Key Insights

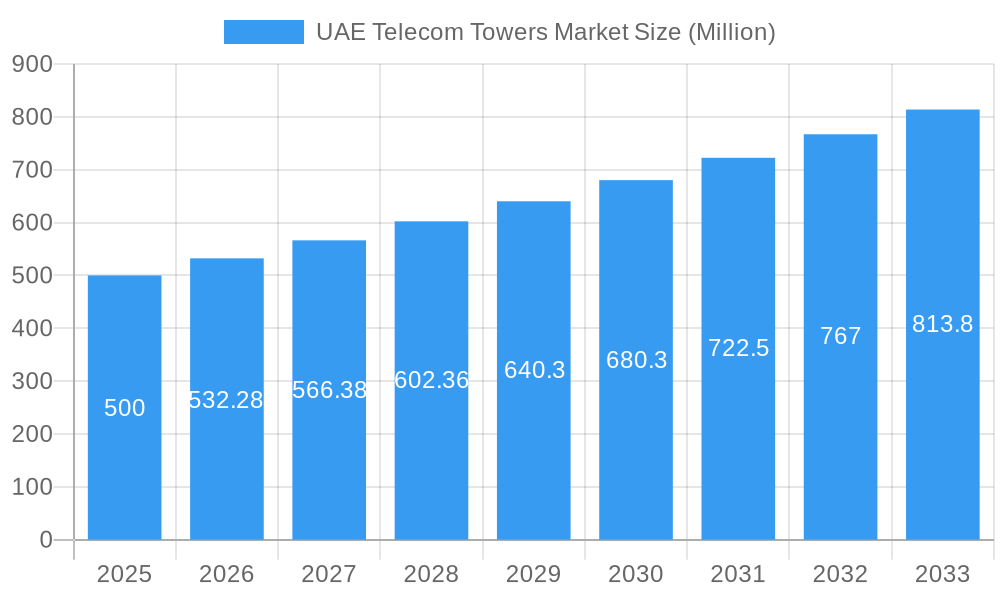

The UAE Telecom Towers market is projected to experience significant expansion, driven by the increasing demand for high-speed mobile broadband and data services, fueled by a growing population and high smartphone penetration. The ongoing 5G network rollout necessitates substantial tower infrastructure enhancement for improved coverage and capacity. Key industry players are actively investing in their tower portfolios to capitalize on this growth trajectory.

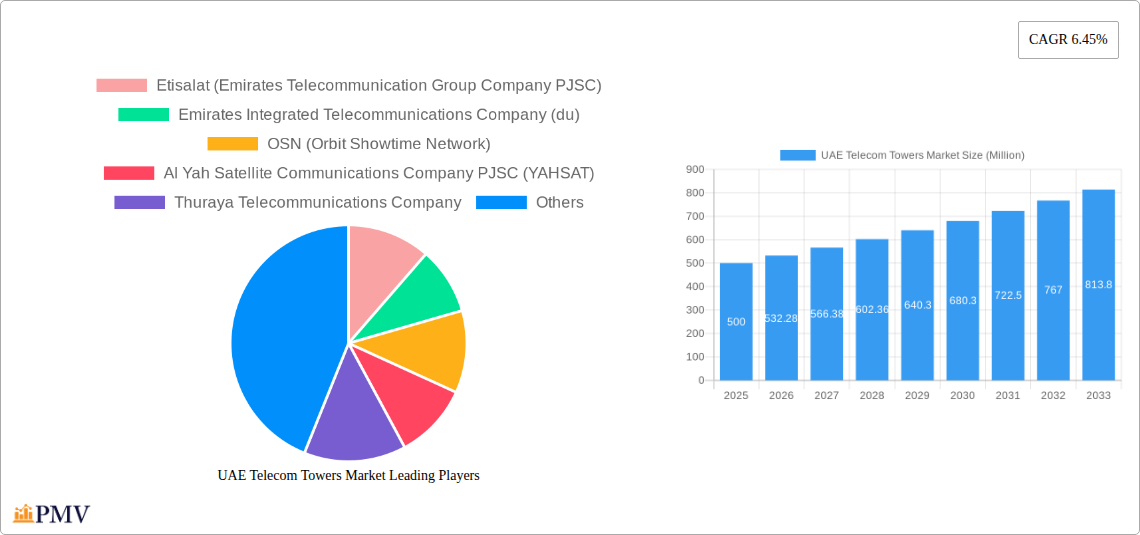

UAE Telecom Towers Market Market Size (In Billion)

The market is segmented by tower type, location, and ownership. Despite potential regulatory and land acquisition challenges, the robust growth outlook for the UAE's telecom sector strongly supports continued investment and expansion in the telecom towers market. The UAE Telecom Towers market is expected to reach a market size of 9.67 billion by 2025, with a CAGR of 3.15.

UAE Telecom Towers Market Company Market Share

The competitive landscape features established players and specialized operators. A growing trend towards infrastructure sharing and third-party ownership is evident, with operators focusing on core competencies and cost-effective network deployment solutions. Future growth will be influenced by government digital transformation initiatives, expanding IoT applications, and the deployment of advanced technologies like private 5G networks, all of which augment the demand for reliable telecom tower infrastructure. The UAE's strategic focus on technological advancement and digital infrastructure positions it as an attractive investment destination for the telecom tower sector.

UAE Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Telecom Towers Market, covering market structure, competitive dynamics, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for telecom operators, tower companies, investors, and industry stakeholders seeking to understand and capitalize on the opportunities within this dynamic market.

UAE Telecom Towers Market Structure & Competitive Dynamics

The UAE telecom towers market exhibits a moderately concentrated structure, dominated by a few major players alongside several smaller, specialized companies. Market share data for 2025 indicates Etisalat and du hold the largest portions, with xx% and xx% respectively. The remaining market is shared amongst Helios Towers, IHS Towers, NXN Group, Inteltec Emirates, and Gulf Bridge International (GBI), with smaller independent operators and colocation providers also contributing.

Innovation within the ecosystem is driven by the need for higher capacity, improved network efficiency, and the deployment of 5G technology. The regulatory framework, overseen by the Telecommunications and Digital Government Regulatory Authority (TDRA), plays a crucial role in shaping market access and competition. The market also experiences some level of substitution with alternative solutions such as distributed antenna systems (DAS) and small cells, though tower infrastructure remains the dominant method for macro-cell deployments.

The UAE market has witnessed several mergers and acquisitions (M&A) activities in the historical period (2019-2024), with deal values totaling approximately xx Million USD. These transactions reflect ongoing consolidation and strategic expansion within the sector.

- Key Market Dynamics:

- High market concentration with Etisalat and du leading the market.

- Growing adoption of 5G driving demand for new tower infrastructure.

- Increasing emphasis on network densification and improved coverage.

- M&A activity reflecting industry consolidation.

- Regulatory changes impacting market dynamics.

UAE Telecom Towers Market Industry Trends & Insights

The UAE Telecom Towers market is experiencing robust growth, fueled by the increasing penetration of mobile broadband services, the expansion of 5G networks, and the rising demand for reliable connectivity across both urban and rural areas. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven by technological advancements, government initiatives promoting digital transformation, and a burgeoning population with increasing smartphone adoption. Market penetration of 4G and 5G services continues to increase, further stimulating demand for telecom tower infrastructure.

Technological disruptions, such as the adoption of advanced antenna technologies (e.g., Massive MIMO) and the deployment of small cells and private networks, are reshaping the competitive landscape, driving innovation and efficiency improvements. Consumer preferences are increasingly focused on high-speed, reliable data services, putting pressure on operators to constantly upgrade their infrastructure. The competitive dynamics are characterized by intense competition among operators, who are actively investing in network modernization and expansion to meet rising consumer demands. Overall, these factors contribute to a dynamic and growing market with continued opportunities for new entrants and expansions.

Dominant Markets & Segments in UAE Telecom Towers Market

The UAE's telecom tower market is dominated by the urban areas of Abu Dhabi and Dubai, reflecting high population density and increased demand for mobile services. This is further amplified by significant investments in infrastructure development related to tourism, commerce, and government projects.

- Key Drivers of Dominance:

- High population density in urban centers.

- Extensive government investments in infrastructure development.

- High demand for mobile broadband and 5G services.

- Presence of major telecom operators with large network footprints.

The dominance of urban areas is likely to continue throughout the forecast period, although expansion into less densely populated areas is expected as 5G infrastructure and the provision of broadband services expand nationwide. The market is further segmented by tower type (macro, micro, small cells), technology (2G, 3G, 4G, 5G), and ownership model (owned, leased, co-located). Each segment presents distinct opportunities and challenges, shaped by technological advancements and regulatory dynamics.

UAE Telecom Towers Market Product Innovations

The UAE telecom towers market is witnessing significant product innovations, particularly in antenna technologies, site design, and network optimization solutions. Advancements such as Massive MIMO antennas, which dramatically increase capacity, and the use of intelligent remote monitoring systems for improved maintenance and efficiency are prevalent. These innovations aim to enhance network performance, reduce operational costs, and meet the increasing demand for high-capacity networks. The integration of 5G and private network technologies into tower infrastructure further demonstrates the continuous adaptation and innovation that is shaping the market.

Report Segmentation & Scope

The report segments the UAE telecom towers market based on several key parameters, including:

By Geography: Abu Dhabi, Dubai, other Emirates. Growth projections show the highest rates in areas with extensive infrastructure development and population growth.

By Tower Type: Macrocell towers, microcell towers, small cells, and distributed antenna systems (DAS). This segmentation highlights the varying deployment strategies and technological advancements across each type.

By Technology: 2G, 3G, 4G, and 5G. The rapid adoption of 5G is expected to significantly increase the demand for tower infrastructure.

By Ownership Model: Owned, leased, and co-located towers. These ownership models reflect the varied approaches to infrastructure deployment and management.

Each segment is analyzed in terms of market size, growth projections, competitive dynamics, and future opportunities.

Key Drivers of UAE Telecom Towers Market Growth

Several key factors are driving the growth of the UAE telecom towers market:

Government Initiatives: The UAE government’s strong focus on digital transformation and smart city initiatives is creating significant demand for advanced telecom infrastructure, including the substantial development of 5G networks.

Technological Advancements: The ongoing advancements in 5G, IoT, and other technologies necessitate the construction of new towers and the upgrade of existing ones to support higher data speeds and greater capacity.

Rising Mobile Penetration: The UAE boasts exceptionally high mobile penetration rates. This requires continuous investment in infrastructure to meet the demands of this large and active user base.

Increased Data Consumption: The proliferation of smartphones and data-intensive applications is leading to a surge in data consumption, requiring more robust and widespread tower infrastructure.

Challenges in the UAE Telecom Towers Market Sector

Despite the growth potential, the UAE telecom towers market faces certain challenges:

Regulatory Hurdles: Obtaining necessary permits and licenses for tower deployment can sometimes be complex and time-consuming, impacting the overall speed of network deployment.

Right of Way Issues: Securing appropriate land rights for tower placement can present logistical and financial challenges, specifically in densely populated urban areas.

Competition: Intense competition among telecom operators, and potentially the emergence of new players, could affect pricing and profitability for tower owners and operators.

These challenges impact the overall deployment pace and investment decisions within the sector.

Leading Players in the UAE Telecom Towers Market Market

- Etisalat (Emirates Telecommunication Group Company PJSC)

- Emirates Integrated Telecommunications Company (du)

- OSN (Orbit Showtime Network)

- Al Yah Satellite Communications Company PJSC (YAHSAT)

- Thuraya Telecommunications Company

- Helios Towers

- IHS Towers

- NXN Group

- Inteltec Emirates

- Gulf Bridge International (GBI)

Key Developments in UAE Telecom Towers Market Sector

June 2024: The TDRA's USD 2.21 Million contribution to the ITU for upgrading global radiocommunication databases will indirectly benefit the UAE's telecom sector by streamlining frequency allocation processes and supporting the continued growth of 5G and other advanced wireless technologies.

May 2024: The partnership between Sterlite Technologies (STL) and du for advanced optical fiber cables will significantly enhance the performance of du's FTTH network, supporting the growth of data services and indirectly increasing the demand for telecom tower capacity to accommodate the increased data traffic.

Strategic UAE Telecom Towers Market Outlook

The UAE Telecom Towers market is poised for continued robust growth, driven by the increasing demand for high-speed data services, 5G network expansion, and ongoing government investment in digital infrastructure. Strategic opportunities exist for tower companies to capitalize on the growing demand for co-location services and the deployment of advanced technologies such as small cells and distributed antenna systems. The market's strategic outlook is positive, indicating strong potential for investment and growth in the coming years. Further diversification into related sectors such as edge computing and IoT infrastructure deployment will open up further avenues for market expansion and revenue generation.

UAE Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

UAE Telecom Towers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Telecom Towers Market Regional Market Share

Geographic Coverage of UAE Telecom Towers Market

UAE Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployment to Address the Increasing Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North America UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 6.1.1. Operator-owned

- 6.1.2. Private-owned

- 6.1.3. MNO Captive sites

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Rooftop

- 6.2.2. Ground-based

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Renewable

- 6.3.2. Non-renewable

- 6.1. Market Analysis, Insights and Forecast - by Ownership

- 7. South America UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 7.1.1. Operator-owned

- 7.1.2. Private-owned

- 7.1.3. MNO Captive sites

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Rooftop

- 7.2.2. Ground-based

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Renewable

- 7.3.2. Non-renewable

- 7.1. Market Analysis, Insights and Forecast - by Ownership

- 8. Europe UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 8.1.1. Operator-owned

- 8.1.2. Private-owned

- 8.1.3. MNO Captive sites

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Rooftop

- 8.2.2. Ground-based

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Renewable

- 8.3.2. Non-renewable

- 8.1. Market Analysis, Insights and Forecast - by Ownership

- 9. Middle East & Africa UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 9.1.1. Operator-owned

- 9.1.2. Private-owned

- 9.1.3. MNO Captive sites

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Rooftop

- 9.2.2. Ground-based

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Renewable

- 9.3.2. Non-renewable

- 9.1. Market Analysis, Insights and Forecast - by Ownership

- 10. Asia Pacific UAE Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 10.1.1. Operator-owned

- 10.1.2. Private-owned

- 10.1.3. MNO Captive sites

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Rooftop

- 10.2.2. Ground-based

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Renewable

- 10.3.2. Non-renewable

- 10.1. Market Analysis, Insights and Forecast - by Ownership

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Integrated Telecommunications Company (du)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OSN (Orbit Showtime Network)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Yah Satellite Communications Company PJSC (YAHSAT)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thuraya Telecommunications Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Helios Towers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IHS Towers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NXN Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inteltec Emirates

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gulf Bridge International (GBI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Etisalat (Emirates Telecommunication Group Company PJSC)

List of Figures

- Figure 1: Global UAE Telecom Towers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Telecom Towers Market Revenue (billion), by Ownership 2025 & 2033

- Figure 3: North America UAE Telecom Towers Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 4: North America UAE Telecom Towers Market Revenue (billion), by Installation 2025 & 2033

- Figure 5: North America UAE Telecom Towers Market Revenue Share (%), by Installation 2025 & 2033

- Figure 6: North America UAE Telecom Towers Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 7: North America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 8: North America UAE Telecom Towers Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UAE Telecom Towers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Telecom Towers Market Revenue (billion), by Ownership 2025 & 2033

- Figure 11: South America UAE Telecom Towers Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 12: South America UAE Telecom Towers Market Revenue (billion), by Installation 2025 & 2033

- Figure 13: South America UAE Telecom Towers Market Revenue Share (%), by Installation 2025 & 2033

- Figure 14: South America UAE Telecom Towers Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 15: South America UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: South America UAE Telecom Towers Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UAE Telecom Towers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Telecom Towers Market Revenue (billion), by Ownership 2025 & 2033

- Figure 19: Europe UAE Telecom Towers Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 20: Europe UAE Telecom Towers Market Revenue (billion), by Installation 2025 & 2033

- Figure 21: Europe UAE Telecom Towers Market Revenue Share (%), by Installation 2025 & 2033

- Figure 22: Europe UAE Telecom Towers Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 23: Europe UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 24: Europe UAE Telecom Towers Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UAE Telecom Towers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Telecom Towers Market Revenue (billion), by Ownership 2025 & 2033

- Figure 27: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 28: Middle East & Africa UAE Telecom Towers Market Revenue (billion), by Installation 2025 & 2033

- Figure 29: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Installation 2025 & 2033

- Figure 30: Middle East & Africa UAE Telecom Towers Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 31: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 32: Middle East & Africa UAE Telecom Towers Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Telecom Towers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Telecom Towers Market Revenue (billion), by Ownership 2025 & 2033

- Figure 35: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 36: Asia Pacific UAE Telecom Towers Market Revenue (billion), by Installation 2025 & 2033

- Figure 37: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Installation 2025 & 2033

- Figure 38: Asia Pacific UAE Telecom Towers Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 39: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 40: Asia Pacific UAE Telecom Towers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Telecom Towers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 3: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Global UAE Telecom Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 7: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Global UAE Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 13: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 14: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 15: Global UAE Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 20: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 21: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 22: Global UAE Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 33: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 34: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 35: Global UAE Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 43: Global UAE Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 44: Global UAE Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 45: Global UAE Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Telecom Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Telecom Towers Market?

The projected CAGR is approximately 3.15%.

2. Which companies are prominent players in the UAE Telecom Towers Market?

Key companies in the market include Etisalat (Emirates Telecommunication Group Company PJSC), Emirates Integrated Telecommunications Company (du), OSN (Orbit Showtime Network), Al Yah Satellite Communications Company PJSC (YAHSAT), Thuraya Telecommunications Company, Helios Towers, IHS Towers, NXN Group, Inteltec Emirates, Gulf Bridge International (GBI.

3. What are the main segments of the UAE Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployment to Address the Increasing Market Demand.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: The UAE's Telecommunications and Digital Government Regulatory Authority (TDRA) pledged a voluntary contribution of CHF 1.9 million (USD 2.21 million) to the International Telecommunication Union (ITU). This contribution stems from a surplus in the budget allocated for WRC-23, held in Dubai, UAE, late last year in 2023. The ITU plans to utilize these funds to refresh global radiocommunication databases and enhance the software applications and tools offered by the ITU Radiocommunication Bureau (BR). These upgrades will aid countries globally in applying for radio frequency assignments, aligning with the newly revised Radio Regulations (2024 Version).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Telecom Towers Market?

To stay informed about further developments, trends, and reports in the UAE Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence