Key Insights

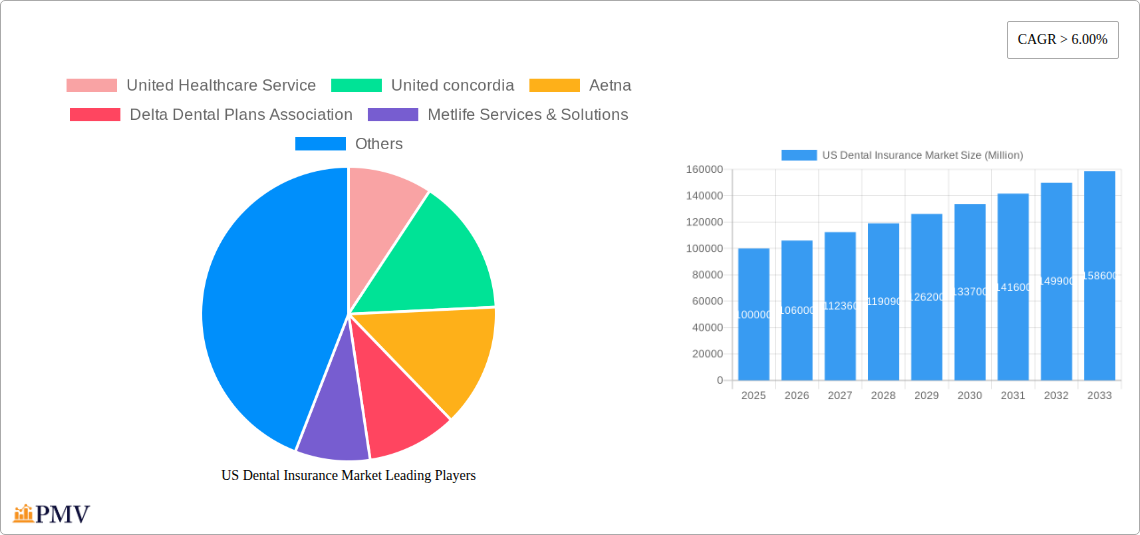

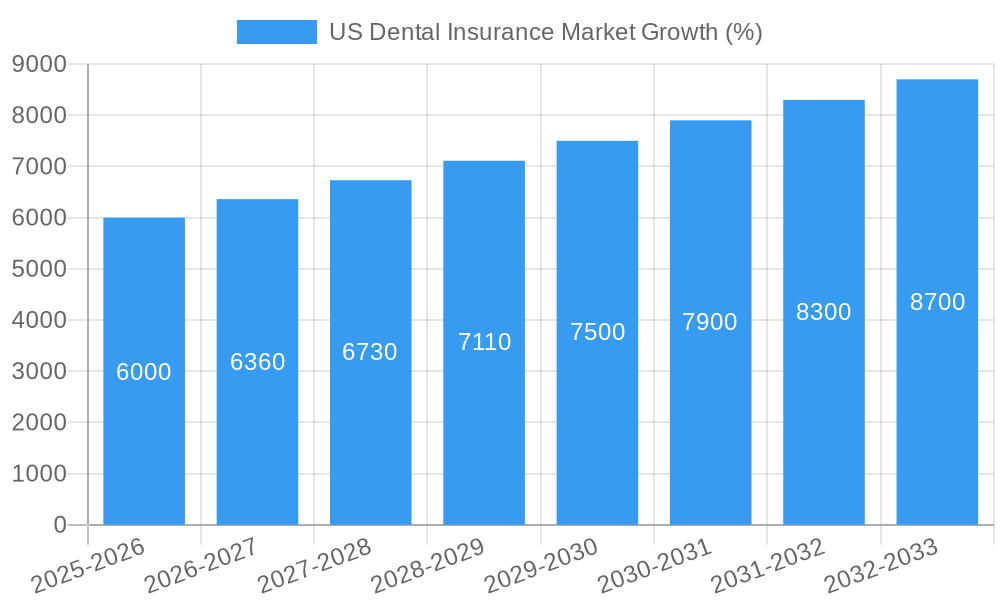

The US dental insurance market, currently valued at approximately $100 billion in 2025 (estimated based on a substantial market and provided CAGR), is projected to experience robust growth, exceeding a 6% compound annual growth rate (CAGR) through 2033. This expansion is driven by several key factors. The rising prevalence of dental diseases, coupled with an aging population requiring more extensive dental care, fuels demand for comprehensive coverage. Furthermore, increasing awareness of oral health's connection to overall well-being is encouraging individuals to prioritize dental insurance. The market is segmented by procedure type (preventive, major, basic), industry served (chemicals, refineries, metal and mining, food and beverages, others), and coverage type (dental HMOs, PPOs, indemnity, EPOs, POS). Growth within the preventive care segment is particularly noteworthy, reflecting a proactive approach to oral health. The significant presence of established players like UnitedHealthcare, Aetna, Delta Dental, and MetLife, alongside regional and specialized providers, contributes to market competitiveness. However, factors such as rising premiums and the persistent issue of affordability may serve as potential restraints to market expansion in certain segments. Growth will likely be concentrated in areas with higher disposable incomes and a greater emphasis on preventative healthcare.

The competitive landscape is characterized by a mix of large national insurers and regional providers. Large national players benefit from economies of scale and extensive distribution networks, while regional providers may offer more personalized service and tailored plans. Market segmentation is crucial for strategic planning, with industry-specific needs influencing insurance product design and pricing. Future growth will depend on addressing affordability concerns, innovating product offerings to meet evolving consumer needs (such as incorporating telehealth and preventative services), and adapting to changes in healthcare policy. The ongoing integration of technology into dental practices and the rise of data-driven analytics also present opportunities for enhancing efficiency and improving customer experience. These factors are shaping the landscape of the US dental insurance market, creating a dynamic environment ripe with potential for growth and innovation.

US Dental Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US dental insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and future trends. The report includes detailed segmentation by procedure (preventive, major, basic), industry (chemicals, refineries, metal and mining, food and beverages, others), and coverage type (Dental HMOs, PPOs, indemnity plans, EPOs, and POS). Key players like UnitedHealthcare, MetLife, Delta Dental, Aetna, and others are analyzed for their market share, strategies, and competitive landscape. The report's value lies in its data-driven approach, actionable insights, and future market projections, enabling informed strategic planning. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

US Dental Insurance Market Structure & Competitive Dynamics

The US dental insurance market is characterized by a moderately concentrated structure, with several large players holding significant market share. The market's competitive landscape is dynamic, driven by factors including technological innovation, evolving consumer preferences, and ongoing mergers and acquisitions (M&A) activity. Key players, such as UnitedHealthcare, Aetna, Delta Dental Plans Association, MetLife Services & Solutions, and Humana, compete intensely on factors like coverage options, pricing, network size, and digital capabilities.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2024. This level of concentration indicates a relatively mature market with established players.

- Innovation Ecosystems: The market exhibits a high level of innovation, particularly in areas such as telehealth dentistry, digital dental records, and AI-powered diagnostic tools. Several startups and established players are actively investing in these areas.

- Regulatory Frameworks: Government regulations, including HIPAA and state-level mandates, significantly impact the market structure and pricing dynamics. Compliance requirements can influence the cost and complexity of operating within the dental insurance sector.

- Product Substitutes: Limited direct substitutes exist for dental insurance, although cost-conscious consumers might opt for alternative payment methods, impacting market penetration.

- End-User Trends: A growing focus on preventative dental care, driven by improved awareness of oral health's connection to overall wellness, creates opportunities for growth in relevant insurance offerings.

- M&A Activities: The market has witnessed considerable M&A activity in recent years, with deal values exceeding xx Million in total. These activities aim to expand market reach, enhance service offerings, and gain a competitive edge. For instance, a recent significant merger resulted in a combined entity holding xx% market share.

US Dental Insurance Market Industry Trends & Insights

The US dental insurance market is experiencing robust growth, driven by factors such as increasing awareness of oral health, an aging population with greater dental needs, and advancements in dental technology. The rising prevalence of chronic diseases like diabetes, which is linked to increased risk of gum disease, also fuels market demand. Technological advancements such as telehealth dentistry and AI-powered diagnostic tools are transforming the industry, improving access to care and driving efficiency. Consumer preferences are shifting towards comprehensive coverage, digital access, and personalized dental plans. The market's competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative solutions that target underserved segments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million by 2033. Market penetration currently sits at xx%, with significant potential for further growth, especially in underserved communities.

Dominant Markets & Segments in US Dental Insurance Market

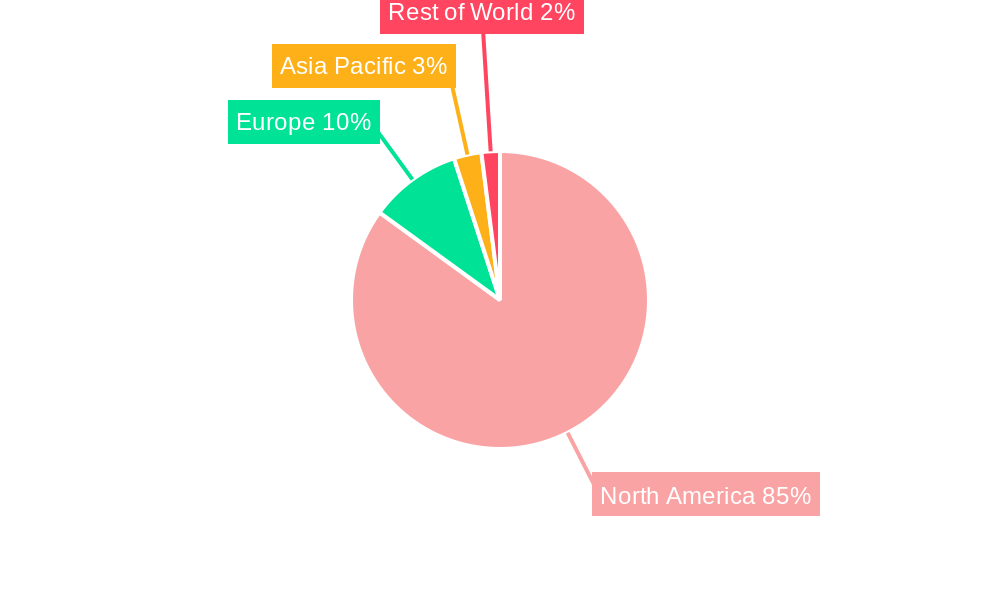

The US dental insurance market exhibits regional variations in growth and penetration. The specific dominant region requires further investigation. However, based on population density, access to healthcare, and economic factors, we predict the dominant segment will be the South.

- By Procedure: The preventive segment currently holds the largest market share, driven by increasing awareness of oral hygiene and the cost-effectiveness of preventive care. The major and basic procedure segments also show significant growth potential.

- By Industry: The food and beverage industry is expected to drive substantial growth due to the inherent occupational hazards.

- By Coverage: Dental PPOs currently dominate the market due to their flexibility and wider network of participating dentists.

Key Drivers:

- Economic Policies: Government incentives and subsidies for dental insurance can significantly impact market growth.

- Infrastructure: Availability and accessibility of dental healthcare infrastructure across different regions influence market dynamics.

- Technological Advancements: Introduction of innovative dental technologies and digital platforms plays a critical role.

US Dental Insurance Market Product Innovations

Recent years have witnessed significant product innovation in the US dental insurance market. Key developments include the integration of telehealth platforms, offering virtual consultations and remote monitoring, AI-powered diagnostic tools that enhance accuracy and efficiency, and personalized dental plans tailored to individual needs and risk profiles. These innovations enhance accessibility, improve efficiency, and cater to evolving consumer preferences, creating competitive advantages and fostering market growth.

Report Segmentation & Scope

This report provides a granular segmentation of the US dental insurance market across various parameters:

- By Procedure: Preventive, Major, Basic. Each segment's growth projections, market size estimates and competitive analysis are provided.

- By Industry: Chemicals, Refineries, Metal and mining, Food and beverages, Others. Industry-specific needs and insurance preferences are discussed, impacting market penetration and demand.

- By Coverage: Dental HMOs, PPOs, Indemnity Plans, EPOs, and POS. The report details the market size, growth projections, and competitive landscape of each coverage type.

Key Drivers of US Dental Insurance Market Growth

Several factors fuel the growth of the US dental insurance market. Firstly, heightened awareness of oral health and its link to overall wellbeing promotes preventative care and insurance adoption. Secondly, an aging population with increased dental needs significantly expands the market. Thirdly, technological advancements such as telehealth and AI-powered diagnostics increase efficiency and access. Finally, favorable regulatory frameworks and government initiatives supporting dental care access stimulate growth.

Challenges in the US Dental Insurance Market Sector

The US dental insurance market faces challenges. Regulatory complexities and compliance requirements impose operational costs, while pricing pressures and competition constrain profitability. The rising costs of dental procedures and the need to balance affordability with comprehensive coverage present further challenges. Supply chain issues involving dental materials and equipment, especially after the pandemic, have also impacted the industry. These factors collectively impact market expansion and profitability.

Leading Players in the US Dental Insurance Market Market

- United Healthcare Service

- United Concordia

- Aetna

- Delta Dental Plans Association

- Metlife Services & Solutions

- AFLAC Inc

- Renaissance Dental

- AXA

- Ameritas

- Humana

- Cigna

- Allianz

Key Developments in US Dental Insurance Market Sector

- February 9, 2022: UnitedHealthcare partnered with Quip to enhance virtual dental care benefits, expanding access and convenience.

- May 4, 2022: MetLife authorized a USD 3 Billion stock repurchase, signaling confidence in the company's future and market position.

Strategic US Dental Insurance Market Market Outlook

The US dental insurance market presents significant growth opportunities. Continued innovation in telehealth and AI-driven diagnostics will enhance accessibility and efficiency. Personalized plans catering to individual needs and risk profiles will drive demand. Strategic partnerships and M&A activities will shape the competitive landscape. Focusing on underserved populations and preventative care initiatives will unlock substantial market potential. The market's future hinges on adapting to evolving consumer preferences, technological advancements, and regulatory changes.

US Dental Insurance Market Segmentation

-

1. Coverage

- 1.1. Dental health maintenance organizations

- 1.2. Dental preferred provider organizations

- 1.3. Dental indemnity plans

- 1.4. Dental exclusive provider organizations

- 1.5. Dental Point of service

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. Industries

- 3.1. Chemicals

- 3.2. Refineries

- 3.3. Metal and mining

- 3.4. Food and beverages

- 3.5. Others

-

4. Demographics

- 4.1. Senior citizens

- 4.2. adults

- 4.3. minors

US Dental Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Dental Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Government Initiatives Boosting Dental Insurance Market in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental health maintenance organizations

- 5.1.2. Dental preferred provider organizations

- 5.1.3. Dental indemnity plans

- 5.1.4. Dental exclusive provider organizations

- 5.1.5. Dental Point of service

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by Industries

- 5.3.1. Chemicals

- 5.3.2. Refineries

- 5.3.3. Metal and mining

- 5.3.4. Food and beverages

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior citizens

- 5.4.2. adults

- 5.4.3. minors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Dental health maintenance organizations

- 6.1.2. Dental preferred provider organizations

- 6.1.3. Dental indemnity plans

- 6.1.4. Dental exclusive provider organizations

- 6.1.5. Dental Point of service

- 6.2. Market Analysis, Insights and Forecast - by Procedure

- 6.2.1. Preventive

- 6.2.2. Major

- 6.2.3. Basic

- 6.3. Market Analysis, Insights and Forecast - by Industries

- 6.3.1. Chemicals

- 6.3.2. Refineries

- 6.3.3. Metal and mining

- 6.3.4. Food and beverages

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Demographics

- 6.4.1. Senior citizens

- 6.4.2. adults

- 6.4.3. minors

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Dental health maintenance organizations

- 7.1.2. Dental preferred provider organizations

- 7.1.3. Dental indemnity plans

- 7.1.4. Dental exclusive provider organizations

- 7.1.5. Dental Point of service

- 7.2. Market Analysis, Insights and Forecast - by Procedure

- 7.2.1. Preventive

- 7.2.2. Major

- 7.2.3. Basic

- 7.3. Market Analysis, Insights and Forecast - by Industries

- 7.3.1. Chemicals

- 7.3.2. Refineries

- 7.3.3. Metal and mining

- 7.3.4. Food and beverages

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Demographics

- 7.4.1. Senior citizens

- 7.4.2. adults

- 7.4.3. minors

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Europe US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Dental health maintenance organizations

- 8.1.2. Dental preferred provider organizations

- 8.1.3. Dental indemnity plans

- 8.1.4. Dental exclusive provider organizations

- 8.1.5. Dental Point of service

- 8.2. Market Analysis, Insights and Forecast - by Procedure

- 8.2.1. Preventive

- 8.2.2. Major

- 8.2.3. Basic

- 8.3. Market Analysis, Insights and Forecast - by Industries

- 8.3.1. Chemicals

- 8.3.2. Refineries

- 8.3.3. Metal and mining

- 8.3.4. Food and beverages

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Demographics

- 8.4.1. Senior citizens

- 8.4.2. adults

- 8.4.3. minors

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Middle East & Africa US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Dental health maintenance organizations

- 9.1.2. Dental preferred provider organizations

- 9.1.3. Dental indemnity plans

- 9.1.4. Dental exclusive provider organizations

- 9.1.5. Dental Point of service

- 9.2. Market Analysis, Insights and Forecast - by Procedure

- 9.2.1. Preventive

- 9.2.2. Major

- 9.2.3. Basic

- 9.3. Market Analysis, Insights and Forecast - by Industries

- 9.3.1. Chemicals

- 9.3.2. Refineries

- 9.3.3. Metal and mining

- 9.3.4. Food and beverages

- 9.3.5. Others

- 9.4. Market Analysis, Insights and Forecast - by Demographics

- 9.4.1. Senior citizens

- 9.4.2. adults

- 9.4.3. minors

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Asia Pacific US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Dental health maintenance organizations

- 10.1.2. Dental preferred provider organizations

- 10.1.3. Dental indemnity plans

- 10.1.4. Dental exclusive provider organizations

- 10.1.5. Dental Point of service

- 10.2. Market Analysis, Insights and Forecast - by Procedure

- 10.2.1. Preventive

- 10.2.2. Major

- 10.2.3. Basic

- 10.3. Market Analysis, Insights and Forecast - by Industries

- 10.3.1. Chemicals

- 10.3.2. Refineries

- 10.3.3. Metal and mining

- 10.3.4. Food and beverages

- 10.3.5. Others

- 10.4. Market Analysis, Insights and Forecast - by Demographics

- 10.4.1. Senior citizens

- 10.4.2. adults

- 10.4.3. minors

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. United States US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Canada US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Mexico US Dental Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 United Healthcare Service

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 United concordia

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Aetna

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Delta Dental Plans Association

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Metlife Services & Solutions

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 AFLAC Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Renaissance Dental**List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 AXA

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Ameritas

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Humana

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Cigna

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Allianz

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 United Healthcare Service

List of Figures

- Figure 1: Global US Dental Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Dental Insurance Market Revenue (Million), by Coverage 2024 & 2032

- Figure 5: North America US Dental Insurance Market Revenue Share (%), by Coverage 2024 & 2032

- Figure 6: North America US Dental Insurance Market Revenue (Million), by Procedure 2024 & 2032

- Figure 7: North America US Dental Insurance Market Revenue Share (%), by Procedure 2024 & 2032

- Figure 8: North America US Dental Insurance Market Revenue (Million), by Industries 2024 & 2032

- Figure 9: North America US Dental Insurance Market Revenue Share (%), by Industries 2024 & 2032

- Figure 10: North America US Dental Insurance Market Revenue (Million), by Demographics 2024 & 2032

- Figure 11: North America US Dental Insurance Market Revenue Share (%), by Demographics 2024 & 2032

- Figure 12: North America US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America US Dental Insurance Market Revenue (Million), by Coverage 2024 & 2032

- Figure 15: South America US Dental Insurance Market Revenue Share (%), by Coverage 2024 & 2032

- Figure 16: South America US Dental Insurance Market Revenue (Million), by Procedure 2024 & 2032

- Figure 17: South America US Dental Insurance Market Revenue Share (%), by Procedure 2024 & 2032

- Figure 18: South America US Dental Insurance Market Revenue (Million), by Industries 2024 & 2032

- Figure 19: South America US Dental Insurance Market Revenue Share (%), by Industries 2024 & 2032

- Figure 20: South America US Dental Insurance Market Revenue (Million), by Demographics 2024 & 2032

- Figure 21: South America US Dental Insurance Market Revenue Share (%), by Demographics 2024 & 2032

- Figure 22: South America US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe US Dental Insurance Market Revenue (Million), by Coverage 2024 & 2032

- Figure 25: Europe US Dental Insurance Market Revenue Share (%), by Coverage 2024 & 2032

- Figure 26: Europe US Dental Insurance Market Revenue (Million), by Procedure 2024 & 2032

- Figure 27: Europe US Dental Insurance Market Revenue Share (%), by Procedure 2024 & 2032

- Figure 28: Europe US Dental Insurance Market Revenue (Million), by Industries 2024 & 2032

- Figure 29: Europe US Dental Insurance Market Revenue Share (%), by Industries 2024 & 2032

- Figure 30: Europe US Dental Insurance Market Revenue (Million), by Demographics 2024 & 2032

- Figure 31: Europe US Dental Insurance Market Revenue Share (%), by Demographics 2024 & 2032

- Figure 32: Europe US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa US Dental Insurance Market Revenue (Million), by Coverage 2024 & 2032

- Figure 35: Middle East & Africa US Dental Insurance Market Revenue Share (%), by Coverage 2024 & 2032

- Figure 36: Middle East & Africa US Dental Insurance Market Revenue (Million), by Procedure 2024 & 2032

- Figure 37: Middle East & Africa US Dental Insurance Market Revenue Share (%), by Procedure 2024 & 2032

- Figure 38: Middle East & Africa US Dental Insurance Market Revenue (Million), by Industries 2024 & 2032

- Figure 39: Middle East & Africa US Dental Insurance Market Revenue Share (%), by Industries 2024 & 2032

- Figure 40: Middle East & Africa US Dental Insurance Market Revenue (Million), by Demographics 2024 & 2032

- Figure 41: Middle East & Africa US Dental Insurance Market Revenue Share (%), by Demographics 2024 & 2032

- Figure 42: Middle East & Africa US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific US Dental Insurance Market Revenue (Million), by Coverage 2024 & 2032

- Figure 45: Asia Pacific US Dental Insurance Market Revenue Share (%), by Coverage 2024 & 2032

- Figure 46: Asia Pacific US Dental Insurance Market Revenue (Million), by Procedure 2024 & 2032

- Figure 47: Asia Pacific US Dental Insurance Market Revenue Share (%), by Procedure 2024 & 2032

- Figure 48: Asia Pacific US Dental Insurance Market Revenue (Million), by Industries 2024 & 2032

- Figure 49: Asia Pacific US Dental Insurance Market Revenue Share (%), by Industries 2024 & 2032

- Figure 50: Asia Pacific US Dental Insurance Market Revenue (Million), by Demographics 2024 & 2032

- Figure 51: Asia Pacific US Dental Insurance Market Revenue Share (%), by Demographics 2024 & 2032

- Figure 52: Asia Pacific US Dental Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific US Dental Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Dental Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 3: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 4: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 5: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 6: Global US Dental Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 12: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 13: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 14: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 15: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 20: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 21: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 22: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 23: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 28: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 29: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 30: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 31: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 42: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 43: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 44: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 45: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Turkey US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Israel US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: GCC US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: North Africa US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Africa US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East & Africa US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global US Dental Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 53: Global US Dental Insurance Market Revenue Million Forecast, by Procedure 2019 & 2032

- Table 54: Global US Dental Insurance Market Revenue Million Forecast, by Industries 2019 & 2032

- Table 55: Global US Dental Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 56: Global US Dental Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific US Dental Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Dental Insurance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the US Dental Insurance Market?

Key companies in the market include United Healthcare Service, United concordia, Aetna, Delta Dental Plans Association, Metlife Services & Solutions, AFLAC Inc, Renaissance Dental**List Not Exhaustive, AXA, Ameritas, Humana, Cigna, Allianz.

3. What are the main segments of the US Dental Insurance Market?

The market segments include Coverage, Procedure, Industries, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Government Initiatives Boosting Dental Insurance Market in the United States.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

On February 9, 2022, UnitedHealthcare collaborated with Quip, a software company, and launched digital resources, which include enhanced virtual dental care benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Dental Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Dental Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Dental Insurance Market?

To stay informed about further developments, trends, and reports in the US Dental Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence