Key Insights

The United States printed signage market, while exhibiting a modest Compound Annual Growth Rate (CAGR) of 0.40% during the 2019-2024 period, is projected to experience a period of moderate growth driven by several key factors. The increasing adoption of digital printing technologies is enabling greater customization and faster turnaround times for signage, catering to the diverse needs of businesses across various sectors. Growth in e-commerce and the expansion of retail spaces, particularly in urban areas, are further boosting demand for visually appealing and informative signage. Furthermore, the resurgence of in-person events and conferences following the pandemic is driving demand for temporary signage solutions such as banners, pop-up displays, and trade show materials. However, the market faces constraints like the rising costs of raw materials (paper, inks, and substrates) and increasing competition from digital advertising alternatives. The segmentation of the market shows significant potential in the retail, BFSI (Banking, Financial Services, and Insurance), and sports & leisure sectors, which are predicted to remain significant drivers of growth during the forecast period.

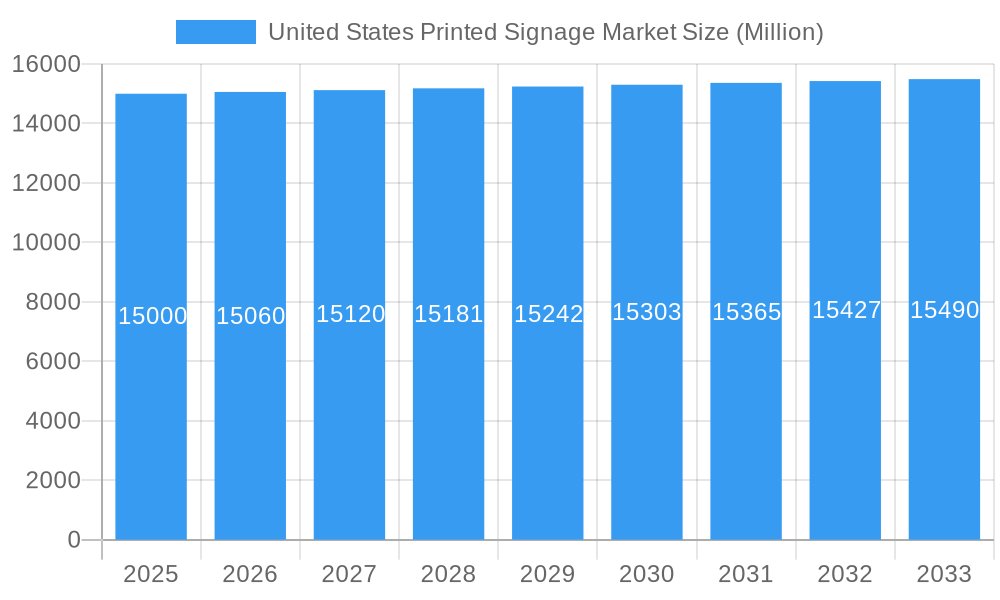

United States Printed Signage Market Market Size (In Billion)

Despite the relatively low CAGR, specific segments within the US printed signage market are expected to witness more robust growth. The demand for high-impact, durable outdoor signage, such as billboards and backlit displays, is projected to remain stable, while the indoor signage segment is likely to see increased demand fueled by the continued expansion of retail spaces and the growing trend toward customized branding and internal wayfinding. The adoption of sustainable and eco-friendly printing materials and practices is also emerging as a key trend, influencing the choice of materials and printing processes for signage solutions. Market players are focusing on providing innovative and technologically advanced signage solutions, including interactive displays and augmented reality (AR) integrated signage to enhance customer engagement. This innovation, coupled with strategic partnerships and marketing initiatives, will be key to achieving sustained growth in the coming years. The competitiveness of the market indicates a need for businesses to differentiate themselves through specialization, service quality, and innovative offerings.

United States Printed Signage Market Company Market Share

United States Printed Signage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States printed signage market, offering valuable insights for businesses, investors, and industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report dissects market dynamics, competitive landscapes, and future growth potential. The market size in 2025 is estimated at xx Million, with a projected xx% CAGR during the forecast period.

United States Printed Signage Market Market Structure & Competitive Dynamics

The competitive landscape of the US printed signage market is characterized by a dynamic interplay of established industry leaders and a vibrant ecosystem of regional and specialized businesses. While a moderately fragmented structure prevails, with several large corporations holding substantial influence, the market also benefits from the agility and localized expertise of numerous smaller enterprises that contribute significantly to overall market volume and diversity.

Leading players such as Avery Dennison Corporation, Vistaprint (Cimpress plc), and 3A Composites USA Inc. are at the forefront, driving innovation and shaping market trends. However, the market's health is also sustained by a multitude of smaller, agile companies that cater to specific niches and regional demands.

Market share analysis indicates a competitive environment where the top 5 players collectively command approximately **[Insert Specific Percentage Here]%** of the market share. This balance allows for both strategic competition and collaborative innovation. The market's evolutionary trajectory is heavily influenced by continuous advancements in printing technologies, including enhanced color accuracy and speed, sophisticated material science leading to more durable and sustainable options, and the increasing integration of digital design tools that streamline the creative and production processes. The regulatory framework, encompassing advertising standards and environmental impact guidelines, plays a crucial role in shaping product development and market practices. Simultaneously, the emergence of digital signage and advanced display technologies presents a competitive challenge, pushing printed signage providers to emphasize unique value propositions such as tactile quality, durability, and cost-effectiveness. End-user demands are increasingly shaped by the growing emphasis on experiential marketing and the desire for deeply personalized brand interactions, driving the need for customized and impactful signage solutions. Mergers and acquisitions (M&A) remain a moderate but significant force in the market, with recent deal values averaging around **[Insert Specific Million Value Here] Million**, reflecting ongoing consolidation and strategic expansion efforts. Further in-depth analysis, including specific M&A examples and their market ramifications, along with a comprehensive PESTLE analysis, is available to provide a holistic understanding of the market's complexities.

- Market concentration: Moderately fragmented, with strategic influence from key players and significant volume contribution from smaller businesses.

- Top 5 players market share: Approximately **[Insert Specific Percentage Here]%**, indicating a competitive but consolidated tier.

- Average M&A deal value: Approximately **[Insert Specific Million Value Here] Million** in recent years, reflecting strategic investments and consolidation.

United States Printed Signage Market Industry Trends & Insights

The US printed signage market is experiencing robust growth, propelled by a confluence of influential industry trends and evolving consumer preferences. Key growth drivers include the escalating adoption of outdoor advertising strategies, the expansion and revitalization of retail sectors, and the undeniable surge in the popularity of experiential marketing, which demands visually compelling and immersive brand experiences. These factors collectively fuel a consistent demand for high-quality printed signage solutions.

Technological advancements are revolutionizing the market, with innovations in LED backlit displays offering enhanced visibility and impact, alongside significant strides in large-format printing capabilities that enable larger and more intricate designs. Furthermore, a growing emphasis on sustainability is driving the adoption of environmentally friendly materials, appealing to both businesses and consumers conscious of their ecological footprint. Consumer preferences are increasingly shifting towards dynamic, eye-catching, and interactive signage that captures attention and reinforces brand messaging effectively. This trend fuels a heightened demand for innovative products, including signage that offers interactive elements and personalized experiences, thereby deepening customer engagement.

The competitive dynamics within the market are multifaceted, characterized by strategic price competition, a strong emphasis on product differentiation to stand out in a crowded field, and robust branding efforts to build consumer recognition and loyalty. The market has demonstrated consistent upward momentum, achieving a compound annual growth rate (CAGR) of **[Insert Specific Percentage Here]%** during the historical period (2019-2024). Looking ahead, the forecast period (2025-2033) anticipates a sustained growth trajectory with a projected CAGR of **[Insert Specific Percentage Here]%**. Within this landscape, the market penetration for specific signage types varies, with LED backlit displays emerging as a high-growth segment. This is attributed to their superior impact, enhanced visibility, and appeal for creating impactful displays, boasting a high market penetration rate of **[Insert Specific Percentage Here]%**.

Dominant Markets & Segments in United States Printed Signage Market

This section delves into the key segments driving the US printed signage market, identifying their dominance across product types, signage applications (indoor vs. outdoor), and various end-user verticals. Understanding these dominant areas is crucial for strategic planning and resource allocation within the industry.

Dominant Segments:

- Product Type: Billboards continue to hold a dominant position due to their unparalleled visibility and broad reach for mass advertising campaigns. Point-of-Purchase (POP) displays are exhibiting significant growth, proving highly effective in capturing consumer attention at the critical decision-making stage within retail environments. Banners also remain a strong performer, offering versatility and cost-effectiveness for various promotional needs.

- Signage Type: Outdoor signage commands a larger market share than indoor signage, largely owing to the pervasive nature of outdoor advertising and its capacity to reach a wider and more diverse audience.

- End-user Vertical: The Retail sector is a powerhouse of growth, fueled by an increasing need for eye-catching in-store promotions and a constant drive for enhanced brand visibility in a competitive marketplace. The Banking, Financial Services, and Insurance (BFSI) and Transportation & Logistics sectors are also substantial contributors to the overall market size, driven by their unique signage requirements for branding, wayfinding, and operational efficiency.

Key Drivers for Dominant Segments:

- Retail Sector: Increased consumer spending, continuous expansion of retail spaces, and a growing imperative to create engaging and memorable in-store experiences for customers.

- Billboards: Their inherent high visibility, extensive reach, and proven effectiveness in executing impactful outdoor advertising campaigns.

- Outdoor Signage: A sustained and growing demand for impactful outdoor advertising, coupled with the continuous need to build and reinforce brand awareness across public spaces.

United States Printed Signage Market Product Innovations

Recent product innovations in the US printed signage market include the development of sustainable and eco-friendly materials, advancements in digital printing technologies offering higher resolution and faster turnaround times, and the integration of smart technologies such as interactive displays and QR code integration for enhanced customer engagement. These innovations provide competitive advantages through improved visual appeal, cost-effectiveness, and enhanced customer experiences, aligning perfectly with current market trends toward sustainability and digital engagement.

Report Segmentation & Scope

This report segments the US printed signage market by product type (Billboards, Backlit Displays, Pop Displays, Banners, Flags, and Backdrops, Corporate Graphics, Exhibition, and Trade Show Materials, Others), signage type (Indoor Printed Signage, Outdoor Printed Signage), and end-user vertical (BFSI, Retail, Sports & Leisure, Entertainment, Transportation & Logistics, Healthcare, Other end-user verticals). Each segment's growth projections, market sizes, and competitive dynamics are analyzed thoroughly. The report projects significant growth across all segments, with variations based on specific market factors affecting each area.

Key Drivers of United States Printed Signage Market Growth

The growth of the US printed signage market is primarily driven by factors including the increasing demand for effective outdoor and indoor advertising, the expansion of the retail and hospitality sectors, and advancements in printing technologies and sustainable material options. Further government initiatives supporting infrastructure development and investments in public spaces drive the demand for high-quality signage.

Challenges in the United States Printed Signage Market Sector

The US printed signage market navigates a landscape fraught with several significant challenges that impact its profitability and long-term sustainability. Intense competition from both established players and emerging niche providers necessitates continuous innovation and efficiency. Fluctuating raw material prices, particularly for substrates and inks, can lead to unpredictable cost structures and affect profit margins. Environmental regulations are becoming increasingly stringent, focusing on the disposal of materials and the sourcing of eco-friendly alternatives, requiring significant investment in sustainable practices and materials. Furthermore, the accelerating adoption of digital signage offers a compelling alternative for dynamic content delivery, posing a direct competitive threat that printed signage providers must strategically address through differentiation and by highlighting unique advantages such as durability, tactile appeal, and cost-effectiveness for static messaging.

Leading Players in the United States Printed Signage Market Market

- Kelly Signs Inc

- Midwest Sign & Screen Printing Supply Co

- Neenah Inc

- Chandler Inc

- James Printing & Signs

- Sabre Digital Marketing

- Vistaprint (Cimpress plc)

- AJ Printing & Graphics Inc

- Avery Dennison Corporation

- RJ Courtney LLC

- Southwest Printing Co

- 3A Composites USA Inc

Key Developments in United States Printed Signage Market Sector

- 2023-Q3: Avery Dennison Corporation launched a new line of sustainable signage materials.

- 2022-Q4: Midwest Sign & Screen Printing Supply Co expanded its operations to a new state.

- 2021-Q2: A significant merger between two regional signage companies. (Further details to be included in the full report)

Strategic United States Printed Signage Market Market Outlook

The US printed signage market is poised for a promising future, driven by ongoing advancements in printing technology, a discernible shift towards sustainable materials, and the sustained growth within key end-user sectors. Strategic opportunities abound for businesses that can effectively capitalize on these trends. This includes a strong focus on developing innovative and high-impact product offerings that cater to the evolving demands of experiential marketing and brand personalization.

Expanding into niche markets with specialized signage needs, such as event signage, custom architectural graphics, or unique retail displays, presents a significant avenue for growth. Embracing and promoting sustainable practices, from material sourcing to production processes and end-of-life considerations, will be crucial for meeting increasingly eco-conscious consumer preferences and regulatory requirements. The emphasis on creating visually striking, memorable, and interactive signage experiences will remain paramount for businesses aiming to achieve success and maintain a competitive edge in the dynamic market of the coming years.

United States Printed Signage Market Segmentation

-

1. Product

- 1.1. Billboards

- 1.2. Backlit Displays

- 1.3. Pop Displays

- 1.4. Banners, Flags, and Backdrops

- 1.5. Corporat

- 1.6. Others Products

-

2. Type

- 2.1. Indoor Printed Signage

- 2.2. Outdoor Printed Signage

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Sports & Leisure

- 3.4. Entertainment

- 3.5. Transportation & Logistics

- 3.6. Healthcare

- 3.7. Other end-user verticals

United States Printed Signage Market Segmentation By Geography

- 1. United States

United States Printed Signage Market Regional Market Share

Geographic Coverage of United States Printed Signage Market

United States Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Effectiveness of Printed Signage

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Printed Billboards are Expected to Witness Downfall

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Billboards

- 5.1.2. Backlit Displays

- 5.1.3. Pop Displays

- 5.1.4. Banners, Flags, and Backdrops

- 5.1.5. Corporat

- 5.1.6. Others Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Printed Signage

- 5.2.2. Outdoor Printed Signage

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Sports & Leisure

- 5.3.4. Entertainment

- 5.3.5. Transportation & Logistics

- 5.3.6. Healthcare

- 5.3.7. Other end-user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kelly Signs Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midwest Sign & Screen Printing Supply Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neenah Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chandler Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Printing & Signs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sabre Digital Marketing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistaprint ( Cimpress plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJ Printing & Graphics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avery Dennison Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RJ Courtney LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Southwest Printing Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3A Composites USA Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kelly Signs Inc

List of Figures

- Figure 1: United States Printed Signage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Printed Signage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: United States Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Printed Signage Market?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the United States Printed Signage Market?

Key companies in the market include Kelly Signs Inc, Midwest Sign & Screen Printing Supply Co, Neenah Inc *List Not Exhaustive, Chandler Inc, James Printing & Signs, Sabre Digital Marketing, Vistaprint ( Cimpress plc), AJ Printing & Graphics Inc, Avery Dennison Corporation, RJ Courtney LLC, Southwest Printing Co, 3A Composites USA Inc.

3. What are the main segments of the United States Printed Signage Market?

The market segments include Product, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Effectiveness of Printed Signage.

6. What are the notable trends driving market growth?

Printed Billboards are Expected to Witness Downfall.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Printed Signage Market?

To stay informed about further developments, trends, and reports in the United States Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence