Key Insights

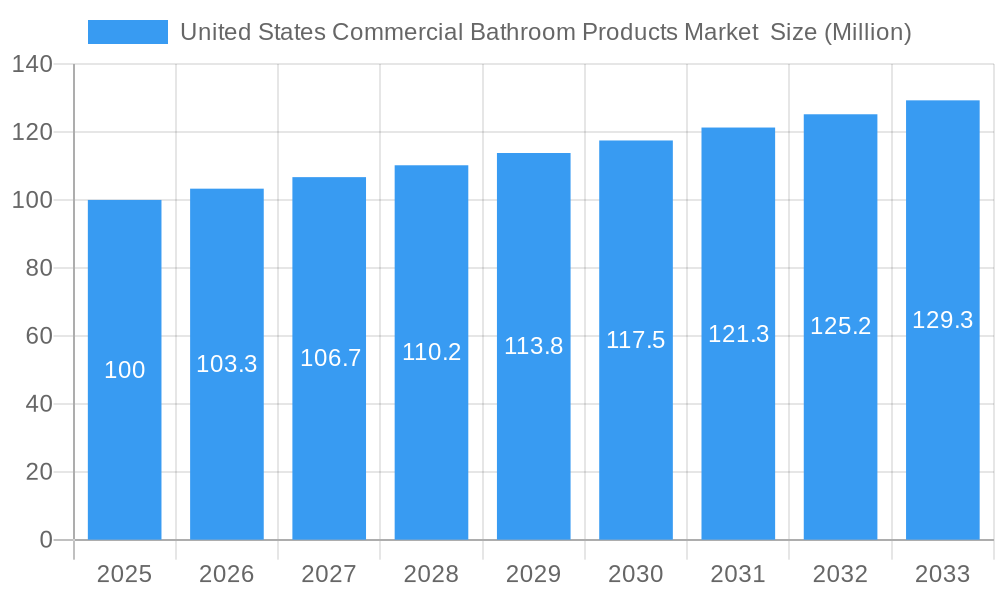

The United States commercial bathroom products market, while lacking precise figures in the provided data, exhibits strong growth potential mirroring global trends. Considering the global market size of $358.08 million in 2025 with a CAGR of 3.30%, and extrapolating based on the US's significant share of the global economy and commercial construction sector, we can reasonably estimate the US market size to be substantial. The market is segmented by product type (toiletries, soap dispensers, faucets & showers, basins, bathtubs), price point (standard, premium, luxury), and distribution channel (online, offline). Key drivers include increasing commercial construction activity, rising demand for sustainable and touchless bathroom fixtures driven by hygiene concerns (particularly post-pandemic), and the growing adoption of smart bathroom technology. Trends indicate a shift towards premium and luxury products, reflecting a focus on enhanced user experience and design. Potential restraints could include fluctuating raw material costs and economic downturns impacting construction spending. Major players like Kohler Co., Bradley Corp., and LIXIL Corp. compete fiercely, with innovations in water efficiency and hygiene playing crucial roles in their strategies. The market's online distribution channel is expected to expand, driven by increased accessibility and convenience.

United States Commercial Bathroom Products Market Market Size (In Million)

The forecast period (2025-2033) suggests a continued, albeit moderate, growth trajectory. Given the robust construction activity and ongoing focus on hygiene in commercial spaces, the market is likely to experience above-average growth compared to other segments of the building materials sector. The competitive landscape is expected to remain intense, with companies prioritizing product differentiation, technological advancements, and strategic partnerships to gain a larger market share. Further research focusing specifically on the US market would be necessary to provide more precise quantitative data. Nevertheless, the qualitative insights outlined suggest a promising outlook for the US commercial bathroom products market.

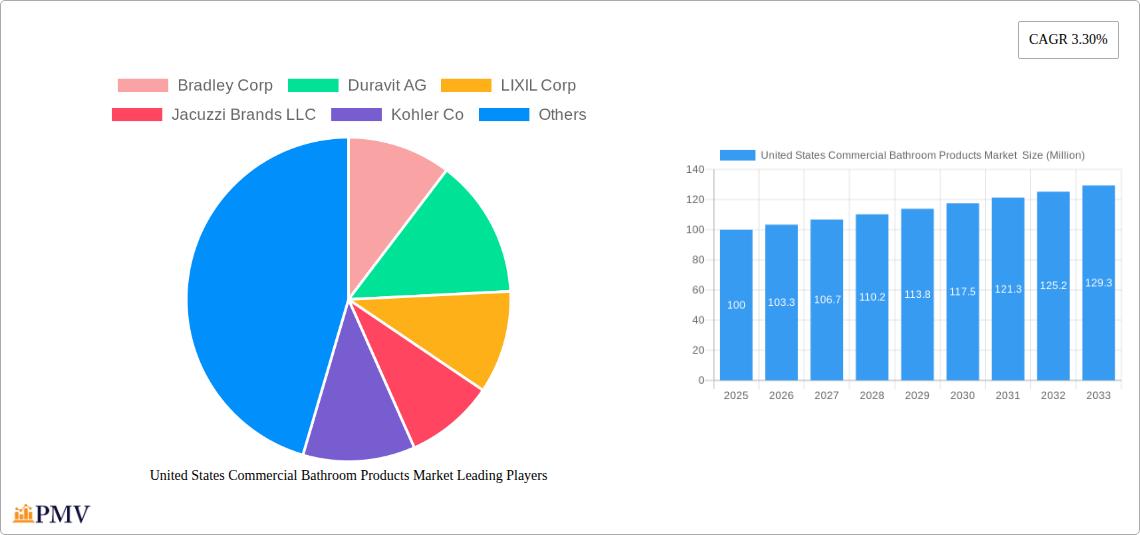

United States Commercial Bathroom Products Market Company Market Share

This comprehensive report provides a detailed analysis of the United States commercial bathroom products market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period 2019-2033, with a focus on 2025, this report delves into market structure, competitive dynamics, growth drivers, challenges, and future opportunities. The report segments the market by product type (toileteries, soap dispensers, faucets and showers, basins, bathtubs), price point (standard, premium, luxury), and distribution channel (online, offline). The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Commercial Bathroom Products Market Market Structure & Competitive Dynamics

The United States commercial bathroom products market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by intense competition, driven by innovation, technological advancements, and evolving consumer preferences. Market leaders like Kohler Co, Bradley Corp, and LIXIL Corp leverage their established brand reputation and extensive distribution networks to maintain their dominance. However, smaller players are also making inroads through specialized product offerings and targeted marketing strategies. The regulatory landscape plays a significant role, with compliance requirements influencing product design and manufacturing. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in recent years. Examples include strategic acquisitions aimed at expanding product portfolios and geographical reach. The substitution of traditional products with technologically advanced alternatives is also shaping the market. For instance, the growing adoption of touchless faucets and smart toilets is impacting the demand for conventional models. End-user trends towards sustainable and water-efficient products are also driving innovation and reshaping the competitive landscape. The market is expected to witness continued consolidation, driven by the pursuit of economies of scale and access to new technologies.

United States Commercial Bathroom Products Market Industry Trends & Insights

The United States commercial bathroom products market is witnessing robust growth, propelled by several key factors. Increasing construction activity in both the commercial and residential sectors is a primary driver, creating significant demand for bathroom fixtures and fittings. The rising focus on hygiene and sanitation, particularly in the wake of recent global health concerns, is fueling demand for touchless and technologically advanced bathroom products. Technological advancements, such as the incorporation of smart technology in faucets, toilets, and showers, are transforming the market. Consumers are increasingly seeking products that offer convenience, energy efficiency, and water conservation. The market is also experiencing a shift towards premium and luxury products, driven by increased disposable incomes and a growing preference for high-quality, aesthetically pleasing bathroom designs. The overall market is experiencing a shift toward sustainable and eco-friendly products, with manufacturers incorporating recycled materials and water-saving technologies into their designs. The competitive landscape is characterized by intense innovation, with companies constantly striving to introduce new products with enhanced functionalities and improved aesthetics. This competitive pressure leads to continuous improvement and increased value for customers. The market is also segmented by price point, with standard, premium, and luxury segments experiencing varying growth rates. The CAGR for the overall market is projected at xx%, with the luxury segment showing the highest growth rate due to increasing consumer spending. Market penetration of smart bathroom products is steadily increasing, particularly in commercial settings, driven by the need for enhanced hygiene and efficiency.

Dominant Markets & Segments in United States Commercial Bathroom Products Market

The United States commercial bathroom products market is geographically diverse, with significant variations in regional demand patterns. The Northeast and Western regions are currently leading the market due to high construction activity and substantial investments in commercial infrastructure. Key growth drivers across segments include:

Product Type:

- Faucets and Showers: This segment dominates due to high replacement rates and the increasing adoption of water-efficient models.

- Toilets: Strong demand driven by ongoing construction and renovations in commercial spaces.

- Basins: Significant demand, driven by renovation projects and new construction.

Price Point:

- Premium: This segment is witnessing robust growth, fueled by increased consumer preference for high-quality and aesthetically advanced products.

- Luxury: The luxury segment is experiencing a high growth rate due to increasing disposable incomes and a growing preference for high-quality, design-centric bathroom fixtures.

Distribution Channel:

- Offline: Offline channels (wholesalers, distributors, retail stores) continue to hold a substantial market share, particularly for larger, bulk purchases.

- Online: Online sales are increasing, driven by growing e-commerce adoption and improved online shopping experiences.

Economic policies supporting infrastructure development and strong consumer spending contribute significantly to market dominance in key regions and segments.

United States Commercial Bathroom Products Market Product Innovations

Recent product innovations demonstrate a clear focus on smart technology, water conservation, and enhanced hygiene. The launch of smart toilets with advanced features, such as integrated bidet functions and voice-activated controls, reflects the growing consumer preference for technology integration. The emphasis on water-efficient fixtures underlines the increasing awareness of environmental concerns. Manufacturers are also incorporating antimicrobial materials and touchless functionalities to enhance hygiene and reduce the spread of germs. These innovations are shaping the competitive landscape, leading to increased market penetration and consumer satisfaction.

Report Segmentation & Scope

This report provides a granular segmentation of the United States commercial bathroom products market across various parameters:

- Product Type: The market is segmented into toiletries, soap dispensers, faucets and showers, basins, and bathtubs. Each segment's growth trajectory and competitive dynamics are analyzed separately.

- Price Point: The market is categorized into standard, premium, and luxury segments, providing insights into varying pricing strategies and consumer preferences.

- Distribution Channel: The report analyses both online and offline distribution channels, highlighting their respective contributions to market sales and competitive landscapes. Each segment’s growth is analyzed based on market size, growth projections, and competitive dynamics within those segments.

Key Drivers of United States Commercial Bathroom Products Market Growth

Several factors contribute to the growth of the United States commercial bathroom products market. These include strong economic growth leading to increased construction activities, rising disposable incomes fueling demand for premium and luxury products, and technological advancements driving innovation and the adoption of smart bathroom products. Government regulations promoting water conservation are also stimulating demand for water-efficient fixtures. Furthermore, the growing emphasis on hygiene and sanitation has boosted demand for touchless and technologically advanced products.

Challenges in the United States Commercial Bathroom Products Market Sector

The United States commercial bathroom products market faces certain challenges. Fluctuations in raw material prices impact production costs and profitability. Supply chain disruptions can affect product availability and lead times. Intense competition requires companies to continuously innovate and differentiate their offerings. Stringent regulatory compliance requirements impose additional costs on manufacturers. Economic downturns can reduce construction activity, dampening demand for bathroom products. These factors collectively influence market dynamics.

Leading Players in the United States Commercial Bathroom Products Market Market

- Bradley Corp

- Duravit AG

- LIXIL Corp

- Jacuzzi Brands LLC

- Kohler Co

- Jaquar Group

- Gerber Plumbing Fixtures LLC

- Fujian Xinchang Sanitary Ware Co Ltd

- Hansgrohe SE

- Fortune Brands Innovations Inc

Key Developments in United States Commercial Bathroom Products Market Sector

- January 2023: Kohler Co. launched the innovative smart toilet, KOHLER Numi 2.0. This launch significantly impacted the smart toilet segment, driving increased consumer interest in advanced bathroom technology.

- March 2023: Roca launched the InWash Insignia shower toilet, featuring advanced technology and Roca Connect for enhanced user experience. This launch boosted the market segment for high-end shower toilets.

Strategic United States Commercial Bathroom Products Market Market Outlook

The United States commercial bathroom products market exhibits significant growth potential. Continued investment in infrastructure development, the increasing adoption of smart technologies, and a growing focus on sustainable and water-efficient products are set to drive market expansion. Strategic opportunities exist for companies to leverage technological advancements, cater to evolving consumer preferences, and expand into underserved market segments. Focus on sustainability, smart technology integration, and innovative design are key strategic considerations for players seeking a competitive edge.

United States Commercial Bathroom Products Market Segmentation

-

1. Product Type

- 1.1. Toiletries

- 1.2. Soap Dispensers

- 1.3. Faucets and Showers

- 1.4. Basins

- 1.5. Bathtubs

-

2. Price Point

- 2.1. Standard

- 2.2. Premium

- 2.3. Luxury

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

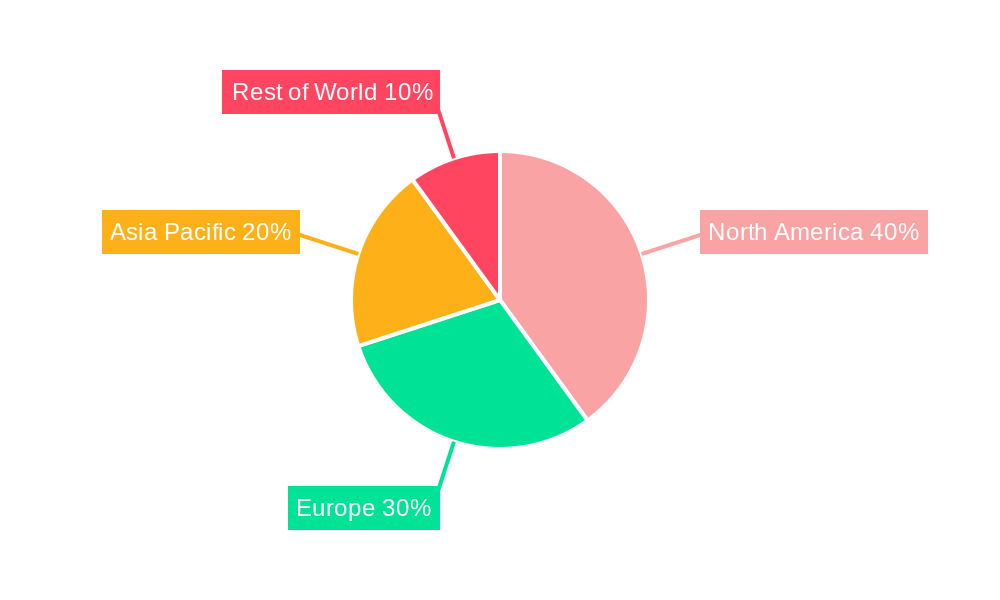

United States Commercial Bathroom Products Market Segmentation By Geography

- 1. United States

United States Commercial Bathroom Products Market Regional Market Share

Geographic Coverage of United States Commercial Bathroom Products Market

United States Commercial Bathroom Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives; More Expensive than Traditional Fixtures

- 3.4. Market Trends

- 3.4.1. The Increasing Demand of Smart Bathrooms Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Bathroom Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Toiletries

- 5.1.2. Soap Dispensers

- 5.1.3. Faucets and Showers

- 5.1.4. Basins

- 5.1.5. Bathtubs

- 5.2. Market Analysis, Insights and Forecast - by Price Point

- 5.2.1. Standard

- 5.2.2. Premium

- 5.2.3. Luxury

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bradley Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Duravit AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LIXIL Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jacuzzi Brands LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kohler Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaquar Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerber Plumbing Fixtures LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujian Xinchang Sanitary Ware Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hansgrohe SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands Innovations Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bradley Corp

List of Figures

- Figure 1: United States Commercial Bathroom Products Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Commercial Bathroom Products Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Bathroom Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: United States Commercial Bathroom Products Market Revenue Million Forecast, by Price Point 2020 & 2033

- Table 4: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Price Point 2020 & 2033

- Table 5: United States Commercial Bathroom Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Commercial Bathroom Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Commercial Bathroom Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: United States Commercial Bathroom Products Market Revenue Million Forecast, by Price Point 2020 & 2033

- Table 12: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Price Point 2020 & 2033

- Table 13: United States Commercial Bathroom Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Commercial Bathroom Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Bathroom Products Market ?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the United States Commercial Bathroom Products Market ?

Key companies in the market include Bradley Corp, Duravit AG, LIXIL Corp , Jacuzzi Brands LLC, Kohler Co, Jaquar Group, Gerber Plumbing Fixtures LLC, Fujian Xinchang Sanitary Ware Co Ltd, Hansgrohe SE, Fortune Brands Innovations Inc.

3. What are the main segments of the United States Commercial Bathroom Products Market ?

The market segments include Product Type, Price Point , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 358.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market.

6. What are the notable trends driving market growth?

The Increasing Demand of Smart Bathrooms Drives the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives; More Expensive than Traditional Fixtures.

8. Can you provide examples of recent developments in the market?

March 2023 - Roca launched the InWash Insignia shower toilet, which includes advanced technology to achieve maximum comfort and hygiene and is equipped with Roca Connect. The feature would enable users to operate in different modes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Bathroom Products Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Bathroom Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Bathroom Products Market ?

To stay informed about further developments, trends, and reports in the United States Commercial Bathroom Products Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence