Key Insights

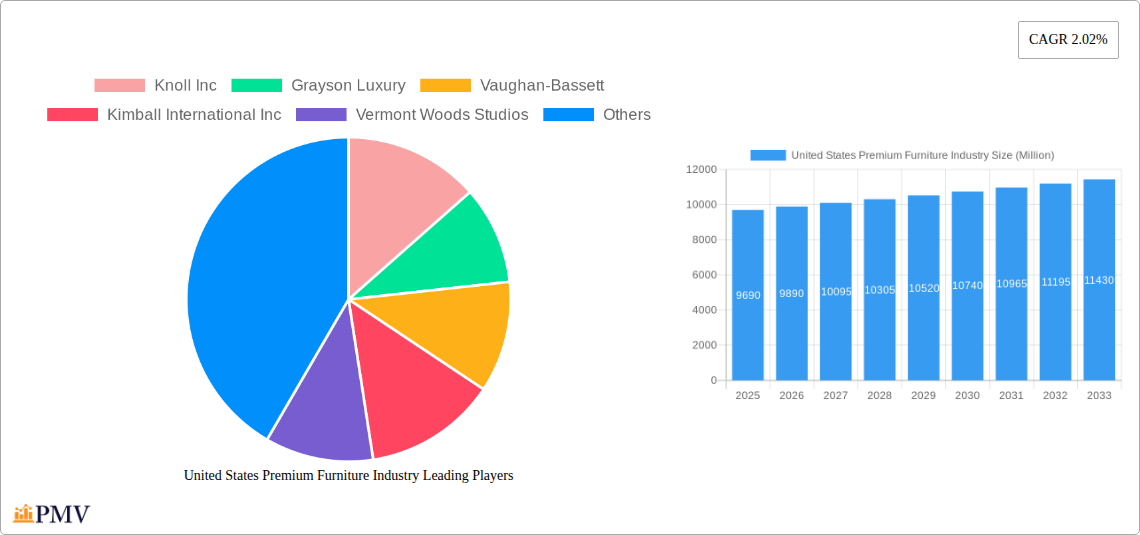

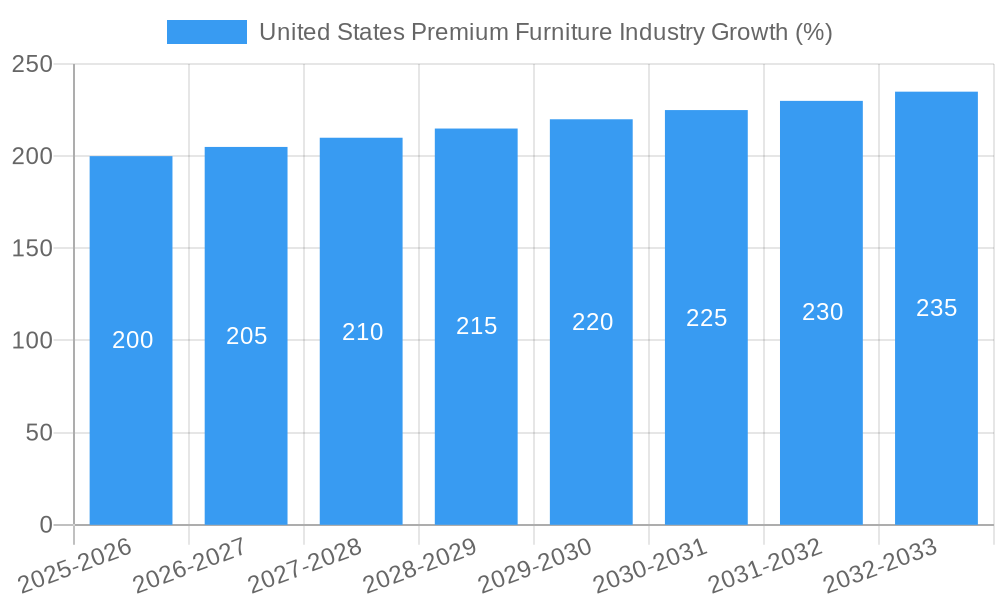

The United States premium furniture market, valued at approximately $9.69 billion in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.02% from 2025 to 2033. This growth is fueled by several key drivers. The increasing disposable incomes among high-net-worth individuals and a rising preference for high-quality, aesthetically pleasing furniture are significant contributors. Furthermore, the growing trend of home improvement and renovation projects, particularly among millennials and Gen X, is boosting demand for premium furniture pieces. The online sales channel is experiencing considerable growth, driven by enhanced e-commerce platforms offering detailed product information, virtual reality showrooms, and convenient delivery options. However, the market faces some restraints, including the volatility of raw material prices and the potential impact of economic downturns on consumer spending for luxury goods. The market segmentation reveals a strong preference for premium lighting, tables, chairs, and sofas, reflecting a focus on creating sophisticated and comfortable living spaces. The residential segment dominates the end-user market, although commercial spaces, such as high-end hotels and offices, contribute significantly.

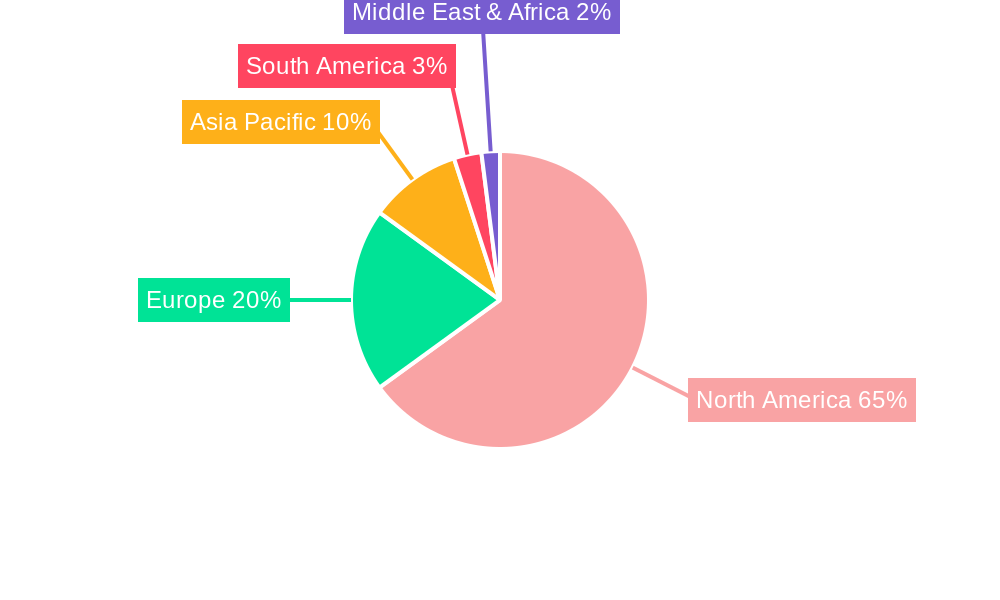

The geographic distribution of the market reflects the strong purchasing power in North America, particularly the United States. While other regions, such as Europe and Asia-Pacific, exhibit growth potential, the US market remains the core driver of industry revenue due to its established high-end furniture market and consumer preferences. Leading companies such as Knoll Inc., Grayson Luxury, and Hooker Furniture are capitalizing on these trends by focusing on innovative designs, sustainable materials, and exceptional customer service. Competition remains intense, prompting brands to differentiate themselves through unique design aesthetics, personalized customization options, and an emphasis on superior craftsmanship. Future growth will hinge on adapting to evolving consumer tastes, leveraging technological advancements in design and manufacturing, and maintaining a balance between luxury and sustainability to appeal to environmentally conscious consumers.

United States Premium Furniture Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the United States premium furniture industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast extending to 2033. It meticulously examines market structure, competitive dynamics, key trends, and growth drivers, providing actionable intelligence for informed decision-making. The total market size in 2025 is estimated at $xx Million.

United States Premium Furniture Industry Market Structure & Competitive Dynamics

The US premium furniture market is characterized by a moderately concentrated structure with several key players holding significant market share. While precise market share figures for individual companies fluctuate, leading players like Knoll Inc, Kimball International Inc, and Hooker Furniture command substantial portions of the market. The industry exhibits a dynamic competitive landscape shaped by innovation ecosystems, stringent regulatory frameworks concerning materials and manufacturing, and the presence of substitute products, particularly those made from more sustainable or readily available materials. End-user trends, particularly towards sustainability and personalization, are significantly impacting product design and marketing strategies. The past five years (2019-2024) have witnessed moderate M&A activity, with deal values ranging from $xx Million to $xx Million, primarily focused on expanding product portfolios and enhancing distribution channels.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share.

- Innovation Ecosystems: Focus on sustainable materials, smart furniture, and personalized design.

- Regulatory Frameworks: Compliance with safety and environmental regulations.

- Product Substitutes: Increasing availability of mid-range furniture with premium aesthetics.

- End-User Trends: Growing demand for personalized, sustainable, and technologically integrated furniture.

- M&A Activity: Moderate activity with deals valued between $xx Million and $xx Million.

United States Premium Furniture Industry Industry Trends & Insights

The US premium furniture market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors including rising disposable incomes, particularly among higher-income households, a growing preference for high-quality, aesthetically pleasing furniture, and the increasing popularity of home improvement and renovation projects. Technological disruptions, such as the integration of smart technology into furniture and the use of advanced manufacturing techniques, are influencing product development and market competition. Consumer preferences are shifting towards sustainable and ethically sourced materials, pushing manufacturers to adopt more environmentally friendly practices. The competitive dynamics are intensified by the emergence of e-commerce platforms, offering wider product choices and increasing price transparency. Market penetration of online sales channels is steadily growing, reaching approximately xx% in 2025, with projections of xx% by 2033.

Dominant Markets & Segments in United States Premium Furniture Industry

The residential segment dominates the US premium furniture market, accounting for approximately xx% of the total revenue in 2025. However, the commercial segment is expected to exhibit robust growth in the forecast period, driven by the expansion of hospitality, office, and healthcare sectors. Offline distribution channels still hold the largest market share (approximately xx%), but online sales are experiencing significant growth. The most popular product categories include sofas, tables, and chairs, followed by bedroom sets and accessories.

- Key Drivers of Residential Segment Dominance: Rising disposable incomes, home renovation trends.

- Key Drivers of Commercial Segment Growth: Expansion of hospitality, office, and healthcare industries.

- Key Drivers of Offline Channel Dominance: Experience-based shopping, product inspection and customization.

- Key Drivers of Online Channel Growth: Convenience, wider selection, price transparency.

- Key Products: Sofas, tables, chairs, bedroom sets and accessories.

United States Premium Furniture Industry Product Innovations

Recent innovations in the US premium furniture industry focus on incorporating smart technology, sustainable materials, and personalized designs. This includes integrating Bluetooth speakers, USB charging ports, and motion-activated lighting into furniture pieces. The use of recycled and sustainably harvested wood, along with other eco-friendly materials, is also gaining traction. Companies are increasingly offering customization options, enabling customers to personalize furniture to suit their individual tastes and lifestyles, enhancing the perceived value and exclusivity of premium furniture offerings.

Report Segmentation & Scope

This report segments the US premium furniture market by distribution channel (offline and online), end-user (residential and commercial), and product type (lighting, tables, chairs and sofas, accessories, bedroom, cabinets, and other products). Each segment is analyzed in detail, offering market size estimates, growth projections, and a competitive landscape analysis. This allows for a comprehensive understanding of the various aspects driving the market's performance. For instance, the online channel is projected to grow at a CAGR of xx%, while the commercial segment is expected to grow at a CAGR of xx%.

Key Drivers of United States Premium Furniture Industry Growth

The growth of the US premium furniture industry is fueled by several key factors: rising disposable incomes, especially amongst high-net-worth individuals, increasing demand for home improvement and refurbishment, growing awareness of sustainable and ethically sourced materials, and the integration of smart technology into furniture. Favorable economic conditions and government policies that support the industry also contribute to the market's growth.

Challenges in the United States Premium Furniture Industry Sector

The industry faces challenges including escalating raw material costs, supply chain disruptions, increasing labor costs, and intense competition. These factors can impact profit margins and limit market expansion. Regulatory compliance, particularly environmental regulations, can add to manufacturing costs and complexity.

Leading Players in the United States Premium Furniture Industry Market

- Knoll Inc

- Grayson Luxury

- Vaughan-Bassett

- Kimball International Inc

- Vermont Woods Studios

- Brown Jordan International

- Henkel Harris

- Ralph Lauren Corporation

- Hooker Furniture

- Kincaid

Key Developments in United States Premium Furniture Industry Sector

- January 2023: Knoll Inc. launched a new collection of sustainable furniture.

- June 2022: Kimball International acquired a smaller competitor, expanding its market share.

- October 2021: Hooker Furniture introduced a line of smart furniture with integrated technology.

- Further developments to be added based on data availability.

Strategic United States Premium Furniture Industry Market Outlook

The US premium furniture market presents significant growth opportunities in the coming years. The industry is expected to continue its upward trajectory, driven by the factors outlined in this report. Strategic focus on innovation, sustainability, and personalized customer experiences will be crucial for success in this competitive market. Companies that can successfully adapt to changing consumer preferences and technological advancements will be well-positioned to capitalize on the market's growth potential.

United States Premium Furniture Industry Segmentation

-

1. Product

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Accessories

- 1.5. Bedroom

- 1.6. Cabinets

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

-

3. End User

- 3.1. Residential

- 3.2. Commercial

United States Premium Furniture Industry Segmentation By Geography

- 1. United States

United States Premium Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Urbanization is Driving the Market; Increase in Rising Disposable Income

- 3.3. Market Restrains

- 3.3.1. Price Sensitivity is a Significant Challenge in the Indian Furniture Market

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income and Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Accessories

- 5.1.5. Bedroom

- 5.1.6. Cabinets

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Rest of North America

- 7. Asia Pacific Region United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 India

- 7.1.2 China

- 7.1.3 Japan

- 7.1.4 Australia

- 7.1.5 Rest of Asia Pacific Region

- 8. South America United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Brazil

- 8.1.2 Argentina

- 8.1.3 Rest of South America

- 9. Europe United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 United Kingdom

- 9.1.2 Germany

- 9.1.3 Italy

- 9.1.4 Rest of Europe

- 10. Middle East United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. South Africa United States Premium Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Arab Emirates

- 11.1.2 Rest of Middle East

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Knoll Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Grayson Luxury

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vaughan-Bassett

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kimball International Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vermont Woods Studios

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Brown Jordan International

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Henkel Harris

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Ralph Lauren Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hooker Furniture

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kincaid

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Knoll Inc

List of Figures

- Figure 1: United States Premium Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Premium Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: United States Premium Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Premium Furniture Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Premium Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: United States Premium Furniture Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: United States Premium Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: United States Premium Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: United States Premium Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: United States Premium Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: United States Premium Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Premium Furniture Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: India United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: China United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: China United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Japan United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Japan United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Australia United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia Pacific Region United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Region United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of South America United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: United Kingdom United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Germany United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Italy United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: United Arab Emirates United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: United Arab Emirates United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East United States Premium Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Middle East United States Premium Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: United States Premium Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 58: United States Premium Furniture Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 59: United States Premium Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 60: United States Premium Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 61: United States Premium Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 62: United States Premium Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 63: United States Premium Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: United States Premium Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Premium Furniture Industry?

The projected CAGR is approximately 2.02%.

2. Which companies are prominent players in the United States Premium Furniture Industry?

Key companies in the market include Knoll Inc, Grayson Luxury, Vaughan-Bassett, Kimball International Inc, Vermont Woods Studios, Brown Jordan International, Henkel Harris, Ralph Lauren Corporation, Hooker Furniture, Kincaid.

3. What are the main segments of the United States Premium Furniture Industry?

The market segments include Product, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Urbanization is Driving the Market; Increase in Rising Disposable Income.

6. What are the notable trends driving market growth?

Rising Disposable Income and Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity is a Significant Challenge in the Indian Furniture Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Premium Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Premium Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Premium Furniture Industry?

To stay informed about further developments, trends, and reports in the United States Premium Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence