Key Insights

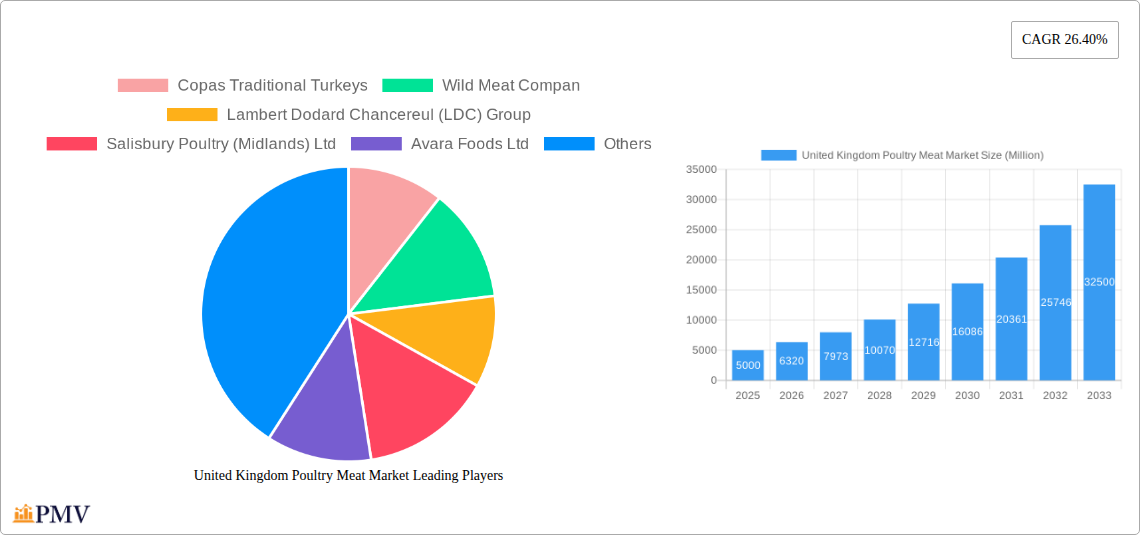

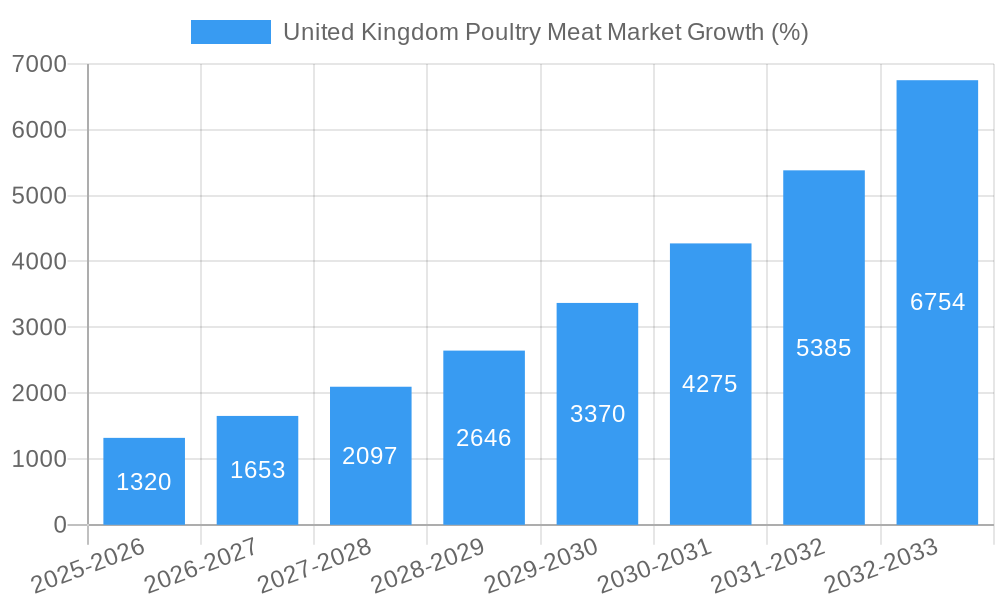

The UK poultry meat market, a significant sector within the broader food industry, exhibits robust growth potential. Driven by rising consumer demand for protein-rich foods, increasing health consciousness (fueling demand for lean poultry options), and the convenience offered by processed poultry products, the market is projected to experience substantial expansion. The 26.40% CAGR indicates a dynamic market landscape, particularly in the forecast period (2025-2033). Key market segments, including canned, fresh/chilled, frozen, and processed poultry, contribute to this growth, with varied consumption patterns influencing market share. The distribution channels, encompassing both off-trade (supermarkets, retail) and on-trade (restaurants, food service), play a significant role in market dynamics, reflecting changing consumer preferences and purchasing habits. Leading players such as 2 Sisters Food Group, Cranswick plc, and Gressingham Foods dominate the market, showcasing a competitive yet consolidated landscape. However, potential restraints, such as fluctuating feed prices and concerns regarding avian influenza outbreaks, need careful consideration when forecasting long-term market performance. These factors influence production costs and supply chain stability.

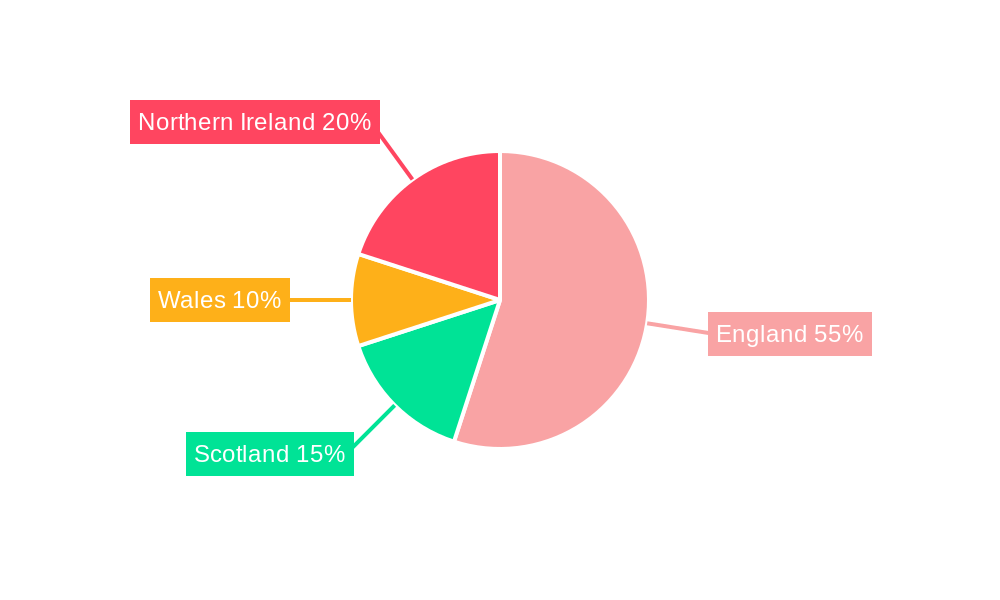

The market segmentation, highlighting the diverse product forms and distribution channels, allows for a granular understanding of consumer preferences. For example, the growth of the fresh/chilled segment might reflect increasing consumer focus on quality and freshness. Conversely, processed poultry's performance could reflect busy lifestyles and convenience-driven purchasing. Regional variations in consumption patterns within the UK also contribute to market segmentation. Further analysis of specific regional data (e.g., differences between demand in urban vs. rural areas) would provide a more detailed picture. The competitive landscape indicates the significant role of established players, but also the potential for new entrants and innovative products to carve out market share, especially in specialized niches such as organic or free-range poultry. Future market success will hinge on agility in responding to consumer trends, effectively managing supply chain challenges, and proactively mitigating risks associated with disease outbreaks and fluctuating input costs.

United Kingdom Poultry Meat Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom poultry meat market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, dominant segments, and key players, equipping businesses with the knowledge needed to navigate this dynamic sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. The market size is expressed in Millions throughout the report.

United Kingdom Poultry Meat Market Structure & Competitive Dynamics

The UK poultry meat market exhibits a moderately consolidated structure, with several large players commanding significant market share. The market concentration ratio (CR4) is estimated at xx%, reflecting the presence of both large multinational corporations and smaller regional producers. Innovation within the sector focuses primarily on improving production efficiency, enhancing food safety, and developing sustainable packaging solutions. The regulatory framework, encompassing food safety regulations and animal welfare standards, significantly impacts market operations. Product substitutes, such as plant-based meat alternatives, are gaining traction, albeit slowly, presenting a long-term competitive challenge. End-user trends towards healthier and more sustainable food choices influence product development and marketing strategies.

Mergers and acquisitions (M&A) have played a notable role in shaping market dynamics. Recent deals include:

- Gressingham Group's acquisition of Hemswell Coldstore (June 2023): This acquisition expanded Gressingham's cold storage capacity by 5000 pallets, strengthening their logistical capabilities. Estimated deal value: xx Million.

- Other significant M&A activities in the past five years are estimated to have a total value of xx Million.

These activities reflect the ongoing consolidation within the sector and the pursuit of greater scale and efficiency.

United Kingdom Poultry Meat Market Industry Trends & Insights

The UK poultry meat market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors, including:

- Rising demand for protein: The increasing global population and changing dietary habits are driving up the demand for protein-rich foods, including poultry meat.

- Growing popularity of convenience foods: Ready-to-eat poultry products are gaining popularity due to busy lifestyles and increased demand for convenience.

- Technological advancements: Innovations in poultry farming and processing techniques are leading to increased efficiency and improved product quality.

However, challenges such as fluctuating feed prices, avian influenza outbreaks, and increased competition from imported poultry meat are likely to temper growth. Market penetration of processed poultry products is expected to reach xx% by 2033, driven by increased consumer preference for convenience and ready-to-eat meals.

Dominant Markets & Segments in United Kingdom Poultry Meat Market

The fresh/chilled segment dominates the UK poultry meat market, accounting for approximately xx% of the total market value in 2025. This is attributable to consumer preference for fresh, high-quality poultry meat.

- Key Drivers for Fresh/Chilled Segment Dominance:

- Consumer preference for freshness and quality.

- Strong distribution networks supporting efficient delivery of fresh products.

- Limited shelf-life challenges are effectively managed through supply chain improvements.

The off-trade distribution channel accounts for a larger share (xx%) of the market compared to the on-trade channel. The larger share of off-trade market is driven by consumer buying patterns in supermarkets and hypermarkets.

United Kingdom Poultry Meat Market Product Innovations

Recent innovations include a shift towards sustainable packaging, exemplified by Cranswick's adoption of PaperLite™ trays, reducing plastic usage. Furthermore, there's a focus on value-added products, including ready-to-cook and ready-to-eat options, catering to changing consumer preferences for convenience. These innovations aim to enhance product appeal, improve sustainability, and enhance the competitive edge.

Report Segmentation & Scope

This report segments the UK poultry meat market across multiple dimensions:

- Form: Canned, Fresh/Chilled, Frozen, Processed. The fresh/chilled segment is projected to exhibit the highest CAGR, driven by consumer preferences.

- Distribution Channel: Off-Trade (supermarkets, hypermarkets, etc.), On-Trade (restaurants, hotels, etc.). The off-trade channel holds a larger market share.

- Others: Various sub-segments under other category will be covered in the report. The market size and growth projections for each sub-segment are detailed within the full report. Competitive dynamics vary across segments.

Key Drivers of United Kingdom Poultry Meat Market Growth

The UK poultry meat market's growth is primarily driven by factors such as increasing demand for protein, changing consumer lifestyles favoring convenience, and advancements in poultry farming and processing technologies resulting in cost-effectiveness. Government support for the agricultural sector also plays a supportive role.

Challenges in the United Kingdom Poultry Meat Market Sector

The sector faces challenges including volatile feed prices impacting production costs, the threat of avian influenza outbreaks disrupting supply chains, and increasing competition from imports, which puts pressure on domestic producers. These factors collectively influence pricing and overall market stability.

Leading Players in the United Kingdom Poultry Meat Market Market

- Copas Traditional Turkeys

- Wild Meat Company

- Lambert Dodard Chancereul (LDC) Group

- Salisbury Poultry (Midlands) Ltd

- Avara Foods Ltd

- Blackwells Farm

- 2 Sisters Food Group

- Cranswick plc

- Gressingham Foods

- JBS SA

- Donald Russell Ltd

- Danish Crown AmbA

Key Developments in United Kingdom Poultry Meat Market Sector

- May 2023: Avara Foods Ltd announced the closure of its Abergavenny factory due to inflationary pressures and reduced demand for UK-produced turkey. This highlights the vulnerability of the sector to economic factors.

- May 2023: Cranswick's adoption of sustainable PaperLite™ packaging indicates a shift towards environmentally friendly practices within the industry.

- June 2023: Gressingham Group's acquisition of Hemswell Coldstore demonstrates strategic expansion within the cold storage infrastructure, enhancing operational efficiency.

Strategic United Kingdom Poultry Meat Market Outlook

The UK poultry meat market presents significant opportunities for growth, driven by evolving consumer preferences and technological advancements. Companies focusing on sustainable practices, innovative product development (including plant-based alternatives), and efficient supply chain management are well-positioned to capitalize on the future market potential. Strategic partnerships and acquisitions will likely continue to shape the competitive landscape.

United Kingdom Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

United Kingdom Poultry Meat Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Expansion of leading retail chains is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. UAE United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Saudi Arabia United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. South Africa United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of Middle East and Africa United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Copas Traditional Turkeys

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wild Meat Compan

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lambert Dodard Chancereul (LDC) Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Salisbury Poultry (Midlands) Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Avara Foods Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Blackwells Farm

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 2 Sisters Food Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cranswick plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gressingham Foods

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JBS SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Donald Russell Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Danish Crown AmbA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Copas Traditional Turkeys

List of Figures

- Figure 1: United Kingdom Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United Kingdom Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United Kingdom Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: United Kingdom Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United Kingdom Poultry Meat Market?

Key companies in the market include Copas Traditional Turkeys, Wild Meat Compan, Lambert Dodard Chancereul (LDC) Group, Salisbury Poultry (Midlands) Ltd, Avara Foods Ltd, Blackwells Farm, 2 Sisters Food Group, Cranswick plc, Gressingham Foods, JBS SA, Donald Russell Ltd, Danish Crown AmbA.

3. What are the main segments of the United Kingdom Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Expansion of leading retail chains is driving the market.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

June 2023: Gressingham Group acquired a cold storage facility in Lincolnshire called Hemswell Coldstore. They are capable of housing 5000 pallets of frozen meat.May 2023: Avara Foods Ltd announced to shut its Abergavenny factory in Autumn 2023 attributed by significant inflationary pressure in fuel, commodities and labour, which has driven up pricing and significantly reduced demand for UK-produced turkey in the retail market.May 2023: Cranswick Convenience Foods Milton Keynes is working with fibre-based packaging supplier, Graphic Packaging, to move a range of cooked meats from plastic, into trays produced from PaperLite™ - a thermoformable packaging material which contains 90% plant-based fibre.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Poultry Meat Market?

To stay informed about further developments, trends, and reports in the United Kingdom Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence