Key Insights

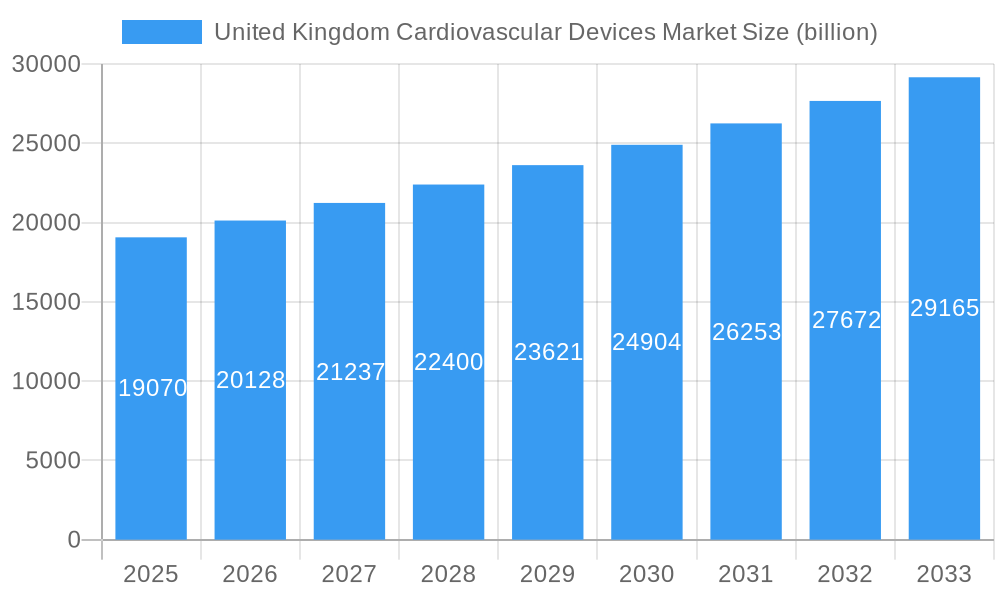

The United Kingdom cardiovascular devices market is poised for robust expansion, with a projected market size of £19.07 billion in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.6% over the forecast period. A significant driver for this market is the increasing prevalence of cardiovascular diseases (CVDs) within the UK population, necessitating advanced diagnostic and therapeutic interventions. The aging demographic further exacerbates this trend, leading to a greater demand for cardiac monitoring, rhythm management devices, and surgical interventions. Technological advancements, including the development of less invasive procedures and sophisticated remote monitoring solutions, are also contributing to market expansion.

United Kingdom Cardiovascular Devices Market Market Size (In Billion)

Key segments within the UK cardiovascular devices market include Diagnostic and Monitoring Devices, such as Electrocardiogram (ECG) devices and remote cardiac monitoring systems, and Therapeutic and Surgical Devices, encompassing cardiac assist devices, rhythm management devices, catheters, grafts, heart valves, and stents. Companies like GE Healthcare, Abbott Laboratories, Siemens Healthineers AG, and Medtronic Plc are at the forefront, driving innovation and catering to the growing demand. Favorable healthcare policies and increasing healthcare expenditure within the UK are expected to further bolster the market. However, potential restraints, such as stringent regulatory approvals and high initial costs of advanced devices, will need to be navigated to fully realize the market's potential.

United Kingdom Cardiovascular Devices Market Company Market Share

Here's the SEO-optimized, detailed report description for the United Kingdom Cardiovascular Devices Market, adhering to all your specifications:

Report Title: United Kingdom Cardiovascular Devices Market: In-Depth Analysis and Forecast (2019–2033)

Report Description: Uncover critical insights into the United Kingdom cardiovascular devices market with this comprehensive report. Analyzing the market from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this study provides an unparalleled understanding of market dynamics, emerging trends, and future opportunities. Delve into the performance of key segments including Diagnostic and Monitoring Devices (e.g., Electrocardiogram (ECG), Remote Cardiac Monitoring) and Therapeutic and Surgical Devices (e.g., Cardiac Assist Devices, Cardiac Rhythm Management Devices, Catheters, Grafts, Heart Valves, Stents). This report meticulously examines market concentration, innovation, regulatory landscapes, and the strategic moves of leading players such as Medtronic Plc, Abbott Laboratories, Siemens Healthineers AG, Boston Scientific Corporation, GE Healthcare, Biotronik, Livanova, Cardinal Health, B Braun SE, and W L Gore & Associates Inc. Discover growth drivers, market challenges, and the impact of recent industry developments, including the Novartis Biome UK Heart Health Catalyst 2022 and the innovative Cysoni bionic device. With a projected market size expected to reach several billion pounds, this report is essential for stakeholders seeking to capitalize on the robust growth within the UK's cardiac health technology sector and medical device industry.

United Kingdom Cardiovascular Devices Market Market Structure & Competitive Dynamics

The United Kingdom cardiovascular devices market is characterized by a moderately consolidated structure, with several large, established players holding significant market share. Key companies like Medtronic Plc, Abbott Laboratories, and Siemens Healthineers AG dominate through extensive product portfolios, strong distribution networks, and ongoing innovation. The innovation ecosystem is vibrant, driven by a confluence of academic research institutions, hospital trusts, and specialized medical device manufacturers. Significant investment in R&D fuels the development of advanced diagnostic and therapeutic solutions. Regulatory frameworks, primarily governed by the Medicines and Healthcare products Regulatory Agency (MHRA) and European CE marking requirements (prior to full divergence), play a crucial role in market access and product approval, influencing the speed of new product introductions.

The threat of product substitutes, while present, is often limited by the specialized nature of cardiovascular interventions. However, advancements in less invasive techniques and digital health solutions are gradually reshaping treatment paradigms. End-user trends are increasingly focused on minimally invasive procedures, personalized medicine, and remote patient monitoring, driven by a desire for improved patient outcomes and reduced healthcare costs. Mergers and acquisitions (M&A) activities are strategic tools for market expansion and portfolio enhancement. While specific M&A deal values are not publicly disclosed for the entire UK market, global acquisitions by major players indicate a strategic intent to consolidate market leadership and gain access to innovative technologies, with billions invested annually in such transactions across the global medical device sector that heavily influences the UK market.

United Kingdom Cardiovascular Devices Market Industry Trends & Insights

The United Kingdom cardiovascular devices market is experiencing robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is primarily fueled by an aging population, leading to a higher prevalence of cardiovascular diseases (CVDs), and an increasing awareness regarding early diagnosis and treatment. Technological advancements are at the forefront of market evolution, with a strong emphasis on developing sophisticated diagnostic tools and minimally invasive therapeutic devices. The integration of artificial intelligence (AI) and machine learning (ML) in diagnostic imaging and predictive analytics is revolutionizing patient care, enabling earlier detection and more personalized treatment plans.

Remote cardiac monitoring devices are gaining substantial traction, empowered by advancements in wearable technology and the growing acceptance of telehealth services, particularly accelerated by recent global health events. These solutions allow for continuous patient monitoring outside of traditional clinical settings, leading to improved management of chronic conditions and reduced hospital readmissions. In the therapeutic segment, innovations in structural heart disease interventions, such as transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve repair (TMVR), are offering viable alternatives to open-heart surgery for a growing number of patients. The demand for advanced cardiac rhythm management devices, including sophisticated pacemakers and implantable cardioverter-defibrillators (ICDs) with enhanced sensing capabilities and extended battery life, remains strong.

Furthermore, the increasing focus on patient-centric care and value-based healthcare models is driving the adoption of devices that demonstrate clear clinical and economic benefits. Manufacturers are investing heavily in research and development to bring to market devices that not only improve efficacy but also enhance patient comfort and reduce recovery times. The competitive landscape is dynamic, with both established global players and agile start-ups contributing to innovation. Strategic partnerships between device manufacturers, healthcare providers, and academic institutions are crucial for accelerating the translation of research into clinical practice. The market penetration of advanced cardiovascular devices is steadily increasing, reflecting a growing willingness among healthcare providers and payers to adopt innovative solutions that promise better health outcomes for the UK population. The total market size is estimated to be in the range of several billion pounds, with continuous upward trajectory.

Dominant Markets & Segments in United Kingdom Cardiovascular Devices Market

The United Kingdom cardiovascular devices market is segmented into two primary categories: Diagnostic and Monitoring Devices and Therapeutic and Surgical Devices. Within the Diagnostic and Monitoring Market, Electrocardiogram (ECG) devices continue to hold a significant share due to their fundamental role in diagnosing a wide range of cardiac abnormalities. The widespread availability of portable and advanced multi-lead ECG machines, coupled with the increasing adoption of Holter monitors and Remote Cardiac Monitoring solutions, are key drivers of this segment's dominance. The latter, in particular, is experiencing exponential growth, driven by the need for continuous patient observation, proactive management of chronic heart conditions, and the expansion of home-based healthcare initiatives.

- Key Drivers for Diagnostic and Monitoring Dominance:

- Rising prevalence of cardiovascular diseases necessitating regular monitoring.

- Technological advancements in miniaturization and connectivity of diagnostic devices.

- Government initiatives promoting early detection and preventative healthcare.

- Increasing demand for point-of-care diagnostics.

The Therapeutic and Surgical Devices segment is the largest contributor to the overall market value, driven by the high demand for interventional and implantable devices. Cardiac Rhythm Management Devices, including pacemakers and defibrillators, represent a substantial portion, catering to the growing number of patients with arrhythmias. Catheters for various diagnostic and interventional procedures, such as angioplasty and stenting, are indispensable tools in modern cardiology. Heart Valves, particularly with the rise of transcatheter aortic valve implantation (TAVI), and Stents for coronary artery revascularization, are crucial in managing structural heart disease and coronary artery disease, respectively. The Cardiac Assist Devices market, though more niche, is growing as solutions for heart failure management advance.

- Key Drivers for Therapeutic and Surgical Dominance:

- High incidence of heart failure and coronary artery disease.

- Advancements in minimally invasive surgical techniques.

- Development of longer-lasting and more sophisticated implantable devices.

- Increasing number of interventional cardiology procedures performed annually.

- Growing patient and physician preference for less invasive treatments.

The United Kingdom, as a whole, represents a dominant market due to its advanced healthcare infrastructure, high disposable income, and a strong emphasis on adopting cutting-edge medical technologies. Within this landscape, London and other major metropolitan areas often lead in the adoption of novel cardiovascular devices owing to the presence of specialized cardiac centers and a higher concentration of healthcare professionals and research facilities. The economic policies supporting healthcare innovation and investment in state-of-the-art medical equipment by the NHS further bolster the dominance of these segments and regions. The market size for these segments collectively runs into billions of pounds, with significant growth projected for both.

United Kingdom Cardiovascular Devices Market Product Innovations

Product innovation within the United Kingdom cardiovascular devices market is primarily focused on enhancing diagnostic accuracy, improving treatment efficacy, and increasing patient comfort. Key trends include the development of miniaturized and AI-enabled diagnostic devices for more precise and early detection of cardiac issues. In the therapeutic realm, advancements in structural heart devices, such as next-generation transcatheter heart valves offering improved durability and implantation techniques, are transforming patient care. Innovations in cardiac rhythm management are leading to smaller, longer-lasting devices with enhanced sensing capabilities and remote monitoring features. The drive towards minimally invasive approaches continues to spur the development of advanced catheters, guidewires, and closure devices, reducing patient trauma and recovery times.

Report Segmentation & Scope

This report meticulously segments the United Kingdom cardiovascular devices market into two overarching categories: Device Type.

The Diagnostic and Monitoring Market encompasses sub-segments crucial for identifying and tracking cardiovascular conditions. This includes Electrocardiogram (ECG) devices, fundamental for capturing electrical activity of the heart; Remote Cardiac Monitoring devices, facilitating continuous patient observation outside clinical settings; and Other Diagnostic and Monitoring Devices, covering a range of technologies like echocardiography equipment and cardiac magnetic resonance imaging (MRI) solutions. This segment is expected to show steady growth, driven by technological integration and preventative healthcare initiatives, with a market size projected to reach hundreds of millions of pounds by the forecast period.

The Therapeutic and Surgical Devices segment addresses the treatment and management of cardiovascular diseases. This comprises Cardiac Assist Devices for heart failure support; Cardiac Rhythm Management Devices such as pacemakers and ICDs; Catheters used in angioplasty and other interventions; Grafts for bypass surgeries; Heart Valves for replacement or repair; and Stents for opening blocked arteries. Other Therapeutic and Surgical Devices include items like introducers and vascular closure devices. This segment commands the largest market share, driven by the high prevalence of cardiovascular diseases and advancements in interventional cardiology, with projected growth into billions of pounds over the forecast period.

Key Drivers of United Kingdom Cardiovascular Devices Market Growth

The United Kingdom cardiovascular devices market is propelled by several interconnected factors. A primary driver is the persistently high and increasing prevalence of cardiovascular diseases, largely attributed to an aging population and lifestyle factors. This demographic shift directly translates into a greater demand for diagnostic, monitoring, and therapeutic cardiovascular devices. Technological innovation plays a pivotal role, with continuous advancements in device miniaturization, AI integration, and minimally invasive technologies offering improved patient outcomes and procedural efficiencies. Furthermore, government initiatives aimed at improving cardiovascular health outcomes, promoting early detection, and investing in advanced healthcare infrastructure create a conducive environment for market expansion. The growing acceptance and adoption of telehealth and remote patient monitoring solutions, accelerated by recent global health trends, also significantly contributes to the market's growth trajectory.

Challenges in the United Kingdom Cardiovascular Devices Market Sector

Despite strong growth prospects, the United Kingdom cardiovascular devices market faces several challenges. Stringent regulatory approval processes, though ensuring product safety and efficacy, can lead to longer time-to-market for innovative devices, impacting their rapid deployment. Economic pressures within the National Health Service (NHS), including budget constraints and cost-containment measures, can influence procurement decisions and potentially limit the adoption of newer, more expensive technologies. Supply chain vulnerabilities, exacerbated by global geopolitical events and logistical complexities, can disrupt the availability of critical components and finished medical devices. Intense competition among both established global players and emerging companies also drives down profit margins and necessitates continuous innovation and strategic market positioning. Furthermore, challenges in ensuring equitable access to advanced cardiovascular devices across all regions of the UK can hinder overall market penetration.

Leading Players in the United Kingdom Cardiovascular Devices Market Market

- Biotronik

- Livanova

- GE Healthcare

- Abbott Laboratories

- Siemens Healthineers AG

- Cardinal Health

- Medtronic Plc

- Boston Scientific Corporation

- B Braun SE

- W L Gore & Associates Inc

Key Developments in United Kingdom Cardiovascular Devices Market Sector

- July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022. This initiative, a world-first investor partnership with Medtronic Ltd., RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust, aims to identify and implement solutions that empower patients to improve their heart health and help prevent future heart attacks or strokes through home-based digital solutions.

- February 2022: Ceryx Medical Limited, in collaboration with scientists at the Auckland Bioengineering Institute (ABI) and the Universities of Bath and Bristol, developed Cysoni. This bionic device paces the heart with real-time respiratory modulation, innovating from the principle that heart rate naturally fluctuates with breathing (respiratory sinus arrhythmia).

Strategic United Kingdom Cardiovascular Devices Market Market Outlook

The strategic outlook for the United Kingdom cardiovascular devices market is exceptionally positive, driven by an imperative to address the nation's significant cardiovascular disease burden. Growth accelerators include the ongoing digital transformation within healthcare, enabling seamless integration of remote monitoring and AI-powered diagnostics, which will further enhance patient management and preventative care. Continued investment in R&D for advanced minimally invasive techniques and personalized treatment solutions will be critical for companies aiming to capture market share. Strategic partnerships between device manufacturers, healthcare providers, and technology firms are expected to intensify, fostering innovation ecosystems that accelerate product development and adoption. The market's future lies in its ability to deliver value-based solutions that demonstrate clear clinical efficacy and economic benefits, aligning with the evolving priorities of the NHS and patient expectations for improved quality of life.

United Kingdom Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Market

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Market

United Kingdom Cardiovascular Devices Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Cardiovascular Devices Market Regional Market Share

Geographic Coverage of United Kingdom Cardiovascular Devices Market

United Kingdom Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Market

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Market

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Biotronik

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livanova

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cardinal Health

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Biotronik

List of Figures

- Figure 1: United Kingdom Cardiovascular Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Cardiovascular Devices Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: United Kingdom Cardiovascular Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Cardiovascular Devices Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the United Kingdom Cardiovascular Devices Market?

Key companies in the market include Biotronik, Livanova, GE Healthcare, Abbott Laboratories, Siemens Healthineers AG, Cardinal Health, Medtronic Plc, Boston Scientific Corporation, B Braun SE, W L Gore & Associates Inc.

3. What are the main segments of the United Kingdom Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Cardiovascular Diseases; Technological Advancement in the Devices.

6. What are the notable trends driving market growth?

Cardiac Rhythm Management Devices Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

July 2022: Novartis Pharmaceuticals United Kingdom launched the Novartis Biome UK Heart Health Catalyst 2022 in a world-first investor partnership with Medtronic Ltd., RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity, CW+. The initiative aims to identify and implement solutions that empower patients to improve their heart health and help prevent future heart attacks or strokes through home-based digital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the United Kingdom Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence