Key Insights

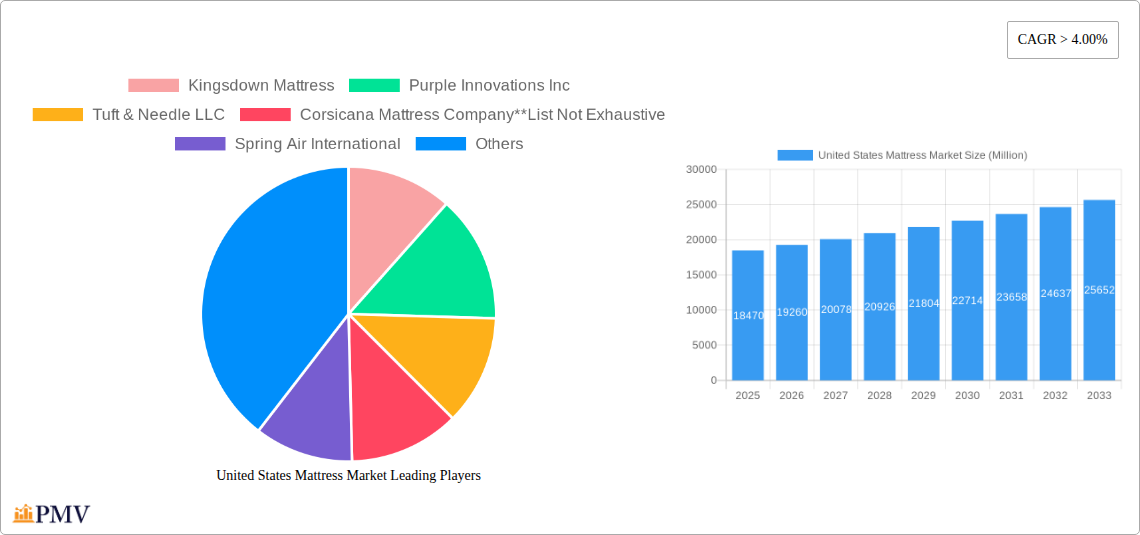

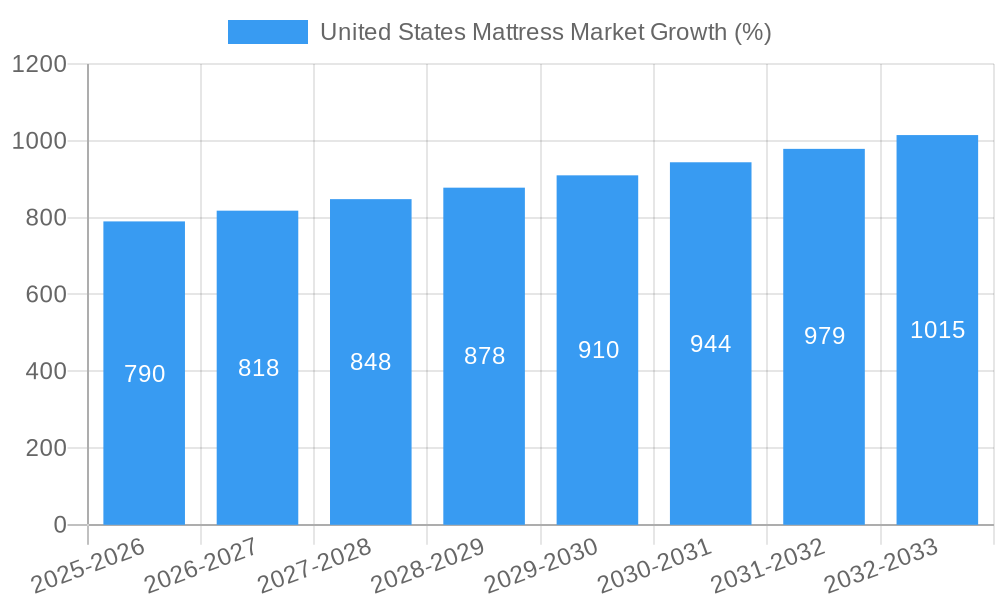

The United States mattress market, valued at $18.47 billion in 2025, is projected to experience robust growth, exceeding a 4% compound annual growth rate (CAGR) through 2033. This expansion is driven by several key factors. Firstly, increasing disposable incomes and a growing preference for higher-quality sleep solutions are fueling demand for premium mattresses, particularly those incorporating advanced technologies like memory foam and latex. Secondly, the rise of e-commerce platforms has significantly altered the distribution landscape, offering consumers greater convenience and a wider selection of brands and models. This online accessibility is complemented by the expansion of specialized brick-and-mortar stores catering to discerning consumers seeking personalized sleep consultations. Furthermore, health consciousness is driving demand for mattresses that promote better spinal alignment and overall sleep quality, further boosting market growth. Competition is fierce, with established players like Tempur Sealy International and Serta Simmons Bedding vying for market share alongside innovative startups like Casper and Purple Innovations.

However, the market also faces certain challenges. Economic downturns can impact consumer spending on discretionary items like mattresses. Additionally, concerns about the environmental impact of mattress manufacturing and disposal are growing, leading to increased demand for sustainable and eco-friendly options. The market segmentation reveals a strong preference for memory foam and innerspring mattresses in the residential sector, with online and multi-brand stores dominating the distribution channels. To capitalize on market opportunities, manufacturers are focusing on innovation, offering a wider range of materials, designs, and price points to cater to diverse consumer preferences and needs. The increasing prevalence of sleep disorders and a greater awareness of their impact on overall health and well-being are also significant drivers contributing to this continued market expansion.

United States Mattress Market: A Comprehensive Report (2019-2033)

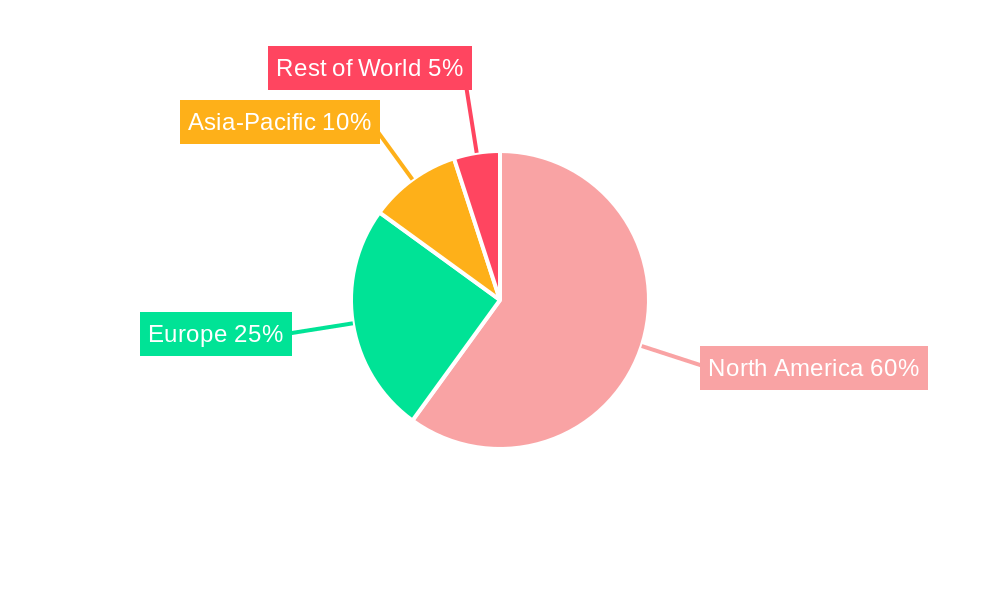

This detailed report provides a comprehensive analysis of the United States mattress market, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The study utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. This report is essential for industry stakeholders, investors, and anyone seeking a deep understanding of this dynamic market. Key players like Serta Simmons Bedding LLC, Tempur Sealy International Inc, and Sleep Number Corporation are extensively analyzed, alongside emerging competitors. The report also analyzes market segments by type (Innerspring, Memory Foam, Latex, Other Types), end-user (Residential, Commercial), and distribution channel (Multi-Brand Stores, Specialty Stores, Online, Other Distribution Channels).

United States Mattress Market Structure & Competitive Dynamics

The United States mattress market is characterized by a moderately consolidated structure, with a few major players holding significant market share. While precise market share data for each company requires further analysis, leading players like Tempur Sealy International Inc and Serta Simmons Bedding LLC command substantial portions of the overall market. This dominance, however, is challenged by the emergence of innovative direct-to-consumer brands such as Casper Inc and Saatva Inc, leveraging online channels and unique product offerings.

The market exhibits a dynamic innovation ecosystem, fueled by ongoing advancements in materials science, sleep technology, and manufacturing processes. Regulatory frameworks, primarily focused on safety and consumer protection, influence product design and manufacturing practices. Substitute products, including air mattresses and adjustable beds, exert some competitive pressure. End-user trends, particularly a growing focus on health and wellness, drive demand for premium and specialized mattresses. Mergers and acquisitions (M&A) activity has been moderate, with deal values varying significantly depending on the size and strategic fit of the companies involved. In the past five years, xx Million has been the average annual value for M&A deals in the sector, resulting in a slight increase in market concentration.

- Market Concentration: Moderately consolidated, with a few dominant players.

- Innovation: Strong focus on material science, sleep technology, and manufacturing processes.

- Regulatory Framework: Safety and consumer protection standards drive market practices.

- Substitutes: Air mattresses and adjustable beds present some competitive pressure.

- End-User Trends: Increasing emphasis on health and wellness boosts demand for premium options.

- M&A Activity: Moderate, with average annual deal values at approximately xx Million.

United States Mattress Market Industry Trends & Insights

The United States mattress market is experiencing significant growth, driven by several key factors. A rising disposable income, coupled with increasing awareness of the importance of sleep quality for overall health and well-being, fuels consumer demand. Technological advancements, such as the incorporation of smart technology in mattresses (as exemplified by Sleep Number Corporation's innovations), enhance consumer experiences and broaden the appeal of premium products. Consumer preferences are shifting towards specialized mattresses catering to specific needs and sleep styles, fueling segment-specific growth within the market.

The market shows a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of innovative technologies, such as smart beds, remains relatively low, providing ample scope for future expansion. Competitive dynamics are increasingly shaped by e-commerce, with online retailers gaining significant market share. The overall market exhibits a complex interplay between established players and emerging brands, each employing unique strategies to capture market share.

Dominant Markets & Segments in United States Mattress Market

The residential segment overwhelmingly dominates the United States mattress market, accounting for approximately xx% of the total market value in 2025. This is driven by the significant and growing population size and rising disposable incomes of the US population. The innerspring mattress type retains its leading position, although memory foam and hybrid options are steadily gaining market share. Online distribution channels are rapidly expanding, especially for direct-to-consumer brands, challenging the traditional dominance of multi-brand and specialty stores.

- Leading Segment: Residential (xx%)

- Leading Mattress Type: Innerspring (xx%), followed by Memory Foam (xx%)

- Leading Distribution Channel: Multi-Brand Stores (xx%), followed by Online (xx%)

Key Drivers of Dominance:

- Residential Segment: Large population base, increasing disposable income, and awareness about sleep quality.

- Innerspring Mattresses: Established market presence, affordability, and wide availability.

- Online Distribution: Convenience, competitive pricing, and targeted marketing strategies.

United States Mattress Market Product Innovations

Recent product innovations center on incorporating technology for improved sleep quality and personalization. Smart beds with sleep tracking and adjustment capabilities, as seen in Sleep Number Corporation's latest offerings, are gaining traction. Mattresses with advanced materials offering improved pressure relief, temperature regulation, and enhanced comfort are also emerging. These innovations cater to the increasing consumer demand for superior sleep experiences and personalization. The market is witnessing the introduction of eco-friendly and sustainable options, reflecting increasing consumer consciousness.

Report Segmentation & Scope

The report segments the market in three key ways:

By Type: Innerspring mattresses constitute the largest segment, followed by memory foam, latex, and other types. The forecast period projects continued growth across all segments, with memory foam and hybrid options exhibiting the fastest growth rates.

By End-User: The residential sector is by far the largest segment, but the commercial segment is showing promising growth, with hotels and other hospitality businesses increasingly adopting high-quality mattresses to enhance guest experiences.

By Distribution Channel: Multi-brand stores maintain a substantial share, but online sales are expanding rapidly, driven by consumer convenience and direct-to-consumer brands' success. Specialty stores cater to niche consumer preferences, offering curated selections and personalized services.

Key Drivers of United States Mattress Market Growth

Several factors fuel the growth of the United States mattress market. These include rising disposable incomes, improved awareness of sleep's importance for health, technological advancements in materials and sleep technology, and the increasing popularity of online retail. Government regulations promoting safety standards and consumer protection also indirectly drive market growth by ensuring quality and consumer confidence. Moreover, the expanding e-commerce sector provides new avenues for reaching consumers and increasing market penetration.

Challenges in the United States Mattress Market Sector

Despite positive growth trends, the market faces challenges. Supply chain disruptions, particularly in raw material sourcing, can impact production costs and availability. Intense competition, especially from both established players and emerging direct-to-consumer brands, puts pressure on pricing and profitability. Furthermore, stringent regulatory requirements can increase manufacturing costs and limit innovation for some companies. Finally, fluctuating consumer confidence and economic downturns can negatively influence spending on non-essential items such as premium mattresses.

Leading Players in the United States Mattress Market Market

- Kingsdown Mattress

- Purple Innovations Inc

- Tuft & Needle LLC

- Corsicana Mattress Company

- Spring Air International

- Casper Inc

- Saatva Inc

- Serta Simmons Bedding LLC

- Sleep Number Corporation

- Tempur Sealy International Inc

Key Developments in United States Mattress Market Sector

- August 2023: Sleep Number Corporation launches its next-generation smart beds and lifestyle furnishings, leveraging 19 billion hours of sleep data for improved sleep quality. This innovation significantly impacts the premium mattress segment, driving technological advancement and market differentiation.

- September 2022: Saatva introduces a dorm-friendly mattress bundle targeting the student demographic. This strategic move expands market reach and caters to a previously underserved segment.

Strategic United States Mattress Market Outlook

The United States mattress market presents significant growth potential. Continued innovation in materials and technology, alongside the increasing focus on personalized sleep solutions, will drive market expansion. Strategic opportunities lie in leveraging e-commerce channels, expanding into niche market segments, and developing sustainable and eco-friendly products. The market's future hinges on meeting evolving consumer needs and adapting to technological advancements, ensuring consistent innovation and market leadership in this competitive landscape.

United States Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Mattress Market Segmentation By Geography

- 1. United States

United States Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing Consumer Preferences is Driving the Market; Growth in Health awareness is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Competition among manufacturers barrier to market

- 3.4. Market Trends

- 3.4.1. Memory-Foam Mattresses Dominated the United States Mattress Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Mattress Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Kingsdown Mattress

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Purple Innovations Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tuft & Needle LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corsicana Mattress Company**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spring Air International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Casper Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saatva Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Serta Simmons Bedding LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sleep Number Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tempur Sealy International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kingsdown Mattress

List of Figures

- Figure 1: United States Mattress Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Mattress Market Share (%) by Company 2024

List of Tables

- Table 1: United States Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: United States Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: United States Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: United States Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: United States Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: United States Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 9: United States Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 10: United States Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 11: United States Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 12: United States Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: United States Mattress Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Mattress Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Mattress Market?

Key companies in the market include Kingsdown Mattress, Purple Innovations Inc, Tuft & Needle LLC, Corsicana Mattress Company**List Not Exhaustive, Spring Air International, Casper Inc, Saatva Inc, Serta Simmons Bedding LLC, Sleep Number Corporation, Tempur Sealy International Inc.

3. What are the main segments of the United States Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Changing Consumer Preferences is Driving the Market; Growth in Health awareness is Driving the Market.

6. What are the notable trends driving market growth?

Memory-Foam Mattresses Dominated the United States Mattress Market.

7. Are there any restraints impacting market growth?

High Competition among manufacturers barrier to market.

8. Can you provide examples of recent developments in the market?

August 2023: Sleep Number Corporation has introduced the next generation of smart beds and lifestyle furnishings. Designed to be used independently yet most effectively when combined, these innovations aim to enhance sleep quality and unlock individuals' full potential across all life stages. The next generation of Smart Beds was developed from the original Sleep Number 360 and awarded for its innovation. The knowledge of more than 19 billion hours of proprietary, longitudinal sleep data from the 360 Smart Bed has led to the most recent advances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Mattress Market?

To stay informed about further developments, trends, and reports in the United States Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence