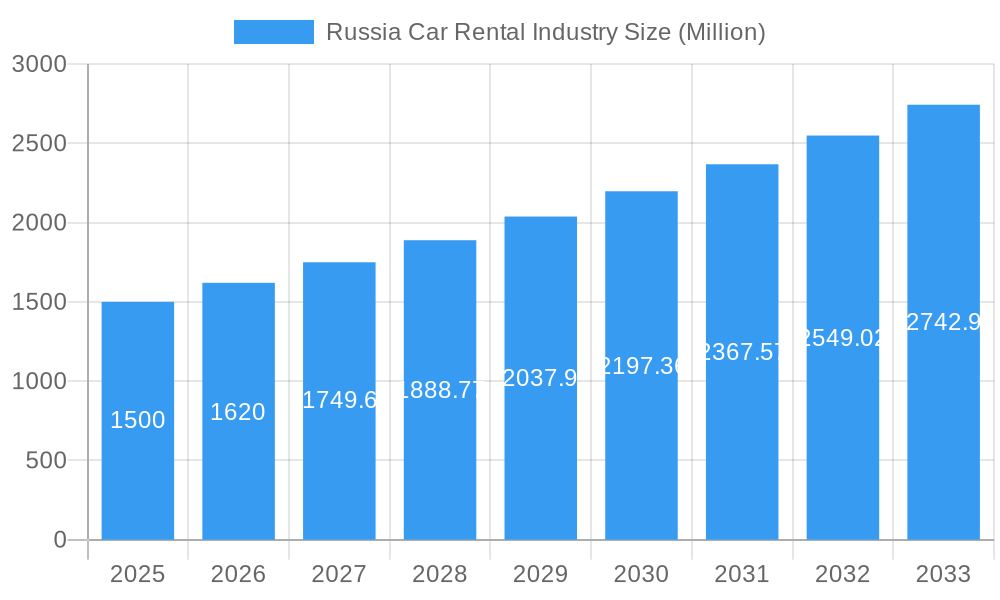

The Russian car rental market is projected for significant expansion, with an estimated market size of $2.33 billion in 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.23% between 2025 and 2033. Key growth drivers include a robust tourism sector, especially in Western and Southern Russia, and the increasing adoption of online booking platforms. The rise of ride-hailing services also indirectly stimulates market familiarity with on-demand transportation. Business travel expansion, fueled by economic activity in major cities, further supports this growth. Potential restraints include economic volatility and seasonal tourism fluctuations. Market segmentation indicates a preference for hatchbacks and sedans for short-term rentals, with SUVs gaining traction for long-term and business use. Leading companies like Delimobil, Europcar, and Hertz are enhancing their fleets and technologies to meet evolving customer demands.

Russia Car Rental Industry Market Size (In Billion)

The competitive environment features both global and local entities. International players leverage brand strength, while domestic companies offer market-specific insights. Western Russia is anticipated to hold the largest market share due to population and economic density, followed by Southern Russia's tourism appeal. Players differentiate through vehicle specialization, rental duration, or target customer segments. Future growth hinges on adapting to regulatory shifts, infrastructure improvements, and evolving consumer behavior influenced by economic conditions and technological advancements. Improved digital infrastructure and expanded transportation networks will be crucial for sustained market expansion.

Russia Car Rental Industry Company Market Share

Russia Car Rental Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia car rental industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025) to forecast market trends until 2033. It is an indispensable resource for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Russia Car Rental Industry Market Structure & Competitive Dynamics

The Russia car rental market exhibits a moderately concentrated structure with several major players and numerous smaller operators. Key players like Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, and Enterprise Holding Inc compete intensely, influencing market share and pricing. The market is shaped by a complex regulatory framework, evolving technological advancements, and fluctuating consumer preferences. The increasing adoption of online booking platforms and the rise of subscription-based models are significantly reshaping the competitive landscape. Furthermore, M&A activities have played a notable role in market consolidation, though precise deal values for recent years in Russia remain xx Million. For instance, the consolidation of smaller players by larger firms to expand market reach and service offerings is a prominent trend. Market share data reveals a xx% share for the top three players in 2024, indicating ongoing competition and potential for further consolidation. The innovation ecosystem is characterized by a blend of established international players and agile local startups focusing on technological advancements, such as minute-based rentals and digital platforms.

Russia Car Rental Industry Industry Trends & Insights

The Russia car rental market is experiencing robust growth, driven by several key factors. Increasing urbanization and rising disposable incomes fuel demand for convenient transportation options. The tourism sector's expansion contributes significantly to short-term rentals, while businesses increasingly utilize car rentals for fleet management and employee mobility. Technological disruptions, particularly the rise of mobile booking apps and digital platforms, are significantly enhancing customer experience and operational efficiency. Consumers increasingly favor online booking for its convenience and transparency. The market is witnessing a shift towards premium car rental services and subscription models, reflecting changing consumer preferences. The competitive dynamics are marked by intense rivalry, with companies constantly innovating to enhance their offerings and capture market share. The CAGR for the Russia car rental market is estimated at xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Russia Car Rental Industry

- Leading Region: Moscow and Saint Petersburg, due to high population density, robust tourism, and strong business activity, dominate the market.

- Booking Type: Online booking is the fastest-growing segment, driven by increasing smartphone penetration and preference for convenient, transparent transactions. Offline booking still maintains a significant share, particularly in smaller cities and among less tech-savvy customers.

- Car Type: SUVs are experiencing rapid growth due to their versatility and appeal to families and business travelers. Sedans remain a significant segment, catering to individual travelers and business needs. Hatchbacks cater to budget-conscious travelers and represent a considerable portion of the market.

- Rental Length: Short-term rentals dominate the market due to tourist traffic and individual travel needs. Long-term rentals are increasingly popular among businesses and those relocating.

- Application: Business travel and tourism are the major applications for car rentals. Leisure/Tourism remains significant due to a growing number of tourists. Business applications are steadily increasing due to the rise of car-sharing and flexible working arrangements.

Key drivers for the dominant segments include favorable economic policies encouraging tourism and business growth, investment in infrastructure like roads and airports, and increased adoption of technological solutions like online booking platforms. The dominance of Moscow and St. Petersburg is primarily due to their well-developed transport networks, high population densities, and concentration of business activities.

Russia Car Rental Industry Product Innovations

Recent innovations have focused on enhancing customer experience and operational efficiency. The introduction of minute-based rentals, fully digital services like EASY2DRIVE, and premium subscription models like Audi Drive reflect the growing trend of flexibility and convenience. The use of technological platforms for managing vehicle fleets demonstrates the growing emphasis on data-driven optimization. These innovations are aimed at enhancing market fit by offering customized solutions and targeting various customer segments' specific needs. The integration of advanced technologies like GPS tracking, telematics, and predictive analytics will further revolutionize the industry.

Report Segmentation & Scope

This report segments the Russia car rental market based on booking type (online and offline), car type (hatchback, sedan, SUV), rental length (short-term and long-term), and application (leisure/tourism and business). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For example, online bookings are projected to grow at a xx% CAGR, while the SUV segment is expected to witness the highest growth in terms of market size. Competitive dynamics vary significantly across segments, with intense competition observed in the online booking segment.

Key Drivers of Russia Car Rental Industry Growth

Growth is fueled by several factors: Rising disposable incomes among the population are increasing demand for convenient transportation, with tourism and the business sector contributing significantly. Technological advancements like mobile apps and digital platforms enhance convenience and efficiency, attracting more customers. Government initiatives promoting infrastructure development and tourism further support market expansion.

Challenges in the Russia Car Rental Industry Sector

The industry faces challenges including fluctuating fuel prices and economic uncertainties impacting affordability and consumer spending. Regulatory hurdles and fluctuating exchange rates can impact profitability and operations. Intense competition from various players, including ride-sharing services, necessitates continuous innovation and operational efficiency. Supply chain disruptions may constrain availability and impact pricing.

Leading Players in the Russia Car Rental Industry Market

- Delimobil

- Europcar International

- The Hertz Corporation

- Naprokat R

- YouDrive

- Yandex Drive

- Belka Car

- Budget Rent a Car System Inc

- Avis

- Enterprise Holding Inc

Key Developments in Russia Car Rental Industry Sector

- June 2021: Yandex Drive launched a fleet management platform.

- March 2021: Audi Russia launched its premium subscription service, Audi Drive.

- October 2021: MINI Russia launched its fully digital EASY2DRIVE service.

- May 2022: Mercedes Benz and BMW AG jointly introduced a minute-based car rental service.

These developments have significantly impacted market dynamics, driving innovation and enhancing customer experience, ultimately shaping the competitive landscape.

Strategic Russia Car Rental Industry Market Outlook

The Russia car rental market presents significant growth potential, driven by continued urbanization, rising incomes, and technological advancements. Strategic opportunities exist in expanding into underserved regions, developing innovative service models, and leveraging technological advancements to enhance operational efficiency and customer experience. Companies focused on sustainable practices and digital innovation are well-positioned to capture significant market share in the years to come.

Russia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Car Type

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. SUV

-

3. Rental Length

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Leisure/Tourism

- 4.2. Business

Russia Car Rental Industry Segmentation By Geography

- 1. Russia

Russia Car Rental Industry Regional Market Share

Geographic Coverage of Russia Car Rental Industry

Russia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Online Booking Segment Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Car Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Car Type

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. SUV

- 5.3. Market Analysis, Insights and Forecast - by Rental Length

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Leisure/Tourism

- 5.4.2. Business

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delimobil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Europcar International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Hertz Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Naprokat R

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YouDrive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yandex Drive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Belka Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Budget Rent a Car System Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Enterprise Holding Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delimobil

List of Figures

- Figure 1: Russia Car Rental Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Car Rental Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Car Rental Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 2: Russia Car Rental Industry Revenue billion Forecast, by Car Type 2020 & 2033

- Table 3: Russia Car Rental Industry Revenue billion Forecast, by Rental Length 2020 & 2033

- Table 4: Russia Car Rental Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Russia Car Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Car Rental Industry Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: Russia Car Rental Industry Revenue billion Forecast, by Car Type 2020 & 2033

- Table 8: Russia Car Rental Industry Revenue billion Forecast, by Rental Length 2020 & 2033

- Table 9: Russia Car Rental Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Russia Car Rental Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Car Rental Industry?

The projected CAGR is approximately 8.23%.

2. Which companies are prominent players in the Russia Car Rental Industry?

Key companies in the market include Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, Enterprise Holding Inc.

3. What are the main segments of the Russia Car Rental Industry?

The market segments include Booking Type, Car Type, Rental Length, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Online Booking Segment Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In May 2022, Mercedes Benz and BMW AG jointly introduced a car rental service in Russia. The service allows the user to rent a car by the minute. The vehicles were booked over a smartphone application and can be returned anywhere in the business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Russia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence