Key Insights

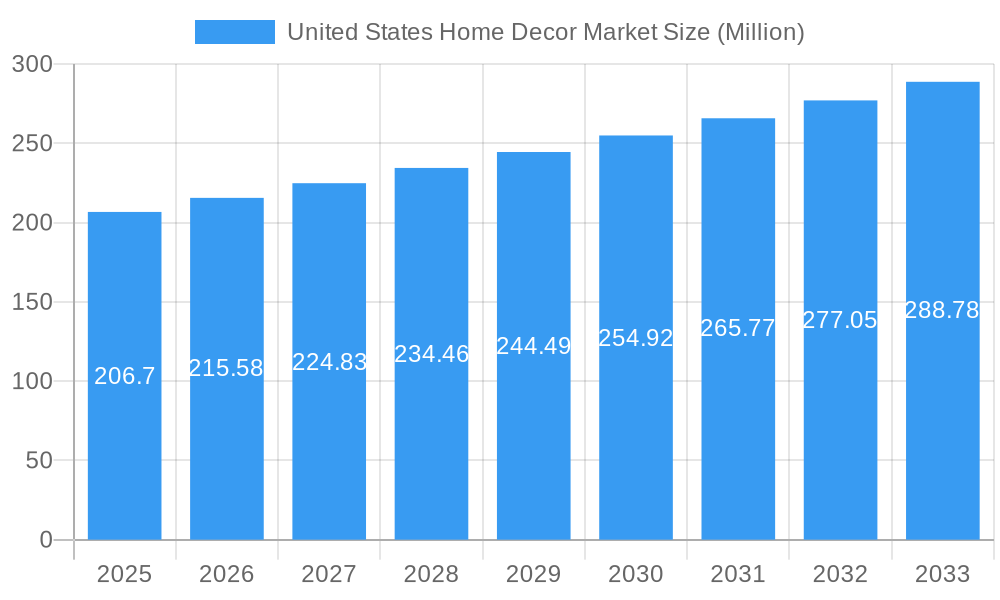

The United States home decor market, valued at $206.70 million in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes, particularly among millennials and Gen Z, fuel demand for aesthetically pleasing and functional home spaces. The increasing popularity of home renovation and remodeling projects, fueled by a desire for personalized living environments, further boosts market expansion. E-commerce platforms play a significant role, offering convenient access to a wide range of products and inspiring design trends through visual media. While supply chain disruptions and inflation pose challenges, the market's resilience is evident in its consistent growth. The diverse product segments, including home furniture, textiles, flooring, and lighting, offer varied avenues for growth, with online channels gaining significant traction. The segmentation by distribution channel reflects the evolving consumer preferences, highlighting the importance of both traditional retail outlets and online marketplaces in reaching target demographics. Major players like IKEA, Shaw Industries, and Ashley Furniture are driving innovation and competition, contributing to market expansion through brand recognition and product diversification.

United States Home Decor Market Market Size (In Million)

The forecast period (2025-2033) anticipates a continued, albeit moderated, expansion. The projected Compound Annual Growth Rate (CAGR) of 4.11% suggests a gradual but consistent increase in market value. Regional variations are expected, with areas experiencing higher population growth and economic activity potentially demonstrating faster growth rates. The continued focus on sustainable and eco-friendly products will influence consumer choices, shaping future market dynamics. Competitive pressures will likely intensify as brands strive to differentiate themselves through design, quality, and customer experience. Successful companies will need to adapt to the evolving consumer landscape, leveraging data-driven insights to refine their strategies and cater to the diverse needs and preferences of their target audiences.

United States Home Decor Market Company Market Share

United States Home Decor Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States home decor market, offering invaluable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key players, and forecasts future trends. The study period (2019-2024) provides historical context, while the forecast period (2025-2033) offers projections for future growth. The base year is 2025, and the estimated year is also 2025. Expect actionable data and strategic recommendations to navigate this dynamic market.

United States Home Decor Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the US home decor market, examining market concentration, innovation, regulation, and market dynamics. The report delves into the interplay of established players like Ikea USA, Shaw Industries Group, and Herman Miller Inc., alongside emerging competitors. We assess market share distribution, identifying dominant players and emerging niches. Furthermore, the report scrutinizes Mergers and Acquisitions (M&A) activities, including deal values and their impact on market consolidation. Analysis includes:

- Market Concentration: The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and identifies the top 5 players’ combined market share, estimated at xx%.

- Innovation Ecosystems: We assess the role of startups, research institutions, and collaborative initiatives in driving innovation within the home decor sector. This includes examining the role of technology in product design, manufacturing, and distribution.

- Regulatory Frameworks: This section analyzes relevant federal and state regulations impacting product safety, labeling, and environmental standards, quantifying their impact on market operations. An estimate of xx Million in regulatory compliance costs is projected annually for major players.

- Product Substitutes: The study identifies potential substitute products and their impact on market share dynamics for different home decor segments. We analyze the impact of these substitute products on the overall market size, estimated to be xx% by 2033.

- End-User Trends: We examine evolving consumer preferences, including sustainability concerns, minimalist design trends, and the increasing demand for personalized home decor. We also analyze shifts in consumer spending habits and their correlation with market growth.

- M&A Activities: The report details significant M&A activities within the US home decor market during the historical period, including deal values (e.g., the acquisition of select Bed Bath & Beyond assets by Overstock.com). We project xx number of M&A deals within the forecast period.

United States Home Decor Market Industry Trends & Insights

This section provides a detailed analysis of key industry trends shaping the US home decor market. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the intensifying competitive landscape. The report will present a detailed analysis of the Compound Annual Growth Rate (CAGR) projected for the forecast period, as well as market penetration rates for various segments.

- Market Growth Drivers: We will analyze factors driving market expansion, including rising disposable incomes, increasing urbanization, and a growing preference for home improvement projects. Specific growth drivers such as the influence of social media and home staging trends are also detailed.

- Technological Disruptions: The report will explore the impact of e-commerce, 3D printing, augmented reality (AR), and virtual reality (VR) on the home decor industry, analyzing their influence on purchasing decisions, design innovation, and manufacturing processes.

- Consumer Preferences: The report analyzes evolving consumer preferences, such as the increasing demand for sustainable, ethically sourced products, smart home integrations, and personalized design solutions. Data from market research surveys is used to support these findings.

- Competitive Dynamics: The report explores the competitive dynamics within the US home decor market, evaluating the strategies of key players, including market positioning, pricing strategies, and product differentiation.

Dominant Markets & Segments in United States Home Decor Market

This section identifies the leading regions, countries, and market segments within the US home decor market. Detailed analyses of key drivers are provided, incorporating economic policies and infrastructural considerations.

By Distribution Channel:

- Online: This segment is projected to experience significant growth due to increasing internet penetration and the convenience of online shopping. Key drivers include robust e-commerce platforms and digital marketing initiatives.

- Specialty Stores: This channel maintains a strong market presence despite the growth of online sales. Key drivers include curated product selections and expert advice.

- Supermarkets/Hypermarkets: This segment contributes a smaller portion of overall sales but offers an accessible entry point for certain home decor products.

- Other Distribution Channels: This section analyzes other relevant channels, including wholesale distributors, direct sales, and pop-up shops.

By Product:

- Home Furniture: This segment dominates the market due to high demand for functional and aesthetically pleasing furniture. Key drivers include rising household incomes and increasing urbanization.

- Home Textiles: This segment includes bedding, curtains, and rugs and is influenced by fashion trends and consumer preferences for comfort and style.

- Flooring: The flooring segment is driven by renovation and new construction activities.

- Wall Decor: Driven by evolving aesthetic preferences and trends in interior design.

- Lighting and Lamps: This segment benefits from technological advancements and the growing demand for energy-efficient lighting solutions.

- Accessories: This segment includes a broad range of products that complement home decor, contributing to overall market growth.

- Other Home Decor Products: This category encompasses various other products influencing market dynamics.

United States Home Decor Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the US home decor market. Emphasis is placed on technological trends and market fit. The increasing adoption of smart home technology, sustainable materials, and personalized design solutions are highlighted as key drivers of innovation. This leads to the emergence of products such as smart lighting systems, customizable furniture, and eco-friendly home textiles.

Report Segmentation & Scope

This report segments the US home decor market based on distribution channels (Supermarkets/Hypermarkets, Specialty Stores, Online, Other Distribution Channels) and product categories (Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting and Lamps, Accessories, Other Home Decor Products). Each segment is analyzed in terms of growth projections, market size, and competitive dynamics. Market sizes for each segment are provided in Millions for both the base year and projected years, along with CAGR projections. Competitive dynamics are explored through analysis of market share and key competitive strategies.

Key Drivers of United States Home Decor Market Growth

The growth of the US home decor market is propelled by several key factors. Rising disposable incomes and a growing preference for home improvement are significant contributors. Technological advancements, particularly in e-commerce and personalized design tools, significantly impact market expansion. Furthermore, government policies promoting homeownership and sustainable practices further boost market growth.

Challenges in the United States Home Decor Market Sector

The US home decor market faces challenges including supply chain disruptions, fluctuating raw material costs, and intense competition. These factors influence pricing strategies and profitability. Regulatory compliance costs add to operational expenses. The impact of these challenges on market growth is quantitatively assessed in the report.

Leading Players in the United States Home Decor Market Market

- Ikea USA

- Shaw Industries Group

- Crane & Canopy Inc

- Mannington Mills Inc

- Herman Miller Inc

- Generation Lighting

- Ashley Furniture

- Mohawk Flooring

- Kimball International

- American Textile Systems

- Acuity Brands Lighting

Key Developments in United States Home Decor Market Sector

- April 2023: IKEA announced a USD 2.2 Billion investment in its US omnichannel expansion.

- June 2023: Overstock.com acquired select intellectual property assets from Bed Bath & Beyond.

- August 2023: Overstock.com and Bed Bath & Beyond launched BedBathandBeyond.com.

Strategic United States Home Decor Market Outlook

The US home decor market presents significant growth opportunities in the coming years. Continued investment in e-commerce, technological innovation, and sustainable practices will shape market dynamics. Companies that adapt to evolving consumer preferences and embrace technological advancements are poised for success. The market is expected to witness continued expansion, driven by robust consumer spending and the increasing demand for high-quality, aesthetically pleasing home decor products.

United States Home Decor Market Segmentation

-

1. Product

- 1.1. Home Furniture

- 1.2. Home Textiles

- 1.3. Flooring

- 1.4. Wall Decor

- 1.5. Lighting and Lamps

- 1.6. Acessoriess

- 1.7. Other Home Decor Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United States Home Decor Market Segmentation By Geography

- 1. United States

United States Home Decor Market Regional Market Share

Geographic Coverage of United States Home Decor Market

United States Home Decor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities.

- 3.3. Market Restrains

- 3.3.1. The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture

- 3.4. Market Trends

- 3.4.1. The Market is Being Fueled by the Growth of E-Commerce Distribution

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Decor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Home Furniture

- 5.1.2. Home Textiles

- 5.1.3. Flooring

- 5.1.4. Wall Decor

- 5.1.5. Lighting and Lamps

- 5.1.6. Acessoriess

- 5.1.7. Other Home Decor Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ikea USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crane & Canopy Inc**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Herman Miller Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Generation Lighting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashley Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawak Flooring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kimball International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 American Textile Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Acuity Brands Lighting

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ikea USA

List of Figures

- Figure 1: United States Home Decor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Home Decor Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Home Decor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Home Decor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Decor Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the United States Home Decor Market?

Key companies in the market include Ikea USA, Shaw Industries Group, Crane & Canopy Inc**List Not Exhaustive, Mannington Mills Inc, Herman Miller Inc, Generation Lighting, Ashley Furniture, Mohawak Flooring, Kimball International, American Textile Systems, Acuity Brands Lighting.

3. What are the main segments of the United States Home Decor Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 206.70 Million as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities..

6. What are the notable trends driving market growth?

The Market is Being Fueled by the Growth of E-Commerce Distribution.

7. Are there any restraints impacting market growth?

The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture.

8. Can you provide examples of recent developments in the market?

August 2023: Overstock.com Inc., in collaboration with Bed Bath & Beyond, unveiled BedBathandBeyond.com in the United States. This strategic move consolidates the strengths of both companies, creating a unified online retail platform operating exclusively as Bed Bath & Beyond.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Decor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Decor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Decor Market?

To stay informed about further developments, trends, and reports in the United States Home Decor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence