Key Insights

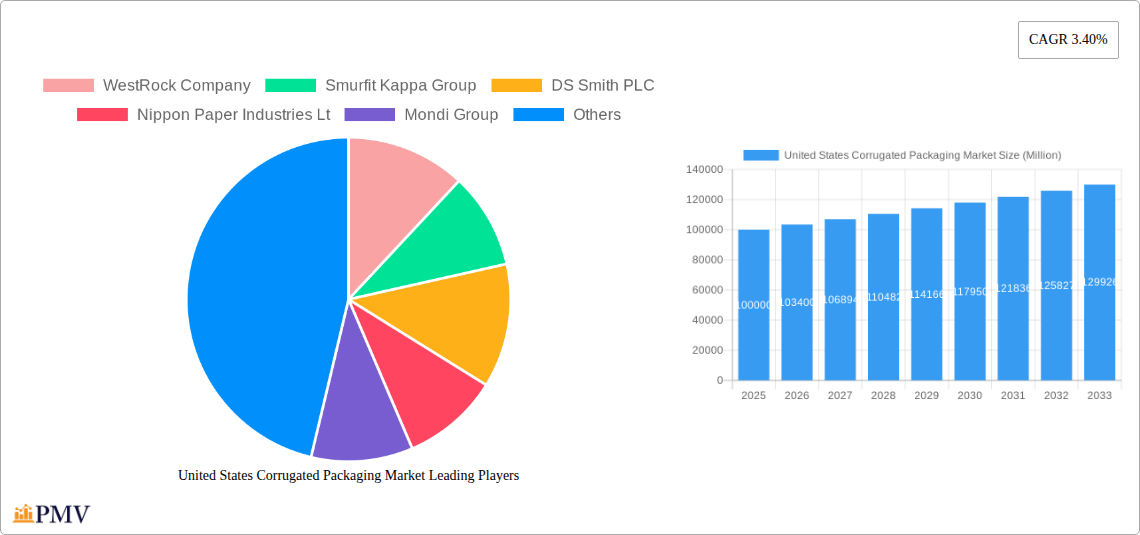

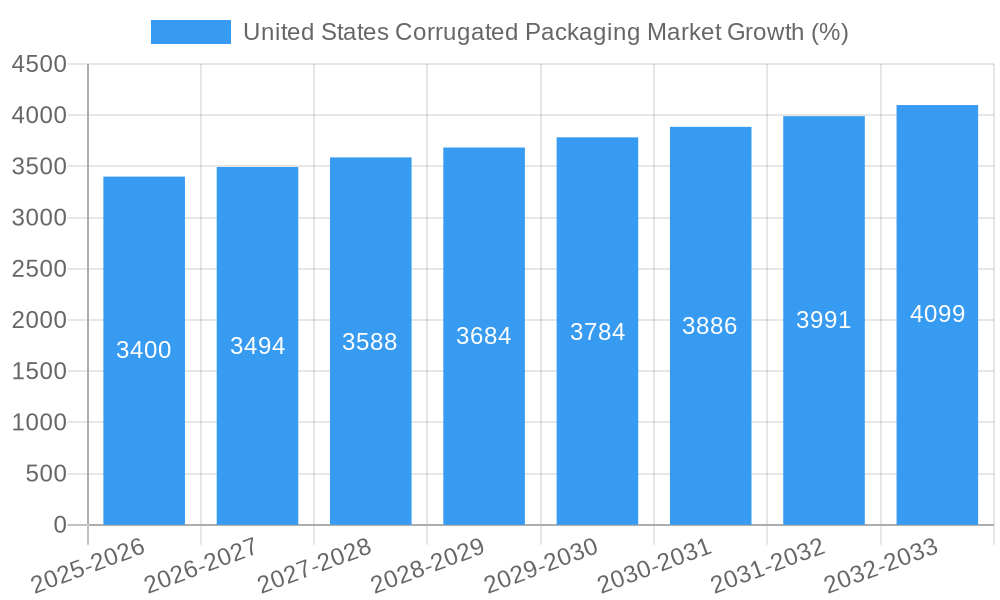

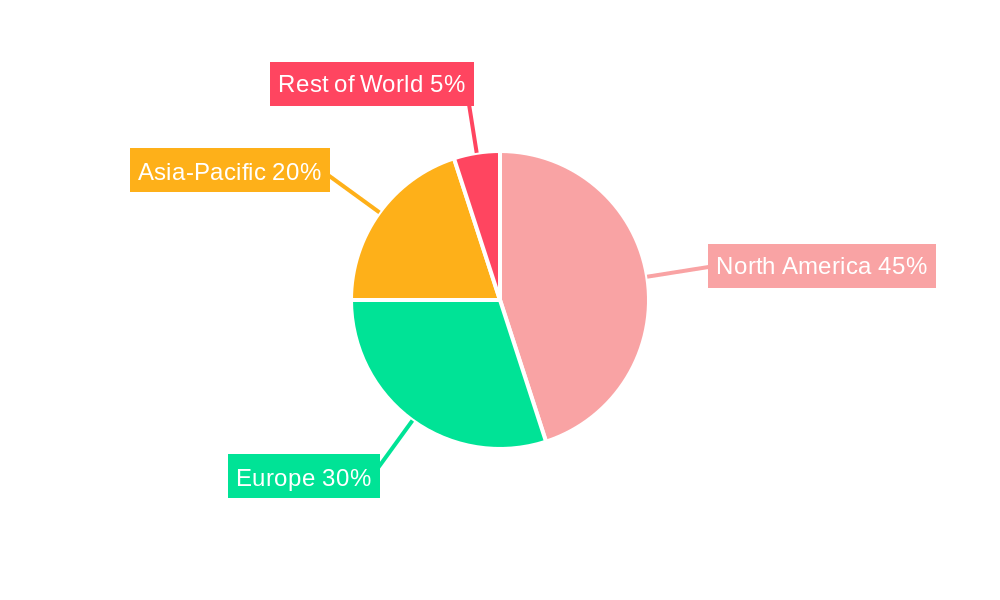

The United States corrugated packaging market is a significant sector, exhibiting steady growth driven by the robust demand from various end-use industries. While precise market size figures for the US are not provided, considering a global CAGR of 3.40% and the substantial size of the US economy, we can reasonably infer a large and growing market. The processed foods, fresh food and produce, and beverage sectors are major drivers, fueled by increasing consumer demand and the need for efficient, sustainable packaging solutions. E-commerce expansion further contributes to growth, requiring substantial quantities of corrugated boxes for shipping and distribution. Growth is also fueled by the ongoing trend toward environmentally friendly packaging materials, as corrugated cardboard is recyclable and relatively easily sourced. However, fluctuations in raw material prices (primarily paper pulp), along with increasing transportation costs, represent potential restraints to market expansion. Competition amongst major players like WestRock, Smurfit Kappa, and International Paper is fierce, leading to continuous innovation in product design and manufacturing efficiency. Future growth will likely depend on the continued expansion of e-commerce, the ongoing adoption of sustainable packaging practices, and the ability of industry players to manage fluctuating input costs. Regional variations within the US market are expected, with higher concentrations of activity in regions with significant manufacturing and distribution hubs.

The competitive landscape is shaped by a mix of large multinational corporations and regional players. These companies are constantly innovating to offer customized solutions, focusing on lightweighting for cost and transportation efficiency, improved printing capabilities for branding, and the incorporation of sustainable materials. The future trajectory will likely see a continued focus on sustainability, with the development of recycled content packaging and biodegradable alternatives gaining traction. The market will also see ongoing consolidation, with mergers and acquisitions shaping the competitive dynamics. Furthermore, technological advancements such as automation in manufacturing and improved supply chain management will contribute to enhanced efficiency and cost optimization. The US corrugated packaging market is poised for continued expansion, though the rate of growth may be influenced by macroeconomic factors and fluctuations in raw material costs.

United States Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States corrugated packaging market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market size, growth drivers, challenges, and competitive dynamics, providing a robust forecast for the future. The report incorporates detailed segmentation by end-user industry, including processed foods, fresh food and produce, beverages, paper products, electrical products, and other end-user industries.

United States Corrugated Packaging Market Structure & Competitive Dynamics

The U.S. corrugated packaging market is characterized by a moderately consolidated structure with several key players commanding significant market share. Leading companies such as WestRock Company, Smurfit Kappa Group, DS Smith PLC, Nippon Paper Industries Lt, Mondi Group, Georgia-Pacific LLC, Oji Holdings Corporation, International Paper Company, Packaging Corporation of America, and Cascades Inc. compete intensely, driving innovation and influencing pricing strategies. Market concentration is further shaped by mergers and acquisitions (M&A) activity, with deal values fluctuating based on market conditions and strategic objectives. Recent M&A activity, though not quantifiable in exact deal values without access to private transaction data, reflects a push towards consolidation and increased vertical integration within the supply chain. Innovation ecosystems are dynamic, driven by the need to improve sustainability, enhance packaging efficiency, and meet evolving consumer preferences. Regulatory frameworks, including environmental regulations and labeling requirements, play a significant role in shaping industry practices and influencing the adoption of eco-friendly materials and processes. The market also faces competitive pressures from alternative packaging solutions, such as plastic and flexible packaging; however, the inherent strength and cost-effectiveness of corrugated cardboard remain key advantages. End-user trends towards e-commerce and personalized packaging are major drivers of innovation and market growth. An estimated xx% of the market is controlled by the top 5 players in 2025, reflecting a concentrated yet competitive landscape.

United States Corrugated Packaging Market Industry Trends & Insights

The U.S. corrugated packaging market exhibits robust growth, driven by several key factors. The burgeoning e-commerce sector fuels a significant demand for shipping boxes, contributing to a substantial market expansion. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting consistent market expansion. Technological disruptions, such as advancements in printing technology and automation, are enhancing efficiency and customization capabilities. Changing consumer preferences are also shaping demand, with an increasing focus on sustainable packaging and innovative designs for product protection and brand enhancement. Market penetration of sustainable materials and packaging solutions is growing steadily, reaching an estimated xx% in 2025, driven by increasing environmental consciousness. This growth is partially countered by fluctuating raw material prices and supply chain disruptions that impact production costs and timelines. The competitive landscape remains intense, with ongoing innovation in product design, material sourcing, and production efficiency being key differentiators.

Dominant Markets & Segments in United States Corrugated Packaging Market

The U.S. corrugated packaging market exhibits diverse segmental performance across different end-user industries. While precise market share data by segment requires further analysis, several observations can be made:

- Processed Foods: This segment remains a major contributor, driven by the ongoing need for robust and protective packaging for shelf-stable food items. Factors such as changing consumer preferences for convenience and the continued growth of the processed food industry are key drivers.

- Fresh Food and Produce: This sector is characterized by a focus on sustainability and maintaining product freshness, leading to demand for specialized packaging solutions.

- Beverages: The beverage industry places a high value on attractive and protective packaging that enhances brand appeal and protects delicate products.

- Paper Products: This segment often employs corrugated packaging for both inner and outer packaging, creating consistent demand.

- Electrical Products: This segment benefits from the use of corrugated packaging for protection and transport.

The dominance of specific segments is linked to factors such as industry growth rate, product characteristics, and consumer demand. Overall, the market displays regional variations in demand due to differing industry concentration and population distributions. For instance, regions with higher concentrations of food processing and manufacturing facilities exhibit a greater demand for corrugated packaging.

United States Corrugated Packaging Market Product Innovations

Recent product innovations focus on sustainable materials, improved printability, and enhanced functionality. Advancements in digital printing are allowing for greater customization and branding opportunities. The incorporation of recycled content is a key trend, reflecting the industry's commitment to environmental responsibility. These innovations enhance packaging performance, improve brand visibility, and cater to consumer preferences for environmentally friendly solutions. The market is witnessing a shift towards lightweight yet high-strength materials, resulting in improved transportation efficiency and reduced environmental footprint.

Report Segmentation & Scope

This report segments the U.S. corrugated packaging market by end-user industry:

- Processed Foods: This segment projects a xx Million market size in 2025, growing at a CAGR of xx% during the forecast period. Competition is relatively high due to the high volume of demand.

- Fresh Food and Produce: This segment is estimated at xx Million in 2025 and anticipates a CAGR of xx% due to the increasing focus on freshness and sustainability. Competition involves specialized packaging solutions.

- Beverages: The market size for this segment in 2025 is projected at xx Million, with a CAGR of xx%. Competition is driven by appealing design and brand visibility.

- Paper Products: This segment is expected to reach xx Million in 2025, growing at a CAGR of xx%. Competition is influenced by efficient packaging and cost-effectiveness.

- Electrical Products: The market size of this segment in 2025 is estimated at xx Million, with a CAGR of xx% during the forecast period. The competitive landscape is driven by protective packaging and efficiency in handling.

- Other End-user Industries: This category accounts for xx Million in 2025 and is projected to have a CAGR of xx% in the forecast period. This segment is influenced by diverse needs and applications for corrugated packaging.

Key Drivers of United States Corrugated Packaging Market Growth

The growth of the U.S. corrugated packaging market is primarily driven by:

- E-commerce Boom: The explosive growth of online retail significantly increases the demand for shipping boxes.

- Technological Advancements: Innovations in printing, automation, and sustainable materials improve packaging efficiency and appeal.

- Government Regulations: Environmental regulations promote the use of recycled materials and sustainable packaging solutions.

- Food and Beverage Industry Growth: The expansion of the food and beverage industry maintains consistent demand for robust and efficient packaging.

Challenges in the United States Corrugated Packaging Market Sector

Significant challenges impacting the market include:

- Fluctuating Raw Material Prices: Changes in the prices of paper and other raw materials directly affect production costs.

- Supply Chain Disruptions: Global supply chain vulnerabilities can lead to delays and increased costs.

- Intense Competition: The presence of numerous established players and the entrance of new entrants create a highly competitive landscape.

- Environmental Concerns: The industry faces increasing pressure to reduce its environmental impact through sustainable packaging practices. These challenges can potentially reduce profit margins and necessitate strategic adjustments by market participants.

Leading Players in the United States Corrugated Packaging Market Market

- WestRock Company

- Smurfit Kappa Group

- DS Smith PLC

- Nippon Paper Industries Lt

- Mondi Group

- Georgia-Pacific LLC

- Oji Holdings Corporation

- International Paper Company

- Packaging Corporation of America

- Cascades Inc

Key Developments in United States Corrugated Packaging Market Sector

- February 2022: McKinley Packaging announces a new DFW plant in Lancaster, Texas, fueled by e-commerce demand.

- February 2022: CBRE announces a 500,000-square-foot McKinley Packaging cardboard box factory in Lancaster, Texas, to meet the surge in e-commerce demand.

- February 2022: Menasha Packaging acquires Color-Box, a Georgia-Pacific unit specializing in high-graphic corrugated boxes for e-commerce, enhancing its capabilities in this rapidly expanding market segment.

Strategic United States Corrugated Packaging Market Outlook

The future of the U.S. corrugated packaging market appears promising, driven by sustained e-commerce growth, increasing demand for sustainable packaging, and ongoing product innovation. Companies focusing on sustainable materials, efficient production processes, and innovative designs will be well-positioned to capitalize on the market's expansion. Strategic partnerships, mergers and acquisitions, and investments in advanced technologies will likely shape the market's evolution. The continued adoption of automation and digital printing technologies will offer opportunities for increased efficiency and customization, leading to enhanced market competitiveness and profitability. The focus on environmentally responsible packaging will drive further innovation in sustainable materials and production methods.

United States Corrugated Packaging Market Segmentation

-

1. End-user Industry

- 1.1. Processed Foods

- 1.2. Fresh Food and Produce

- 1.3. Beverages

- 1.4. Paper Products

- 1.5. Electrical Products

- 1.6. Other End-user Industries

United States Corrugated Packaging Market Segmentation By Geography

- 1. United States

United States Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth In Electronics & Personal Care Segment

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Processed Foods

- 5.1.2. Fresh Food and Produce

- 5.1.3. Beverages

- 5.1.4. Paper Products

- 5.1.5. Electrical Products

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Eastern Europe United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Poland

- 6.1.2 Russia

- 6.1.3 Rest of Eastern Europe

- 7. Western Europe United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Spain

- 7.1.5 Italy

- 7.1.6 Belgium and Switzerland

- 7.1.7 Rest of Western Europe

- 8. Middle East and Africa United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Turkey

- 8.1.2 South Africa

- 8.1.3 Gulf Cooperation Council

- 8.1.4 Rest of Africa

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 WestRock Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Smurfit Kappa Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DS Smith PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nippon Paper Industries Lt

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Mondi Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Georgia-Pacific LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Oji Holdings Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Paper Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Packaging Corporation of America

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Cascades Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 WestRock Company

List of Figures

- Figure 1: United States Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Corrugated Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: United States Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: United States Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Poland United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Russia United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of Eastern Europe United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Belgium and Switzerland United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Western Europe United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Turkey United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Gulf Cooperation Council United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United States Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Corrugated Packaging Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the United States Corrugated Packaging Market?

Key companies in the market include WestRock Company, Smurfit Kappa Group, DS Smith PLC, Nippon Paper Industries Lt, Mondi Group, Georgia-Pacific LLC, Oji Holdings Corporation, International Paper Company, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the United States Corrugated Packaging Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth In Electronics & Personal Care Segment.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

February 2022: McKinley Packaging announced that it would build a new DFW plant in Lancaster as e-commerce fuels the demand for corrugated boxes in the region. McKinley Packaging selected the location in southern Dallas after looking at locations in Louisiana and Oklahoma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the United States Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence