Key Insights

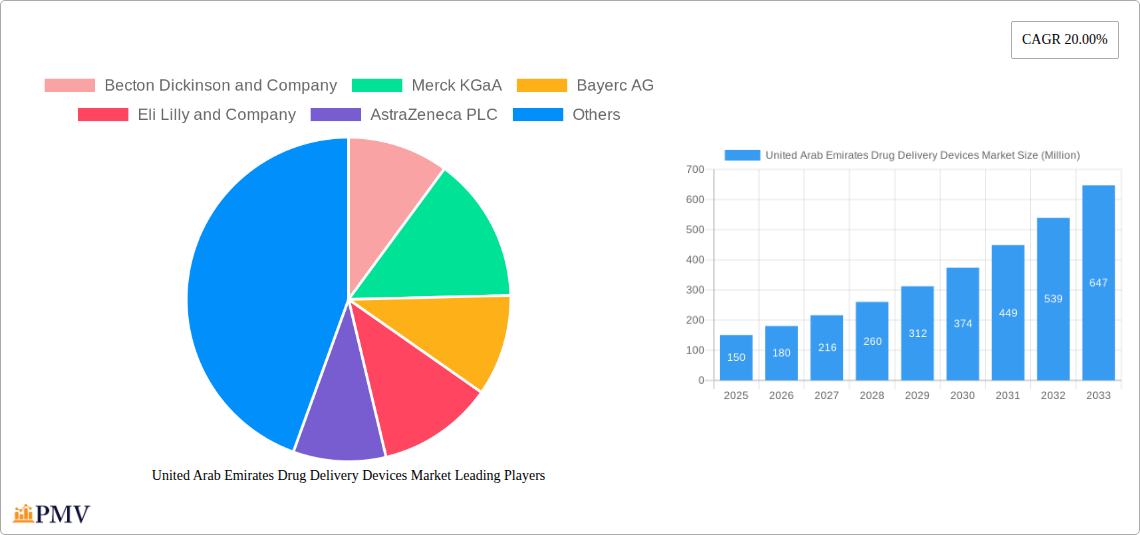

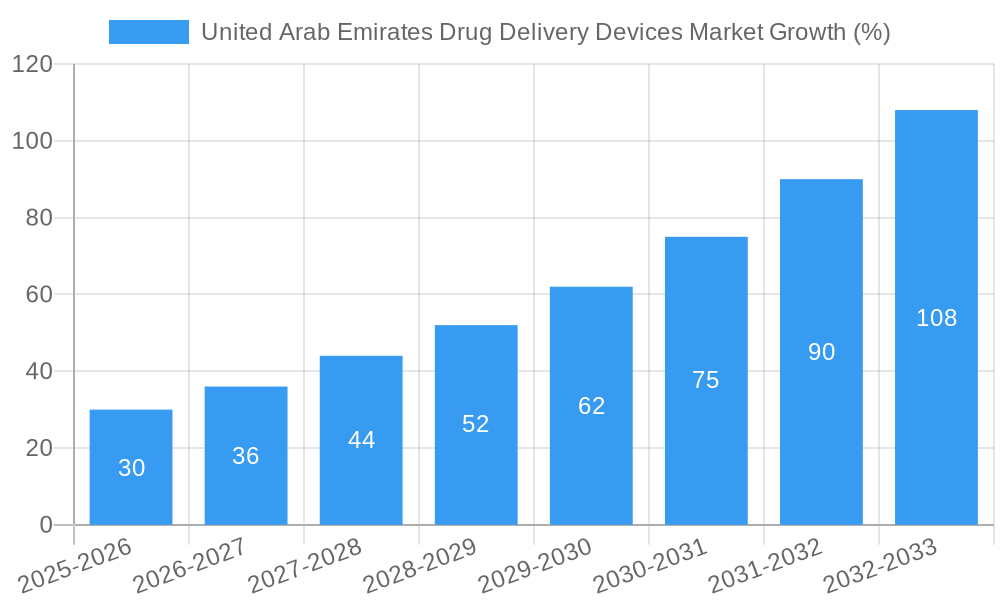

The United Arab Emirates (UAE) drug delivery devices market is experiencing robust growth, fueled by factors such as a rising prevalence of chronic diseases, an aging population, and increasing healthcare expenditure. The market's expansion is further driven by technological advancements leading to the development of innovative drug delivery systems like smart inhalers and microneedle patches, offering improved patient compliance and therapeutic efficacy. Government initiatives promoting healthcare infrastructure development and investment in advanced medical technologies also contribute significantly to market expansion. While data specific to the UAE is limited, considering the global CAGR of 20% and the UAE's high healthcare spending, a conservative estimate for the UAE market size in 2025 is $150 million, projected to reach approximately $350 million by 2033. This growth is anticipated across all delivery modes, with nasal and injectable devices likely holding substantial market shares due to the prevalence of respiratory and chronic diseases. However, the increasing adoption of convenient and patient-friendly options like transdermal and oral delivery systems will also significantly contribute to this expansion. Challenges such as stringent regulatory approvals and high device costs could potentially restrain market growth to some degree.

Despite these challenges, the UAE’s strategic location, its status as a regional healthcare hub, and its commitment to investing in cutting-edge medical solutions, strongly indicate a positive outlook for the drug delivery devices market in the coming years. The market is expected to witness considerable competition among both international and local players, particularly in the segments of innovative delivery technologies. Companies should focus on strategies involving strategic partnerships, R&D investment, and a focus on bringing technologically advanced and user-friendly devices to the market to capture significant market share. The strong emphasis on patient-centric care in the UAE presents a significant opportunity for companies that prioritize user experience and efficacy in their product design and delivery.

United Arab Emirates Drug Delivery Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Arab Emirates (UAE) drug delivery devices market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, providing actionable intelligence to support strategic decision-making. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United Arab Emirates Drug Delivery Devices Market Structure & Competitive Dynamics

The UAE drug delivery devices market is characterized by a moderately concentrated landscape, with a few multinational players dominating the market share. Key players include Becton Dickinson and Company, Merck KGaA, Bayer AG, Eli Lilly and Company, AstraZeneca PLC, F Hoffmann-La Roche Ltd, Johnson and Johnson, GlaxoSmithKline PLC, and Pfizer Inc. These companies compete primarily on the basis of product innovation, technological advancements, and brand reputation.

Market concentration is further influenced by the regulatory framework within the UAE, which necessitates strict adherence to quality and safety standards. The presence of robust regulatory bodies fosters a controlled environment, limiting the entry of new players. The market also experiences influences from the broader pharmaceutical industry, including mergers and acquisitions (M&A) activities. For example, the acquisition of Birgi Mefar Group (BMG) by ADQ in June 2022, valued at xx Million, significantly boosted the UAE's capacity for sterile injectable drug delivery devices. This deal exemplifies the strategic M&A landscape, driving consolidation and reshaping competitive dynamics. Furthermore, the substitution of existing devices with newer, more efficient technologies is an ongoing process influencing market share and competition. End-user trends, driven by technological advancements and changing healthcare preferences, impact device adoption rates.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Deal Values: Total M&A value in the last 5 years estimated at xx Million.

- Innovation Ecosystems: Growing focus on local manufacturing and partnerships for innovation.

United Arab Emirates Drug Delivery Devices Market Industry Trends & Insights

The UAE drug delivery devices market is experiencing robust growth, fueled by several key factors. The increasing prevalence of chronic diseases like diabetes and cardiovascular ailments is driving demand for sophisticated drug delivery systems. The growing geriatric population further contributes to the market expansion, as this demographic segment often requires more frequent medication administration and specialized delivery mechanisms. Government initiatives aimed at improving healthcare infrastructure and promoting pharmaceutical innovation are also creating a favorable environment for market growth.

Technological advancements, including the introduction of smart drug delivery devices and personalized medicine, are revolutionizing the landscape. These innovations enhance patient compliance, improve treatment outcomes, and provide greater convenience. Consumer preferences are shifting towards minimally invasive and user-friendly devices, fostering the demand for innovative products. The competitive landscape is intensifying, with established players investing heavily in research and development to introduce new and improved drug delivery systems. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration of advanced drug delivery systems is steadily increasing, with xx% market share expected by 2033. This growth trajectory is strongly linked to rising healthcare expenditure and the growing adoption of innovative technologies within the UAE’s healthcare sector.

Dominant Markets & Segments in United Arab Emirates Drug Delivery Devices Market

The injectable segment currently dominates the UAE drug delivery devices market. Its dominance stems from the high prevalence of chronic diseases requiring injectable medications, coupled with the widespread availability of established infrastructure for administering these injections. Furthermore, the substantial investments made by the government and private sector in expanding healthcare facilities significantly contribute to the growth of this segment.

- Key Drivers for Injectable Segment Dominance:

- High prevalence of chronic diseases requiring injectable therapies.

- Well-established healthcare infrastructure for injection administration.

- Government investments in healthcare facility expansion.

- Strong adoption of advanced injectable drug delivery systems.

The other segments like Oral, Transdermal, and Topical are also experiencing growth but at a slower pace in comparison to the Injectable segment. These segments face challenges related to patient compliance, efficacy issues and specific requirements of the drug.

United Arab Emirates Drug Delivery Devices Market Product Innovations

Recent product innovations in the UAE drug delivery devices market focus on enhancing the efficacy, safety, and convenience of drug administration. Smart inhalers with digital connectivity, automated injection pens, and microneedle patches are among the notable advancements. These innovations aim to improve patient compliance, reduce medication errors, and deliver more precise dosages. The market is witnessing increased integration of digital technologies, including remote monitoring capabilities, to optimize treatment effectiveness. Such innovation directly addresses unmet needs within the UAE's healthcare system, leading to rapid adoption and market expansion.

Report Segmentation & Scope

The UAE drug delivery devices market is segmented by mode of delivery:

Injectable: This segment is expected to witness significant growth due to the high prevalence of chronic diseases and increasing adoption of advanced injection systems. Competitive intensity is high within this segment.

Oral: This segment is characterized by a wide range of products, from simple tablets to complex oral formulations. Growth is driven by consumer preference for convenient oral medication.

Transdermal: This segment is growing steadily due to the benefits of sustained drug release and improved patient compliance. Market expansion is influenced by technological advancements in patch technology.

Topical: This segment comprises creams, ointments, and gels. Growth is influenced by the increasing prevalence of skin conditions.

Nasal: This segment offers convenient delivery for certain drugs and is expected to witness growth owing to technological advancements in nasal spray technology.

Others (Pulmonary, Rectal, Occular, Implantable): This segment encompasses specialized delivery systems for targeted drug administration and exhibits moderate growth potential.

Key Drivers of United Arab Emirates Drug Delivery Devices Market Growth

The UAE's drug delivery devices market is propelled by several factors. First, the rising prevalence of chronic diseases necessitates advanced drug delivery systems for effective treatment. Second, increased healthcare spending and government initiatives supporting healthcare infrastructure development create a positive environment for growth. Third, technological advancements in drug delivery technologies, such as smart inhalers and personalized medicine, are driving market expansion. Finally, the burgeoning pharmaceutical industry within the UAE is fostering collaborations and investments in drug delivery solutions.

Challenges in the United Arab Emirates Drug Delivery Devices Market Sector

Despite the promising growth outlook, the UAE drug delivery devices market faces some challenges. Stringent regulatory approvals can delay product launches and increase costs. Supply chain disruptions caused by geopolitical factors can impact the availability of devices. Furthermore, intense competition from established global players necessitates continuous innovation and strategic partnerships to maintain market share. The price sensitivity of certain segments and the affordability of advanced technologies also present limitations to market penetration.

Leading Players in the United Arab Emirates Drug Delivery Devices Market Market

- Becton Dickinson and Company

- Merck KGaA

- Bayer AG

- Eli Lilly and Company

- AstraZeneca PLC

- F Hoffmann-La Roche Ltd

- Johnson and Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in United Arab Emirates Drug Delivery Devices Market Sector

June 2022: ADQ's acquisition of Birgi Mefar Group (BMG) strengthened the UAE's manufacturing capabilities for sterile injectable products.

October 2022: A partnership between Abu Dhabi Medical Devices Company, Abu Dhabi Ports Group, Abu Dhabi Polymers Company, and PureHealth, worth USD 70.79 Million, initiated local manufacturing of medical equipment, including syringes and administration devices.

Strategic United Arab Emirates Drug Delivery Devices Market Outlook

The UAE drug delivery devices market holds significant potential for future growth. Continued investments in healthcare infrastructure, coupled with technological advancements and increasing prevalence of chronic diseases, will drive market expansion. Strategic partnerships between local and international players will be crucial for technological advancements and fostering innovation within the UAE. Focusing on unmet needs within the market, including the development of customized and cost-effective drug delivery systems tailored to the specific demands of the UAE population, will be crucial for achieving sustained growth and securing market leadership.

United Arab Emirates Drug Delivery Devices Market Segmentation

-

1. Mode of Delivery

- 1.1. Nasal

- 1.2. Oral

- 1.3. Injectable

- 1.4. Transdermal

- 1.5. Topical

- 1.6. Others (Pulmonary, Rectal, Occular, Implantable)

United Arab Emirates Drug Delivery Devices Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Drug Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases and Growth in the Biologics Market; Increased Understanding of Drug Metabolism and Growing Requirement of Controlled Drug Release and Technological Advancements

- 3.3. Market Restrains

- 3.3.1 High Cost of Development

- 3.3.2 Regulatory Concern and Risk of Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Oral Segment Expects to Register a High CAGR in the United Arab Emirates Drug Delivery Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.1.1. Nasal

- 5.1.2. Oral

- 5.1.3. Injectable

- 5.1.4. Transdermal

- 5.1.5. Topical

- 5.1.6. Others (Pulmonary, Rectal, Occular, Implantable)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

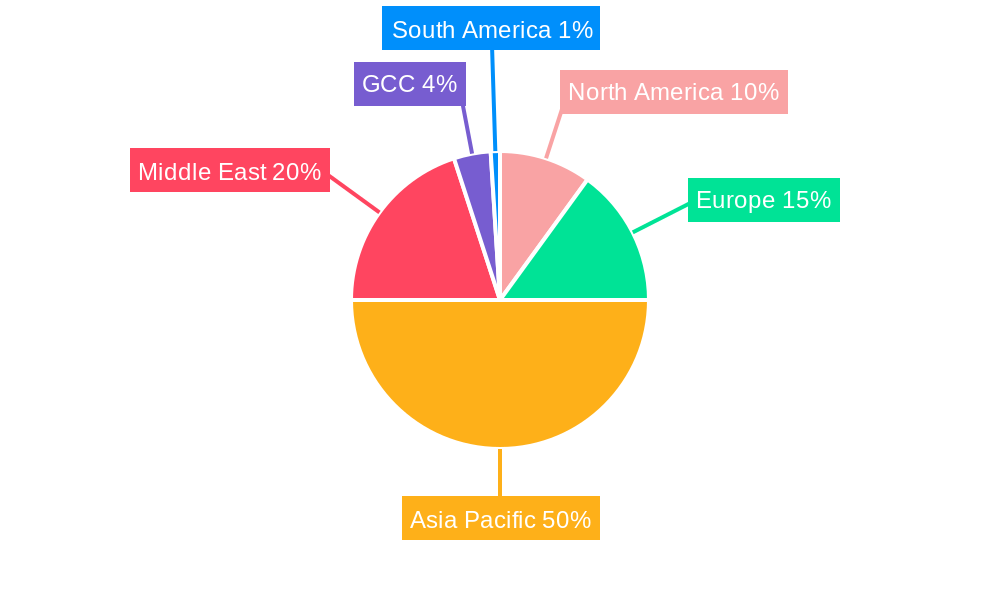

- 6. North America United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. Europe United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Asia Pacific United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Middle East United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. GCC United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. South America United Arab Emirates Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Becton Dickinson and Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Merck KGaA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bayerc AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eli Lilly and Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AstraZeneca PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson and Johnson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 GlaxoSmithKline PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Pfizer Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: United Arab Emirates Drug Delivery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Drug Delivery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 4: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 5: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 20: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 21: United Arab Emirates Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Arab Emirates Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Drug Delivery Devices Market?

The projected CAGR is approximately 20.00%.

2. Which companies are prominent players in the United Arab Emirates Drug Delivery Devices Market?

Key companies in the market include Becton Dickinson and Company, Merck KGaA, Bayerc AG, Eli Lilly and Company, AstraZeneca PLC, F Hoffmann-La Roche Ltd, Johnson and Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the United Arab Emirates Drug Delivery Devices Market?

The market segments include Mode of Delivery.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases and Growth in the Biologics Market; Increased Understanding of Drug Metabolism and Growing Requirement of Controlled Drug Release and Technological Advancements.

6. What are the notable trends driving market growth?

Oral Segment Expects to Register a High CAGR in the United Arab Emirates Drug Delivery Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Development. Regulatory Concern and Risk of Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

October 2022: Abu Dhabi Medical Devices Company, the Abu Dhabi Ports Group, and Abu Dhabi Polymers Company partnered with PureHealth, for AED 260 million (USD 70.79 million) to manufacture medical equipment, such as medical syringes, administration devices, and blood collection tubes, locally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Drug Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Drug Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Drug Delivery Devices Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Drug Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence