Key Insights

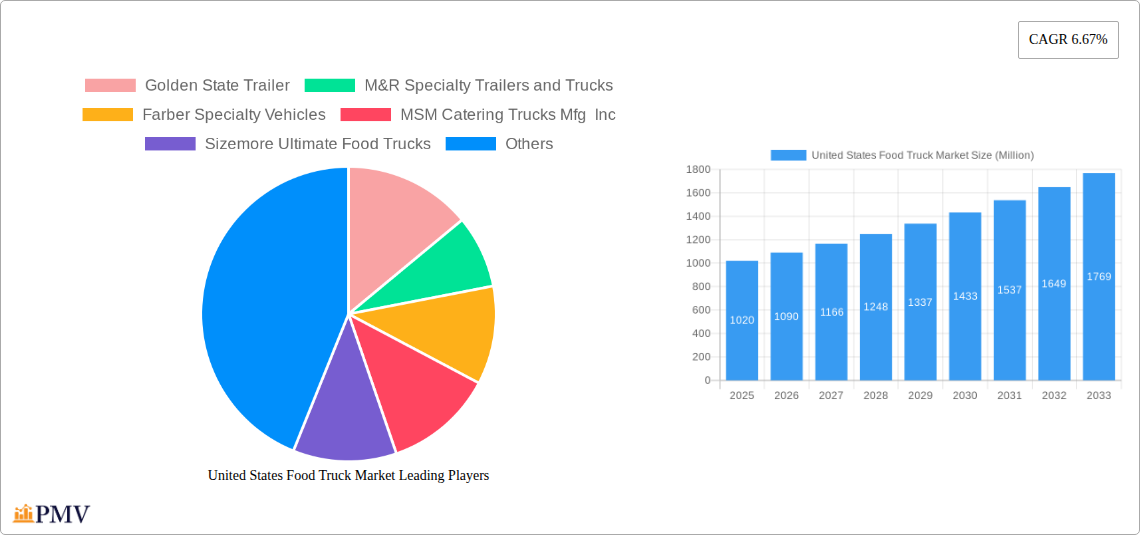

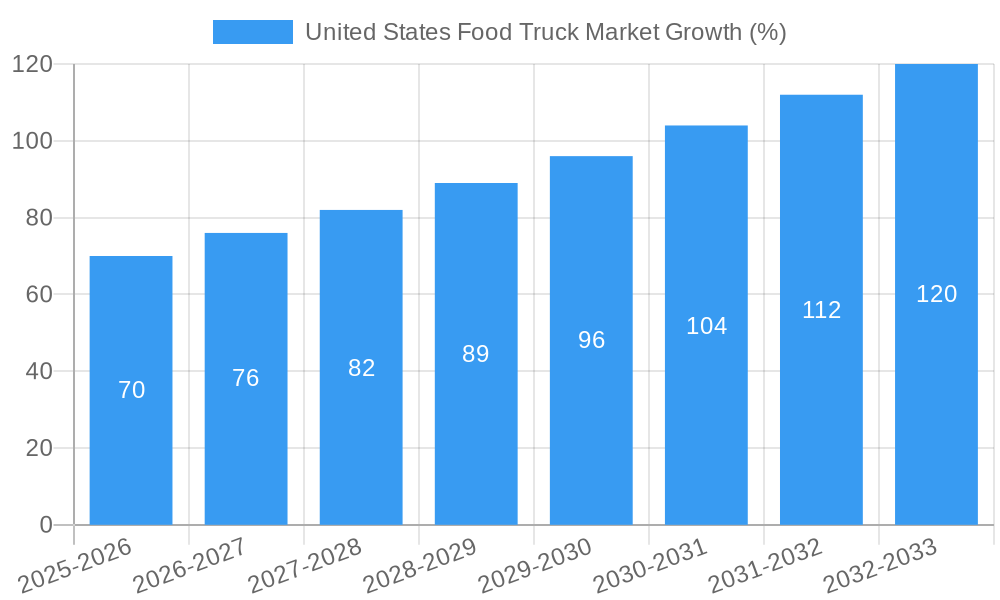

The United States food truck market, valued at $1.02 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.67% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing popularity of diverse culinary experiences, coupled with the convenience and affordability of food trucks, significantly contributes to market growth. Furthermore, the relatively lower startup costs compared to traditional brick-and-mortar restaurants make food truck ventures attractive to entrepreneurs, fostering market competition and innovation. The trend towards healthier options, including vegan and plant-based cuisines, is also impacting the market, with dedicated vegan food trucks gaining traction. However, regulatory hurdles, including permitting and zoning restrictions, pose a challenge to market expansion. Competition from established fast-food chains and fluctuating ingredient costs also act as restraints. The market is segmented by type (vans, trailers, customized trucks, others), application (fast food, vegan/plant-based, barbeque, desserts, others), and size (up to 15 feet, 16-25 feet, above 25 feet). The dominance of specific segments will likely shift over the forecast period as consumer preferences evolve and technological advancements in food truck design and operations emerge. The competitive landscape includes both established manufacturers like Golden State Trailer and newer entrants, indicating a dynamic market with room for both large and small players.

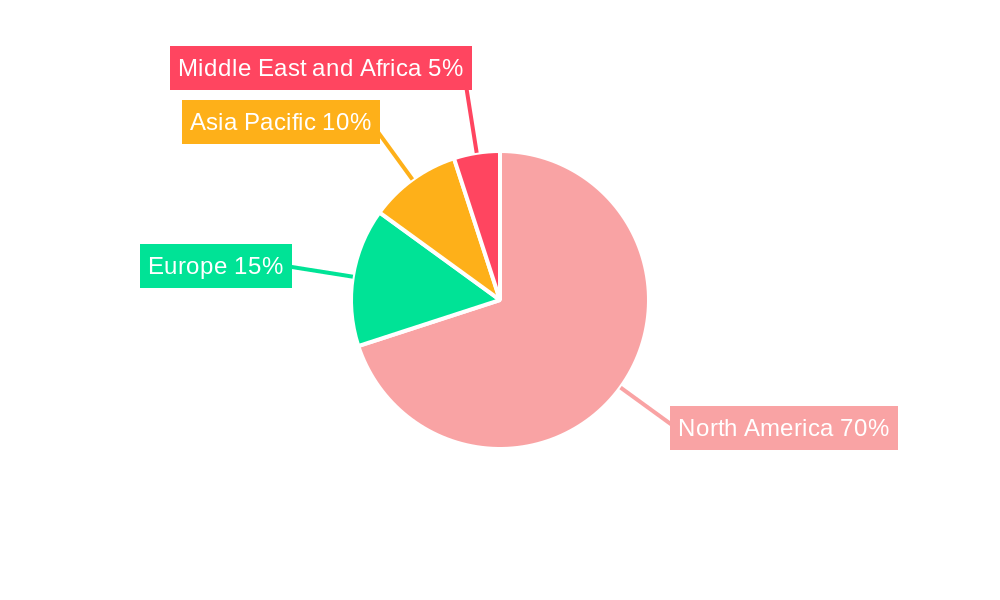

The significant growth in the US food truck market is expected to continue throughout the forecast period, driven primarily by evolving consumer preferences, entrepreneurial dynamism, and the adaptability of the food truck model to various culinary niches. While challenges remain, particularly concerning regulations and competition, the innovative nature of the food truck industry and its capacity to adapt to changing consumer demands suggests a promising outlook. The geographical distribution of the market is likely to be skewed towards urban centers with high foot traffic and a diverse population, but expansion into suburban areas is also anticipated as demand grows. The market's segmentation allows for targeted marketing strategies, with manufacturers and entrepreneurs focusing on specialized areas like vegan food trucks or gourmet dessert trucks to capture specific market segments effectively. This focused approach should further accelerate growth in the coming years.

United States Food Truck Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States food truck market, offering valuable insights for industry stakeholders, investors, and entrepreneurs. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market segmentation, competitive dynamics, growth drivers, and future opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Food Truck Market Structure & Competitive Dynamics

The US food truck market exhibits a moderately fragmented structure, with several key players vying for market share. Market concentration is relatively low, with no single dominant entity controlling a significant portion of the market. However, larger manufacturers like Golden State Trailer and M&R Specialty Trailers and Trucks hold notable positions due to their scale and established distribution networks. Innovation in this sector is driven by evolving consumer preferences, technological advancements (e.g., mobile payment systems, advanced food preparation equipment), and the increasing need for efficient and cost-effective mobile food solutions. The regulatory landscape varies across states and municipalities, impacting operational costs and permitting procedures. Product substitutes include traditional brick-and-mortar restaurants and catering services, while end-user trends, particularly the growing popularity of diverse cuisines and experiential dining, fuel market growth. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focusing on expanding geographical reach and product portfolios. Key metrics such as market share and M&A deal values are analyzed in detail within the report.

- Market Concentration: Low to moderate

- Key Players Market Share: xx% (Top 5 players combined)

- Recent M&A Activity: xx deals in the last 5 years, totaling approximately xx Million in value.

- Innovation Focus: Technology integration, menu diversification, sustainable practices.

United States Food Truck Market Industry Trends & Insights

The US food truck market is experiencing robust growth, fueled by several key factors. The increasing popularity of diverse and customizable food options, particularly amongst millennials and Gen Z, is a significant driver. Technological advancements, such as online ordering and mobile payment systems, enhance customer convenience and streamline operations. The relatively lower startup costs compared to traditional restaurants make food trucks an attractive entrepreneurial venture. The food truck industry also benefits from its inherent flexibility and adaptability – trucks can easily relocate to high-traffic areas or events, maximizing revenue potential. The rising adoption of vegan and plant-based meat options is creating new market segments. However, competitive pressures remain intense, necessitating continuous innovation and adaptation. Challenges include securing permits and licenses, managing operational costs, and navigating fluctuating food prices. The report provides detailed analysis of these trends, with specific market growth rates (CAGR) and market penetration data for various segments. The market shows a high degree of dynamism, with constant evolution in cuisine offerings and business models.

Dominant Markets & Segments in United States Food Truck Market

While the market is spread across the US, certain regions show higher concentrations of food trucks, driven by factors like population density, tourism, and favorable regulatory environments. The coastal regions, especially California, New York, and Florida, display significantly higher market penetration.

By Type: Trailers currently dominate the market due to their versatility and cost-effectiveness, followed by customized trucks offering greater branding opportunities. Vans hold a smaller share, primarily suited for smaller operations. The "Others" category, including expandable food trucks, is growing rapidly as entrepreneurs seek innovative solutions.

By Application: Fast food currently accounts for the largest segment, leveraging speed and efficiency. However, the demand for vegan and plant-meat options and specialized cuisines (BBQ, desserts) is increasing at a faster rate.

By Size: The 16-25 feet segment holds the largest market share, offering a balance between operational capacity and maneuverability. The "Above 25 Feet" segment caters to larger-scale operations and events.

Key Drivers:

- High population density areas: Drive demand for convenient and diverse food options.

- Favorable regulatory environments: Ease of operation and permitting processes.

- Tourism: Increased demand in tourist destinations.

- Food truck events and festivals: Boost visibility and sales.

United States Food Truck Market Product Innovations

Recent innovations focus on enhancing efficiency and customer experience. This includes integrating mobile payment systems, incorporating eco-friendly materials and practices, and utilizing advanced food preparation technologies (e.g., automated cooking systems) to improve speed and consistency. The emergence of specialized food trucks offering niche cuisines adds to the market's dynamism. Companies are also investing in aesthetically pleasing designs and branding to create a more memorable customer experience. These innovations aim to improve operational efficiency, reduce waste, and enhance the customer experience to gain a competitive edge.

Report Segmentation & Scope

This report segments the US food truck market based on type (vans, trailers, customized trucks, others), application (fast food, vegan/plant meat, BBQ & snacks, desserts & confectionery, others), and size (up to 15 feet, 16-25 feet, above 25 feet). Each segment is analyzed in detail, including growth projections, market size estimations, and competitive landscapes. Growth rates are projected to vary across segments, with the customized trucks and vegan/plant meat application segments exhibiting faster growth rates. Market size estimates are provided for each segment for the base year (2025) and forecast period (2025-2033). The competitive dynamics within each segment are also explored, highlighting key players and their strategic initiatives.

Key Drivers of United States Food Truck Market Growth

Several factors drive the growth of the US food truck market. The rise of the "sharing economy" and increasing entrepreneurial spirit encourage new ventures. The flexibility and mobility of food trucks allow operators to tap into diverse markets and events. The growing demand for diverse and unique food options also fuels growth. Government initiatives and events promoting local businesses and food vendors offer additional support. Finally, advancements in technology streamline operations and enhance the customer experience.

Challenges in the United States Food Truck Market Sector

The US food truck market faces several challenges. Stricter health and safety regulations increase operational costs. Competition from established restaurants and other mobile food vendors is fierce. Securing suitable locations and navigating permitting processes are significant obstacles. Fluctuating food costs and economic downturns can impact profitability. These challenges require continuous adaptation and strategic planning for successful operation.

Leading Players in the United States Food Truck Market Market

- Golden State Trailer

- M&R Specialty Trailers and Trucks

- Farber Specialty Vehicles

- MSM Catering Trucks Mfg Inc

- Sizemore Ultimate Food Trucks

- The Fud Trailer Company

- Custom Concessions

- Titan Trucks Manufacturing

- All American Food Trucks

- US Food Truck Factory

- Prestige Food Trucks

- United Food Truck LLC

Key Developments in United States Food Truck Market Sector

- April 2023: AggieEats food truck launch at University of California, Davis, addresses student food insecurity.

- March 2024: Boston National Park opens bidding for food truck vendors at the Charlestown Navy Yard, with a minimum rent of USD 40 per shift per day.

Strategic United States Food Truck Market Outlook

The US food truck market presents significant growth opportunities. Expanding into underserved markets, leveraging technology for enhanced efficiency and customer engagement, and offering unique and customizable menu options are key strategies for success. Focusing on sustainability and ethical sourcing can attract environmentally conscious consumers. Partnerships with event organizers and local businesses can broaden market reach. The future of the US food truck market is bright, with ongoing innovation and adaptation driving continued growth and evolution.

United States Food Truck Market Segmentation

-

1. Type

- 1.1. Vans

- 1.2. Trailers

- 1.3. Customized Trucks

- 1.4. Others (Expandable Food Trucks, etc.)

-

2. Application

- 2.1. Fast Food

- 2.2. Vegan and Plant Meat

- 2.3. Barbeque and Snacks

- 2.4. Desserts and Confectionery

- 2.5. Others (Fruits and Vegetables, etc.)

-

3. Size

- 3.1. Up to 15 Feet

- 3.2. 16-25 Feet

- 3.3. Above 25 Feet

United States Food Truck Market Segmentation By Geography

- 1. United States

United States Food Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vans

- 5.1.2. Trailers

- 5.1.3. Customized Trucks

- 5.1.4. Others (Expandable Food Trucks, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fast Food

- 5.2.2. Vegan and Plant Meat

- 5.2.3. Barbeque and Snacks

- 5.2.4. Desserts and Confectionery

- 5.2.5. Others (Fruits and Vegetables, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Size

- 5.3.1. Up to 15 Feet

- 5.3.2. 16-25 Feet

- 5.3.3. Above 25 Feet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East and Africa United States Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Golden State Trailer

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 M&R Specialty Trailers and Trucks

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Farber Specialty Vehicles

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MSM Catering Trucks Mfg Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sizemore Ultimate Food Trucks

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Fud Trailer Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Custom Concessions

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Titan Trucks Manufacturing

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 All American Food Trucks

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 US Food Truck Factory

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Prestige Food Trucks

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 United Food Truck LLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Golden State Trailer

List of Figures

- Figure 1: United States Food Truck Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Food Truck Market Share (%) by Company 2024

List of Tables

- Table 1: United States Food Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Food Truck Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: United States Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 5: United States Food Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Food Truck Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: United States Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 17: United States Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Food Truck Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the United States Food Truck Market?

Key companies in the market include Golden State Trailer, M&R Specialty Trailers and Trucks, Farber Specialty Vehicles, MSM Catering Trucks Mfg Inc, Sizemore Ultimate Food Trucks, The Fud Trailer Company, Custom Concessions, Titan Trucks Manufacturing, All American Food Trucks, US Food Truck Factory, Prestige Food Trucks, United Food Truck LLC.

3. What are the main segments of the United States Food Truck Market?

The market segments include Type, Application, Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: The National Park of Boston in the United States announced the call for bids for food truck vendors to operate at the Charlestown Navy Yard through a Request for Bids (RFB) proposal. The administration is willing to lease two spaces identified by the National Park Service (NPS) as suitable for mobile food and beverage vending in the Charlestown Navy Yard at Boston National Historical Park. Further, the administration stated that the minimum rent for the lease is USD 40 per shift per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Food Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Food Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Food Truck Market?

To stay informed about further developments, trends, and reports in the United States Food Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence